Insider Briefing of 11 June 2020

Helping You Thrive in the World's ONLY Vital, Scarce and Recession-Proof Market

We launched our first ever short-term rental contract for commercial water systems! The pool recycling unit is the first in a series of up to three pilot programs intended to validate the Investor Water™ short-term rental concept. And COO Tom Marchesello joined CEO Riggs Eckelberry to give the full update on how fast he’s moving in Texas!

Transcript from recording:

Introduction

Riggs Eckelberry:

All right, everyone. It is now the 11th of June and another CEO briefing, Water is The New Gold. And I think that Tom Marchesello is going to join us shortly but we're going to go ahead and get started with stuff that he already knows. It's just hitting the wires, now you're getting a quick flash of what's happening and so I'm going to go ahead and share my screen and show you the press release just now hitting the wires as I speak.

First Water System Rental Program

Here's the big news. And that is that OriginClear has now launched our first water system rental program. This is the final draft, I'll show you what this is about shortly. Basically, we've been talking to you a long time about short-term rentals of larger water systems. Now, everyone can rent a small piece of water equipment, that's no problem. But what about renting larger stuff and why would you? Why would you do that? Well, what we've learned is that, and the story is told here in this release, is that a lot of water users, entrepreneurs, et cetera, they have a long capital cycle. They have to raise the money, they have to do personal guarantees, maybe they have to borrow money, et cetera.

2 Million Pools Program

What we do is go, "Look, put this machine to work immediately and then you'll be able to handle your regulatory problem or make more money or whatever it is." Here we have a very interesting story about this Pool Preserver as we call it. And it's what’s called the 2 Million Pools program, right? What we have here is Ryan Kooistra, found himself without a job or income because of the COVID-19 pandemic and he networked with Dwight Barber. And that's the video you saw, perhaps if you were with us a couple of months ago I'll play it shortly.

The Pool Preserver

Dwight Barber, was the guy who came up with this idea in the first place, got Progressive Water Treatment to build it and later decided to become our partner. And what we did is we funded him passing on this machine to Ryan. And I won't quote the video because you're going to see the video, but as you would see at the end of this, the Two Million Pools Pool Preserver program is the first in this series of up to three pilot programs and intended to validate the Investor Water short-term rental concept.

We have to be very, very careful to not make investment offerings, right? That we don't talk about an investment offering for these water treatment systems and so I want to make it very clear that for now we're running this internally. If you want to invest, then you invest as an accredited investor through our standard regulated offering. All these water projects we would like to get more people involved in investing but that is in future, it is not an offering today for the foreseeable future until we have all the legal I’s dotted and T’s crossed, very important that you know this.

All right, that is the press release and you'll see it shortly hit the wire. I wanted to show you a picture of what this unit looks like. Here's a picture that was taken literally, I think today or yesterday. As you can see if we open up this picture some more, we will see that it is powered by OriginClear and 2millionpools program. We have a temporary website up at 2millionpools.com, you can always take a look. It will be replaced by a better one but it does a pretty good job already.

So what this is is, this idea of not draining your pool and purifying it. Why? Because A, you're going to waste 18, 20,000 gallons of water and B, when you empty pools they crack, they even have minute cracks. And in Florida, for example, they literally float off their foundations. That is why this business is an important business. Now, a pool cleaning tradesman, a pool cleaning professional will charge $600 to $800 for one of these all day. They'll drop off the trailer and run the water through this purifier and it’s $600 to $800 and it's a profit center.

20 Projects In First Month

Ryan booked about 20 projects immediately in the first month. Believe me, he's making good money because he's being charged a fraction, a small fraction of that on our rental program. For this whole unit he's paying, I don't have clearance from him to tell how much he's spending, but he is definitely making out very well. And you can always buy it out. These short-term rentals are only meant to get people going and to create a business and then they can go ahead do a long-term lease, buy it out, finance it, whatever, but this gets them in the business. We think that's key in this post-virus environment where people are scrambling to get their business going, right? They need all help they can get, this really works well.

I'm going to share this video now, we're going to play the video quickly. We have a new channel in YouTube called Investor Water, and it has the key videos on Investor Water. The new model marketplace at the right here is really the intro, gets into it. There's a couple other ones that explain how it works and then there's original one from a few months ago that talked about the app. Let's go ahead and play this one here which really tells this story right?

2 Million Pools Presentation Video

Transcript from recording:

Dwight Barber: You do not want to go up over the walls. When I brought this to Phoenix the vast majority of pool guys called me an idiot, a fool, it'll never work. I'm just the kind of guy who's like tell me I can't do something and I'm going to figure out a way to make it happen. That was three years ago, almost 15 million gallons ago.

It became apparent to me that there had to be a better alternative than just draining a pool. Anytime you drain a pool, you inherently put some things at risk. They're designed to be full of water, the surface to be wet. It becomes extremely problematic as the temperatures rise and summer sets in because of a naturally occurring thing called expansion, when things get hot, they expand. There's no expansion joints in a pool, they create their own by cracking. And it may be just a hairline crack, but it's still a crack and your pool is going to leak and you're going to have issues.

The potential for this is huge. In Maricopa County here in Phoenix, it has I think 375,000-ish pools and each purification unit can do one pool per day. And that’s just Maricopa County, when you take it clear across the Sun Belt, there's millions and millions of pools.

End of Video Presentation

Riggs: That is the video that you will find if you go to Two Million Pools and there's a basic little website there that gets us going. Now, let me explain a little bit how this is working. And I've got Tom Marchesello, who I am going to make into a cohost so he can actually join the broadcast.

Tom Marchesello

Tom: Hey. Now I can say something.

Riggs: Well, what's your T-shirt, Brooklyn what?

Tom: It just says Brooklyn.

Riggs: That's his daughter.

Tom: That is my daughter. Everybody's like, "Oh, are you from Brooklyn?" And I'm like, "No, my daughter's named Brooklyn.” But my parents were from New York, so it's kind of a tribute to both of them I guess, you know?

Riggs: Well, that's cool, it's super cool. It's a great name. You've been watching us go through the win we had with the Pool Preserver. And I know that you really drove this to a completion. So, go ahead and comment a little bit about how this deal got done and who the players were and how well it went, et cetera.

A Team Effort

Tom: Sure. Actually, it's a team effort, obviously we've had a lot of guys working on it internally. So, I think everybody definitely contributed to it by far. But it really originates with our manufacturing guys down in Texas, a couple of years ago when they had met Dwight and he had requested to get into the reverse osmosis pool cleaning business. Marc Stevens and the team down in Texas says, "No problem. We can do that." Mostly it was because we had the experience producing machines that did this water filtration and purification work. It wasn't too hard for us to turn it around and use for the pool industry. At the same time, when we looked at the specifications of the companies out there in the pool industry, we saw about three or four competitors that had a machine or two.

Sizes were a little quirky. So, we had sized it just about right, to be just powerful enough with the right generator style on it and got that into Dwight's hands, and he ran a pretty successful business. As you know, when you guys had then run into him some years later, he was looking to either move on in business or try to expand the business. He wasn't quite sure. Then we made him the offer and he says "Hey, let's do this instead" and that's where the two million pools deal came from. So, I think it was a smart move. And then Ryan, I love Ryan Kooister, I think that guy's great. He's the total prototypical entrepreneurial business guy who you just got to like. He's a smart guy. He actually worked in the utilities industry for a long period of time. He had a great career, very entrepreneurial, made good money.

“Boom! I’m In That!”

So he was in a really good spot to where he was considering starting his own business. And he had the ability to buy one or rent one or work his way through it. Then when the rental program came up, he just jumped on it and he was like, "Boom I'm in that." He immediately came in and booked himself a month straight with work. It's like, "Whoa." He says his phone just rings and rings and rings right now. When we were doing the vehicle wrap, which you showed, I helped him tweak the new version of it. And I said, "Make your phone number really big dude, because if people are driving down the road and they see the thing, they should just be like, 'I got to call that guy'." And he's saying people call it and he's nailing business. It's great. I'm so happy that he's having success with it. I think it's smart and it's a great business.

Riggs: Well, what's great about this is you and I have lived through these incredibly long sales cycles. Ryan was sitting there trying to decide this, that, and the other thing, and we just cut to the chase by saying "Here it's funded, just sign." I think he needed first and last and he's done.

A Job Creator

Tom: Yeah. It was super easy for him. I think it was more work on our side to be honest with you. But it made sense. Hey, make it easy and get somebody into business, because you're a job creator. So, the whole idea of creating work and creating jobs for Americans to go back out there and make a living. I love that story. Just that alone makes me happy. This actually puts a guy out there not just making a living, but actually making good money, and doing something that's exciting and there's a big need for. It's cool to be able to participate and actually, in the middle of coronavirus, showing somebody getting out there and earning money. That's great. That makes me excited.

Brick & Mortars Hit Hard

Riggs: I think we're going to see more and more of this as the impact of the coronavirus on brick and mortar industries. Yeah, Amazon is doing great. But anything that involves actual brick and mortar has been hit hard. I'll be talking about that in a minute. The fact that we can light a fuse on these things, I think really gives us a leg up. It must feel good to not have to have lived through a six or eight month sales cycle.

Tom: Oh gosh. Yeah. This one went really fast, actually. I'll be honest, those guys were moving faster than we were this time. I was like, "Oh, hold on, I've got to catch up with that paperwork" and it was super quick. They were in it and on it within less than 30 days and then already on the street, even before I got them the whole package on all the support. I'm like, "Whoa, whoa, hold on, call this number when you need to ask somebody about how to configure the filters." They were literally catching up while they were already onsite. They were cleaning a pool on the weekend. It was crazy. It was like, wow, they were busy.

Riggs: So that's why Dwight Barber came in, because he's got the expertise. He was able to get Ryan up and running. He's a great partner for us. He was the genius behind the original idea that Marc Stevens built for him back last year.

Each Version Is Better

Tom: Yeah, for sure. Dwight was really a good guy, really just technically brilliant. He's a really good operator, really smart man. Very thoughtful, really knew the details of stuff. And he understood how to maintain the machine properly and get it to really work well. It was interesting too, with his feedback in addition to Marc's innovation down in Texas, the next generation machine, that now comes into the next version when we roll another one out, will be even better. What we did is we took that original version, then we engineered a new version on top of it that has a little bit more power, can do the turning of the water quicker and then get them onsite and offsite faster, which will help the turnaround time for the tradesman who actually deploys it. That's an exciting innovation as well.

Investor Water “Lights The Fuse”

Riggs: Well, that's exactly right. I want to explain for our listeners how this works. This wasn't really technically an Investor Water. The Investor Water division had its first deal that happened. It was financed internally by OriginClear and that's as it should be because we have to put in place the proper paperwork and legal elements to enable people to invest. But in the meantime, we were able to get this up and running. What's exciting about it is that, Investor Water jumpstarts the funding, but then it creates a product line for Progressive Water in Texas, which is able to sell more and more of these. So, we have a “light the fuse” by Investor Water and then it rolls out to Texas.

Tom: Yeah, I think that's a good opportunity for us because we try to make our products awesome every time. And the next time we make it, we try to make it a little bit better and just keep that continuous improvement process in place. But not like we're overhauling the whole thing. 80, 90% of it's done. That's our whole modular prefabricated concept where we know the core. And then what you're doing is you're enhancing the options and features. Then sometimes you're swapping out parts like a pump or some of the hoses or valve elements and that's okay. That's what you want to do is make it stronger and better the next time. Then of course we want to drive our costs down by doing more of these things.

Ahead Of The Competition

Riggs: Well, this is in line with what you do when you're operating on trade secrets, where you're staying ahead of the competition by continually improving it. By the time they get around and tearing it apart and figuring out what it is, you're three versions ahead. We think it's better than trying to lock things down in a patent. This probably wasn't patentable anyway, but our philosophy has become, let's use momentum, speed to market, trade secrets, as opposed to vast amounts of money on patents, that will just probably make it really easy for people like the Chinese. I didn't say that. People like others, to copy our stuff. Because I don't have an axe to grind. I personally, I like the Chinese themselves. The next project we have involves that famous Troy, Alabama trailer park that we've had our eyes on for some months. We didn't get around to it, because we wanted to get our first learning experience out of the way with this pool preserver project and that's done. I love how my ear kind of disappears in this green screen.

Tom: It actually flickers like it's winking. It's like "Hey, how you doing?"

Riggs: Zoom is getting better all the time. My friend Eric Yuan is doing a great job.

Tom: Did they share that chart on Zoom? Did you see how they had a 300% increase in users over the coronavirus period? Their stock doubled or something.

Riggs: Oh, the stock has taken off, it's out of sight. I'm not going to talk about it. I made out okay but I bailed and I'm looking at it like "I'm not going to look at this anymore, please." But I'm invested in OriginClear, happy with that. By the way, the monthly dividends are cool, all that good stuff. Anyway, staying on the topic, this Troy, Alabama project is now our next one. We have this wonderful advance. Looks like, again, we can cashflow it ourselves, although we have investors who want to get into it. But again, we do not want to create regulatory issues. More important is we learned some lessons on the pricing of the first one and then, how do we deal with modeling the downtime and so forth. It's actually a very good spreadsheet which gets into the ins and outs of it.

The Financial Model

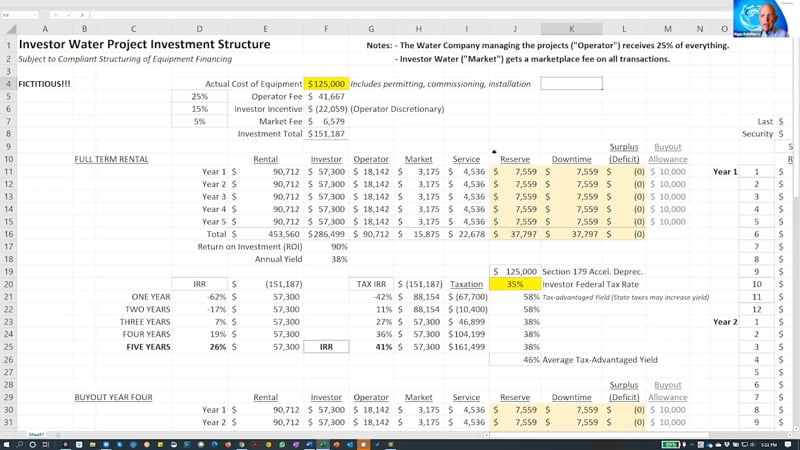

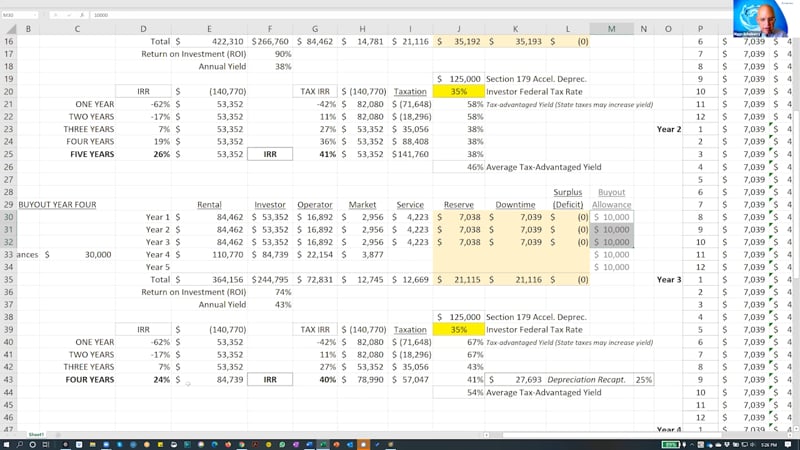

Which I'm actually happy to review it with you guys because it's coming along, this financial model. Here, I'll share it right now. This shows you kind of what the model looks like. So what we have here is a set of assumptions about these project structures, and again, this is fictitious, right? Fictitious. And the reason I'm saying that is that it's just a model at this time.

So, what we did was we went ahead and modeled a five-year life cycle for a rental, and 5% of the price of the product would be the rental fee. And then in this case, the operator gets 20% plus a 5% service fee, so he gets basically 25%. There’s a reserve for downtime, we're allowing one month per year to be downtime. And then the market, this eventual market, Investor Water would get a percentage too. So how does it work out?

Up here we have, we're assuming a $125,000 system. So this is the bare bones costs, including permitting, commissioning, installation, that's all built in. The operator, the water company, and for a long time, the water company will be OriginClear, but eventually we'll bring other water companies in, gets this, and actually we had changed this to 20%, so we got to fix that. But the operator is also giving an incentive to the investor to jump in.

Investor Gets An Incentive

The investor gets an incentive, if the operator wants. So, on the first purchase, the investor is paying 140,000, gets what we call a rent roll, which is what they make every month and every year in this case. And over on the right-hand side, you see a buyout allowance, because remember these are short term rentals, they're expensive, and so people need to be able to get out of them. And we want them to, here's why. The internal rate of return, for those of you invest in real estate and oil and gas and so forth, five-year internal rate of return, 26% is amazing. Amazing, huge.

First Year Depreciation

Now that's even before we count the depreciation, look at that 41%, because we took first year depreciation. Now why? We want it to here on a D-25, but without the tax, why? Because if in November we get a Democratic Administration, this is the first thing that's going to go. They'll get rid of that accelerated depreciation. But for now, you get to depreciate all of this investment. And I see that there's some, yeah, the actual cost of the equipment, not all this stuff. And that gives a tax advantage to yield.

Annual Yield

So the annual yield, call it interest that they make, is in pretax 38%, post tax, 46%. Now, let's say that the thing gets sold at the beginning of year four, so there's only three years of rent roll. And now the thing is bought out by the user that paid rent, got a $30,000 allowance and everybody else came out just fine. Now, it's a little bit less, 24%, but here's the good news, first of all, 24% is still amazingly good. But the good news is that we did the right thing by the renter and everybody made very good money.

Buyout Model

You’ve got to build the buyout model in there for this thing to work, because we feel very strongly that the short-term rentals sort of rev up the engine, but then you've got to allow people to lock a long-term lower expense. So that's where the model is going, and remember that we are not offering this as an investment right now, this is something where we have to develop qualified investors.

Can You Get Involved?

So, if someone wants to get involved with this, they're going to do it by investing in the company, right? And the company itself has an offering for accredited investors and also foreign investors. So, if you're in the US you have to be accredited. What does that mean? That you have made $200,000 for the last two years and expect to make the same this year. And if you have a spouse, if you're doing it as with the spouse, it's 300,000 or you have a million-dollar net worth.

Now, if you are a foreign investor, meaning that you're not a US citizen, at the time of the investment, you were outside the US, then you can invest without having to prove that. And so we have a very, very good offering. And if you want to hear about it, it's got amazing yields. And Ken Berenger will be able to tell you more about that. But needless to say, building a marketplace is interesting.

Feedback Please!

Again, I want to emphasize that this is something that we are in development on. We do not want to get into all the difficult questions that people will want to ask us, because there are many. We'd love to talk to you about it, but we're not going to get into a whole lot of them. What we would like is feedback, but we're not going to try and pass an SAT, right? This is not something that is going to be something that, what you're seeing here will probably not be the end of it.

Conditions Causing This

All right, so let's move on to some of the conditions in the world that are causing this. Miami will be underwater soon, Manhattan maybe, but certainly Miami. Now here's the problem. When they built Southeast Florida, there was no sewage system in Dade County. So here's Dade County, Miami-Dade, southern part anyway. And they developed it as fast as they could, and there was no sewer system, so they just went ahead and put septic tanks in. There's actually, this says 90,000 here, it's actually more like 110,000.

The Solution? Local Water Treatment Systems

Here's the problem. Rising sea levels are causing these septic tanks to literally flow out onto the lawns. So now the city says, "Oh 90,000 homes, we're going to connect them to sewage." Well, that would take about 20 years, tear up all the streets and about $6 billion that Miami-Dade doesn't have. The solution is to do local water treatment systems, either shared in a particular neighborhood or house by house. And we have the expertise with this because we are the people, you saw that case study where we built what's called a blackwater reflush system for that dealership in Pennsylvania, and we know how to do these, this is our business, we've been talking about that.

So this is one big reason why we have to accelerate the installation of water systems in the home, commercial, industrial, and as I say, the key is how to rev it up, right? So instant financing is key. And we know that in this economy, it's very hard for people to necessarily come up with capital. People are very, should I say conservative, about committing to credit. We've seen the savings rate dramatically rise. People are like, "Whoa, I'm holding onto my money. Who knows what's next?" So we all kind of like, okay, yeah, looking at my bank account, I still got cash. But you’ve still got to handle these problems.

Alternative Investments

Now here's the thing, what we're talking about with Investor Water is what's called an alternative investment. Last week, you heard from Ted Parker of Millennium Holdings, very good organization, and 52% of their IRAs are alternative investment. What's an alternative investment? It generates cash yield, it makes you money and it is asset based. Makes you money, and it is asset based. It does not involve the crazy stock market because if you think that this stock market is going to do something predictable, good luck. So this is where it's at. We want to get, people are getting away from the stock market.

Options?

Now, what are their options? Real estate. Okay, let's talk about real estate. Manhattan's empty apartments, new leases plunged 62% in May. People are leaving the big cities. In fact, Tom is in Sarasota, I'm actually planning to make a move from California to Florida, myself. And you're hearing it here for the first time. So big cities are being deserted for a number of reasons. But the number one, one is, it's very expensive. San Francisco rents have crashed. So, what does this do to the real estate investment trust behind these? What does this do?

We're also seeing this with commercial rents, where people are going, hey, WFH, work from home. I don't need to... People have accepted that you can work from home now, this is why Zoom was doing so well. Why do we need an office building? The office buildings are going to be empty. What are they going to replace them with? Apartments? There's going to be a glut of apartments. I think we're going to see a hollowing out of the cities and more and more people… the move to the countryside will be accelerated. But again, what this means is people who have invested in real estate, alternative investments are in a world of pain.

Oil and gas? Similar. We saw oil and gas, actually oil, the price of oil went negative a couple months ago. So those limited partnerships also are having a hard time. And the third one that I know is, solar. Solar is okay. But again, solar's not crashing, but it's not going fast. Because again, people are holding onto their money for these big capital expenses, which says that water is the thing that's going to happen a lot. If you have a good “rev it up” high-speed investment model. So, we think that the alternative investment of choice is going to be water. But guess what?

Can’t Invest In Water Equipment

You can't invest in a water equipment. There's no alternative investors in water, it doesn't exist. Because it's all been billion-dollar systems. That's going away. Well, not going away, but the slack is being taken up. The growth is in the smaller systems and they don't have a source of capital. So long story short, we think that we're in a great spot as regards alternative investments. We're developing this as fast as we can and we think there's a tremendous amount of importance in this area. How do we stay ahead of the competition? Again, by being very nimble, moving very, very quickly. And you guys know that this team is extremely creative and fast, and we have been having a good time.

Contact Us

Now I see there's some chats. Please reach out to us water@originclear.com. We'll be happy to get into it with you. We're really, really interested in feedback, so it would be great. Email us at invest@origin clear.com, (323) 939-6645. Ken is at extension 201, Devin is at 116. Now Devin is the best way to get to me. He's my assistant. And he'll be happy to connect us up. If you want to talk to Ken, he's got a very credible technical view, oc.gold/ken automatically hooks you up.

There was a previous question. Is there any way to tour the facility at McKinney? Absolutely, of course. We can set that up. Business case for the pool preserver? Yes. We're building a business case. Remember all we've done is a proof of concept for the alternative investment marketplace that will happen in the future. Not now. It's not yet a product line. So if you're interested in the pool preserver and a business case, we're building that as fast as we can. So, the facility in McKinney is tourable. Now this is not a beautiful facility, it's a working site. Some very, very competent people, a couple dozen people are doing a great job there, amazingly, technical capabilities are huge.

About Our Regulation A Offering

$500 to $1000 to invest, Daryl. Okay. I want to tell you guys, what's going on with the people who want to invest $500 to $1,000 dollars. As you know, we've had a Regulation A offering for unaccredited investors, right? What we've done is we've paused it because it's coming back new and improved. And so I can't discuss with you because I haven't had approval from the existing shareholders, but we expect to soon be able to give you and outstanding offering. The Securities & Exchange Commission, SEC, has to approve it. So, it's going to be a month perhaps, but we'll restart it and you'll hear all about it.

So Daryl make sure that you subscribe to our newsletter on originclear.com and we will be very happy to once again, offer this for the smaller investors. Personally, I believe the future is the smaller investors. Why? Because it's much more democratic, right? And we can make it very, very worth your while. So it's good for you. Then we don't have to be exposed to the toxic Wall Street money. So, it's a win-win for everybody. Having said that, we love our accredited investors. You guys are really carrying the load every single day for us.

Next Week’s Briefing

Well, I think that brings us to the end of our presentation. I'm so happy that 70 participants have remained. So, thank you for coming on board, everyone. It's a great pleasure. And we will be seeing you again next week. We've once again, re-implemented the hundred participants limit. We were going above that earlier, but we were spending a lot of money to get people in. And we think this organic way of getting people in on a small number of people who are much, much more attached, shall we say, is a better way to go. But if the thing does go crazy, then we're perfectly okay with increasing the limit. But right now that's the webinar limit. So I'll see you all next week. Next Thursday.

We will have more good news, but I'm super happy with this great news about our first proof of concept on Investor Water. We're moving ahead. And if you're an accredited investor, this astonishing, astonishing offering that we have, and you will not be stuck holding stock forever. This is not about holding stock forever. Ken will show you how you can without doing anything crazy, do well and become part of this effort while also taking advantage that this is a public company that has a currency and you are allowed to sell shares. That's what it's all about. But in an orderly fashion, and that's where we can give the information you need to understand how to do it and do well. So, do good, by doing well. Thank you all. Have a great evening. It's been a pleasure and I'll see you next week and I'll update you next week more on my move to Florida. Thank you. And good night.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)