So what happens if you make plans to merge with a company already trading on the NASDAQ? Put it this way — we didn't just cover how to create a network effect for water technology adoption… No promises, but we may have opened the door to a whole new world for innovation in water and for OriginClear! Get the HOT news here in the replay.

Remember it’s a non-binding agreement and nothing is a done deal.

Transcript from recording

Opening

Riggs: Dan, I've got to tell you, I'm so happy to have you on board as the inspirational designer vision of all this. One last mention I wanted to get into about Water On Demand, which, of course, is this water as a service concept is that we're excited about deploying your standardized modules as technology so that when we have these other water companies do the installation that's in Seattle, Washington, and they're going to install it and maintain it, we want to let them license your tech so that the whole fleet that we build through Water On Demand is more standardized.

It seems to me that the golden opportunity to let your patents and your trade secrets and your knowhow become exported to the water industry. And from what our experience so far is, people are excited like, you mean we can have that technology? Yes, you can. We're not only going to give you the business, here, here's a check to pay for this machine. Here's a check to pay for you to maintain it. And by the way, you get to use the Modular Water tech. And I think that's triple winner.

Well, hello and happy Thursday. And here we are on the very first CEO briefing of the year. And wow, is it going to be exciting. Let's take a look. All right. Water — The Blue Gold. And that's for January 5th. Briefing number 192, Water Like an Oil Well™, the emerging income asset.

As usual we have the Safe Harbor statement and disclaimer, and I'll jump right into it.

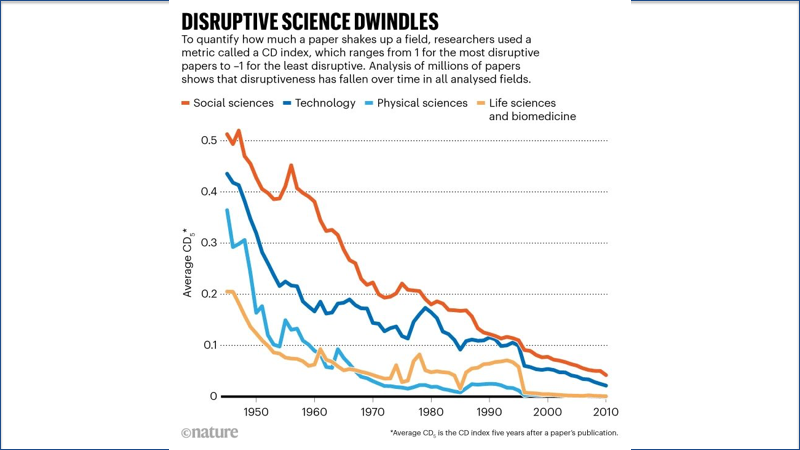

Riggs: So I spoke about this earlier by in my CEO update what's going on with disruptions that seems that we're doing less disruption. That's weird isn't it? So let's take a look.

All the disruption, it appears, was in the fifties and sixties, and there was a kind of a bump in life sciences in the mid eighties to mid nineties. But other than that, it's been pretty much a downward trend. What has been going on with that? Well, the methodology that was used for this really had to do with how much a paper referred to previous art, previous discoveries, right? And there was a methodology and I'm not challenging it. It seems to be pretty straightforward.

This is a story in nature which was pretty well done, and they talked about how they did the research. And I think the problem is not so much that we're not inventing anymore. It's a couple of things. First of all, that maybe research papers are no longer the domain of disruption anymore. Maybe it's become very conventional, the research paper world, and that perhaps a lot of the innovation is happening outside of the academia.

And that's certainly true of our situation where we're being, I think, very disruptive, but we're certainly not doing it with a lot of the signoff of academia. We're just going ahead and doing it. We have excellent scientists and engineers on board and we're simply forging ahead. So maybe that's just a new way of disrupting things. Certainly Uber and Airbnb did not come out of research papers. So I think that may be a very good point.

Drought — Good News

All right. Now good news on that drought. Finally, we have some news. The skiers among us know that California snowpack is the highest in 40 years, running close to 200%, close to double of the average. And so I think that's really good news. It's going to be very helpful for us skiers, but also it's going to be very helpful for our serious drought situation in California. And of course, we have to do something to recycle so that we don't get the same problem again.

Weight Gain — Forever Chemicals

Meanwhile, forever chemicals and weight gains. Well, it turns out that you can gain weight from forever chemicals. Who knew? There's a class of chemicals that apparently lowers your resting metabolic rate the faster your metabolism runs,. it's like a fire, the hotter it burns, the more likely you are to burn calories and you're less likely to become overweight. These chemicals slow down your metabolic rate, whatever other bad things they might do, and thus you tend to get overweight faster from the same amount of food. It's just too bad. It's just one of the many things we're learning about. This is really too bad.

Toxic Stew on Cape Cod

Meanwhile, and I want to thank our investors for sending in these wonderful things. We have wonderful investors who send me these pearls. And sure enough, on Cape Cod, a big mess. Call it climate change, whatever. Probably true. But more importantly, there is these antiquated septic systems that are overflowing into the into the creeks, and that is causing a big mess.

Algae Growth and Sewer Systems

There they are trying to clean it up and it is choking the fish and making these, turning these waterways into dead waterways. And it's being taken over by poisonous algae.

There it is. And that comes from the rising levels of nitrogen that are coming from these these old, old septic systems. And just like I often talked about, Miami Dade County, we have a problem as well with Cape Cod, apparently, where a lot of building occurred without a lot of sewage systems. And the solution for it, of course, is to spend billions. Right.

Solution — Go Off the Grid

And here's these, each of these houses is probably 12 and a half million dollars. I don't know. But they're super expensive. They get far more expensive. Here's the problem the town administrator says is physically, financially and logistically impossible to meet that standard, meaning that it's just not doable. Physically, there's no room for the sewage plants. Financially, they don't have the billions. Logistically, they don't have the 20 years in which to do it. The solution, therefore, is to go ahead and let these homes and housing developments simply go off the grid with their own built in systems and water independence. And that is a solution that backs up our model. All right.

Quick geo economic comment on what's happening. And this also tells us where we're going. Everyone's hunting for alternatives to US dollar. This is about Asia. And here's what's going on with our Asian economies. Places like Myanmar and Japan are in deep trouble. They're really suffering from their dependence on the US dollar. And of course, they're scrambling to get off the dollar.

Commodities Replacing Currencies

And whatever you think of what happened with the Russia Ukraine thing, for sure, it's shown everyone that it is possible to survive being taken off the SWIFT Network. This illustrates the point I'm making, which is that we have a move from currency based finance to commodity based finance. And that transition, it was currency based. Why? Because the dollar was essentially symbolizing the amazing and immense economic power of the United States that is on the decline for many reasons. I'm not going to get into them. It'll be replaced with a form of barter, which is commodities, commodities balancing. And the power of an economy will be based on its commodities.

By the way, the US will do well, relatively speaking, because it has a lot of good commodities. But it also underlines that the new game is commodities and the fact that we are monetizing water as a commodity makes it extraordinarily exciting in this new era of commodity based finance.

OK, well Jared Simmons a few weeks ago interviewed me just before the end of the year on Innovation. Fascinating podcast. This is the second part and I must say he got up close and personal. So let's take a listen.

Start of presentation

Jared: How do you keep fresh thoughts and points of view and diversity and all sorts of those sorts of things in mind as you kind of use that approach? Does it does it make it harder to to to tackle those other things? Or how how does that how does that factor in?

Riggs: Well, I think we can learn a big lesson from the world of sports, which operates very much on stats, the numbers. And are we doing better or are we doing worse? And athletics, they've learned to rate teams and coaches based on criteria that they can, they can watch in real time how well they're doing. And wait a minute, what happened? They're on our losing streak. What's going on here? Able to debug it. And I think that's very valuable.

So to have good metrics is critical and to have a really good sense of okay, you know what? If you as a CEO are playing the piano, then those keys are the data points, right? You've got to know, oh, we know this is this is like we had a great idea, but the execution is not going anywhere. What's going on with that?

Okay. I see we have an issue with resources or personnel or the methodology is wrong or the vision or whatever. But knowing these indicate is indicators are the key performance indicators being met. Are we on track? I think that, you know, you I think you sort of develop a sensitivity to how it's going.

I spent many years at sea. I was a professional mariner ship captain. And you, at all times you're aware of the state because at any point that ship could run into a half sunken container or anything can happen. Right? One time. One time we were going along in the ocean and the hole opened up into the bottom of the ship, just like that is fountain of water was going into the engine room. Instant, instant emergency, Right.

Jared: Oh, my goodness.

Riggs: Yeah. And so not only do you want to react well, but you need to actually in your procedures and your preparations, be ready for that. Like, what happened?

Jared: I see it.

Riggs: So what? So what do you do? And and then as you're dealing with it, you're also like, okay, here's the immediate danger, but wait a minute, we're five days from land. How are we going to get out? Okay, let's start solving, solving, solving, solving. And I watched Airbnb in the early pandemic. They went their business model crashed.

Jared: Right.

Riggs: Crashed. And the CEO of Airbnb said, We went through ten years of work in ten weeks reinventing the company. And they did. They became more local. Airbnb became more of a, more of a local staycation kind of company, less about the resorts or about business travel. And and I think that was a, it was a brilliant reinvention They like, okay, we've got to do something. Other people just went and took the PPP and they sort of hung in there and nothing. And maybe they made it, maybe they didn't.

But the smart ones were like, This is a wake up call. That's what happened to us. We were like, Whoa! Every single assumption we have. Because I remember driving around in LA in the fall of 2019 going, All right, you know, the economy is good. There's a lot of cars on the road. That's my indication of economy. Good, right? Cars in the road. And literally they took all the cars off the road, right? Yeah. From one day to the next. I go, wow, like that. These things instantly.

So the idea that there's any kind of job security or any kind of life security is illusory. Now don't get paranoid because things won't, usually are going to be okay. But the point I'm making is, is that if you're awake to these signals that are going on, these like something going on here, then you have a chance not just to survive, but to innovate and then perhaps to dominate and survive, innovate, dominate. And that's when it becomes, that's now, you know, you've innovated to a point where you started lapping other people and you're like, you own the space.

Jared: Survive, innovate, dominate. I love that it's progressive, but it also reinforces the same mindset at each level, right? I mean, you're always thinking about, like you said, about the future. Survival is about the future. Innovation is about the future and dominating. You want to stay on top. You want to you you know, getting to the top is not dominating. It's staying there for a consistent period of time so you can maintain that future focus through all of those sort of phases of what you described. How has innovation shaped your career, your career path? You mentioned being a professional mariner. It sounds like you've led quite, quite a life. I'm wondering if you can see a thread of innovation through that.

Riggs: It's called "easily bored."

Jared: Oh man, it a great yeah, it sounds like a fascinating life.

Riggs: Well, it's, one of the things that I had to come to terms with was that, you know, while I had lots of good experiences, I did not become the best in the world at this, that or the other thing. They were kind of transitory experiences and I had to come to terms with, you know, like, oh, I regretted not having done this and the other thing like, wait a minute, this is what you're practicing for, right? And all that previous experience. It's for this here and now, and this is the opportunity to be the best at. Now, in terms of what drove me to these things, I have to say that, you know, my dad was a he was an Exec with Procter and Gamble, as P&G.

But he, early on, you know, how he wrote an article called Memoirs of a Soap Salesman. And, you know, they started them all out racking shelves in the Bronx, and that's how they started them out. And, you know, in the sweaty summer with no AC and then that was kind of like the initiation on the sales side, obviously. Right. Distribution. And anyway, the, he was, he did well. He was sent off to to run the branch in Toronto, which was that's where I was born.

And and then he had the opportunity, Oh, he did great, he had to go back to Ohio, and he was like, "No, I like it internationally." And and he literally took himself out of the running for the real, you know, you want to be at HQ to really go up the ladder.

Jared: Right, yeah.

Riggs: He started, he went to then went to Puerto Rico, Venezuela, Paris, Brussels, you know, and he just enjoyed that life. And I remember at one point my mom says to me, "Riggs, your dad makes 40,000 a year." Well, this is like 1960. I mean.

Jared: Yeah, that's good money. It's just a funny thing to say to your, to your son. That's funny.

Riggs: I don't know. And he had the chauffeur and this and that. He lived very well. And it was a good time to be an American in Europe for sure. And so but what was great about it was that I had a very cosmopolitan upbringing. My parents were smart enough not to put me in an American school, but to go into a local school. So I became very French, very Belgian, very before that, very Puerto Rican, Venezuelan. That was that was really good. And then at one point, my dad says, you know what, we're going to Americanize you. That's it, you know.

And so he I get shipped off to America, talk about a culture break. I was like, "Whaaat?" And I landed at Princeton High School. It was literally Fonzie and 57 Bel Airs drag racing up and down in front of the school. And I was like, What?! It was amazing. But anyway, so and then anyway, so actually it was good. It was a good thing. And it kind of made me aware of the world beyond this sort of cloistered European world I was in. Because Europe has got a very, they set your career path and it's kind of how it's going to be.

America is much more disruptive, like, "Hey, be what you want, right?" So I, by the end of of high school, I, I'd really fallen in love with a particular philosophy that, that really made me think that I could help really transform the world that more than just, you know, going to Africa for the State Department or whatever. I could actually do something that as part of a movement to help people be better, have better self esteem. And I became part of that. It was super exciting and this was the early days of it. And I became close to the leader of that movement. And that, I think, gave me a sense that there's really no limits to what can be achieved.

It was tough because at that point I became a very tough critic of myself. But I personally think that we all have that, we all are tough critics of ourselves. We're just not necessarily willing to admit it. You know, like, "I may not have achieved this, but you know what? I have at least I have a home in Levittown and I got this and I got that, I'm good." You know? And we sort of, okay. And then, of course, unfortunately, we get stuck in the next recession and things go to crap or the wife gets cancer and then we have to, all the sudden our life is upside down.

So, I think it's important to have that idea of how can we really sort of evolve individually, as groups, as humanity. And so that was very formative for me. It was ten, 12 years. And, but during that I was trained as a ship captain, and then later in the middle of it, I actually went to the South Pacific and I was a commercial ship captain, which was a whole other world.

And and when I came back and arrived, sort of came out of that nonprofit world, you know, I thought, you know what? Aside from that amazing work I do, what else is going to transform the world? And it's technology. That's what's going to be the incredibly transforming thing. And I started in the early eighties to do tech. I had my own company in New York City, which was, Lord have mercy, don't have 12 employees with no capital and payroll every other week. Oh, in Manhattan. I was like, "Lord have mercy."

Anyway, that was, so I had serious learning experiences, which got me to the next really transformative thing in our culture, I believe, which was the dot com. Because the concept that you could use computers not just for calculation but for communication was incredibly transformative. Before that, we didn't think of them as such, right? Computers were just a calculator.

Jared: I never thought about that sort of delineation from the dot com, you know, for, the dot com era kind of being that demarcation. But it is, it's where you started using the Internet to connect to other people versus just as a tool for, like you said, calculation. That's that's such a great point.

Riggs: And that's where really I started really loving tech per se, because then I went, "Oh, wow, this is going to be a revolution." Now, have there been abuses of privacy in this? Whatever. But I personally believe that we are closer knit today than we were back then. We are much more hyper aware society. Definitely growing pains.

You know, I can run a company that my chief engineer is in Virginia and it doesn't make the slightest difference. None. Unimportant. So that is I think, we're moving towards a model that is still very incomplete, which is why there's all kinds of issues with it. And you know, discovering there's all this censorship of Twitter and so forth. All this stuff is is kind of part of the creating of the new paradigm, in my opinion. Right.

Jared: Okay. So, excuse me. In order to break out of the existing paradigm, you have to step into a new paradigm that the fact that it's new and it's part of the future doesn't mean that it's perfect. So.

Riggs: Far from.

Jared: Right.

Riggs: Far from.

Jared: Right, right.

Riggs: And you've got to realize that human beings dramatize their background, their prior experiences. So, you've got people who have certain prejudices or who think a certain way, and they will impose them on the new paradigm until all those legacy ideas are washed out, right? I have one exec who just loves the idea of going and doing bonds. Small company bonds takes all the out of the room. You go after some big grant, apply for a grant and everybody forgets their job and is going after the stupid grant.

You're like, "You know what? Just do your job. Let's get somewhere." So that is old thinking that the person imported into the company, and then that has to be recognized, "Wait a minute. That is actually a contagion from an old time. We need to think of the new. What is the new?"

And that's where we evolved the new model for our company, which is to turn industrial water, the treatment and management of water into a service rather than a capital activity, and therefore hopefully transforming water all over the world potentially. And that became has become incrementally more and more exciting as a vision that people go, "Oh my gosh, that's that's stunning," right? When they get the vision. And it is true because water is not great in the world. It's not great. And yet we don't know what to do about it. What do I do about water? Give money to Water.org. Yeah. Okay. That's not going to transform water.

Jared: Right.

Riggs: But so what do we do to innovate in water? And that has made things very, very exciting for us as an organization. And we're able to step well beyond our charted path because we fleshed out a vision that was strong enough to drive it, right?

The best analogy I'm just thinking of right now is, our founding fathers, that most of them were still not even 20 when they signed the Declaration of Independence. They were in their teens. And, what they were putting there was an amazing thought that they had no hope of achieving really. I mean, who were they? At the time a majority of the people living in America were loyalists. They were on the side of the British. The Republicans were a minority, the rebels. But by having this really great vision, which didn't come from nowhere and this is something I think we've got to recognize, it came from John Locke and Hume and all these earlier thinkers.

Jared: Right.

Riggs: Thoughts came forward and all these revolutionaries were imbued with these, because they were they were learned, they were well educated and they had learned, many of them in England, of course, had gone to Oxford and so forth. And they knew all this and they and they were like, okay, this is so strong that it literally enabled them to create something that has lasted more than 200 years. And it's kind of still got a lot of development to go.

Jared: Right.

Riggs: Getting to the bottom of what is free speech, what is religious expression, what are all these things. Right. That we're still figuring that out. And so that's what I feel is that is that if you can if you can get to something that is a strong enough not just vision but a concept package, you might say.

Jared: I see.

Riggs: Steve Jobs did it great. He, "the Mac way." Remember the Mac way? Is this a way of thinking like, "You never, you should never need a manual" you know everything should be intuitive.

Jared: I see.

Riggs: Your service. All these ideas are the Mac way, the hardware is excellent. Also, but some stuff that you might challenge like a closed ecosystem. It's very hard. It was very hard to, I remember in the eighties trying to hack into a MAC. Man, it was hard work, right? So this is a comprehensive vision and it propelled Apple way beyond his death. So what I'm getting at it here is that you put together this concept that's evolved from strong antecedents right?

These things, it came from somewhere that make sense. Like we're inventing water as a service. But water as a service already exists. So but we're doing it different and we'll get to what's important. But the point is, is that we're taking good things and then like a new take and a new take that's so transformative. It's so strong that it is transformative. And they can be a level that can drive a movement. That is worth hanging around for.

Jared: Well, I think that it's so important what you highlighted around. You know, everything starts from something else, the starting materials. You know, innovation doesn't just start from a from nothing. And everyone's educated by things. They're educated by, you know, traditionally they're educated by their lived experiences as ship captains, all sorts of things. And it's the synthesis of all those things to your point where you can that you can be smart or, you know, rather than being just marked by those experiences, you can you can have your your future focus informed by those those those experiences and that and those life lessons.

Riggs: Yes, I agree 100 percent.

Jared: All right. I can't let you go without asking if there are some, if there's any advice you might have for innovators out there.

Riggs: Well, okay so. My main one is, "Don't lose that thought," Right? Like, you have an idea, you know, and like, okay, take that idea. Like, well... start beating it up, start reality checking and so forth but don't, don't lose the thought because the most, these, the great things happen from ideas that could just go whizzing by. Right.

Jared: Hmm.

Riggs: So let's say you're faced with a particular situation where a solution is needed, or the next step should be obvious, but it's not as you're working your way through it, thoughts will come up like, "Wait, okay." Keep track because there's one of them is going to is going to turn into something. And so I think it's important to not dismiss those passing thoughts like, hmm, "I had an idea about that and never mind." Well, hold on. Let's take a look at that. What if this? That? Right? And one of my jobs in the company is to people say things, and I go, What was that? What was that idea? And to encourage that, I think parents do that well when they do it well. Right? Oh, wow. That was a really good little song you sang. Where did you get that from? And so I think that's the main thing is don't lose that thought.

Jared: That's great I love that. Riggs, this has been informative, educational, inspiring. I'm just amazed and grateful for everything you've done and what you are doing for the world through the work you do. And, you know, really thankful that you decided to take the time to talk with us. Innovation is the future. I love that. I love that definition. And I look forward to staying connected and hopefully learning more from you in the future. Thanks again for your time and take care.

Riggs: Jared, it's such a pleasure. Happy holidays and have a great year ahead.

Jared: Thank you.

End of presentation

OriginClear — SPAC News

Riggs: All right. Now let's take a look at the news you've probably been waiting for tonight, which is about the SPAC, the Special Purpose Acquisition Corporation.

Announcement

And here we are. What is the latest update? Drumroll. Well. Sure enough, today we announced that OriginClear's Water On Demand subsidiary signs a letter of intent to merge with Fortune Rise Acquisition. Non binding agreement sets basis for negotiations and yes, so we have now agree Fortune Rise, there's a typo there, it's FRLA proposes to acquire all of the outstanding securities of Water On Demand Inc.

So they'll take all of the subsidiary of ours that we've got and merge it with the Nasdaq company. This is not binding and this guides good faith negotiations. So as I was saying, FRLA will acquire 100% of Water On Demand Inc and Water On Demand Inc equity holders will receive shares of common stock.

And that means that upon meeting Nasdaq requirements, we will be trading on the Nasdaq. There is obviously a lot of work ahead of us. The precise structure is to be worked out. And in addition, it talks about what FRLA is. So that's the picture there. And here, in fact, is the news as it showed up on SPAC Insider today, there was a filing and in fact, I'll bring it up right here.

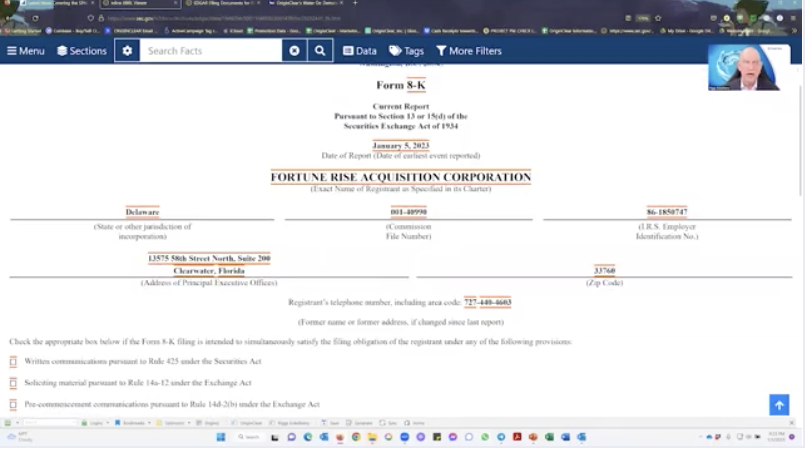

8-K Filed

This is the 8-K by Fortune Rise Acquisition Corp. where discloses that we put out this press release with the letter of intent, and that was in the, right here, you can look it up on SPAC Insider, our press release here and the 8-K from January 5th and the previous one from December 29th. And obviously we expect there'll be a lot of coverage now that this thing has come out.

Freewheeling Discussion

Well, with that, I wanted to bring on Ken to discuss this amazing piece of news and everything that we think is going to come from it. So welcome aboard, Ken. Let's just recap then, the news of the day, which is that we've got a merger with a Nasdaq company of our subsidiary.

Why Not OriginClear?

Now, why is it that a subsidiary is merging with Nasdaq company? Why not OriginClear? Well, there's a couple of reasons. First of all, OriginClear is being positioned as an incubator. And this is our baby. And our baby is now going to college and now is going to become famous, perhaps going to go on a full scholarship at Notre Dame.

Ken: But we want to spoil our baby. And we don't want our baby to have to come up the hard way like we did.

Riggs: Exactly.

Ken: We want to give, we want to give our kids a much better, easier life than than we had ourselves, right? No, no washing dishes.

Fintech Pure Play

Riggs: Exactly. The other reason is a very simple one, is that Water On Demand is a pure play. It is a fintech that does one specific, which is that it is in the business of this mid market, water as a service activity funded by investors. And so it's a solution to the giant, giant centralized water problem. And rather than say, "Well, we do this, that and the other thing and by the way, we're on the Nasdaq." Better that we take these specific companies and put them on the Nasdaq; this is only the first, as I've pointed out in our presentations before, the later ones will follow. Ultimately, OriginClear will, but as a proven incubator.

Ken: Right, in other words, with an extended track record of successful executions, this being the first, which is why this was so important, positioning the parent as an incubator, you had to incubate something, right? You had to be successful. Also, you know, they have a saying that if you have to explain the punchline, the joke's not funny.

30 Second Description

If it takes a few minutes to kind of describe what you do, if you're doing a road show, right? And you can't describe what you're doing in 30 seconds, it's too complicated. "Water On Demand is the world's first midmarket fintech for water as a service on the planet ever." And it's doing to water what cell phones did to telecom or its, "You're basically taking these high density polyethylene drop and go systems and you're Airbnbing them and creating an investable asset."

So, now I'm done. That was 30 seconds, right? So it's it's a pure, it's an uncomplicated, it's also, it's fintech, it's aqua tech. It's the kind of thing that investment bankers are going to be able to easily get behind, easily envision. I've had the pleasure of speaking to a couple of investors recently in this new, new positioning that we have. It's very, very distilled now, right?

As parts were in motion, you kind of include the whole thing and it becomes very kind of lengthy, right? But this much more condensed version, people like, they get it right away and I love it. They're like, "I love what you're doing and I totally get what you're doing."

Riggs: Now, quickly, where do we go from here? It's in our interest to take more time. Why? Because it's only going to build more capital and more shareholders, right? It's only going to build strength. So if it takes a few more months, great.

OriginClear's Role

So here's what's crazy thing that's going to happen. OriginClear is going to continue doing its job preparing the next rollouts because in 2023, I promised we would take the pump station startup and launch that. And then also we're going to be building out Water On Demand. We'll be announcing we have a new operations manager for Water On Demand, which, who will join us. And it's not official yet, so I'm not going to announce it.

But that's happening. So we're staffing up for delivery because these contracts are complex. Water as a service contracts are complex by their nature because you have to, it's always on model, right? Just like it's harder for Microsoft to deliver Microsoft 365 then just sell you a CD, more money, more work.

So that's going on. So there's going to be a lot happening over the next few months. What's critical is to maintain the thread with your investors, and that is, number one, continuing this merger. Number two is a limited opportunity to get on board with the Water On Demand offering itself, which is closed out at that $20 million of which how much has been raised already?

Ken: We're catching up to seven.

Riggs: Exactly. So if you're an accredited investor, you're going to want to get into that. And of course, there's going to be the unaccredited investor offering. Et cetera.

Recap

Just to recap what we're talking about here, this is the very short Water On Demand deck, which is the new investable asset. Again, water goes off the grid. This is all about cutting the cord, businesses doing their own water treatment, the benefits of doing so, what does it require? Capital, technology and expertise. We're providing all three. Now managed services, long term service contract with those Water Systems in a Box™. Business pays on the meter, which is Water On Demand.

This is the quadrant that shows that we are a combination of highly accessible to investors and also very specialized here in managed services. On the same grid, on the same quadrant, Originclear would not be that far to the right because OriginClear does so many other things. That's why it is so beautiful that Water On Demand is super well identified as a pure play. You can tell right here. Nobody like it. And investors provide funding and that's key where you get Founder's shares.

Ken: Only for now.

Riggs: This is very short term. Now, this is a very sweet deal because number one founder shares in Water On Demand Inc. You get founder's shares given to you outside of the private placement because we're lovely people. You get you, get to split 10% Anti-dilutive of Water On Demand Inc, the company that is being merged under LOI right now to be merged with a NASDAQ company, you get that, plus you get 150% of your investment in OriginClear. And by the way, that number is going down.

Ken: I was going to say maybe don't say 150 right now.

Riggs: But, 25% of net profits on the actual investments and the unaccredited investors coming along with the Reg A becomes shareholders in that same Water On Demand Inc. So I'm not going to get into all that, but it's a fully cloud managed technology and the vision we're building now, the team preparing the commercial pilot, creating a network of water companies, raising the capital, doing the Reg A as well as the accredited funding. And that is the picture.

Modular Water Technology is key to making it all happen, miniaturizing things so they can exist in a smaller company. And the strength of the parent company, of course, is we've been a public company for years. Our year over year revenues have tripled. We've incubated Water On Demand. Three other companies are on the launch block as well. EveraMOD™ is going to be the next. And that is the short but sweet picture. Yeah. You couldn't say a word. You were tongue tied.

Call Ken

Well, talk to Ken is he's got a very busy schedule, but he will take your call. Just go to oc.gold/ken and or email invest@originclear.com and he'll tell you more. I want to say to everyone this is the most amazing way to start the year. It's the right way to start the year.

Ken: And I want to say thank you because without you guys, this would have been, tense. It would have been challenging. It would have looked like the House floor.

Riggs: Oh, look, Kevin McCarthy eight times and still going.

Ken: No, ten, ten. But who's counting right now? So, in other words, without the greatest investors in the world, people with vision, this would have been a far more monumental task in such a short, we had three days to act and we were able to tell these guys without having done any of the, without saying, oh, by the way, this is what we're doing.

We had enough confidence in you folks as a group to say, "No, we're going to do this. They're going to get behind us." And you did. Now we're first, we're through the first leg of this race, but we're going to close strong. We're going to get this thing done. And I hope to be having this conversation, you know, as we ring in 2024 in a completely different place in the world. And I think that that's very realistic.

Next Week

Riggs: Right on. So for next week, I plan to bring our operations manager, introduce him. Colin, he's a very, very experienced product engineer and and we'll be talking. Throughout the weeks now, of course, there's going to be a lot of it is going to be about Water On Demand, about the merger, etc., about the things moving into place and so forth.

In addition, there's going to be a lot more news about our conventional business. Remember that we're coming to, we've wrapped up an amazing year for the conventional businesses. You'll be hearing about that. Interviews of customers. I got tired of telling analysts that,"Well we have customers. We can't tell you their names." So we're going to start having those people do testimonials and interviews. So that's going to be good.

Ken: You forced them out of anonymity.

Riggs: Exactly, because. So that's going to start happening. So I don't have to keep saying a certain well known car company that is very top car companies.

Ken: A certain online retailer.

Larger Vision

Riggs: Whatever. Anyway, so that that is going to. So we're going to have a lot of that happening. So be sure to stay tuned to these briefings. It's really exciting times. We are on the way to transforming the world. And by the way, there is an even larger vision for Water On Demand that I'll be sketching out, which is that network effect geometrical growth thing that I've been talking about.

The idea that you start with a drop of water in a football stadium and you fill that stadium with water by doubling every minute. And how fast do you do it? 45 minutes. That's how fast it happens. That's called a network effect, geometric effect. Same thing.

We're going to wrap it up now. Thank you, everyone so much. Charles Davanzo, "Fantastic briefing. Thank you, gentlemen." Yes. And David Johnson,"Drinks on me in 2024." David, you're on. All right, let's beat and do it. Make it happen. I love it. All right. And Ken Fernandez Taylor, "Congratulations Riggs And Ken, thank you for visions and effort." Ken, you're our hero as well, my friend.

Ken: Yes, Thank you. Likewise. Really.

Riggs: Congrats. All right, ladies and gentlemen, thank you so much. It's been a pleasure. This is the best way we could have started the year. So stay tuned.

Ken: I know. I almost want to do it again next week. This was. We've only scratched the surface. You know what? All right, So, to our audience, I promise you, we haven't even gotten started on this stuff. There's so much more stuff to talk about. Hopefully we'll devote a few minutes next week to kind of provide even additional context because there's a there's a ton of great stuff happening.

Riggs: Well, in fact, next week we're going to get the making of the Estrella Nouri video that people are going to very hard time watching.

Ken: So, yeah, I was going to say that's probably easier to watch than me, but that's okay.

Riggs: All right, everyone, have a good night. Catch you next week.

Ken: Good night folks. Have a good weekend.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)