Insider Briefing of 15 April 2021

I reviewed how innovation is coming to the $40 TRILLION dollar Built Environment – which includes water! I demonstrated how our Texas company can build it – and we can finance it “as a service”. That’s Water On Demand™ and we have four ways to build up the funding.

FEATURED OR COVERED IN THIS BRIEFING — QUICK LINKS

- Riggs appearance on Rock Thomas "Rock Your Money, Rick Your Life" podcast and his prophetic commentary.

- The biggest shift in the economy and why it is good for us and the water space.

- The strong rating OriginClear received and what it means for us in 2021.

- Water on Demand news announced for the first time.

- Progressive Water Treatment's launch and its application to Piney Point.

- The testimonial video on PWTs BroncBoost from an affiliated industry professional.

- What industry confidence in our production capabilities and quality has to do with Water on Demand™.

- The "Built Environment" and how it is "just like" the water space.

- What is a non-consensus market and how does that relates to water?

- Green building, net zero and their relativity to our water industry activities.

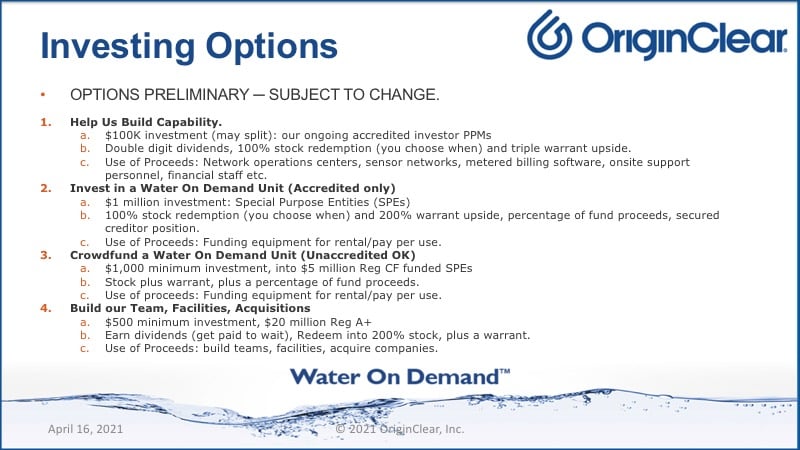

- Four options for funding Water on Demand and benefits of participation.

- How to participate in the OriginClear wave!

Transcript from recording

Introduction

Riggs Eckelberry:

Good evening everyone, this is Riggs Eckelberry, Water Is The New Gold™. And as people start joining, I'm going to go ahead and do the intro stuff. And Ken Berenger is with me, a voice on the radio

Ken: And we're back.

Riggs: And we're back. So, yes, Water Is The New Gold. We have a new splash motif for our PowerPoint. It is increasingly looks like it's, well, it's "vital, scarce and recession-proof." We are briefing number 106, mid April. And so we're just moving right along here into the second quarter.

Forward Looking Statements

Okay, so quick safe harbor statement. Of course, as you know, we try and do our best to guide you straight, and what actually happens could differ materially.

All right. So I'm going to play a quick video here. This'll take you back a bit because it was an actual podcast that I shot back in September. And it should be fun because a lot of it was pretty prophetic. So let's take a look.

Start of video presentation

Introduction

Rock: Riggs Eckelberry is uniquely qualified to ride the huge wave of do it yourself water treatment that is transforming industry, which is really a niche, right? Riggs came to the water industry from a quarter century in high technology, specializing in commercializing breakthrough technologies.

And as we go through this COVID pandemic, it's really interesting to understand what are some of the commodities that are going to be affected? How are you going to be affected by what's happening in retail, the changes with industry? And the fact that part of the way we're adapting is to become less of a consumer society.

If we work more from home, there's not such a need for makeup or new clothing. And this is shifting the way that the world is going to operate. So Riggs is going to give you an insight as to what's happening below the surface of the earth with his years of experience. So I'm thrilled to share this conversation with you. So, let's get to it.

Change the Small

Riggs: What I'm more concerned about Rock, is the basic commodities, right? And we are, OriginClear, my company, we're in water. And what we've seen, I came out of high tech, so I was interested in disruption. It's a long story that I won't bore you with. I ended up running a water company that's public. And trying to change things because I'm a disruptor, that's what I do, and finding that the water industry does not want to be changed. But it's just getting worse and worse gradually. So, what do we do?

And that's where January, February for us was intense, because we had to do something, and we attack the most important part of it, of course, which is, if you can't change the monolithic, if you can't change the big, change the small, right?

Self-Treatment Trend

So there's a trend towards people doing self-treatment. A brewery that wants to increase its capacity finds the local water districts says, "Nope, don't have the capacity, never will. Goodbye. Truck it somewhere else." And instead build their own self-treatment system and now they're independent and they can recycle, all kinds of good things happen. And so now all of a sudden you have water independence, micro utilities.

Water is not Good

But let's talk quickly about water. If you go to the environmental working group website, ewg.org, you will put in your zip code and you find out what's in your water and you'll go, "Oh my gosh, my water is not great." Now, municipality will say, "Well, we're delivering water to the requirements." And it's true, it will not immediately kill you, right? It doesn't have typhus and stuff in it. It's disinfected, but it has all kinds of weird things that, whatever, it's not a good picture.

So we have to more and more take responsibility for water ourselves. Water purification, incoming, and also treating the wastewater, because more and more businesses are being told by the municipalities, "Give us treated water. Don't give us dirty water. We can't handle it."

Consumer Economy

So, failure of infrastructure, I think, Rock, that the biggest problem in America is that years ago we became a pure consuming economy, stopped manufacturing, stopped building infrastructure and just coasted, right? We're just like, "Hey, we'll consume. People will sell stuff to consume. And by the way, the manufacturing is somewhere else."

Try to build a high-speed railway in California, "Nah, let's just do the self-driving car." Why? Because the freeway is already there, so why not just do the self-driving car? Makes sense in a way, but it was also symptom that we've moved away from that ability to do things ourselves.

Shifting to Self-Reliance

And I think that's the biggest shift in the economy, is away from consumption, because we're definitely being retrained to consume less to more because basic building and construction. But it's going to be micro infrastructure.

Look at Fort Lauderdale, well, the Miami-Dade has over 100,000 septic tanks, because they never bothered to build sewage systems when they were expanding back in the 20s. And so good luck tearing up streets for 20 years. And, where are you going to get the money? Well, you can do local. You can just give a rebate for each one of those locations to create a self-treatment system.

So, more and more local responsibility, building your own stuff, your own solar system, it's all going down to a self-reliance thing, which is, in a way, refreshing. The government's no longer doing things for us, which we thought they would do in the 50s. Now, like, "I don't think so."

End of video presentation

Decentralization

Riggs: That was, was recorded, I think September 20th, and it finally appeared this week. So I'm not actually just randomly playing something here. This actually appeared finally this week. The fact is that we have a lot of decentralization happening in this, I was discussing with relation to Miami-Dade, and you're going to see more of that happen late later in this show.

Strong Rating

All right, well, what's this Plimsoll? Well, it turns out that Plimsoll is an analysis firm and a market intelligence. And what happened this week, we were awarded a strong market rating in the new market report.

And so as we operate in the agriculture space, well, there's 14 of our rivals that are in real financial danger. I haven't spent the $669 to buy this report, but we are rated as strong and well-placed to succeed in 2021. So that's cool news, isn't it? And it doesn't look like we're vulnerable to take over either, so that's excellent.

Big Week for News

Let's continue now. Was a big week for news. We had news on both sides, the Water on Demand™ side, and also the, what we call .tech these days. What we've done is, as I've told you in past reports, we've pushed all of our technology activities and our subsidiaries, et cetera, into origiclear.tech. And that's going to go live sometime in the next week or so. And you'll see the website come together as being Water On Demand — FinTech for Clean Water.

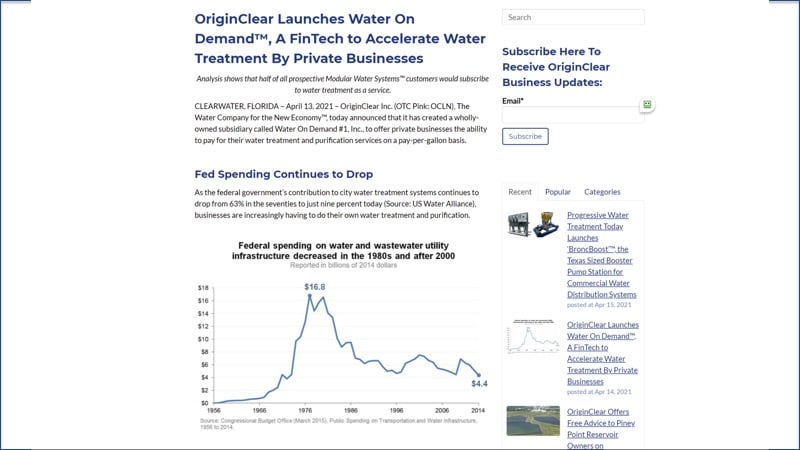

Water on Demand FinTech

And so the first announcement was exactly that. Launching Water On Demand FinTech, to accelerate water treatment by private businesses. And it really headlined the continuing drop in fed spending on water. Which I fear is not stopping anytime soon. We talk a lot about the infrastructure bill, but it seems that the infrastructure bill has a lot to do with transfer payments. And so it's not great, but we can always hope.

Outsourced Water Treatment

And it talks about this design build own operate model, which is what the water industry knows it as, completely outsourced water treatment and paying on the meter. And this is a risk that smart managers will outsource. So, we gave the analogy of, what happens with websites? None of us have a server in house running our website, it's done on a service level agreement, or SLA level. And the equivalent, of course, is these water purchase agreements.

So this was a first announcement of our new business model, but meanwhile our Progressive Water Treatment division in Texas continued to do a bang up job.

The BroncBoost and Piney Point

And they came out with a great piece of technology called BroncBoost™, the Texas sized booster pump station. And this is really important because last week, we covered Piney Point in Tampa with big, big dumps of toxic water. In fact, Piney Point lately has now been shut down, but their solution is not to dewater and clean up like they should. Their solution is to inject it all deep in the ground where it will never show up again.

Industrial Grade System

Nonetheless, we have a really great endorsement of this huge industrial grade pumping system from Consolidated Water Solutions. And you'll get to see the video in a second and basically, this thing cranks 500 gallons per minute. And it is really, really needed in scenarios like this Piney Point situation. All right. So let's take a look at what our friend Jim had to say.

Start of video presentation

Transcript from recording

Tom: I'm Tom Marchesello at OriginClear. I'm the chief operating officer, and we had the pleasure of talking to Jim Davis at Consolidated.

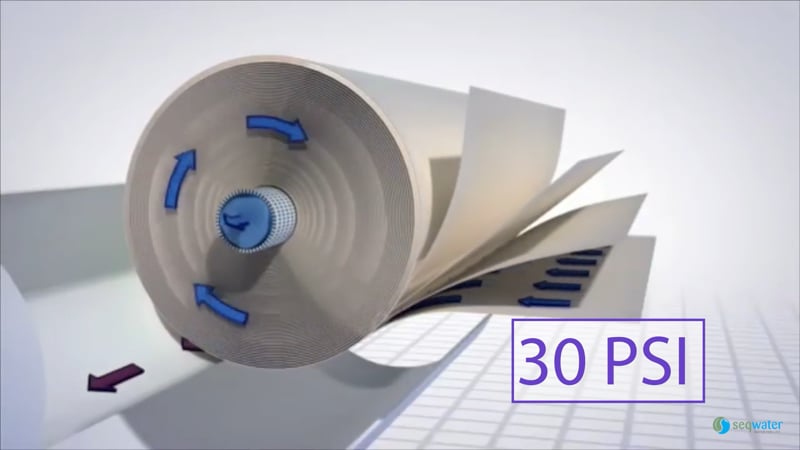

Jim: I'm Jim Davis with Consolidated Water Solutions. I'm an account manager and I focus on project work and we did several projects with PWT. Most recently, we did a project where a customer, a mining company wanted to dewater, their tailing storage facility. And we use the pump booster systems that PWT utilizes to feed both ultrafiltration, of the first stage, reverse osmosis and the second stage, reverse osmosis.

We needed a system that would maintain even pressure flow going in, even though the day tanks behind them might fluctuate. And we need something reliable that wouldn't trip out and it's worked very well. They've had no problems with these pump booster systems.

Mike: We're really pushing the booster pump markets out there.

Tom: Why is it that you feel this kind of a product really has a great niche in the market, not just for this product, but also other areas? What does it really do for you guys and for your customers?

Jim: Well, it gives us a way to reliably feed a certain pressure. And pressure is very important in that these systems like an RO likes to have at least 30 PSI and the ultrafiltration requires a certain amount of pressure to push through. And this just smooths out the operation, everything balances out and you have this even pressure, you don't have tanks going dry and you don't have things tripping out.

If you try to put these systems out all together without a break tank, without a pump boost system like Progressive Water Treatment makes, you run the risk of tripping out a slightest pressure variance. And this could be quite irritating if guys have to go out at two o'clock in the morning and then reset their system.

So we've avoided this by making it a simple and safe system with a good pump boost system. And this is what the customer has ordered again, which means they're very happy with it.

Mike: Jim's the engineer on projects. He's the process guy. So Jim and I started working together because we're both process folks and we started bidding and doing some projects together. We've got a really good history of working together.

Jim: We're integrators, and we do put this equipment together to get a smooth system. And we found that PWT is great if we need custom work and they'd been a great partner to help us with various ancillary systems associated with these total systems. We've really appreciated the support. We've had real good success and real good quality and their ability to help us integrate things is greatly appreciated.

Mike: A kind of a niche that we've also developed that we've worked a few on Jim as a number of containerized systems.

Jim: Yeah. Containerized systems are very important, both to these, what did you call them? Mine remediation companies, they going in and take care of something for them and also for the mining companies themselves to move things around when their needs change. So yes, containerized systems are coming on as something that the customer is looking for.

Tom: That's fantastic. Thanks a bunch, Jim. Thanks, Mike.

Mike: Thanks, Jim.

End of video presentation

Confidence

Riggs: There's a reason why I'm playing this because we would not have the confidence that we can handle this kind of Water on Demand, which is a money for money play. It's all very well to have money to invest in equipment that you put out at the customer site, but if you're not able to do it reliably, then you could get in real trouble.

We have in Progressive Water, a 20 year old company that we bought back in 2015, that has an amazing reputation for integrity and Consolidated, of course, is one of our main partners. And it was really great to know that they have this confidence in us and that this BroncBoost is such a powerful piece of equipment. Okay. So that's super cool, and I'm going to now move right along here.

The "Built Environment"

A really interesting report, and it's hard to find good analysis on the water industry as it's lagging a bit in terms of, what's hip? So the action is happening. We find ourselves to be very much of a pioneer. Let's take a look at what they're saying in a related space called the "built environment." What is the built environment? Let's take a look at that.

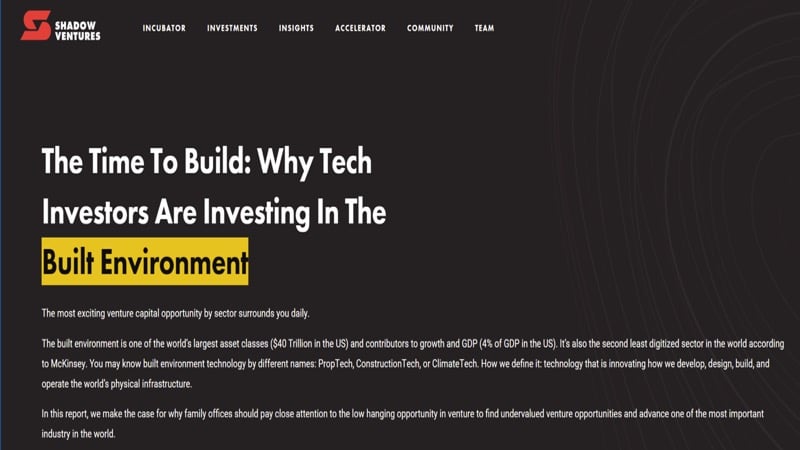

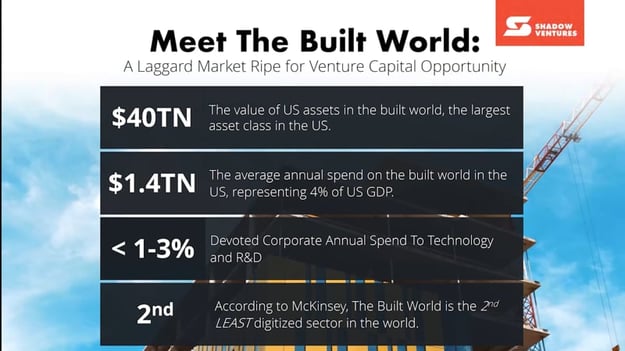

Exactly Like Water

I came across a report by Shadow Ventures, "Why Tech Investors Are Investing In The Built Environment." This is very interesting. It's actually one of the world's largest asset classes, and it also contributes greatly to our gross domestic product, 4%. It's also the second least digitized sector in the world. So it's very, very untech yet, it's the same time, huge.

So let's go ahead and take a look at the actual space. We can see that it's way behind, it's huge, it's wasteful, and it makes me think exactly of water. What are some of the trends? Well, I actually got ahold of the report for you, so I'll go ahead and run it.

Stuff that is Built

Okay. So this is the report from Shadow Ventures and "The Built Environment Investment Thesis." So the built world is basically real estate, construction, architecture, and engineering, and it is huge. And you'll see that the water is mentioned to a small degree here, but this is primarily about stuff that is built.

Huge World

So it's a built, huge world, $40 trillion. It's very large, interestingly enough, there's not a heck of a lot of being spent on technology in R and D and is the second least digitized sector in the world. All right.

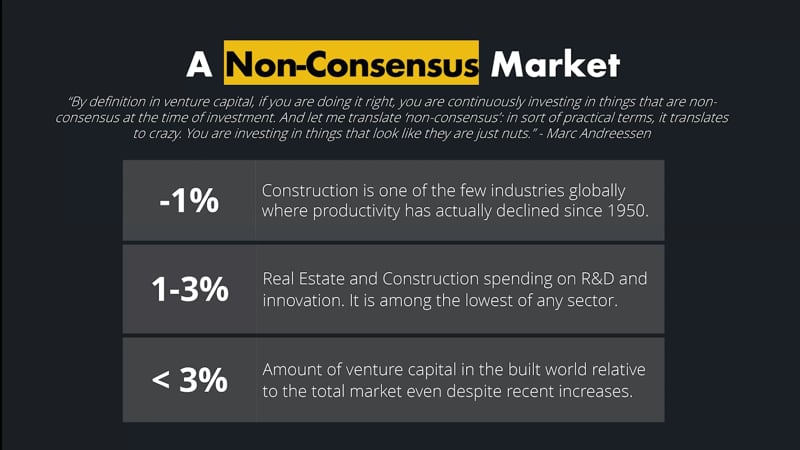

And here's an interesting thing, 68% of the world's population is projected to live in urban areas by 2050, many countries, blah, blah, blah. And they will need of course, much infrastructure including water. So again, the message I've been saying for years now, which is infrastructure is in real trouble, is echoed in this presentation. What is a non-consensus market?

Non-Consensus Market

It means that people don't agree that it's the thing to invest in. Right? For example, remember when Bitcoin was really, really crazy. Now, of course, everybody agrees it's wonderful. So non-consensus means, before people think it's great.

Productivity has declined in construction, amount of spending in R and D and innovation is very low in real estate and construction. And also the amount of venture capital in the built world is very small. So again, this echoes because water is part of the built world. This is part of the situation. We are operating right now, OriginClear and Want On Demand in a non-consensus space. In other words, we're just nuts.

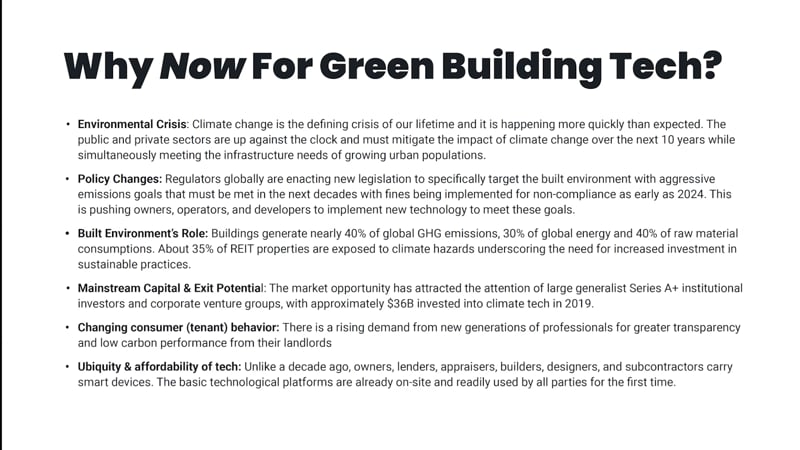

Why Now?

The reason why this is on the verge of large-scale disruption is, again, thinning margins. There's a crisis to innovate. And this is where we feel that Water On Demand is going to dramatically help with the margins so that water companies can deal more effectively with the need to grow.

The workers' problem. There's a Silver Tsunami, quote-unquote in the water industry, similar thing. And productivity, terrible. There's a big environmental crisis. We know that, all kinds of upgrades needed in buildings and treatment and everything. And now, here's the good news. There's more and more technology available, and this is really interesting.

And finally, there're all kinds of interesting advancements and things like 3D printing, autonomous equipment, all the sensors we need and so forth. So this is a great moment for what's called the built world.

Key Issue

Again, problems, I won't go into them. It's pretty much the same stuff that we've discussed. Payment issues. Again, this is something that we identified as the key issue in water, which is how do we fund the water projects? And if we can provide a pay, basically, a water equipment as a service, then we solve a major problem in the water industry.

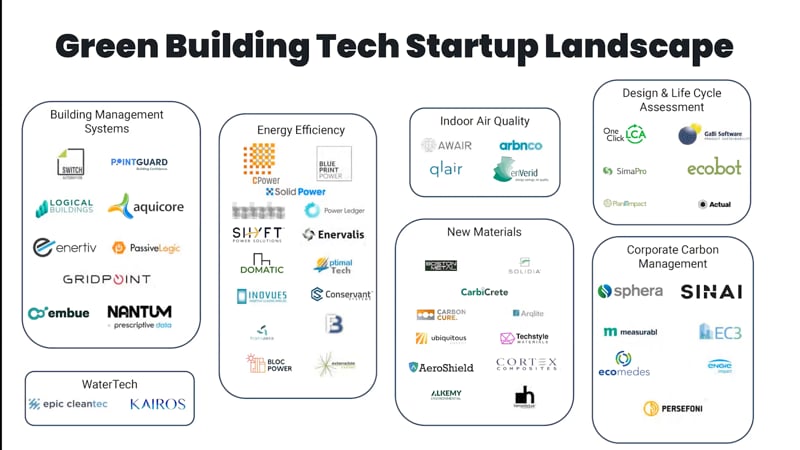

Investment Scope

All right. So again, the technology is to automate all these things, investment scope for this particular venture capital firm is in all these interesting areas And which is really important stuff, obviously.

Growing Fast

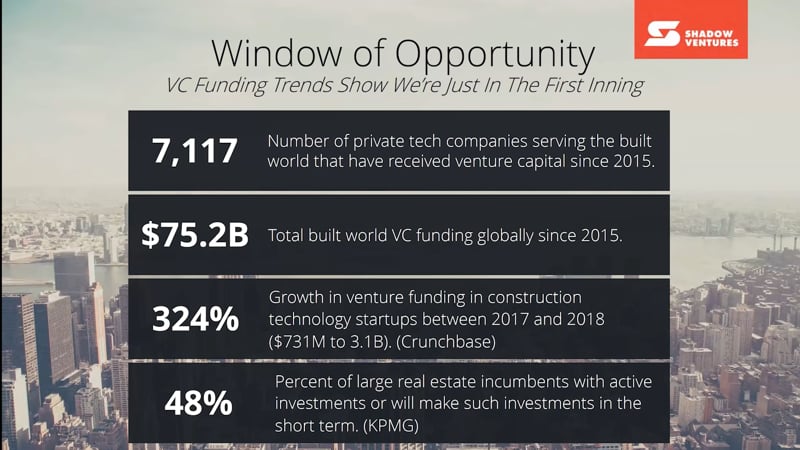

And there is a growing, this is we're early, right? It's early on the amount of money that's gone into the space is relatively small compared to, for example, high-tech but nonetheless has been growing very, very fast.

Look at the growth just between 2017 and 2018 tripling other venture funding in this built world and real estate investments that will be made is fairly large. So people are investing in the built world. Again, you see these are the trends it's obvious what's going on here.

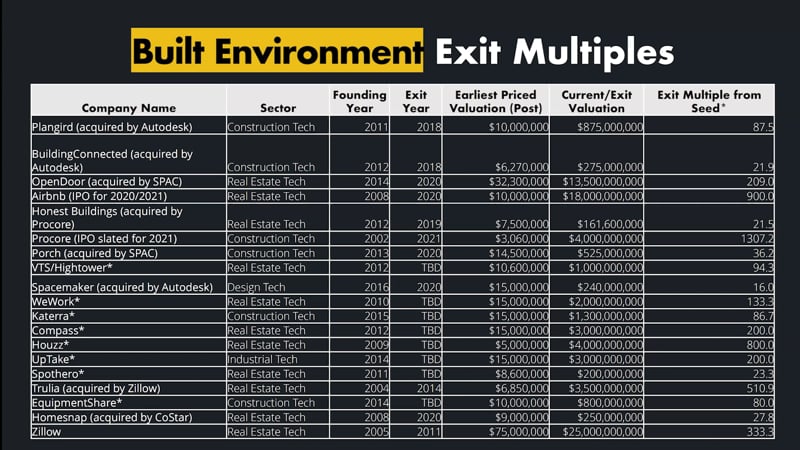

Exit Multiples

This is some of the exit multiples that got achieved, stuff looks really good. Of course, Zillow. Zillow is Zillow, I'm not going to try and confuse this space with water specifically. This is a lot wider and bigger, but it shows that there's a lot of activity going on in this real-world environment.

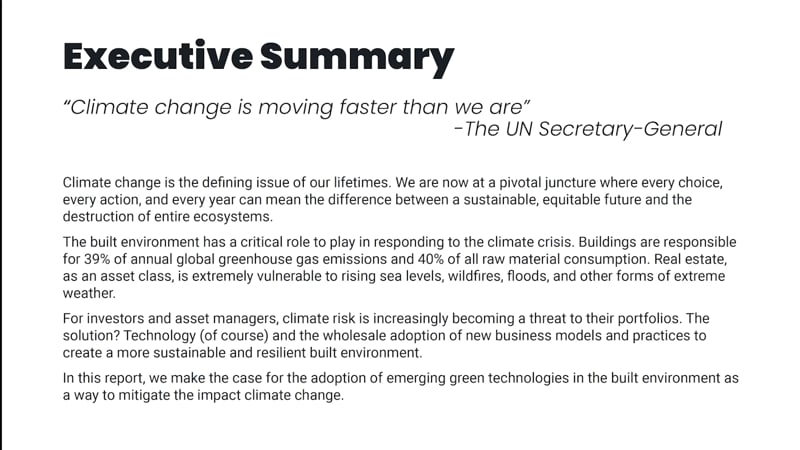

Defining Issue

Innovation to save the planet. Climate change is the defining issue of our lifetimes. And this is very, very important because people may disagree about climate change but is for sure that we have problems with water tables, we have problems with saltwater intrusion, we have a tremendous amount of issues, and there is definitely buildings are a major piece of the picture. And so climate risk is an important risk to manage and this absolutely applies to water. All right, so just getting started again, more of these numbers, I won't bore you with them because this is not exactly water, but it's very, very close indeed.

Green Building and Water

Now, why now for Green Building Tech? Which again tells us that we want to be doing things for Green Buildings that relate to water. And that is that institutional investors are starting to move into this space and by $36 billion has been invested in climate tech in 2019 alone.

Net Zero

Sector trends. Now, the goal of net zero quote unquote is very important for buildings and that buildings are supposed to be not damaging the environment. In other words, it can't be parasites, they have to be net zero. Which means designs that actually, for example, let's say you take heat and you turn it into cooling. You take heat turned into steam which runs air conditioning, for example, things like that.

There's all kinds of interesting things that can be done and there's also water conservation here and you'll see there's a brief mention of a couple of water companies that I'll talk about to give you some context here. And finally, the corporate carbon management. And I won't get into the carbon stuff, that's a bit beyond the scope of this discussion.

But basically it also talks about quote unquote new normal, and that is impacting big time. Technology has gone from being a nice-to-have to a must-have and that I think is very, very true or what's happening in water.

Predictions

Predictions

Now, as we know, the Biden administration has stated they want to upgrade 4 million buildings across the country, and this is huge. And it's also every part, not just the package, the envelope, but every part of the building. And how does that work?

And look at how old half of the buildings are, they were built over the 40 years between 60 and 2000, that makes them very, very old, as old as more than 60 years old, in some cases. And there is a growth in demand for the marketplace of green.

Now I'm not going to get into all the details, but very, very important to discuss the industrial internet of things, which directly is needed for us in the water space.

Only a Beginning

This venture capitalists talks about all the different startups that they've been involved with. There's a couple over here bottom-left. Epic has been working to try and decentralized water treatment for municipalities in other words helped municipalities shift the load to local buildings and Kairos is a leak detection technology so, this is good, it's only a beginning, as you can tell, it should be a much larger piece of it, but it is appearing on the radar. So that's what these Shadow Venture people have done, and I think they're doing a fine job, excellent presentation for which we thank them.

Funding Water on Demand

Riggs: I'm going to move right along here. I want to talk a little bit about how we are gearing up to fund Water On Demand. So why don't we cover that? Ken it's fascinating, isn't it about this built investment?

Ken: It's funny if you close your eyes, if you don't look at the PowerPoint, you just listen to the things that you're talking about. These are the things we discuss in strategy sessions in a completely... This is the first time I'm hearing this and I'm going, "Holy smokes."

Riggs: Right.

Ken: You might be onto a good idea if other people are thinking of the exact same thing in a different space, maybe you're onto something so that's certainly encouraging.

Riggs: It's amazing. And again, technology is coming into the built environment and that's huge. And then I'm going to be looking for a little bit of your input Ken, also because we basically are looking at four major ways we are going to be using. We have this amazing investor base that is helping us first of all, build capability.

Basic Offer

There's this basic offer that we have that Ken talks about every single day to potential investors with the double digit dividends, choose when to redeem your stock, triple warrants, and that is needed because we're going to be building out.

It's all very well to have funding to get equipment done, but then you have to be able to track productivity, software metering, put personnel on site, add more staff, et cetera so, that is needed an ongoing basis. That is what we call this is the outgoing series R which was very good going into what's now called the series U.

Special Purpose Entities

Then there is the investment in the Water On Demand unit, and that is the special purpose entities. The investment requires a million dollars minimum, a lot of people are contributing assets, that's already started to happen. We'll take assets, but obviously cash is great, but we'll work with the assets.

Stock Redemption

Again, 100% stock redemption with a double warrant and earning a percentage of the proceeds from the Water On Demand fund with a secured creditor position on that fund. And again, for the use of proceeds there is the funding of the equipment for the rental or pay per use.

Commodity Diversification

Ken: Riggs, I'm going to jump in here. I had two conversations in the last two days. We talk about real estate as assets, I talked to two fairly significant oil and gas investors that are really, they're kind of down and they're frustrated with the oil and gas, and I think there's a real appetite for a asset-based interest bearing investment in that area.

And I think we're going to see more and more people who want to diversify out of oil and gas, not abandon it, but kind of offload allowing that to come back and I think we're going to see a lot of folks in that space have a keen interest in this because they do dovetail, right?

There's going to be a lot of water work in the oil and gas industry as well, so it might also be an in for people who are more on the operational side as well. But those were two discussions I had just in the last few days.

Fascinating. Well, basically commodity diversification is a very good idea these days. And we've got real estate investors who are coming from that built world and recognizing that water is a huge piece of the action. They see the water problems and they also see the water rates rising dramatically, and so there's a real opportunity there.

Regulation Crowd Funding

So there's a third category here, which is just hitting our radar now. And this is called Reg CF, which stands for Crowdfunding. Reg CF enables us to do a series of these special purpose entities that are funded maximum $5 million, they're fast.

I'm thinking about $1,000 minimum investment. This is widely marketed and we see doing a stock plus warrant type proposition plus again, a profit share. And this does the same thing as number two, but it's for unaccredited investors. Very interesting.

Regulation A Offering

And finally the return of our Regulation A + offering that became obsolete on the 27th of

March because it became a year old and we're going to come back in, but we're going to add a stock redemption feature, which is going to be very useful. And we hope to enable the people invested in last year's offering to roll over into this one.

And what this is good for, is a larger amount of money, it'll run all year long, and it's going to be to build management teams, operation teams, facilities, and acquire companies. We need to do some acquisitions to build capabilities, well, to buy capability as opposed to building it.

Flexibility

This is the layout. This is going to be a lot of hard work. Fortunately, we have a growing investment banking team and of course, Ken is doing a masterful job. He is the man who has the full picture on these investing options, and he's there to discuss them.

So, Ken, I think that you've got, if we're looking here at what you're going to have available, it's going to be very interesting. You and your team, Gary and Charles, and more as you need them to put people into these various instruments, it's going to be a way that people can pretty much choose how they invest in this fast growing asset.

Ken: Yeah. I think the flexibility is also really a delightful problem to have. Generally, in my business, it's kind of like, "Well, this is what it is," and you're basically trying to assure people that it's the right move.

I think having four distinct, different types of platforms, there'll be something for everybody in here. I mean, the story itself, what we're doing is that important, finding a person who can find a good comfort entry level, I think we've unlocked that with this.

Call Ken

Riggs: Love it, love it. So again, I wanted to encourage everyone to simply put oc.gold/ken in your browser, have a discussion with him. The current offerings are rolling over into the new format, and if you're interested at all, you should definitely discuss it with Ken.

Pondster

Okay. Next week, the Pondster™, what is the Pondster? Well, it is our trailer park solution, and we sold a Pondster for mobile home parks. It is now going to be rolling out, and we're going to see if we can get some interviews and so forth.

Speaking of interviews, we're going to start interviewing our investors as they invest, because we're very interested in their points of view, and you'll get to see excerpts every week. With that, I'm going to go ahead and wrap it up for tonight. It's been another fun-filled discussion.

Chat Discussions

Riggs: Darrell Polston : "You're oil and gas investors are looking at sustainability bonds." Well, that's also very good. I would argue that water is really proving to be the ultimate sustainable space. It is quote unquote non-consensus for a lot of people, but that's where all of the gains are.

I kick myself to this day for having not paid attention to Bitcoin 10 years ago. Well, it was never known around 10 years ago, but when it started in nearly early...

Ken: About six months ago.

Riggs: Stop, please stop. But there's an opportunity really to do generational transformation both of the water industry and our own portfolios.

Bob wants to know if the annual report's out yet and I have to tell you, it is not, and we are hours away from it coming out. And thank you all.

How Warrants Work

Adam Wagner wants to know, "I'm familiar with investing in buying stocks, but I'm not sure I'm familiar with the warrant, can you please explain the warrant?"

Okay, well, a warrant is an opportunity. Let's say, you invest $10,000, and you get $10,000 worth of stock. If you get a 100% warrant, meaning a full coverage warrant, it's an opportunity to buy another $10,000 worth of stock at a predetermined price.

So let's say that you invested at five cents, and you get a warrant for five cents, a year from now the stock is, I'm just hypothetically saying, let's say it's 50 cents, you can still buy that same stock for five cents, your price is guaranteed.

So you're kind of rolling the dice there, well, the good news is, it doesn't cost you anything. It's an opportunity to purchase down the road if the conditions are right, and you can also do something called, in many cases we have something called, cashless exercise which means, you just trade pieces of the warrant back and forth, and you don't have to pay.

That's not the most brilliant thing to do if the stock is going up a lot, because you're going to have to give a give up a lot of cheap stock, but it's a way to do it.

Thank You!

And again, thank you all. It's been a wonderful evening talking things over with you. I love where things are going. Stay tuned for a magical, wonderful new website, and a lot of PR activities. As we roll out, Water On Demand, a FinTech for clean water. Good night, everyone.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)