We covered the 10K results, but the real news is Water on Demand… It's the ultimate FInTech pureplay built around a wealth-preserving asset class — WATER. And enables everyday investors to earn royalties from water assets! But does it have the potential to out-perform other dividend-yielding assets? Find out in the replay!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

Riggs: And good evening, everyone. It's a pleasure to be on board for another CEO briefing. They never get old. First of all, it's always something we can say and talk about. Seem to have a lot of news all the time. And in addition, we have some special news about the annual results from last year. As you know, we had some really amazing things happen last year. But, you know, in the real world, these things have a lag. And I will show you exactly how these numbers play out.

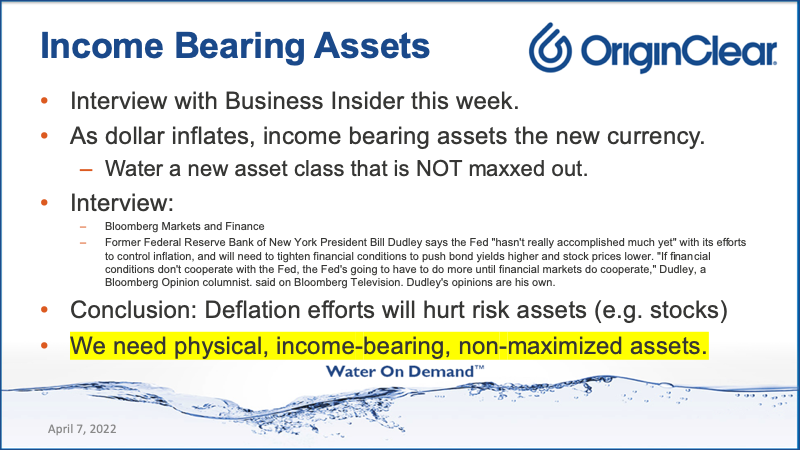

So with that, I'm going to just run through a couple of the numbers here. All right. So it is Thursday, the 7th of April already. And so it's an inflation friendly asset class, but it so happens to be and I'll be discussing this further. It's an income bearing asset. And in this environment and income bearing assets are probably the safest thing there is, but they have to be at the bottom of their run. They can't be maxed out.

Look at commercial real estate. It has very high valuations and it's only going to come down from that because New York is now running at 30% occupancy rates on offices as literally half as many people coming to work as used to, which is a dramatic drop. So all kinds of assets depended upon revenue assumptions that were based upon people showing up in offices, people walking down the street and getting a bagel and so forth.

Those times have changed. So it's a new era and what you need is an asset that will always, always be needed. Number one will always become more scarce and is currently just beginning its run. This is the exciting part about it all and we'll be talking about that further in our free wheeling discussion later.

But meanwhile, of course, as you know, we do a very best to tell you how it is and we fix it as we go. We try to be the most transparent public company on the planet. All right.

Annual Report

Speaking of which, the numbers we filed this morning, the if you go into Edgar, which is the the SEC search system, you will find our annual report. Now, this was, as you know, it was due on the first and there's a standard 15 day extension you can take. We took it, but then we only required, I think, five days of it, five business days. I think it was so actually incredibly good performance by the team given the complexity of our systems. And it's going to get even better yet.

Year over Year

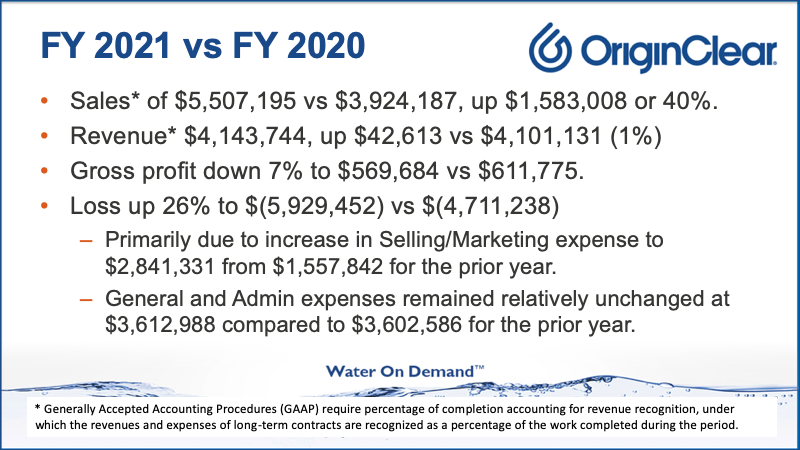

All right. So let's get right down to the numbers. First of all, let's take a look on. Fiscal year 2021 versus 2020, sales were up 40%, which is fantastic. Now, remember that generally accepted accounting procedures, GAP, require what's called revenue recognition, which is based on completion milestones. And so you might have a big sale, but then you've got to recognize it, right? So sales were, as I say, up 40%. So we were typically a $4 million business literally in 2020 was 3.9 million and it popped up, which is great.

Revenue was up just 1%. So basically Flat did not yet reflect those changes. In fact, gross profit was down. Now operating losses are showing dramatic increase in selling and marketing expense because we are in the process of dramatically increasing our burden to build capabilities for what on demand? Much of it is selling and marketing, but general management expenses remain relatively unchanged. Okay.

Fictional Number

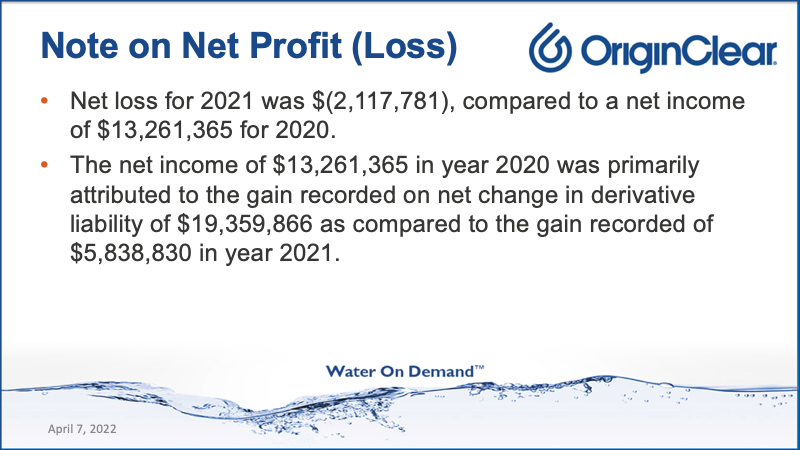

Now, another thing to remember is we have to mention this is this highly fictional number called net profit and loss, 13 million in 2020. But that's all what's called derivative calculations. It relates to how our liabilities are recorded in any given year versus the stock price, etc. And it goes up and down. There's no rhyme or reason to it. I don't understand it.

The bottom line is, is that we go back to basically we're still operating on a loss, about $1,000,000 a quarter, but that is on purpose. Our operating divisions are profitable. It's our efforts to create this brand new thing that is costing us money. And that's a decision we took a little while ago to go all the way and create a big industry success. So that's kind of how it is.

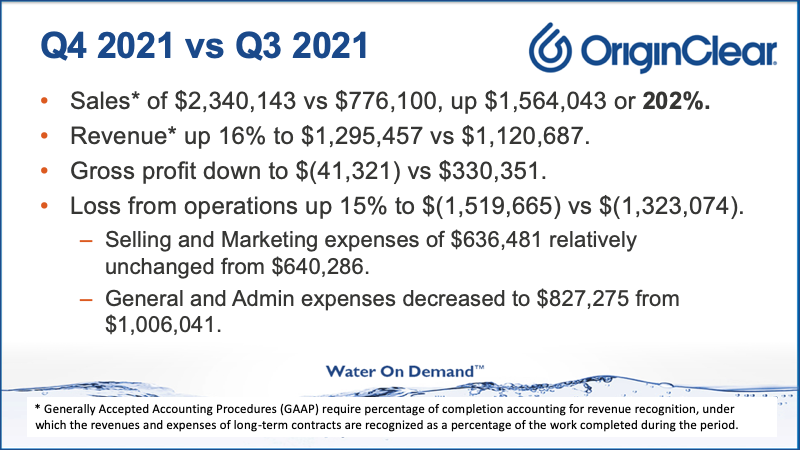

Quarter vs Quarter

Now, here's interesting part. Quarter versus quarter. All right. And that is we had a dramatic increase here. We doubled between Q3 and Q4. We doubled from sales to over $2 million. So that was fantastic. Revenue is up 16%. Gross profit was down. But that was just a factor of, again, just timing of of jobs and losses from operations. In this case, it's relatively unchanged, looks like, of course, we still have losses, as you can see, but the sales and revenue are working their way up.

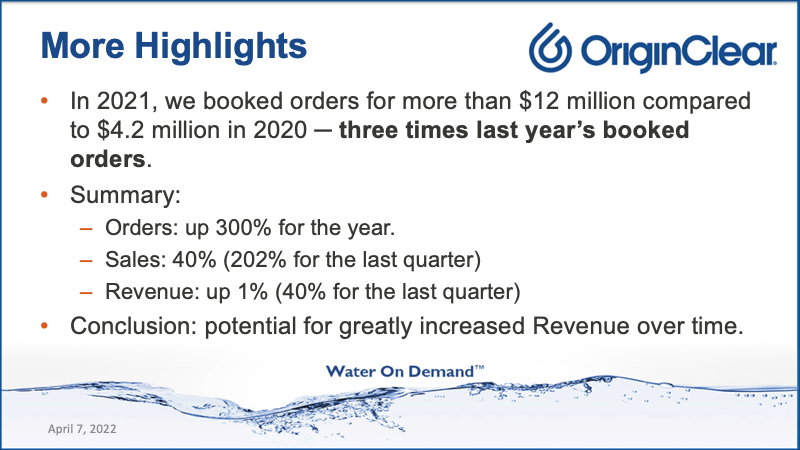

3X Booked Orders

Now, in 2021, we booked orders for more than $12 million compared to 4.2 million in 2020, which is more than three times as much. So here is what it looks like. Orders are up 300% for the year. Sales 40% of revenue just up 1%. But as you can see, it starts to show in the last quarter to 202% in sales, up and 40% from last quarter. In other words, what we believe is there's a potential for greatly increased revenue over time as the orders turn into sales, turn into revenue, and that's how it looks. And there will be a release about this. But I wanted to give you the early numbers.

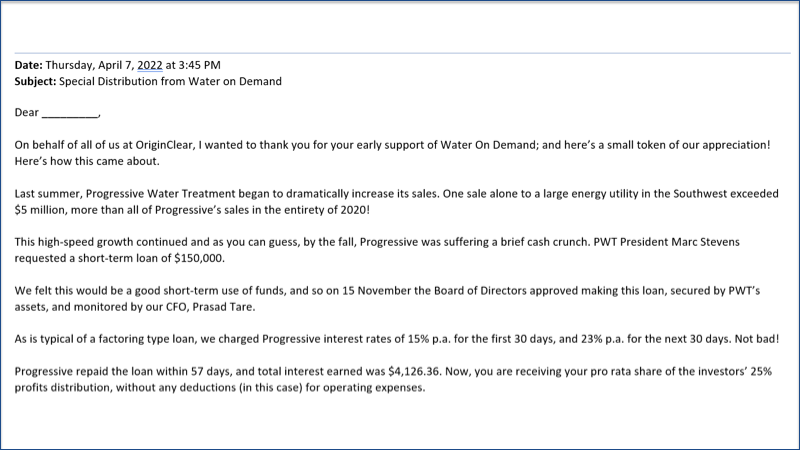

We're happy with how it's going now because these orders boomed so much. We had a story here where Progressive Water treatment, they booked a huge amount of business and they had a short term cash flow requirement. And so we went ahead and this is the first investment we made out of Water on Demand.

Royalty Letter

And here's the letter that describes it just went out today to four investors and basically it tells a story about Progressive Water treatment dramatically increases sales. One job alone was $5 million as an order. Right. And they had a brief cash crunch. Short term loan 150 K and we went ahead and the board approved a loan with security and monitored and very high interest rates 15% per annum for the first 30 days and it pops to 23% for the next 30. Right. Not too shabby. We don't mind making that kind of money.

Progressive repaid within 57 days and there was about a $4000 payment. And the investor here receives their share of the 25% net profits distribution. And because it was such a small amount, we didn't deduct anything for administration or operations or anything like that. We just took the total interest because it was small enough as it is and just gave 25%. So went ahead. We sent it today on an automated clearing house and of course now they are doing fine.

We were like, Do you want more loans? Like, No, no, no, we're fine. We don't need these 23% deals not needed. Thank you very much. It's like credit card rates, right? So. They are now fine. And we're focusing on our real job, which is to invest in these pay per gallon projects with the million dollars dedicated in our program. So it's kind of like framing that first dollar on the wall. It's kind of cool. So we thought it was worth doing. Not a heck of a lot of money. It's like $1,000 total paid out. But, you know, symbolic.

Stocks will Suffer

Ok, in an interview that I gave with Business Insider this week, they basically wanted to know, so what? What is the how are water utilities going to do, meaning municipal bonds, the very large water companies that operate water systems on on contract people like Veolia, American Water Works, Évoqué and so forth, Suez, all these companies, how are they going to do? And I said, generally, great. Only problem is that they're going to suffer because all stocks are going to suffer.

Problem with Inflation

And furthermore, they are there's going to be a problem with inflation is going to, any time you deal with something that consumers consume, you have a problem with, let's say? Well, we saw that with landlords, right? People got tenants got forgiven their rents, but the landlords were high and dry and a lot of them were small and they suffered tremendously. There were tremendous amounts of defaults by landlords. Why? Because the government wouldn't let certain things happen to consumers.

And I believe that this is going to happen with water rates, that they're going to be capped out. There's going to be a limit to how much these water, these vast, large water companies can make. But, you know. This says you really need to be not in a stock, but you need to be in an asset that bears income and of course, an asset class that is not maxed out.

Action by Fed

So in this interview, this is very important. We're going to play it. It's a very short interview, but basically. Risk assets are in danger because the Fed is going to try to pop the bubble. And that's where you really want to be. You know, I remember in the mid seventies, you could get a house in Orange County for $40,000. And I was like, wow, that's a lot of money. Very funny. So you want to start at the beginning? If I bought back then. Then I'd have million dollar, multimillion dollar homes for the same thing. So that tells that story. So let's go ahead and play this and we'll take a look at this little clip.

Start of presentation

Bloomberg Host: Define the difference between Volcker and Brainard. Inflation. What's different with this seven 8% versus a seven or 8% when you were certified at Berkeley?

William Dudley: I think the difference is that the inflation that Volcker had to fight built up over a long period of time. And so inflation expectations started to rise pretty significantly. So it's much harder to get rid of the inflation than the inflation we have now. The good news is that the inflation expectations are still relatively well anchored. So that would imply that the Federal Reserve isn't going to have to do quite as much to push inflation back down.

Bloomberg Host: Your line in your piece this morning, in the lead paragraph, Bill, I think has got everyone's attention. So I'll repeat it. For everybody who hasn't heard it so far, to be effective, it'll have to inflict more losses, inflict more losses on stock and bond investors than it has so far. Bill, run us through financial conditions and how you gauge financial conditions and why you might believe that stocks are a big part of that.

William Dudley: Well, financial conditions are important in the United States, and Powell has emphasized this in his prepared remarks, because that's how monetary policy works. The US economy doesn't really run on short term interest rates, it really runs on long term interest rates. And the stock market is also important because a lot of people have exposure to the stock market and the level of the stock market affects their wealth. So the Fed has said pretty clearly we need to tighten financial conditions to slow the economy down, to keep inflation in check. And so far, financial conditions really haven't tightened very much. The stock market's only 4% or so off its high. It's still up very sharply from where it was a couple of years ago. And bond yields 2.5 to 2.6% are still really low, especially when you adjust for inflation. So in my mind, the Fed hasn't really accomplished much yet. And if financial conditions don't cooperate with the Fed, the Fed's going to have to do more until financial markets do cooperate.

Bloomberg Host: Bill, talk a little bit about the consequences of this. If stocks are a reflection of sentiment, if they affect the way that people are willing to go out and make purchases based on their household wealth, what does that do to the economy? Are you basically saying that if things continue the way they are, the Fed is going to have to torpedo growth to a potentially recessionary degree?

William Dudley: Well, the Fed right now is you know, markets are pretty confident in the Fed's program because they have the Fed taking the short term rates up to about 3%. That causes the economy to slow. And then the Federal Reserve eases policy in 2024 and 2025. And we have a soft landing. You live happily ever after. I don't think it's going to be that easy because because the markets are so confident in the Fed, the financial conditions are still quite buoyant. If financial conditions are buoyant, that means the Fed has to do more to slow down the economy. Also, a soft landing is very, very hard to achieve when the unemployment rate is so low.

The soft landing examples that Powell has cited, 1965, 1984, 1994, were all examples where the Fed tightened and the economy slowed, but did not slow sufficiently to push up the unemployment rate. The unemployment rate in all three of those episodes kept declining. I think in the current environment, with the unemployment rate at 3.6% and wages running well above a rate consistent with 2% inflation, the Fed is going to have to tighten enough to tighten financial conditions, enough to push up the unemployment rate. And when the Fed has done that in the past, it's always resulted in a recession. That's not their intention. They'll go for a soft landing, but their chances of pulling off are very, very low.

Bloomberg Host: Do you think that rapidly reducing the balance sheet, Bill, will be enough to achieve this sell off that you think is necessary in order to enact some of the tightening that the Fed is trying to achieve?

William Dudley: Well, certainly it will work in the right direction. Obviously, quantitative easing helped cut down long term yields. And I think if you reverse course, that should push them up. But we don't know by how much we already know what the Fed's going to do and markets haven't really moved very much. So I think it's just a big wild card in terms of how much will the quantitative tightening do the Fed's job for them. I think the big point I would just make is just it's very unlikely that a year from now we're going to be at this level of bond yields this low and this level of stock prices this high, because that's probably not sufficiently tight financial conditions to do the Fed's job for them

Bill parse the difference is, inflation comes down of the importance of goods inflation coming down versus service sector inflation coming down. Well, obviously, both matter. I mean, I think where the Fed's expectation is, is that goods inflation will come down quite a lot over the. Because of the composition of demand as the economy reopens, will shift away from goods back to services. And the fact that some of these supply chain disruptions, for example, the auto sector will gradually get resolved. And so car prices, for example, will be weaker, used car prices a bit weaker. But the services sector inflation is going to be a lot more persistent because that's really about labor costs. And we're seeing that labor costs are going up because the labor market is unusually tight in the current setting.

Bloomberg Host: Bill Why don't Fed officials, when they're in the seat, talk like you just have now?

William Dudley: Well, it's unpleasant to be a Fed official and talk about how you have to tighten financial conditions to push up the unemployment rate. Now, you don't want to talk about putting people out of work, and that's not obviously the deliberate goal of policy. The deliberate goal of policy is to keep inflation from getting out of hand. Unfortunately, one of the reasons, ways you have to do that is to is to generate enough slack in the labor market to keep inflation in check. And that's just an unpleasant conversation to have. So what the Fed officials talk about is how we have to keep inflation in check so we can sustain this economic expansion and keep the most number of people employed. And that's true, too. What they're not telling you, though, is that how difficult that is to pull off.

End of presentation

Riggs: I would say that I think they're smoking something if they think that they've tamed inflation, there's just way too much going on with other disruptions, geopolitical disruptions, etc.. And also, I think that we have, we're going to have problems with interest rates, etc.. Long story short is I don't think people should be taking risks in high value stock, tech stocks, consumer goods, etc.. Invest in, as I say income bearing assets seems to be the only way to go. But that that's we'll have that discussion shortly. I'm going to go ahead and play the very, very cool presentation that that Ken made. And here we go.

The Money Show

Start of presentation

Money Show Host: All right, everyone, welcome back to Money Show's Virtual Expo. We are pleased to welcome Ken Berenger. He's vice president of business development of the water technology company OriginClear. Ken Berenger is a 30 year veteran in public and private equity and co-creator, co strategist of Origin clear visionary and highly disruptive water on demand TMs, excuse me, trademarked strategy to help rapidly decentralize the world's water treatment. Ken, thank you so much for being here. It's all yours.

Ken: Thanks for having me and welcome and good afternoon. What I'd like to do is I want to get a disclaimer out of the way. I've got a terrible cold, so I may frequently sip some water, otherwise I won't be able to speak. But other than that, I'm excited to get started. So the introduction kind of gave it a summary. I'm going to but I'm going to try to do is lay out we have something very special here and I'm going to give you a high view. We'll probably have some questions that I'd like to leave time for.

I'm going to give you a kind of a two year timeline and some milestones on how Water on Demand goes from a private asset based subsidiary of OriginClear that's financing water projects strategically here in the US alone to bringing it forward as a world brand with several hundred million in royalty bearing assets, generating potentially several billion dollars in annuitized revenue. So it makes us not only an attractive acquisition target, but it's a major multiplier of our market capitalization. And as a as a already publicly traded company, that obviously is exciting. Hopefully, in logically, we would think that maybe it'd be some multiple of those assets that we are going to hopefully have done in the next couple of years.

So to summarize this and then I'll flesh it out for you, it's a securitized asset, Water on Demand that throws off inflation-defensive royalties, and it's wrapped in a fintech envelope. And it's going to create, I hope, two separate potential capital gain plays within one opportunity. So I hope to accomplish in this presentation is just the highlights that we can fill in blanks on in more detail in more of a one on one environment. So that's kind of my, that's my summary argument. Now I'll make my case.

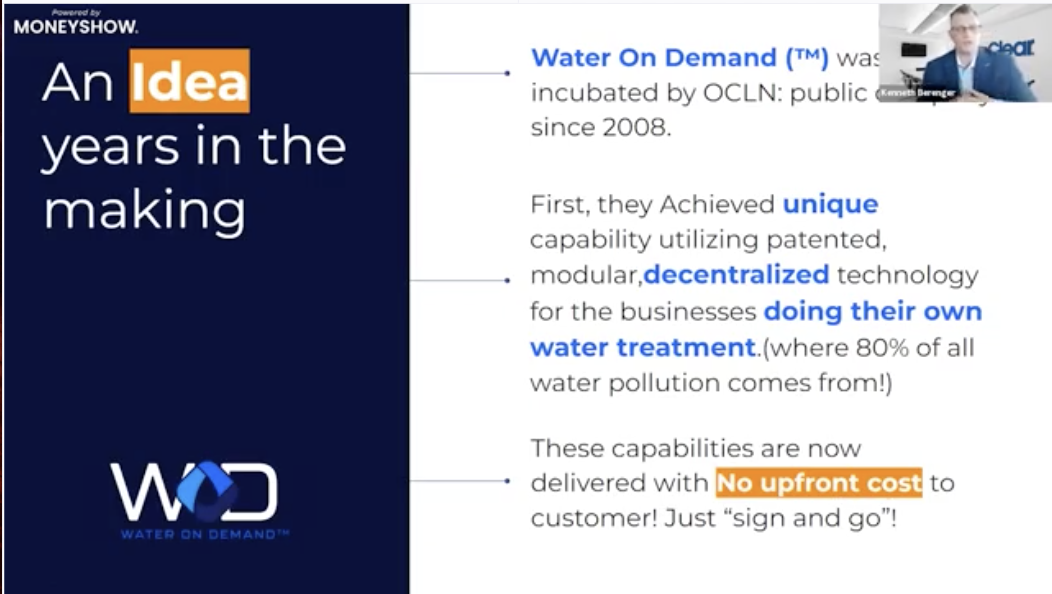

So Water on Demand these decentralized modalities that we've had have been sold for years, the real breakthrough was the ability to deliver those to those who need them as a private utility with no upfront cost similar to what solar panels act as a private utility. So Water on Demand is the brainchild of myself and my fellow strategist CEO Riggs Eckelberry. Originally the company was created in 2008 and we've incubated the Water on Demand vision much more recently. What we did first was we achieved the capability of utilizing patented modular, decentralized water technology for businesses, basically delivering to their place of business to do their own water treatment. 80% of all water pollution comes from agriculture and industry, so that if you fix it there, you fix it everywhere.

Now, these capabilities, the innovation, the real breakthrough is delivering them now as a private utility with no upfront cost. Just sign and go. The prefabricated, patented water system. They're good for almost all applications, but they're really beautifully suited for a bunch of the following that you can see here craft breweries, housing developments, animal farms, mobile home parks, campgrounds. Assembly plants, warehouses. Golf courses. So our motivation was to create a world brand was not to just entirely for wealth creation. But although the wealth creation potential is massive, it's also to solve a global crisis that many aren't even aware of here in North America. So we didn't want to stop with just delivering it to these businesses. We wanted to globalize it. And here's why.

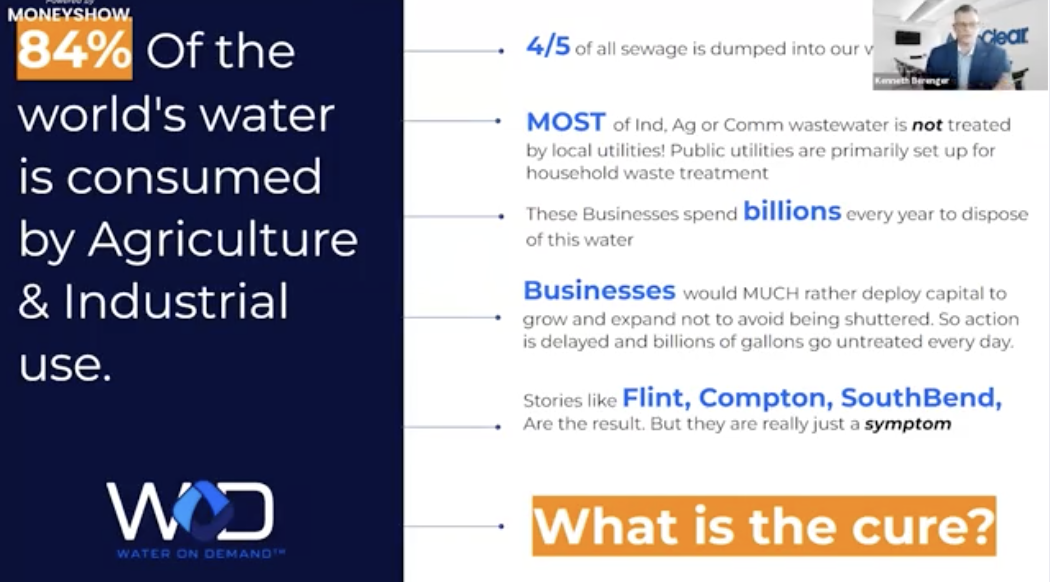

84% of the world's water is consumed by agriculture and industry. Now, that makes up 4/5 of the planet's water. A planet. Sewage, rather, is dumped directly into water supplies with no treatment whatsoever. Most of the agricultural, industrial and commercial wastewater is not treated by your utility. You know, flush the toilet and it works. It doesn't work that way with industry.

Public utilities are primarily, primarily set up to deal with household waste treatment. Businesses, as a result, spend billions of dollars every year to dispose of this waste water. And anyone who's ever run a business knows that you'd much rather if you have $1,000,000, you'd much rather deploy that capital to grow and expand your business, not use it as an effort to just to avoid being shuttered for being a violator.

So what happens is action naturally was delayed and billions and billions of gallons go untreated every day as a result. So then you hear the stories like Flint and Compton and South Bend, now they end up they end up being a symptom. The symptom, really, the disease is inaction.

So what is the cure for that disease? Well, the cure is making water treatment like an oil well. We're going to duplicate the most profitable energy model ever conceived and transform the world's most valuable commodity. The most valuable commodity on earth right now is water. And it basically it's enabling that water to be treated anywhere with no upfront expense to whoever who needs it, and thus treatment doesn't get delayed. And that happens now, right?

Not only is water not not trading, it's the only commodity that I can think of that's not trading at an all time high. But this is the very first way for investors to be a direct funder and royalty recipient ever in history. So this provides strong financial incentive to fund these systems for places that really need them. Now, I'm going to show you hopefully demonstrate as an asset class how water is within these systems, which are portable, much more stable than oil, with better inflation-defense than real estate and going back to energy, unlike traditional energy, which eventually is going to be sunsetted, this will never go away because it's required for all life on Earth.

Right before I get to that rollout and how we get there, I want to spend a second on how our unique capability allow for what used to have to be purchased, thus creating a pain point for businesses and often delayed action can now be placed on site as a private utility, doing the things that large infrastructure cannot do because they can't be built to every location. And we can simply do this by dropping it on site and charging by the gallon.

So the first phase of Water on Demand is already alive. It's a pay as you go program. There's no big capital expense and it transforms the whoever makes these systems, us and many, many others. As I'll demonstrate, we go from selling high end equipment to just blessing people. Here you go. We allows us to say, don't worry about buying the equipment, the million dollars. We own it. We're going to be a private utility that deals with your very specific effluent need, which is also makes it more efficient. Just pay on the meter. Now their response generally has been, okay, great, where do I sign? Think about how much business, anyone who's ever sold high end items, how much you could sell if you didn't have to get the person who needs to spend $1,000,000 to not actually have to spend it right.

They don't have to make that upfront investment. So that million dollar expense goes away and that was delaying action. Right? So now it happens without having to spend the money. So we prevent the delay and we prevent the billions of gallons that would have gone untreated now are getting treated. So we keep the title to these systems and we're creating an asset base that'll elevate us to a national exchange. So we own the assets, we own the contracts, and now we have a multi decade relationship to the client. It's not a one and done and it provides an incredible inflation hedged royalty to the investors.

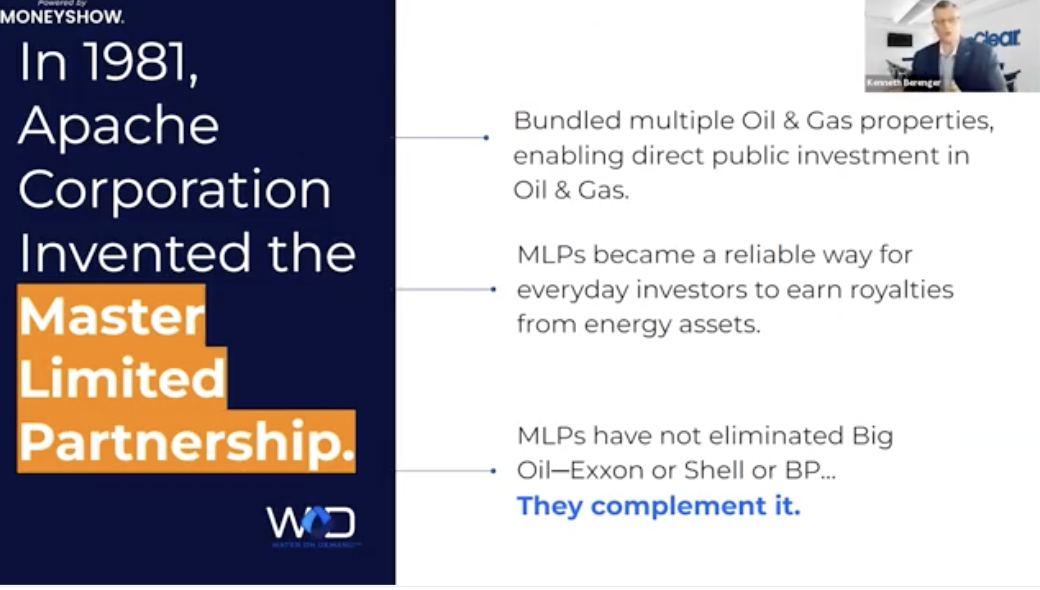

Now, about the royalty I mentioned, it has major advantages over current traditional assets, and I'm going to explain that in a minute. But we designed it after a very well known, very well recognized, phenomenally successful model of the Oil and Gas Master Limited partnership. That was the kind of the spark of the idea or MLP.

So I'll get into the background on MLPs for those of you who aren't familiar and then you'll see how it's a perfect fit for water. So many of you already know.

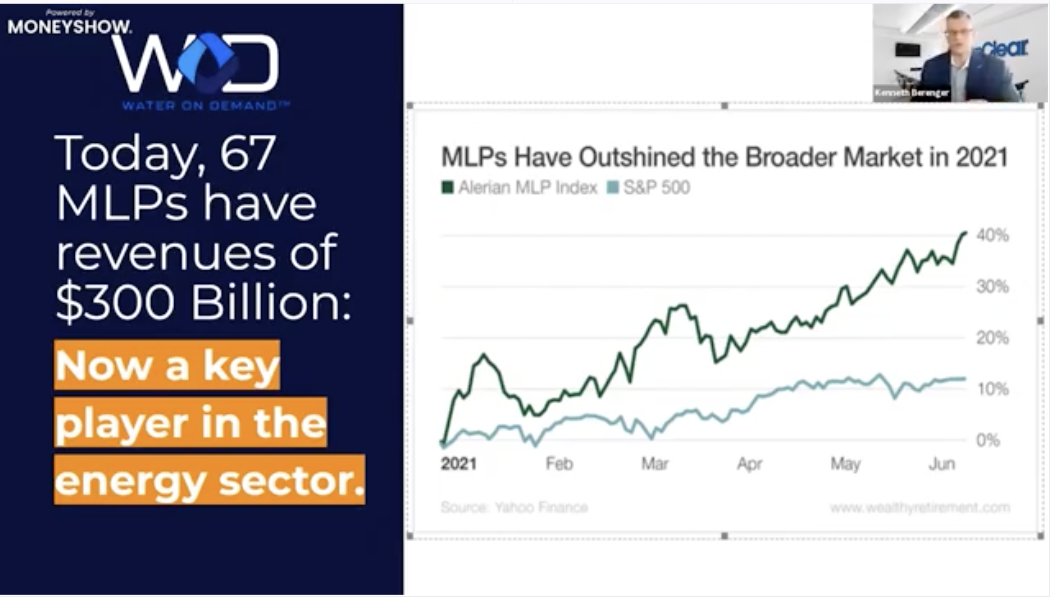

And for those that don't, in 1981, Apache Energy invented the Oil and Gas Limited Partnership, so it allowed for any accredited investor to essentially partner with Big Oil and earn royalties on the continuous production of oil and gas, essentially for life. Now, because oil is an international currency that's been a standalone favorite for asset and inflation protection almost since day one. It's preserved and protected trillions of dollars of wealth over the last 40 years, and that's what it did for the investors.

What it did for the business was it turned it allowed Exxon or Shell or whoever to tap the almost unlimited quantities of capital that were desperate to be preserved against long term inflation. That's what it did for the investor and what it did for the industry is it served it well. It didn't compete with big oil. It actually helped it tremendously by providing capital.

So. This is the MLPs chart compared to the S&P. So inflation-defense, wealth preservation. That's grown the oil and gas MLPs market to about $300 billion a year space. Water on Demand is you're going to see now has a lot of the inflation defense features of an MLPs but none of the drawbacks fossil fuel production has right which makes it universally appealing to both traditional wealth preservation players and the trillions of dollars of eco friendly capital that are looking for a profitable space. So if this is what MLPs could do versus the S&P last year, we have a lot of reason to believe that Water on Demand could potentially do a lot better.

So. You know, the MLPs model. Imagine that MLP model now for the continuous production of clean water. This will have the same real time inflation protection as energy. Here's what it has that MLPs don't have, which makes it more universally attractive and much more stable. Every inch of ground it touches is cleaner and greener. So the humanitarian and environmental benefits of treating trillions of gallons of water are incalculable. But it's profitable, too, right? So there's trillions of dollars out there in ESG and eco funds that can grow and preserve their wealth, too. Right. Without tremendous speculation of a developing technology. But they can still say stay true to their mission.

Now, as I said, as I said earlier, water is much more stable. There's little to no water market price risk. So those of you who are in energy right now are enjoying these huge price spikes in oil. We know that party can't last forever. Oil is always essentially at the mercy of global events in OPEC. But water prices, they rise every year very slowly, which I'll show you. But they're very steadily. There's no big ups and downswings. It's always based on local water rates unique to that area. So it's largely, if not completely immune to international drama. And thirdly, this is going to permit access for the very first time companies like the big Veolia American Water Works, Évoqué There's the multi trillion dollars of water market that's currently inaccessible to them because there is no heavy infrastructure and there never will be because there's no tax funding for it, especially in third world countries.

I'll give you an example. A company like American Waterworks spends $1,000,000,000 a year acquiring companies just to pace ten or 12% annual growth. So a company like them acquiring our capability for a few billion dollars would open access to 80% of the planet that they can operate in because there is no water infrastructure and there's no government spending to support it.

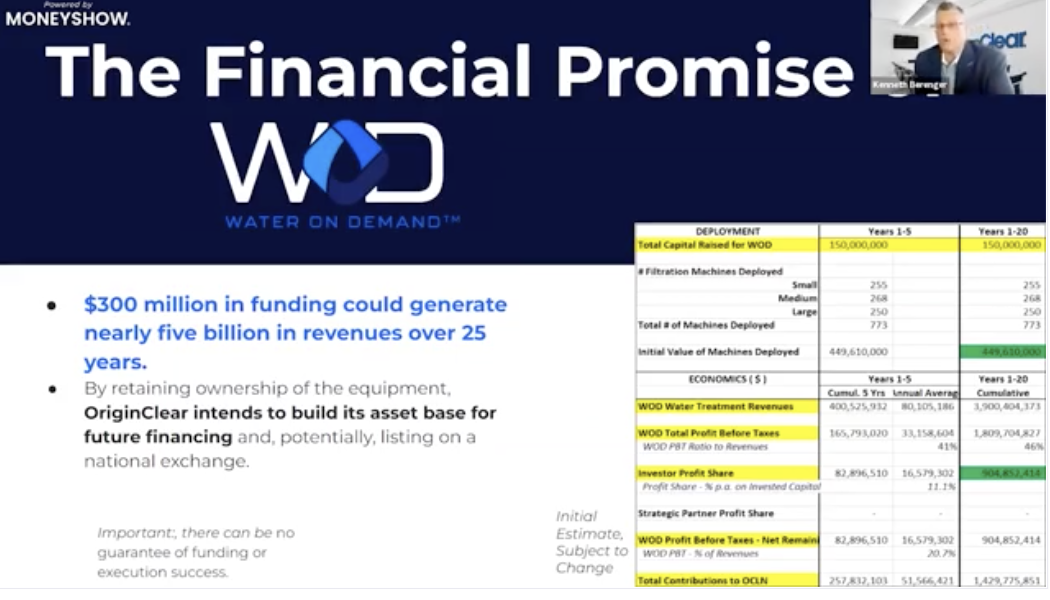

So how we're now bringing this to the fore is we've got a $300 million fund. It's going to be now added to Manhattan Street Capital is adding our fund to their portal, giving us worldwide exposure to crowdfunding and family office investors. So here's how it starts. Let's say you have $150 Million that goes into capital equipment that would create value of machines deployed about 450, so about 3 to 1 leverage. And it would generate about a little over 20 years, about just under $4 billion in total revenue, which is a wonderful annuitized type of asset. But it also creates about $904 million is what we project to the investors. So you're investing let's say you invested 300 million in total as an investor class and you're getting back triple that in pay streams.

Every nickel raised in this new asset class has immediate cash flow with asset securitization. So it's not this spray and pray. And I believe that this will begin a cycle of larger scale Wall Street funded micro utilities, very profitable to the investors. And I think it's going to stimulate rapid entry into this asset class. What asset investor is going to say no to ultimately receiving roughly 300% of their capital invested with real time inflation adjustments. Plus, because it's owned by a public company, you're going to get a grant of 150% return on top in the form of the parent company stock. Right.

Then there's the real intent of also bringing Water on Demand forward as an entity some day. So there's the potential upside of being an early founder in that as well. So this stock that I'm referencing, whether it's the parent, the some future iteration is all it's all free. Okay. So there's really potential unlimited upside, but without the normal capital risk, remember, your capital is in a securitized asset, so principal goes there. And if capital gains are your motivator, well, there's certainly a lot here. But if asset wealth and inflation protection are important to, then this has the potential to outperform a lot of other asset classes. But having that outside capital gain potential as well, and we've set it up so investors don't just survive inflation, which we're all sensitive to right now, but actually thrive.

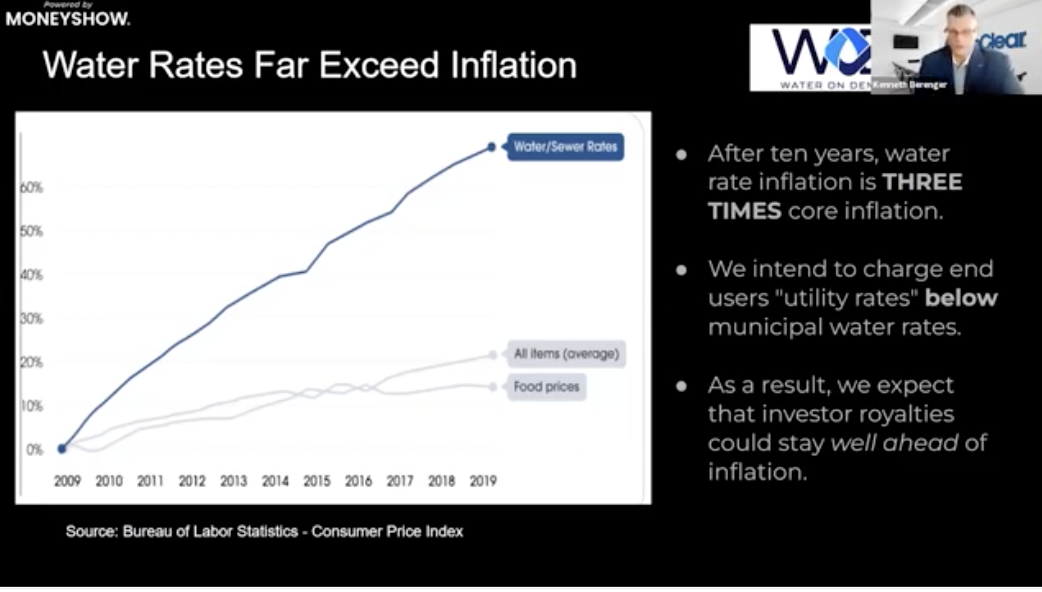

So a way to assure that the investors assets and their pay streams grow faster than inflation. Simple. We tie the pay streams to water rates. So water rates inflate at three times faster than core inflation. But water rights are very stable. And as you can see in this graph here, the end users, we charge a utility rate somewhere well below that new water rate. In other words, $1,000,000 a month water user would simply reuse that same water that they've already paid for and get multiple turns on the water and eventually discharging it. So it's not just water treatment, it's major water conservation. But the business, well, he's just saving a lot of money. Right. And that may be his primary driver. Solving the financial pain point to the world's main polluters removes that barrier, and that's how that works.

Now, here's how we protect your pay streams. Regardless of what happens with inflation. What we've created here is it represents the world's first direct investment in water assets, better price stability than oil, and more inflation protection. Every single, oil works directly with inflation. Water actually outperforms inflation. Every single dollar of investment in Water on Demand can be ultimately directly linked to a number of gallons of water that those dollars were able to reclaim and reuse. $1,000,000 investment in Water on Demand will be responsible for seven excuse me, 175 million gallons of new, new clean water. That's the definition of impact investing.

Now, because of this, there are trillions of dollars out there, ESG eco funds that will have the benefit of knowing what kind of an impact with each dollar that that they bring to bear. And eventually, number five here, Water on Demand becomes a pureplay. It allows every quality water company and manufacturer to be a service provider. Essentially, the entire world is our manufacturer. The entire world is our sales, sales agents and so on and so forth. And it's a it's a model that's far more profitable than the simply build and sell model.

Now, imagine the power of dramatically expanding $1,000,000,000,000 industry like cellular did to telecom. And that's what we think that this can do. But you also have a securitized asset that grows faster than inflation. Now you combine those ideas with decades of real time inflation adjusted yields. Those yields are actually fixing water with every dollar that it's necessarily protecting from this looming hyperinflation that we read about.

Let's talk about inflation for a minute. The true CPI right now, this is your consumer price index. This is the number the government reports. I think last month was 8%. They ended the year at seven. The true CPI right now is the blue line here. This is from Shadow Stats and that's my source. The government numbers of 8% or whatever. Nonsense, we're probably 15 or 20%. Best case scenario, if it doesn't climb higher 20% for several years, meaning savings will be obliterated if no action is taken.

But we're seeing a pattern here of repeating of 1981. If that happens, we could be looking at if the government number is 36%, the real number is 56% by 2026. That's not a far off date here. So this becomes not just an investment that you turn some of your aggressive money into potentially a lot or do something that you feel good about because by finding environmentally beneficial, it is all that. But it's much, much more. This becomes where you allocate what you've earned in your life that you don't want to be evaporated over the next few years for the previous mentioned reasons. And it's a chance to outpace inflation in what's coming in real time. Water rates run three times faster, so no one's rooting for hyperinflation. None of us want this to happen. But not addressing it means that you risk throwing that money kind of to the wind, and this prevents that.

So tying the opportunity together, given what an all around solution this is on both the application to water and as an asset class to investors this world brand. Believe me, we're fully aware that it deserves to be its own pure play.

End of presentation

Open Discussion

Riggs: And with that, I'm actually going to hold this because I think it gets into the details of the offering at this point. And I would like to spend a little bit of quality time with our good man Ken Berenger here. So Ken pop your video on and let's let's get with the the free flow.

Ken: I lack the power.

Riggs: Hang on. Oh, you know what? That's my bad. A second. Let me add you as a co-host.

Ken: Nobody puts baby in the corner. Come on.

Riggs: That's to prevent you from popping in. Control the man, please.

Ken: All right.

Ken: I wore cloths and everything. I'm good.

Riggs: Oh, man. Tell you.

Ken: All right. How are you?

Riggs: He's Zoom formal.

Ken: Yes, I am. I am. Yes. So. Yeah. And I'm glad you cut it off there. That was a very that was kind of a, that was kind of a high view at the Money Show. And. You know, it's so funny because things have actually evolved and accelerated so much since then. I'm looking at that and I'm thinking...

Riggs: He's like, forget this thing.

Water — The Next Great Asset

Ken: No, no, no. It's all. It's all there. But there's, like. There's this whole new trunk of stuff that. God, I wish I had a chance to talk about it then, but we were probably a couple of weeks, that was like before the summit and stuff like that and kind of the manifestations of what came out of that. But it was interesting to watch that. We've been in, we've been yelling, we've been yelling from the mountaintop about assets being the way to go and water being the greatest asset ever. And decentralized, like all these terms that no one had any idea about. And all of a sudden, I'm seeing all these validation articles on how water is the next great investment.

I'm like, See, I told you, it's you feel validated, but you almost feel frustrated. You wish people had kind of had that come to Jesus moment a little earlier before they were buying into these a lot of these bubbles. I read three. I keep sending you all the. You know, ZeroHedge doomsday stuff like first thing in the morning, like, good morning. Here's how the world is ending today.

Bringing Down Inflation

Well, because there's a lot of doom and gloom on the financial side of that. And they're saying that. Powell needs to kind of wreck the market and wreck the housing market in order to, in order to kind of bring inflation under control. That's a little drastic. I thought maybe not printing 17 trillion would have helped.

Riggs: Yeah. You know, they say he was saying that it's going to be relatively easy bringing down inflation. I think that's a pipe dream. I think it's a pipe dream. Right. But anyway. Look, we know inflation is a fact. We know that if you are in any one of these maxed out investing classes, you're in for a big surprise.

A FinTech Pureplay

And so tell me a little bit about why you're having such success right now, getting investors into Water on Demand? He goes, How much can I, How much am I allowed to say.

Ken: What am I allowed to say? Okay. I would I would recommend that folks that want a detailed kind of rollout strategy reach out to me personally. This vehicle, this entity, of course, needs to be its own, its own identity, its own thing.

Riggs: The word is pureplay.

Ken: It's a pure play. It's a fintech pure play that's wrapped around what could be $1,000,000,000,000 asset.

Riggs: Now, why is it a fintech pure play?

Ken: Well, it's fintech because really all it is, is it's. So I'll make other because people don't understand.

Riggs: Because you just signed up for the Wharton extended course on that.

Ken: Yes, I'm going to be a Wharton graduate. So I signed up for the Wharton Business School course on both fintech. And actually there's cryptocurrency in there, which wasn't my reason for signing on. It's funny, I knew fintech before I knew it was fintech, right? In other words, you and I dream this thing up and we just I was verbalizing it in lay terms and you were like, That's fintech, right? So we I am. In other words, I guess I intuitively understood what fintech was without having the formal educated access. The way they, the way they....

Riggs: Wharton is going to fix for you. Thank God.

Ken: They're going to fix me up. Good, right? I'm going to come out very stuffed, very stuffed shirt.

Riggs: But the fact is that we are unique in the water industry. There's no one else doing only finance. No one else.

Ken: So, so, so how is it fintech? So, you've got to that. So when I. So how is this fintech? Since they don't understand the mechanisms that are going on in this head, I say, look, Airbnb owns zero real estate. They don't own a dog house, their $100 billion valuation. All they do, they take your money, they facilitate the payment of your credit card to me to rent my property. Neither one of us have to have to even meet. Right. And you could do that in Israel and I'm in Argentina. Right.

So it creates this this entire mesh around the planet, which allows the rapid movement of money. I can buy properties in Montana all day now, never lay eyes on them and have them rent it out as soon as the damn thing closes. Which I do buy assign. This creates real, this creates electronic real estate funding, financing, renting, that sort of thing. So that's what Water on Demand is. It allows an end user in Montana to receive a system that he can't afford. It's deployed by an investor who then becomes a partner with OriginClear or Water on Demand. In this case, Water on Demand. It becomes a real partner for life.

So that's fintech, that's financial technology. And basically, it's they process his ACH payment. The investor gets that ACH payment. That's the down payment. That's his first month. Boom, he gets that. And then as this meter runs and as these revenues, as this monthly bill is accumulated, a quarter of it is immediately shunted off to the accounts of the investors. And because, look, water is super stable and super safe in a way that real estate or oil and gas never be. But because we're going to set these up as funds, you will have a, you will have a variety of properties with a diversity of properties.

Riggs: It's a basket.

Diversified Structure

Ken: So so maybe the really, really nastiest water out there in a super dry area, that thing is going to, that thing is going to blow out tons and tons of cash, whereas something that maybe is much more moderate effluent used in a much more water rich area where water rates are low. So. So in other words, you don't have to be the guy who buys a strip mall in Baltimore. And it's boarded up. Well, it's boarded up. Right. You could buy a REIT. You could have a you could have a you could be part of a fund that owns 1000 properties. That's just one that's a total non performer. Right. But the high rise somewhere is performing beautifully. Right.

So now obviously we're not subject to the same risks as high as commercial real estate or oil and gas, because we don't have that. We're not we're not at the mercy of international turmoil. Right. It's all it's all immune from that. But still, some forms of water treatment are going to be a richer revenue source than others. So what we're going to do is we're not going to stick Mr. Jones with this super high payer and Mr. Smith or Ms.. Smith, excuse me, with something that reduces, the lower... And the reason we can the reason we can kind of estimate these things very accurately is because the portfolio will yield X based on 25 years of our operating history. And that's exciting.

Achieving Focus

Riggs: Yes. And you know, there's a great book and we're going to wrap this up because we're at ten till. But there's a great book that I'm a big evangelist for, which is, the last week I talked about three books and this is the third book, right? The second book was The Innovator's Dilemma. And of course, the first one was Inside The Tornado. Well, the third one is called Focus by Jack Trout, the guy who was part of the team that created the whole positioning revolution.

And he's, and one of the things he says is to achieve focus, you've got to have sacrifice. They come together, right? The same coin, the face of it is focused. The reverse is sacrifice. You have to give stuff up to be focused in our case. The normal. What the water industry is doing is there doing these same operation of maintenance things, keeping it all right.

Ken: It's very parochial. It's very parochial. It's I get 100% of something. Right? When you could have...

It's scalable. What we've learned and I've learned from experience since 2015 with Progressive Water Treatment. What we've learned is that there's a lot of work involved in these projects, takes months and months to get them bid. And the margins are low and it's a slow business, so how are you going to blow it up? How are you going to create the kind of expansion that our investors expect? Just don't do that. Just shop it out. That's right. And do the high, high turn, high profit stuff which is the money.

Ken: That's right. That's right. And you know what? Ask ask any guy who's trying to compete out there if they could have access to a modality that would make it lighter, cheaper, more durable and make it a superior product, tell them that they can have that. Oh, by the way. And we'll supply the money. So that, you know that guy you've been going you've been dancing around with for three years. This is the conversation we had Riggs on the phone with so-and-so.

Riggs: Yeah absolutely, that golf course deal.

Ken: Just tell him. Don't worry about it. I got the money. And you know what he's going to say. Oh, okay. Right. It was that it was a Hollywood thing you said that day. It was the same thing. If I brought the money. Oh, then you could do whatever you want. So this is the thing.

Riggs: Which is why, why the ugly girls, the ugly guys in Hollywood get the chicks. They got the money.

Ken: Got the money, right. So the end result is, is that what we've done is we've broken that parochial mold. We've turned this into, look, the benefit of you and I, neither of us being in water is when they said, "You have to do it this way," we said, "No, you don't." And that's that.

Riggs: We challenged that.

Ken: I also want to, next week remind me to mention I went on a land search this weekend, was looking at tracts of rural land and what you'll never guess what the problem was with most of these properties.

Riggs: It's the water stupid.

Ken: It's the water stupid, right? Yep. And we'll talk about that because it involves major, major land developers, people they're building thousands of homes well outside the...

Riggs: We are going to do that next week, my friend. So hold that thought. It's now 8:53 p.m. Eastern and you know, I have my beauty sleep ahead of me.

Ken: You better get to bed early.

Call Ken

Riggs: I'm just going to show quickly the contact screen here for you guys and gals to talk to. Ken, you know the drill, but here is the information. You can email, you can book the call. Just put oc.gold/Ken in your browser or give us give him a call. He is an absolute whiz at this and really he deserves better than to work here. But we're very grateful.

Ken: I'm going to call my agent. All right. Get my agent on the phone, Amanda. All right, guys. It was lovely speaking with all of you. I hope you. I hope you got something. Now, I can. I can drill down with you folks, so please reach out, call me, book an appointment with me, set aside some time, and I'll fill in the blanks for you. Good.

Riggs: Thank you very much, everyone.

Ken: Goodnight.

Thank you for all you do for us and we will catch you next week. I guarantee you it'll be exciting. We'll be getting into the real killer app. For Water On Demand, which is housing developments. Badabing badaboom, have a good night all. Take care.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)