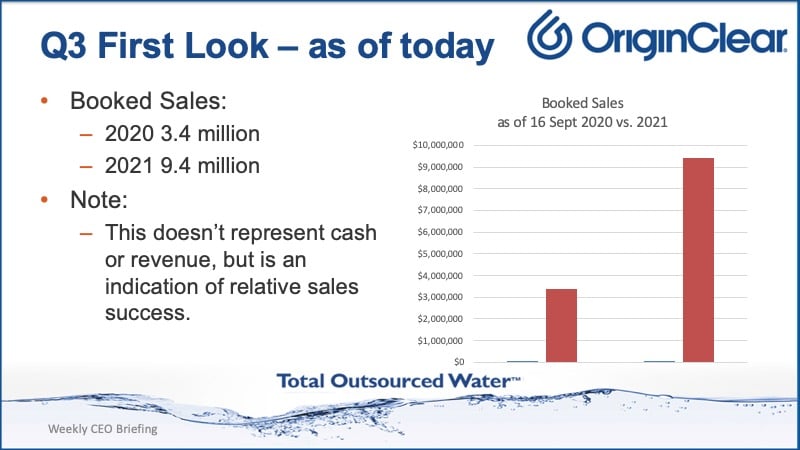

With Booked Sales for this time of year TRIPLE what they were in 2020, our basic business is moving faster and faster. Ken B reported on the Money show and why the Unicorn possibility came from an investor there! And we had our kickoff meeting on ClearAqua, The Water Coin For The World™. Could we become a Unicorn?

Transcript from recording

Introduction

Riggs Eckelberry:

Good evening everyone and welcome to the CEO briefing. And we are on the 16th of September. Couple more weeks before the quarter is over. I have some exciting news about what's happening in the quarter. Thank you for your patience. We had some delayed content. Again, we will make sure that we start on time in the future, and I'm just making sure that everything is good.

Let me start right away with the content, the start-off stuff. So this is Water is the New Gold, your weekly show, and we bring a lot of value to this show, "Helping you thrive in the world's ONLY vital, scarce, and recession-proof market."

So as always, we have the Spanish channel in real-time. It's really a pleasure to have Heather do such a great job and provide the Spanish translations. And we hope to add more languages as we go.

So Safe Harbor Statement, we have... Okay. What this says is that we believe or anticipate, estimate certain things which may not turn out to be true. And we do our very best to correct these as we go. All right. The reason I'm interrupting myself is that I have a video, which is still making its way. So let's proceed.

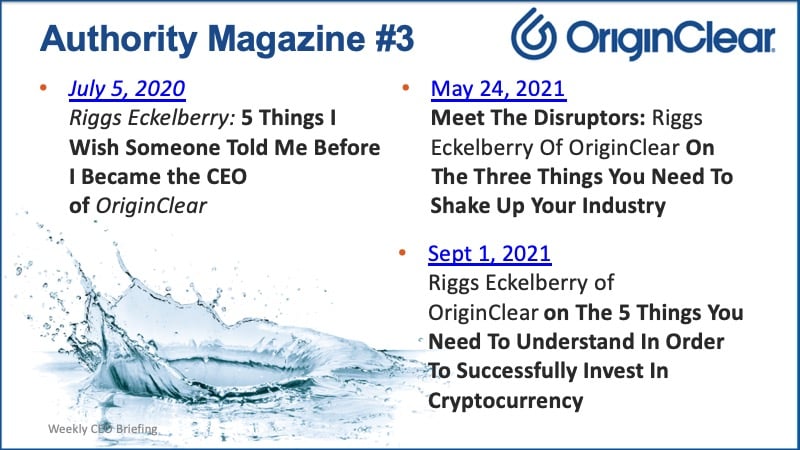

We've got some press. Now here's what's cool. Authority Magazine is a very cool magazine based on Medium, back in July 5th, 2020,

'Things I wish someone had told me before I became the CEO of OriginClear,' that was a good article. These are very in depth and lengthy. I'll show you, well, I'll show you.

Then just May 24th of this year, 'The three things you need to shake up your industry,' which is certainly something we're working on over here.

And finally appeared just September 1st, 'The five things you need to understand in order to successfully invest in cryptocurrency.'

And Neil and Kimberly Castillo say, "hello," and thank you. Thank you for joining. So let me just show you the most recent article here. Here it is, 'The five things you need to understand in order to successfully invest in cryptocurrency.'

Covering Cryptocurrency

And let me show you the article right here, here it is. And just to give you a sense of what the thing presents, like the main homepage of it, it looks like this, right? So has just all these cool influencers and it's really an honor to have a lengthy article on this show, on this publication.

So let's just see a few of the things that, "avoid get-rich-quick schemes," so, a few more things like, well of course... The great whole thing about my background and this is a book I recommend, which is The Innovator's Dilemma and then mistakes I made, et cetera, et cetera. And then it gets into, okay, projects, ClearAqua, Water Coin for the World™, et cetera, and so on and so forth. And what was our concerns? First of all, big holders can really move the currencies.

And so that is still a problem in cryptocurrency. Secondly, attempts to tax crypto, I think are ultimately dangerous. I think what we've done so far tracking, which you hold in exchange for taxation. Otherwise I think we will go underground with a lot of stuff.

And finally, these meme coins, hello. I mean, come on, Dogecoin, that was great. Now we have like 1200 meme coins and people are making get-rich-quick stuff happen. So those are the three things.

Crypto Myths

Now myths. Crypto is not real money. Let's get over this. Later in the show, Ken is going to talk to us about how a prominent Fox Business anchor is now in his sixties. He's a very conservative investor, is on the board of a cryptocurrency. So that is... The well-established cryptos are solid. And of course we're going to see a raft of digital currencies from governments. And those are not the real thing for sure. All right.

Creating a World Market

"Potential helps decide the future." Well, of course, I like to talk about water and packaging, water payments. I've talked to you a lot about this and here's, what's important. Any commodity, you've got to be able to manage your risk, right? You got to be able to go, "Okay, I'm paying too much over here in Northern California, but maybe I could offset it with the cost of water in Singapore."

Well, you can't do that right now. It's impossible. And so there's an opportunity here. And what we're really doing is we're hooking into the actual dollars per gallon. I say gallons, it can be cubic meters, whatever, to create eventually a world market. So that is really a very, very important goal.

Crypto Mining

Now, environmental challenge of crypto mining, I think that is overstated problem. If anybody's looked at the ecological cost and the climate fossil fuel cost of lithium, oh my gosh, you wouldn't buy a single electric car, but there's a reason why we buy them. And that is because it goes in the right direction. And that's the same thing with crypto. Okay.

The 5 things

And then a few other cool things. So what are the five things you need to understand in order to successfully invest? Number one, avoid get-rich-quick schemes. Yes. I wasted some money, myself, not a lot, but it actually burned me. And I stayed out of the market, which was not great.

Number two, look for the team behind the crypto. WaterChain™, back in 2018, we had a management team, but we weren't a team for some reason. It was a lot of individuals. So I think the key is to really make sure that the proven team continues to work on it, which we now have.

Number three, keep it simple. Don't go nuts. Right? So use currencies that are very strong and reliable, like Ethereum, Facebook group, and also my advice, which is what I'm following myself, don't sell. Just hold on, hold on for dear life, hold on.

So, all right. I also advise people to get a proper hardware wallet, keep good accounts. Don't get advice from that buddy who as a particular coin offering. That doesn't work too well. Don't day trade and don't stop investing.

All right. Well, I'm not going to spend your time too much on this, but if you search Authority Magazine, Riggs Eckelberry, you will find this and it will be on our website as well. So let's turn back to where I was. Here we go.

The Canary in a Coal Mine

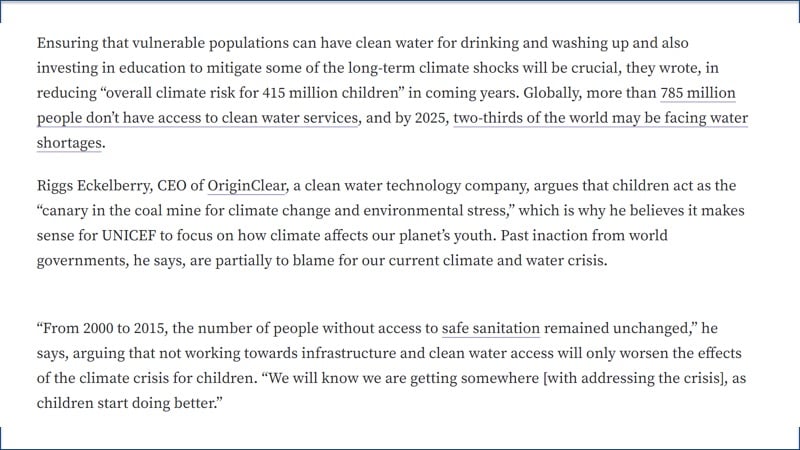

And oh we were in Popular Science, this is so cool. Of course I was always a Popular Science geek, so to me it was so great.

Well, it's an article about half of the world's children living in dangerous climate conditions and how important climate mitigation or reduction of risk is to protect the world's youth.

And sure enough, here is where we are being quoted. That we believe that children are the canary in a coal mine, meaning to indicate where the stress is happening and unchanged number of people without access to safe sanitation. Now, I always want to say that population has increased and we've kept up with population increase, but the core number has not changed. So that's a problem.

Okay. Monday we had kickoff meeting of ClearAqua, the Water Coin for the World™ and I am going to play you... You're be getting to fly on the wall for this meeting. Okay. This is what's so cool about Zoom meeting, but this is an excerpt. It's a short one, but it'll give you a sense. So I'm going to switch over now to the thumbnail mode. Here we go. And let's rock.

Start of video presentation

Kickoff Meeting With Baja Technologies

Riggs: Oh, okay, over to you.

Baja Rep 1: From my end, just, we're really excited to get started. You know, the way we've got it planned out, we're going to be working on the white paper for the next two weeks. And once we get that going, you know, start building out the token itself and building out the websites.

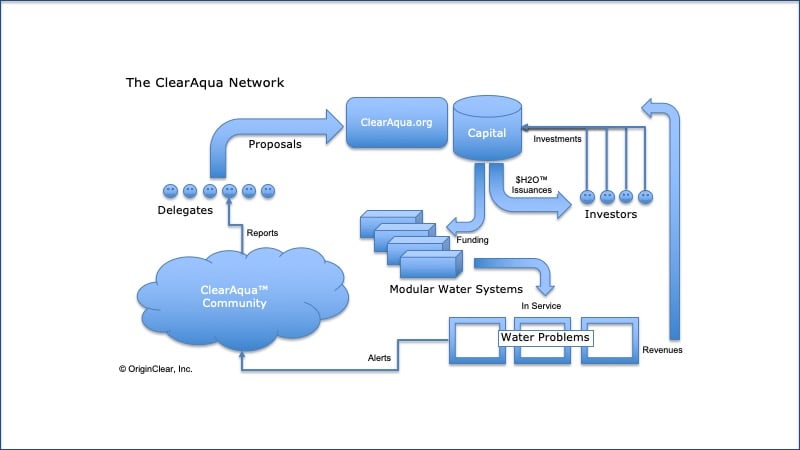

Riggs: So just, pulling back 30,000 feet, this is the basic concept, The mission of this needs to be understood. And, of course, the proposals bubble up, and now we've got a bunch of proposals, which then can be put out in some way to, even people like charity.org and stuff like that. So, what we are going to tie together with these people, so if Charity Water could fund a water project in Chad, the right-hand side is not just $H2O, it's also, kind of everybody, the planet, right? The mission is to identify problems and put together proposals.

Baja Rep 1: Giving emphasis on people really, really feeling so strongly about the project that they're willing to put more tokens behind it.

Ric: If you will, with your money, then you're putting skin in the game.

Baja Rep 1: That's right. But we're going to move as quickly as possible with this. We've actually got a meeting with a contact we have that's an expert in tokenonomics, and we're going to be working closely with him, building this white paper out. And we want to get everything just perfect, so we can have it set to go as far as functionalities and from the legal side so we can move forward. Yeah.

Riggs: It is a utility token, meaning it's not for investment and it is meant for people to earn money. It's a way for them to be, define it basically, they can, it can be modest, right? Like when I stake my Theta, when Theta starts robbing my bandwidth, it's not, I don't get a lot of money out of it. But it clearly makes a utility.

Baja Rep 2: But it has, yeah, it has to be utility. Available-

Baja Rep 1: Yeah Riggs, the purpose of this meeting was to tell you that we're starting today or heads on, that we're excited. You have a timeline that we're willing to stick to and to define specifics that, I mean, typically in projects, we do either a weekly demo or a biweekly demo. We have to define the customer expectations.

Riggs: Mm-hmm (affirmative).

Baja Rep 1: Under the agile methodology that we follow, so it was just to define the rules of engagement of this relationship and making sure that everything is flowing on the go. It's nice to meet Ric, if he wants to provide feedback or input, it's welcome. So that's the purpose of this meeting, just to kick it off officially.

Riggs: Good. All right, gentlemen. Well, thank you very much. I'm very excited and I will keep close track. Thank you.

Baja Reps: Thank you.

End of video presentation

Breaking News!

Riggs: So that's the progress there. Now, I'm going to interrupt this transmission to give you an update from... I just received something from our good friend, Ivan Anz of PhilanthroInvestors®. So, he says, and this has literally just been posted here, "Number one, OriginClear was highlighted in one of the top, family legacy passing podcast in the world." So, this is where they figure out how to do estate planning, basically. That's going to broadcast in October.

We got the first official investor in Argentina and a second one in Latin America. We received an offer and reserve deposit for our real estate pilot. Yes, so that's continuing efforts.

We rely on Philanthroinvestors to broaden our international network, and they're certainly doing that for us. And I love that we ended up being in a very important family office, estate planning, type podcast. Right? That's super cool. All right. So...

I'm being sent a link. Ah! I understand now. All right. Okay, seconds of silence, not good, but here's what happened is, we do have a video we'll be playing shortly, but let me get back to the actual show. All right. So back to share...

More About the ClearAqua Developers

Riggs: And by the way, the gentlemen who's bald like me with the head headset was Ricardo Garcia. He's our advisor for crypto, basically he's a senior program engineer over at Red Hat. And he's working with us to coordinate things from our end, because I don't pretend to be a technical guy. And on the other side, the three gentlemen you saw there, are from Baja Technologies. They're based in the U S, in Mexico, but primarily the development is happening in Cordoba, Argentina, which is a fantastic development center, very well known.

JRW says he likes my jacket. Well, thank you for that.

Okay, now I'm going to pull up, I did a video earlier on a Zoom with Ken, and this is the raw thing. So here it is. I'm going to flip over and play it. And I'm going to switch that share again to where it is optimized. And it's meant to be prettied up for the briefing replay. You're seeing the rough stuff, and I thank you for your patience. All right. I'm going to re-share, with optimization for video, and here's my discussion earlier on with Ken.

Riggs: So Ken, did you survive Las Vegas? What have you left there?

Ken B: About a year of my life. Between-

Riggs: My condolences.

Ken B: Yeah. Between like 12 planes and... Planes, trains and automobiles. I'm buying stock in, is Uber public?

Riggs: Oh yeah.

Ken B: Yeah. I need to buy Uber because I'm supporting the company, which was fun. Vegas was... All right, so here's the thing, it's funny because the conference really did have pretty good attendance. Traditionally they have 3000 people, but in COVID they were expecting 800. We had about 1300 people, which is quite a bit. And then you go out into the street of Vegas, the streets, like literally, Las Vegas strip, it's dead. It's empty.

Riggs: Oh God.

Ken B: Manuel and I were able to walk into the Bellagio, walk to the top sushi place, which I sent you pictures of.

Riggs: Yeah.

Ken B: I sent you pictures of my sushi, and we just didn't, we'd be like, "Yeah, can we get a table?" Like, "Sure, we got six of them." So yeah, they're hurting. They're hurting. It's not ideal.

Riggs: And they weren't nice people before. So I guess... Whatever. Karma, karma's a bitch, but-

Ken B: Humility comes from humbling experiences.

Riggs: That's so true. So, your experience at the money show?

Interested Investors

Ken B: I met, God, dozens and dozens of interested investors. It's funny. This was not normally our venue. You have the guys that have been going, they basically do four money shows a year and they do every money show. So it's interesting. You know, we had a couple of rookie mistakes, where we put the sign, I let some guy-

Riggs: And where was the hot, model babe?

Ken B: I didn't get, right, I didn't hire a girl. Well, you know what...

Riggs: Never mind. Continue.

Ken B: I am a married man, and my wife would be taking, I take pictures of the, because she'd be like, "Who's that?" "I don't know, we just met her." That would go great. You know?

Riggs: Oh, right. We had, no, we hired her. We hired her.

Embracing Cryptocurrency

Ken B: We just hired, In Vegas. Oh, that's fine. So yeah. So, the other thing that's interesting is, is that everybody, no matter what they were dealing in, talked about this nuclear bomb that's ticking.... We had Wayne Allyn Root... So we had Steven Moore from Fox News, he came in, he was a keynote speaker.

Riggs: And you spoke to him?

Ken B: Spoke to him, yeah. Took a picture with him, shook hands with him. He say, he'd come by the show, I don't know if he did. My particular presentation, I don't know if he made it or not. But he spoke, Wayne Allyn Root spoke, I think, Steve Forbes showed up,I don't know if he spoke. But there was a common theme, this impending nuclear bomb, that's going off, with what the fed is doing with the dollar.

Numerous companies embracing cryptocurrency. Steve told me that he just joined the board of a cryptocurrency and this is a man in his 60s who was kind of, traditional Wall Street, right, until yesterday. And all of a sudden he's, kind of, buying in on the idea that maybe we do need an alternative, to what the fed tells us is money. You know what I mean? And it literally is, we're telling you what's money, you just believe us, we're the government.

Asset Investing

And I think, that there's a common theme among investors right now that are very, very worried about asset investing. I got numerous complaints... Not complaints. More concerns, commercial real estate-

Riggs: Mm-hmm (affirmative).

Ken B: Oil and gas. I'll give you an example, there's a guy there and he says, he's killing it. He has people giving him gigantic swats of land with oil and gas wells on them. So the people that own these properties are in their 80s and they're aging out. And they're leaving them to widows and so on, and so forth. And they don't want them, they're not able to produce on them.

So he's essentially taking them, he's got the expertise and the mechanical know-how, to get these gas wells running, to provide income for these folks, on the property they live on. But a oil and gas, commercial real estate, a big concern in the general... Everyone had spoke about it, we had Wayne Allyn Root... I mean, hard selling gold, you got to buy gold, you got to buy gold, you got to buy gold. He's predicting... I think, he's wrong about the market crashing, I think there'll be a small correction, but I think he funds too much of taxpayer...

Dilution of the Dollar

Riggs: No, no. I agree that it's not so much a crash, as just continued dilution of the dollar basically, right?

Ken B: Correct.

Riggs: And the thing about gold, gold is safe haven, everyone should have gold of course, but it's not a high-growth vehicle, right? And so that's where... I mean, how does our particular...

Ken B: Freeze-dried money.

Riggs: Okay.

Ken B: You know what I mean? $1,000 dollars worth of gold... So in other words, an ounce of gold, 40 years ago, we'll buy, in today's dollars, what it bought in 1965 dollars.

Riggs: Yeah.

Ken B: Right so, did it grow in value or did our currency just get smashed, right. So that's what I call freeze-dried money. But the other thing... So continue what you were saying about it.

An Acceleration Vehicle

Riggs: So what I was getting at is, are now, water as an asset, our offering, how investors can grow their investment using our particular growth model. How does that play alongside these other ones?

Ken B: Right. So the asset investors that I spoke to were very skittish about what they were in. We don't know each other yet, so there wasn't a whole lot of reveal there. But they demonstrated the curiosity of looking for alternatives in the asset class.

When I discuss the offering itself, they were really amazed at how creative we were and the fact that we're incorporating cryptocurrency as kind of, an overlay, not just to our model, but to our financial instrument, right. That was super attractive. And I had people... It's funny, people that I've never spoken to before, people I only spoke to for a moment or two, they asked a couple of questions.

Riggs: And I want to make it clear that the overlay is not a security, it is a utility token, that is no investment value. Continue.

Ken B: Exactly. What he said. But I meant it in using the cryptocurrency as a mechanism for acceleration. And that's what they found truly fascinating, I wasn't talking about a financial vehicle. I was talking about an accelerator vehicle.

Riggs: Oh, I get it.

Well Worn Path

Ken B: . And so many people got it, they said, "Look, this has been..." And I talk about, this has been done before, Amazon did, it took 15 years. Netflix, they took 15 years. So the fact that it's now a well-worn path, could cut our time to disruption, significantly, but adding a potential accelerator, put this thing in terms of years, not decades.

And that was really exciting. I had people that had never spoken to us before, knew nothing about us. When I started talking about the model, they were able to complete some of my sentences for me, because it makes so much sense, right.

It's just common sense and they go, "How come no one's ever thought about that before?" And I said, ""I think basically, someone had to just say, "We want to do it different" and not come up against, "Well, you can't.""

Riggs: Right.

Ken B: Right. I think someone probably has had an idea or two, that was totally, "You can't do it, that's not the way we do it." And they took "Yes" for an answer or they took "No" for an answer. Fortunately, we don't listen to anybody and that works.

Riggs: Plus we changed so fast, people don't know what we got, so they can't say no.

Ken B: That's true. That's true.

Four Level Stack

Riggs: But having said that, I think you know, we've frozen our model and now we have this four-level stack, basic engineering solutions. And just today, I got this number out of Marc Stevens in Texas, as of today, we're at.

Ken B: Are you going to break news?

Riggs: Yes, sir.

Ken B: Live? Well, quasi-live?

Riggs: No. This is booked sales as of today.

Ken B: OK, Booked.

Riggs: $9.4 million. Today, last year, same time, 3.4 million. Now, booked sales, you still have to deliver, but it's an amazing indicator. So that first level is rocking. Second level, Modular Water Systems™, I don't know if you heard about this. There's literally, a housing development in McKinney that is expanding so much, they can't do sewage anymore, they have to have their own facility.

This is what we've been saying all along, so Modular Water Systems has taken off crazy. Looks like they had, potentially, another million-dollar month in booked sales. Now, that may be part of that number I just gave you, so I don't want to-

Ken B: Might be my crossover to PWT?

Riggs: Yeah, yeah. Totally. And what's great about modular water systems, it's not custom it's prefab, we launched that Pondster™ last week, et cetera. The third level, Water on Demand™, which is where people don't have to pay for machine up front, we go from selling to blessing, we bless you with a system, here you go and they pay by the gallon. That not only liberates them, but also creates assets for us because we continue to own these and that eventually, sends us to the NASDAQ. And the final piece of course, is this crypto, which is my personal project.

Potentially a Unicorn?

There's a video in this briefing where literally, the kickoff, maybe with some excerpts from the kickoff, it's kind of cool. So what I was getting at with this four-level stack here is, are we potentially looking at a unicorn?

Ken B: It's funny. I forgot to tell you, one of the potential investors I spoke to, Indian gentlemen, he's already kind of, active in crypto.

Riggs: Mm-hmm (affirmative).

Ken B: He came over to me because the sign says, "Water 2.0 cryptocurrency." He goes, "What the hell does water have to do with crypto?" I said, "Well, I'm glad you asked." And he was the guy that was finishing my sentences for me, by the time I got halfway through, so he totally got it.

But I basically, talk to him about this $300-million group of SPVs that would form, almost a fund, almost a SPAC-like fund. And I said... And the idea is to keep... 299 million of that is assets, so he said to me, he goes, "So you guys basically, are taking a really old business and making it into a unicorn-growth play? You guys can be a unicorn."

And so at that moment, I was, "Well, that's cool." And then you sent... It was so creepy, you sent the email that day or the next day about OriginClear being a unicorn "Did I talk to him about this?" I'm, "I don't think I did."

Riggs: No.

Ken B: It was...

Riggs: "These are not the droids you're looking for."

Ken B: Right. Right, right. I didn't know, maybe he was a shill you sent in to talk to me.

Riggs: Yeah. That's what I do because I have the time. But listen, that's really exciting.

Chit Chat

So you're going to... Tonight. Well, you might or might not see you, this is why we're pre-recording this because you're doing Cub Scouts with your kid, shooting off BB guns, woo-hoo?

Ken B: Yes, sir.

Riggs: That should be fine.

Ken B: "You're going to take your eye out with that kid."

Riggs: Yeah. That's why we wear glasses.

Ken B: That's a Christmas-Story reference, never mind.

Riggs: So yeah. Yeah. That's Home Alone? No.

Ken B: Christmas Story. The kid who wanted the Red Ryder wagon, the Red Ryder, he had the decoder ring. "You're going to put your eye out kid. You're going to shoot your eye out kid." Okay.

Riggs: Yeah, yeah. Yeah.

Ken B: You had to grow up in the '80s.

Riggs: Well, I'm considerably older than you, my friend.

Ken B: Yes.

Riggs: Shut up. All right, buddy. Well, thank you. Welcome back, very well done. I hear you're killing it this week.

Ken B: Yeah.

Riggs: We're running...

Ken B: I haven't left my desk. They're going to start sending food up to me. No. I mean, it's literally been stacked one after the other, where I have to get off at the end of the call because I have another one going. It's great. It's really busy.

Riggs: That's a wonderful thing. My friend, I know you have another call shortly, so I'll let you go. If you're there tonight, you'll see yourself on TV. If not, then you'll see the replay.

Ken B: All right.

Riggs Thank you.

Ken B: Goodnight, folks.

Riggs: Take care. Bye.

End of video presentation

Riggs: Well, that is the report from the front, and I'm going to switch the shares back. All right. So, Davis says, "Thank you. You are doing a great job for our society, so thank you for that." No. A lot was learned. It's really so strange that this guy comes up with the unicorn idea at the show. And then, separately I'm like, "Well, what if we became a unicorn?" And yeah, it's a jump. I'm not going to say it's like, "Oh yeah, no problem." It's not something I'm minimizing. It's a tough pull, but it's a 100x. It's not a 1000 or 20,000x, right? It's a 100x, so it is within view at least. It's a possibility. Okay. So I just want to disclaim that because I don't want to say, "You told me you were going to be a unicorn." Well, I do believe we will be. But again, it's one of those things where I would not want to minimize it.

Quarterly Filing

Okay. So, let's take a look at what else we got here. Oh, we filed the second quarter 10-Q today. The quarterly filing was filed. It was late, as I told you. It was not as late as the last one, but it was nonetheless late. And we are being assured by all concerned that Q3 will be in good shape. In fact, the auditors told me that they felt that these last two filings in terms of quality have been the best they've seen yet. Q1 was good, but this Q2 one was really excellent.

The whole team, Eric Sandler is controller. Gwen Duffy is outside accountant. Prasad is CFO and, of course, the auditors themselves. It was just the quality of the filing was excellent, and I was very happy to hear that. We will be making sure we're on time from now on. Okay. And Keith, "Rock on." Ivan, "Go, Prasad." Right on. Anyway, everybody's working really well.

Snap Shot

Now, I'm going to give you the quick snapshot of what these numbers were, all right? So the three and six-months year-over-year is not really improved. Essentially, the first half of the year, compared to last year first half, was essentially down. Now, this will be published on the website.

Don't feel you have to race your eyes over, and I'm not going to go over in great detail. But essentially, cost of sales did decrease. Gross profit increased. Loss from operations did increase. So, the three months looked to a certain extent better. We did not fully recover in the first half of this year. That much is clear from last year.

Slow Start

However, here's what's interesting. Q2 versus Q1 revenue increased by 17%, so that was excellent. So essentially, we had a slow start in the year, and so that's what we were overcoming. And gross profit increased by 69%, so that was good. And we had loss from operation increase, and that's really because that does not come...

I want to say this. Texas, always, it is never negative. The expenses you see here are the ones to develop the new programs, the water, and demand, the cryptocurrency, etc., all these things that we're working on. The actual work on the ground is... Well, they always come out ahead, so that's not reflective of what happens in McKinney, Texas.

Q3

Now, Q3. Let's take a look at what's going on, on Q3. As of today... I got this report from Marc Stevens. On the 16th September 2020, we were at 3,400,000, which basically we ended up at 4,000,000 for the year roughly. Now, we are $9,400,000 so far. Now, this is neither cash nor revenue. Remember, a big chunk of it is that $5,000,000 deal that we got.

But even throwing that out, we're still almost a $1,000,000 ahead, so even throwing out the $5,000,000 deal. So just remember that. This is not going to increase by that much this year, I don't think. I mean, that $5,000,000 deal is going to take two years to deliver. It's three power plants, right? But it is a great indication of how well the system is going. So, that's my report for the day.

Call Ken

You were just listening to Ken. He is really on fire. He's doing a great job. We have programs that invest... This is a great survey. It says, "We went to the money show. We presented alongside 20 other companies, to people who were wandering the halls, and they loved the format. And the offering was just so clever for the investors, so as to minimize the possibility that the investor on the downside would lose money and then maximize their upside." So, we got a good vote there. Schedule a call. Just type in oc.gold/Ken in your browser and schedule a call. He is wall-to-wall, but he is there for you. All right.

And then finally, there is a survey at the end, and we really, really listen to these surveys. We look at what you have to say. And this is your chance to say, "Hey, dude, this is what I care about. This is what I want. Da, da, da." So spend a few moments, if you wouldn't mind, filling out the post-Zoom survey. So, that's pretty much it.

Next Week

Now, we had a full commissioning. Remember last week, I showed you a first look of the Pondster and trailer park. Well now, next week, we expect to do an announcement of it, and coverage, and so forth. But there will be a video, a killer video, with people being interviewed on the ground and all that good stuff. So it's going to be a blast. I think you'll enjoy it, so do join us next week.

Thank you everyone for hanging around. There were a few missteps, but we survived them. I would like to wish you a happy weekend and stay safe. Stay healthy. Stick around for us because you do matter, and we love you all for your support of our mission. Thank you. I'm going to stop the video now, so that the interpretation can catch up, and then I'm going to tune out. Have a good night.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)