The BIG Announcement and coverage of Water on Demand's first $1 Million raised and Water on Demand Summit Meeting are powerful… What rural and suburban mega-trend is driving adoption of Water on Demand™? Why are we building a web of relationships with regional water companies? And finally, we got to show the Sustainability Champions footage… Watch it for a powerful statement of how Water On Demand could change the world!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

Hello everyone. I do...Not exactly sure why I have a blank screen. There we go. Stop and restart it. It's always a good trick, right? The next step is to take a hammer and hit the thing. It's a tried and true tech results, you know. And from James Wright to everyone, "Good evening, everyone. Hope all is well." Yes, indeed. We have so many amazing things. And Andrea and Ken will join us shortly.

Meanwhile, I'm going to get started with this party, Water is the New Gold, and never more than now. Our vital mission is to help the world invest in water, the new stable, inflation friendly asset class. So let's take a look at what's going on right now.

First of all, real fast. This is your statement that we, of course, are always giving you forward looking statements that we have to qualify by law, but we do our very best to fix them as we go. Okay. Next.

Our Promotion

This week was two days ago with World Water Day 2022. And our position on that, the actual World Water Day promotion this year was on groundwater, which is not specifically our job. We're not specifically focused on groundwater, although our division, Progressive Water, has cleaned up aquifers in the past and that's a cool case study of theirs. But our job really, as you know, is to fix the treatment of water which is falling apart. And so that's this is what we promoted a couple of days ago on World Water Day.

Current Capital Status

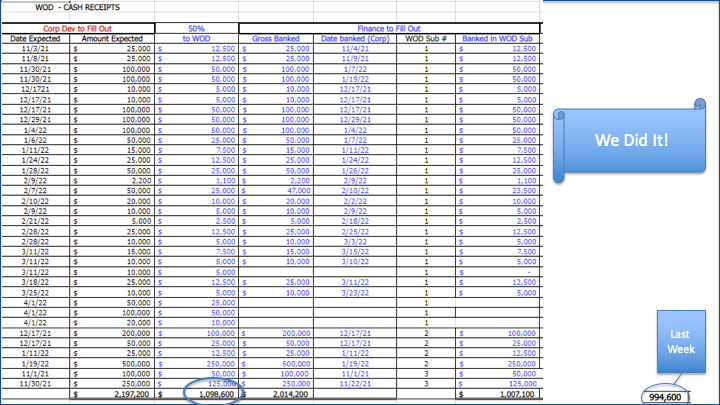

Okay, now. Current capital status. Well, guys. We were at 994,600 last week, and the full amount that is in Water on Demand™ is a million, ninety-eight thousand, six hundred. On the far right, you see actual bank is 1,007,000 anyway, so over a million. There's still a few that have not made it into the banking process. But as you can see, we are solidly in the million dollar bracket and we're super, super happy about that. This is a red letter day for us.

Announcement

And as you can see, we have an announcement. I'll quickly go through the announcement to give you what we basically said. Okay. So, again, first $1 million milestone and dedicated capital. This is capital that can only be used for secured purposes. And now we're also evaluating the first pilot opportunity to treat dirty water by the gallon as a managed service. This is super cool. All right.

Regional Partners

Actually, it's more than one. We have quite a few of these going on. And also we are in discussions with partners. The bottom paragraph here, "OriginClear plans to work with regional water service companies to build and operate the water treatment systems and finances," which is significant because we have competitors in water as a service, one of them being the very large company, Seven Seas, which does entire islands. Private utility for entire islands using desalination and another one being Cambrian Innovation.

I reviewed this a couple weeks ago, which is doing a great job with mostly breweries and food and beverage. But both these companies, first of all, insist on building their own and doing their own finance. Our differences that we have innovated to create Water Like an Oil Well™, meaning that it's very similar to a water, an oil well partnership, but for water. So that's number one. We're bringing regular investors in to create these programs, these zero capital programs.

And the second thing is that we don't want to try and build all these systems ourselves and try and manage them because we'd still be building that network ten years from now. It takes a long time to build these networks. So instead we're going to create a web of relationships with regional water companies. We're already in talks with a at least two that I know of that are firm discussions. And the, I see this as a as like our Tesla supercharger network. Right. Because once we have relationships with these players, then it's hard for others to jump in. So we kind of want to become sort of the the master player in that respect. Okay. So that's that part.

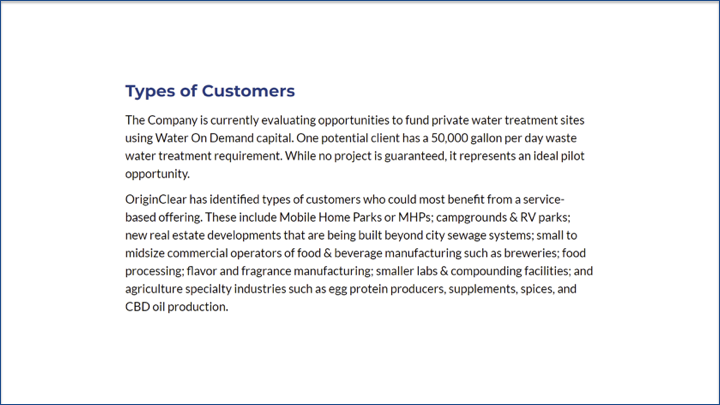

Vertical Markets

And then we have, there's that potential client that we're talking about, and also different kinds of clients. We're going to do a full, we're going to bring Tom Marchesello and Dan Early back on board to talk about these. Mobile home parks, and by the way, Flash. We've had a big success with the trial of a site where we had to do a lot of hard work. Remember, a couple of weeks ago, we had Dan Early on site in Troy, Alabama, and the Pondster™ is refined and operational and has finished its pilot and is commercial.

Again, we'll do a special coverage of that. So mobile home parks, campgrounds and RV parks, new real estate developments that are built beyond city sewage systems, small to midsize breweries, food processing, etc. flavor and fragrance, smaller labs and specialty agriculture, such as, for example, CBD oil production.

So that's the kind of stuff that is very suited for Water on Demand that's quite a few what we call verticals, right? Vertical markets, it does expand. It goes beyond that. But this these are the ones that are most natural for it. And we have potential Water on Demand customers in several of these categories, which is why we mentioned them. All right.

Mega Trend

So now here's the other thing that that Tom said in this release, which is that, as you know, COVID and the freedom to work from home WFH allows families to move to the country or even to suburbs, and that's been a big change. And the cities have gone through very New York City and Los Angeles have had a hard time because of this. Well, the problem is, of course, that these rural and semi-rural locations have small water treatment sites or no connections to sewage at all. That's where we come in. So this is very, very key to mega-trend. In other words.

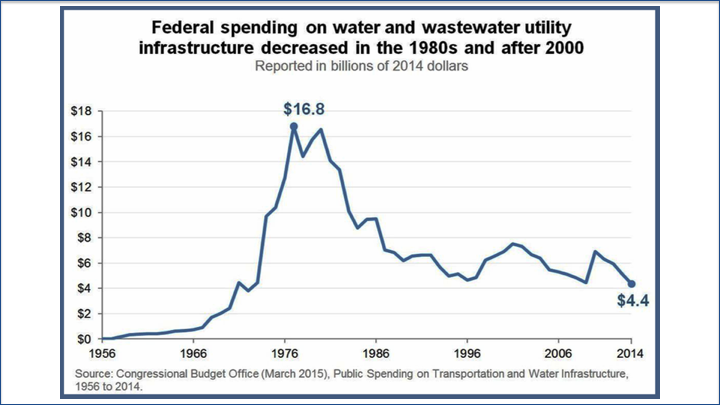

This stat tells it all the central infrastructure is not being funded. And sure enough, we talk about this in the release. Less and less money to municipalities.

And so at leads to underfunded infrastructure and the need for industry and agriculture to do more real water treatment on their own, which we are enabling with this finance program. And as you may have heard before, we were on a prime time show and we will be getting more. Okay. So that's that part.

The Money Show

Now, today, our own Ken Berenger made a presentation to The Money Show, which was super cool. I'll just show you one slide from the thing right here. And it's this on the right hand side is is the slide. And basically, it was very well received and we'll get the recording and play it to you next week. It should be very, very cool. All right. So with that said, let's move on here.

Sustainability Champions

Now, last week, as you know, I had a technical problem and it was actually good because we cut straight to that live what one shareholder called the couch summit in my condo. And it was actually really cool that we did it. But I do want to play it because it's got some tremendous information in it.

Start of presentation

Daniel Hartz: Did you know Americans drink more than 1 billion glasses of tap water per day? That's a lot of tap water and that's just tap water. I was thinking about this. That's not bottled water. That's specifically tap water. And as water scarcity continues because of climate change and our constantly changing climate and where water is moving to and from, this can pose some really big challenges to our water supply in the future. And that is exactly why I'm speaking today with sustainability champion Riggs Eckelberry, who is the president and CEO of OriginClear, who, he saw this challenge and decided to do something really interesting and innovative about it. So OriginClear created something called Water on Demand. And it's it's basically a pay per gallon water recycling system that businesses and housing developments use to treat water on their own in order to become self-reliant, which makes a lot of sense and raise that. We'll dive much more into that. And so today what we'll be discussing is really what OriginClear does, what that term "Water on Demand" really means. And also, why are investors so interested in water.

Riggs: In America alone, we have a problem with infrastructure. The, for some reason we don't fund infrastructure. And the current administration funded about half a billion or, sorry, $55 billion worth of infrastructure, which represents less than one year of the backlog. So each year we're falling behind about $75 billion in what we should be spending. So what's happening is infrastructure's falling apart and of course, water is still being made dirty. Nobody stopped that part. So as a result, businesses are being forced to do more and more of their water treatment, which is good and bad. Right.

The good part is actually that they can recycle, they can pay less money, and they can also by taking the load at the edge, they can, say the central infrastructure doesn't have to do as much, because it so happens that 87% of all water is made dirty by industry and agriculture. So if you're going to go for the biggest problem, then obviously you're going to go help businesses. And that's what we're doing.

So let's take, for example, an example of a brewery that's making lots of beer and they're selling lots. And all of a sudden the county says, I'm sorry, we can't take your stuff anymore, and now we want to make more beer. But now we're trucking it to other counties and we're doing all kinds of things. And along comes a company like us and says, Don't worry, we'll help you do your water treatment. The next problem is how to pay for it. This brewery would like to spend money on beer equipment, not water treatment equipment, and so they don't have the budget for it. And that's when we came up with this amazing idea of Water on Demand, which is "Don't pay for it. We'll take care of that. And you just pay as you go." Pretty much the way you're accustomed to with the city, but it's us. It's a private utility, and that is what we're doing. And it's really exciting.

Daniel Hartz: I mean, that sounds really cool. And that, that what you just described with the brewery example is that the Water on Demand?

Riggs: So the paradigm is number one people have to do their own treatment, so private water treatment and number two, getting rid of the capital problem completely. Now that means that we have investors who come in and they help us purchase the equipment and we keep the equipment as an asset of ours. And then people are basically paying for use, just like we pay for using Microsoft Office. Right now, Microsoft Office used to be $130. You paid for it and you were done. Now it's, I don't know, $20 a month. You're paying more, but arguably you're getting more value. You've got the cloud and you've got real time support and all these good things all built in. So services are, I think, the way everybody is going. And strangely enough, it took a long time for water to get around to that, but it is happening.

Now, here's another interesting thing. Right now, as we speak, commodities are just taking off. Oil, gas, foodstuffs, fertilizer, you name it, it's all just taking off for really, reasons that are beyond your control of mine. We're, we can't do much about it. But for the investor, for many investors, the opportunity has already gone. Oil already took off. Many of these prices are out of sight already. I was looking at gold and gold just. Okay. Well, that's over $2,000 now. Okay. So the question is, how can I get into an asset that is not already taken off? And the answer is that water has just been liberated. It's been desocialized, liberated from the cities and turned into a private thing.

And now there's an opportunity to invest in a water system the same way you would in an oil well, make royalties. Get stock in the company and really help create this new productive asset. And our idea is to do it democratically. The other big thing that's happening, as you know, is that all the elites are snapping up land and all kinds of resources. They haven't done it for water yet because, again, water has been sort of the domain of the government. So our idea is, instead of having one Jeff Bezos own all of water, let's have 10,000 or 100,000, you know, divide Jeff Bezos into 10,000. You still have a lot of money. So let's give individual investors an opportunity to jump into this as the new hip asset.

And guess what? It's water. How fun is that? Right. And I can tell you, we're close to... We just started raising the money for this capital in November. We're close to $1,000,000 already that we're ready to start spending. And the program is rolling. We're super happy about it. And this is coming from everyday investors. It's not coming from some big fund. Right. Because the everyday investors are the people who believe and they get it. They go, oh, I get that. That's cool. So we're super happy about people like you and me actually jumping into the water industry and, you know, making good returns on their investment.

Daniel Hartz: So I guess there's this concern that by privatizing water, I guess you may be limiting access to some people. How does that part work?

Riggs: Fresh water still comes from the city. We're not changing any of that. We're talking about treating the dirty water. Do you know that throughout the world, 80% of all sewage is thrown away into lakes, rivers and oceans? I think we should take responsibility for that. I don't think we should delegate it to the people who are not doing anything about it. Right. So people go, oh, my God, you know, you have a right to water. Yes, you have a right to clean water. We're talking about making the dirty water clean. Right. And this is something that's urgent.

Dirty water is killing 6000 kids a day in the world. As we're speaking, hundreds of kids are dying. Right. That's, a sustainable idea is cleaning the darn water. Years ago, Andy Young, who became the mayor of Atlanta, said that if you put a pipeline through Africa from from Cote d'Ivoire all the way to Algeria, one pipeline would eliminate 50 diseases forever in Africa. Right. Why? Clean water access, right?

Now, part of the big problem is we're wasteful of our water. Israel recycles almost 90% of their water. The second in the world is Spain at 20%. The US 1%. We're great. We throw it all out. We're good. Meanwhile, we have droughts in California and in fact, you know, California is an obvious example. But do you know that the the biggest aquifer in America, the Ogallala Aquifer, which is the Midwest, has one third of all produce, is produced from that one aquifer is down in some places as much as 130 feet. And that is going to take, it's going to take centuries to replenish. Groundwater does not replenish like that.

So we've got a real problem because we're overusing water and then we're being very profligate and just letting it and and the oceans are getting filthy. I think it's a scandal. And we're being told not to worry about it. And then tap water, go to Environmental Working Group EWG.org/tapwater. Put in your zip code, if you're in America, and you will see what's in your water and it's not a happy thing. So I think that we need to actually fix the quality of the water. And it seems to me that if I'm a responsible business and I get water from the city, why shouldn't I get two or three turns from it? Right. Everybody right now in America is just taking it and throwing it out.

And it's not the fault of anybody. It's the fact that, it's a paradox, that old infrastructure is a handicap when you modernize, right? There you are stuck with your old infrastructure. So the sewage systems that were built in America a century ago only went in one direction, from you, from your toilet or your machinery or whatever, or your kitchen, straight to the wastewater treatment plant and then into the lakes, rivers, oceans. Right. Treated, I'm not saying they weren't treated, but they were wasted. This and there's no return trip. It's not built into the system because it's old. Basically, Water on Demand is a way to let the existing infrastructure be there, but create a new one that is light and responsive and actually sustainable. And that's where we are answering the sustainability challenge.

Daniel Hartz: You're not privatizing the public water. What you're privatizing essentially is if I'm a business, I use water, I make it dirty. I'm allowing that business to clean it and then reuse it. You said two or three times, but in theory, could it be infinitely? Or.

I mean there's a loss factor. Also, you have to make a decision, for example, a brewery. Are you going to use it to make beer? Many people would say no. Right? So but you can with non beer uses of the water, you can recycle 50% for wash down, steam vessels, you know, various uses. So it's really a decision about how you want to use the water again. Realistically speaking, I would say at least one turn is fair, maybe two. And also you can throw it on to your lawn. Right? So graywater re-use is another way to do it.

We have a client right now that is launching a luxury hotel and we're not able to say who it is yet. But this is a new product line of ours which cleans the water, the incoming water for an entire hotel, ultra premium water. It's not just that bottle on the dresser when you walk in, it's everything. The shower, the kitchen, you name it. It's all perfectly clean. And one of the, and so we're doing that for all the hotels in that chain. We've been sort of adopted as a preferred vendor, but our real hope is that we're going to help them do some graywater recycling because that's very virtuous, right? You know, all of a sudden, there's a little sign on the lawn, this water has been recycled.

So that's very nice. And then you can also get, for example, all kinds of carbon benefits because, you know, when you take sewage and you send it far away, you're actually incurring a carbon that ends up in a big, big circular pond that spout it all and all that nitrogen and stuff goes into the air. Well, there's a way to treat it right on spot without doing all that. And that has been shown to be a net positive gain for climate change.

There are areas of high adoption of this new idea. Obviously not everybody wants Water on Demand, but who does, for example, is in America and elsewhere people are moving more and more away from cities. This was a trend already, but it was accelerated by COVID and work from home. And all of a sudden you can move to Colorado and keep your job. And so people are you know, there's housing subdivisions being built in all kinds of interesting places that are not served by sewage or very poor sewage. Right?

We have a client in Troy, Alabama, that has a trailer park and all the poop in the trailer park goes into a lagoon. And throughout the south, the poop is in the lagoons. Well, you know, the departmental, departments of environmental quality in Alabama and elsewhere want to do something about that. So the easy thing was, well, why not just connect to the city sewage? The city goes, "No, no, no, no, we don't want that." So now the city won't take it. They're forced to put in their own water treatment system, and that's what's happening.

So there's mobile home parks, trailer parks, RV campgrounds, housing, subdivisions, breweries are an excellent one. And mainly because breweries have a very high output of liquid and it's not very toxic, but there's a lot of it. So certain users are better than others in terms of their adoption. But basically anybody who wants to set up shop away from the sewer grid is either going to spend $5 million to connect to sewer, but maybe the city won't even accept it, or they just build their own system. And Bob's your uncle.

Daniel Hartz: Building your own system is extremely expensive, and that's really where OriginClear shines, because you don't have to actually pay to build your own system. You just install it basically for free. And then the, in this case, the trailer park would just pay, I suppose, a monthly usage depending on volume for access.

Riggs: To the way it's structured is, is the equipment fee just to take care of the basics. And then there is a consumption fee. So depending, pay per gallon, right and it's very similar...You know, the other day I was getting coffee from an espresso machine self-serve. And I say, "So how much did this machine cost you?" And the guy running the canteen said, "Oh, no, no, this is just a service we just pay by the cup. Right?

Daniel Hartz: Really?

Riggs: Now, maybe it's more money. But guess what? They don't have to maintain the machine. They don't have to buy the coffee. They don't have to do anything. They just, the thing sits over there and people happily get their coffee. And so that's the beauty of a service, right? Where it's not your core business, then why should you do it? For most people, water treatment is not their core business. It used to be delegated to this city. Now I'm stuck with it. Well, I'd rather just delegate it like, okay, you handle it, do all the maintenance, everything's good. And I just keep making beer or, you know, running a housing development or whatever, right?

Daniel Hartz: Yeah. So it really is water as a service, as in software as a service. You're just, it's basically plug and play. I just need this to be taken care of. I don't want to think about it. I don't want to really pay very much for it. And I'll just yeah, I mean, it makes a lot of sense. On the investor side, someone asked earlier, do you have to be accredited?

Riggs: That's a very good question. If you go to originclear.com and top right, there's an invest now button and in the US you need to be accredited, which means you make 200,000 a year as an individual, 300,000 as a joint, as a couple. And by the way, that does not mean just married. It means any cohabitation. Or have a net worth of $1,000,000 outside of your primary home.

Now, if you're investing from outside the US. You should be accredited, but it's not subject to the same controls. So it's really your own decision based on your own country's accreditation requirements. We don't. We take it, if you say you're accredited, fine. In the US we're required to verify that you are. If you're coming from outside the US, then it's pretty much on your say so.

So now technically it's $100,000 investment, but we do take less because we find that people invest multiple times. They like it. They get their royalties, they get 25% of the net profits from all the... We've organized these into a series of Water on Demand subsidiaries and we put you in one of them, and now you're going to get a percentage, 25% of the net profits as defined in the offering, from the operations.

And you're going to get a substantial stock grant and also what's called warrants, which is options to buy in the future at a predetermined price. And why are we doing all that? Well, because you're early. You're a co-founder, right? Down the road, it'll only be royalties and it'll be a good deal. Today since it's just starting you, you're taking a risk and we acknowledge that, which is why we make you a stockholder as well.

Now, we had a breakthrough which allows us to play in Water on Demand for regular businesses because we acquired a technology in 2018 called Modular Water Systems™ and it's prefab water treatment systems that are all identical. Seems logical, right? Well, it turns out that a lot of water systems are built, you know, custom. But we have a line of systems, and if you go to modularwater.com, you'll see them.

These are box standard machines. And that enables us to standardize the fleet that we're sending out here. And it also enabled us to shrink. When you go into local businesses, you've got to go smaller, you've got to get down to $500,000 to $2 Million Systems. And that's a challenge, always a challenge. So we feel we've conquered that with our unique technology. It wouldn't be possible without it, because think about it, you have a 100 or 200 of these systems all over America and they're all different. Try to manage those, right? You've going to have to standardize.

Daniel Hartz: What you're doing sounds extremely impressive, and what do you see as the future?

Riggs: We want to delegate the actual building and supporting of these systems to local water companies all over America and eventually the world. That's scalable, right? That's playing the finance game, contract management, project management, but not doing the actual building and supporting, which is going to allow us to do parallel, parallel processing, right? Work with multiple deals because we have water companies elsewhere. We'll bring in the investors, we'll give them a viable deal, a generous deal, and then we'll invest it. And the good thing for the investor is they have an asset sitting there because we don't sell that asset, we hold it.

This takes us to where the future is for the company. By building this asset base, we are automatically building enterprise value. We're moving on to hopefully the Nasdaq, Right? But for that you need substantial assets. So by not selling these machines, keeping them in our inventory, we create an asset base which makes us more and more bankable over time. And then you get into leverage and all kinds of interesting ways of financing things. So we want to solve the financial problem related to putting in water treatment in your business. We have the technology solution, but the manpower is the entire world of water service companies.

Daniel Hartz: Well, Riggs, thank you so much for your time. I think the work that you're doing with OriginClear, it's amazing. And I think you're absolutely right. It's you know, you're you're creating this system and infrastructure to help reduce the amount of wastewater going into places that shouldn't be, like rivers and oceans, while also helping companies and governments to be more effective and to save money and to really make a difference. Yeah. Thank you again so much for your time. And I think what you're doing is fantastic and wishing you wishing all the best.

Riggs: I love your mission. Thank you very much and good luck to your work as well.

End of presentation

Water on Demand Summit

Riggs: So that was very cool. Very cool indeed. I'm going to slip right into the preview of the Water on Demand summit last week. So here we go.

Start of presentation

Andrea: Everybody needs to understand, "Why Water on Demand?" So if anybody's asking, the company needs to have an answer. And also from the standpoint of why we are raising capital. Why, what is the benefit in that? And maybe more than anything else, we have all synced throughout the group.

Infrastructureless

Riggs: Well, that's excellent. You know, most of the world does not realize there's a problem. They know, oh, Flint, they hear about things popping up, but they don't know why. And why? Why did Flint fall apart? Well, it was a symptom of a deeper problem, which is the underfunding of infrastructure in our country and the total lack of infrastructure in other countries, which kills people in India, sewer workers, several thousand every year that die from sewer gas. And so we are really moving into a phase of infrastructureless water treatment, zero infrastructure.

Ken: Infrastructureless would almost, and again, you get into that "wireless," right? It's that same major, major shift in how infrastructure is delivered. Right. And I think when Riggs said the average person doesn't know, the major advantage that we have is that industry does. You know, when you talk to anybody who's ever made anything, built anything, farmed, anything, they will go on and they'll tell you all day what a terrible problem water is. So raising the awareness to the public, I think, I think elicits the type of excited advocacy that we want to see in this project. But the end user demand right now is just it's enormous.

Fixing the Underlying Problem

Riggs: So the issue is, people instinctively feel there's a problem, like Flint — problem. And I constantly get people going, "What are you doing about Flint?" Well, that's just like bailing a boat that's got a hole in it. Fix the hole.

Ken: Right.

Riggs: You're bailing, bailing, bailing, bailing. And that's what's happening. So, you know, these issues of brown water in Compton and people don't even know about South Bend, which has all those layers of toxic waste in those places, and then places like Miami-Dade, Fort Lauderdale, with endless water main breaks. So those are all just those are things that poke up above the general clutter. But we got to get to the underlying issue.

The underlying issue is that the paradigm of central water treatment, which was taken for granted, is gone. It's like those huge concrete spillways in LA that are always, that never have any water. Yeah. You know, and they might have water once in a thousand years. That was the think big concrete thing, but A. You would never build those today and B. You would build them more responsibly, you know, the way they're trying to do now. So I think we need to think of water as root causes.

Ken: Correct.

The Root Cause

Riggs: The root cause of water problems has to do with how humans are using it and treating it and so forth. And if we can, essentially it's a responsibility game, right? Let people be responsible for their own water treatment and they, driven by a profit motive, will reuse it, will husband it, will use the graywater to water the plants, all that stuff.

Ken: Not only let it, encourage it. We've treated the symptom constantly. We've never gotten at the disease, which is fix it where it's getting really made really, really bad. And it gets better everywhere downstream and not by a little, by a lot.

A Good Strategy

Manuel: It all fits together. Test of a good strategy, is it internally consistent? Is it consistent with the needs in the market? Is it consistent with the interests and needs of investors? If you're a brewery, you stay focused on making advertising and selling beer. You know, you're not worried about having to hire somebody to be like a water technician. You know, that's now either on your full time payroll or part time payroll.

You should stay focused on your business. You pay a monthly bill based on what you use and not being gouged. And, you know, and you just move on and you stay focused on your specialty and you don't waste time. So it's a system that provides tremendous efficiency throughout and enables us to catch up in the sectors that are most needy faster without having to wait for a major infrastructure government program. So I think that internal consistency of all these pieces is what is actually giving me huge confidence that's going to be a very successful program.

End of presentation

Riggs: Wow. So isn't that cool?

Andrea: Wow. It really is. It really, really is.

Riggs: So what I'm going to do is I've got a couple more slides to go that are kind of cool. And then we're going to get into our famous three way where we basically, the sky's the limit and it gets kind of cool. I just wanted to quickly check. Check.

There we go. I've got some great chats. Keith Roeten, "Awesome that we can relate and associate water to a commodity and asset." Definitely it is. The final part of this presentation. Here we go. All right.

Big news from PhilanthroInvestors, our partners. OriginClear was featured in an event organized by Keller Williams in Hawaii, OriginClear was featured in the AwarePreneur's Mastermind. That's an interesting term, but it's apparently a big deal. And also featured in the WeInvested podcast to a 700 person audience. So well done and continue.

Open Discussion

All right. And this brings us to the open discussion. So, gentlemen, jump on with me and let's talk about what's been happening.

Ken: Sorry, Andre. I didn't have the power. I don't ever want it.

Riggs: We've done it. We've done it. Yeah. Zoom is very hierarchical. You have to have the power, and if you don't have the power, then you are in bad shape. Andrea, where are you?

Andrea: I am currently in the lounge of Air Emirates.

Riggs: Air Emirates, You're about to take off.

Andrea: In about 3 hours, neh, 2 hours.

Riggs: Well, fantastic. Good for you.

The Unseen Problem

Andrea: Going to, Going to Italy. Going to see the family in Italy. I don't know if you know, guys, I sent a believe one message to Riggs, but you know what my friends are sending me from Italy? They're sending me newspaper, magazines, that is basically outlining, all page, I can even share the screen and show you. The problem with water, basically, they are saying the unseen problem is coming up now. Know they're really publishing this thing.

And recently there was a commercial and a campaign done by Giorgio Armani, in regards to, involving models to promote the problem of water, saying that this is a problem that nobody talks about and bigger than the energy crisis. And I thought it was quite interesting. It's coming up now.

Riggs: Well, anything involving models is a wonderful idea.

Ken: Right. And I think it was very I think it was very considerate of them to wait till we were ready. I mean, that was nice.

Andrea: They were, they actually, I think that they give you a call Ken, they said, "Ken can we go?" And you said, thumbs up. Thumbs up.

Ken: I gave them my blessing.

Riggs: Yeah, you get my blessing.

Not Somebody Else's Problem

Ken: You know, the funny thing is, we talked about this at the summit, right? The general awareness has always been there. It's kind of been like a low level background hum, right? We kind of knew. And remember when I stood on your deck and I said, "Who here drinks tap water, raise your hand." And like nobody did.

So, look, if you're not drinking it, you know. Right. But I think it's rising to the top of of kind of global social conscience that this is no longer, somebody else... I think for a long time it was viewed as somebody else's problem. And I apologize for my voice in the video. That was Andrea's fault, because of karaoke. That's why I couldn't speak in the video. That's why I wasn't doing my Godfather imitation. I really had lost my voice.

Andrea: We took Ken to like, we work all day long, Bunch of meetings one after the other. And then at the night we took him to karaoke with the rest of execs. Just to have a moment all together.

Ken: And I wasn't going to sing at all and then I was up there like AC/DC, right? So it was fun. All right. So getting back to business, I think that the, I think that the idea for a long time it was someone else's problem. And I think now the consciousness has changed. It's basically like no, it's all of our problem, and it needs to be solved. And it couldn't have happened at a better time when we're finally kind of moving towards a, a truly globally scalable type of solution. So it's timing is everything.

Riggs: David Jones is asking, can long term investors meet the GA models? I love Ken, but... What does that mean? You've got to love Ken unconditionally. We can't have any...

Ken: He does. He does. He didn't mean that.

Riggs: But what is a GA model? I'm like general and administrative? I'm not sure. So I'm asking for Dave to clarify that. But here's the bottom line. Here's the deal, long term investors do really well in this model. The breakthrough was a perpetual royalty model. Right. As long as your, your money is invested and as long as it is in a program, then it is getting the net profit. And we'll continue to see these, by the way, these programs are very long, typically, a customer will sign a ten or 15 year service contract and then we roll the same equipment over into the next. And by the way. Oh. Oh. I think. Okay, now we're getting somewhere. Do you realize what's going on here? Emil George, just clarified it.

Ken: No, no, David. The models are mine.

Riggs: So I was taking it seriously.

Ken: What honey?

Riggs: You guys, you guys are wacko. You guys are crazy. I was actually taking it seriously.

Ken: I know. We were like, we're thinking of GA models, GA models. Okay, General Administrative. So let's get into that. Right.

Riggs: Can long term investors, Okay. Now this rephrases his question. "Can long term investors meet the Giorgio Armani models? I love Ken, but..." That's what's going on. Right. And I think that we could, In fact, Andrea, we have an amazing, high integrity, beautiful woman who is a potential influencer for us, who was in the summit, who was interviewed, who will be part of our coverage in weeks to come, and long term investors might even be allowed to meet her. But that would be...

Ken: And she's hysterically funny and can sing like an angel, by the way.

Riggs: I didn't know that.

Ken: Oh, my God. Usually, when you're that beautiful, you're like, "She can't sing." And you're like, "Wow, she can sing." Yeah, she was really, she's really and she's a comedian. She's really, really, she's a joy to be around. So.

Generating Royalties

But something I did want to mention considering when David, because we will talk about OriginClear a little bit, the long term investors, we've had a bit of a breakthrough on the kind of royalties that can be generated for this because it doesn't have to be a cash for cash arrangement.

Standard utilities leverage their equipment sometimes as high as 10 to 1. So with very, very modest leverage of cash in hand, we could with a 150,000 or so, 150 million or so dollars worth of actual capital for equipment deployment. We could control as much as, Riggs what we said, about almost $500 million worth of equipment. So these royalty models actually become really, really rich. I mean, they were rich to start with.

But if you could potentially, and we would pass that on to the investors, it would be their 25% profit share. So it's just 25% of $500 million rather than 150 million. So it ends up being something like, I believe that $300 million totally invested in the model could be generating something as much as $904 million.

Riggs: For the investors.

Ken: For the investors, that's their portion, right? It would do about 3.9 billion on a 20 year cycle for the for the whole project, but a little under $1,000,000,000, so over 300%. So this gets, this goes from like hmm to wow, you know, and who knows, we may have access. This is new. So they're probably not going to bank us. Like you said, you become more bankable as you as you grow this thing. You know, they may not treat this like a standard 30 year kind of operating thing, like a utility and give you 10 to 1. It may end up only being 5 to 1, right. But even in 3 to 1.

Riggs: My understanding of finance is that it's really based more on the wizardry of finance versus what's actually real. What Wall Street engages in, well, it's kind of a shell game. In fact, they go, they leverage up as high as 26 to 1 because, of course banks can do that.

Ken: Bring in mortgage derivatives. Right.

Riggs: But we do not plan to have a Water on Demand you know, junk bonds.

Ken: Derivative instrument?

Countering the Risk

Riggs: Right, because every, one of the things I want to do is, and this is going to be policy, if we do leverage these funds, we're going to have, we're going to hedge. Right. We want to make sure... So it's going to reduce the leverage, but it will be hedged. In other words, I want a safe position. I don't want to go just woo hoo. Right. Because at the end of the day, this is a long term plan. So it may go down to 5 to 1 for that reason alone. Right, because of the need to do a counter risk.

Ken: The number I gave you, I said 3 to 1, The number I gave you is at 3 to 1? So it's really, really modest.

Riggs: That I think is very achievable. Good. Well, gentlemen, thank you very much. It's been a wonderful night.

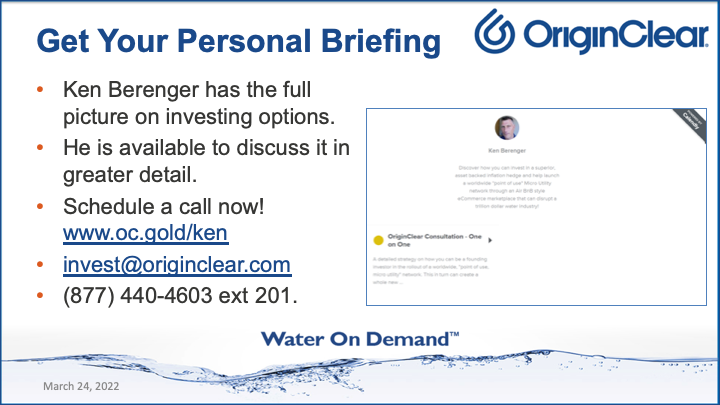

Call Ken

And I just wanted to jump back into the presentation because I'm going to tell you something that is going on here and that is participating in our future, of course, which Ken is your man to talk about. Simply go to oc.gold/Ken, and you need to book time with him because he's got he's got it going on. I'm just saying.

Ken: Just ask Dave, he can tell you.

Riggs: Exactly. You know, the problem is, Ken is not a Giorgio Armani model. That's the issue.

Ken: No, I don't even wear Giorgio Armani suits.

Andrea: Should I share the screen and show the model? Like, I don't know. It seems like there was not a...

Ken: We have to leave some mystique for next time. Let's leave it a coming attraction.

Coming Attractions

Riggs: Coming attraction. Giorgio Armani model. But also, we will have the Money Show presentation that Ken gave today, which is very interesting. And so I look forward to everyone being with us next week. And it's been really fascinating.

A Worldwide Pure Play

I loved the summit. And by the way, there was so many things that we covered specifically in detail. What you saw was kind of the fluff. This was some serious action. What it was was the beginning of the Water on Demand rollout. And we are spending time right now seeing how can we turn the brand into a worldwide brand as a pure play, what we call a pure play? What is a pure play? That is something that is only that thing. And I'm unable to say more than that, but believe me, it's exciting and it's very, very good for those investors who have had the courage to jump into the Water on Demand program. And we love you dearly for having do so. So thank you all. You're wonderful and we will see you again next week. Bye for now.

Ken: And I think all of us. I think they're going to love us back. I think they're going to love us back when they. When they see it all roll out. So good night, folks.

Riggs: Good night.

Ken: Great way to end.

Riggs: Safe travels, Andrea.

Ken: Yeah. Fly safe, my friend.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)