Insider Briefing of 12 November, 2020

Helping you thrive in the world’s ONLY vital, scarce and recession-proof market

In this briefing I covered our progress on putting together our own "GM Financial" and the news IS exciting! But what stole the show was the sneak-peek of the documentary revealing why our expansion is really taking off... PLUS — COO Tom Marchesello's report on the Water As A Career™ program...One of our best briefings ever!

FEATURED OR COVERED IN THIS BRIEFING — QUICK LINKS

- A sneak-peek behind the scenes at OriginClear's Design and Fabrication facilities reveals why company expansion is accelerating.

- How our technologies and equipment can handle virtually any contaminated water.

- Why Dan Early's Modular Water Systems are the most advanced in the water industry.

- Marc Stevens, President of Progressive Water on working with OriginClear.

- Tom Marchesello's report on OriginClear's corporate progress.

- Why bid requests are pouring in for our products.

- The latest on Water As A Career™ and the Waterpreneur Academy™.

- The new lead-gen component for Water As A Career biz-op and its effectiveness.

- The powerful result of focusing on what people care about in the Pool Preserver pilot.

- Our next big pilot in the Water As A Career program.

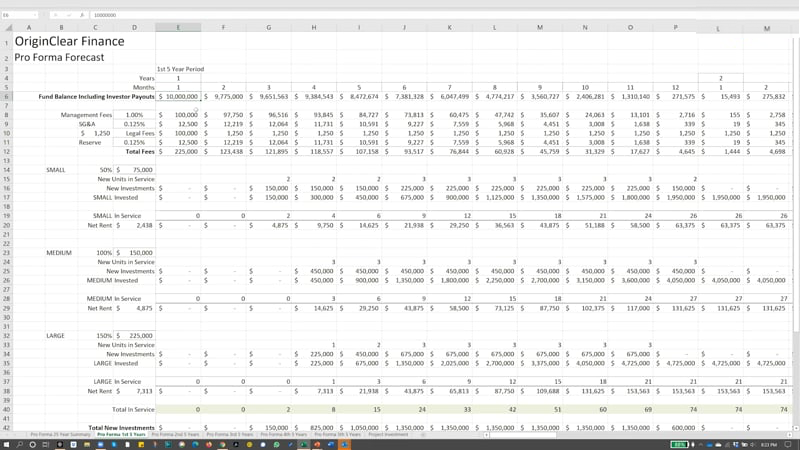

- A 10M dollar fund and financing future waterpreneurs.

- How investors could make a 12% yield and a 17% internal rate of return.

- The pro forma for the Water As A Career financing fund.

- What analyst Ken McElroy predicted about the economy and real estate markets a few months back, how it's playing out, and relates to OriginClear's offering.

- News on talk of moving stock markets from NY and NJ to Texas!

- A forewarning about upcoming price inflation.

- The Federal deficit and hyper-inflation.

- How to participate in the future of water and OriginClear's offerings.

- Getting on the NASDAQ and how that relates to current initiatives.

Transcript from recording:

Introduction

Riggs Eckelberry:

And welcome everyone. Its Thursday, the 12th of November. Exciting times in the world and believe me water is even more exciting if that's even possible. We like to say, "Water is the New Gold", maybe I should say, "Blue is the New Gold." I don't know, something fun and different. But anyway, it continues to be a dwindling commodity and there's no question about it. We have way too much money in the world, but we don't have enough water and that's really a problem.

Important Notice

It is briefing number 87 and we're going to jump right into it. Again, these are forward looking statements which we anticipate, believe, et cetera and we're not being profits.

OriginClear's Videographer

So now, as you know, our good videographer, my brother Stephen, the man with too many cameras. This time he went up to Texas to shoot what's going with the team and it was really, really, good. He caught a lot of the really important developments over there and I'm going to show a brief clip from what he recorded.

Video Presentation

My name is Marc Stevens and I'm the president here at Progressive Water Treatment.

My dad started in water treatment back in the '70s, started his own business in the early '80s, and invited me to come work with him and I've been in ever since.

The Right Way

What I learned from him was to treat employees the right way, treat suppliers and customers the right way and you will have a successful business. That's probably how we have now 20 years of existence behind us.

More Contaminated Water Than Ever

And the world has more contaminated water now than we've ever had before. Luckily, we have equipment that can deal with, and clean up, and purify water. Almost unlimited, really whatever contaminant there might be in water, we have a piece of equipment that can clean up and deal with that water. Between OriginClear, Modular Water, and Progressive Water, we have a technology that can deal with the majority of the contaminants that enters into our water system.

Most Advanced

The Modular Water System™ designed by Dan, utilizing plastic pipe and plastic panel material is revolutionary. Everything we've seen in the past was always based around concrete and steel. Two materials that have a short life, and versus a plastic, it's three to four times as long with plastic. The installation is faster, the cost is lower, and the life cycle is longer. So when Dan invented this stuff around, reinforced plastic pipe, it was just the most advanced anybody in this business has seen.

Dan: What we've done is we've taken this industrial municipal scale technology. We've scaled it down so that the everyday man with a low flow can use the same technology to provide the same level of treatment that they would need, that you would get at a much larger facility.

Marc: And whenever we get to talk to customers or engineers, they're usually just completely amazed at the price and the speed at which they can get these things in the ground and working over the dinosaurs of concrete and steel.

Working With OriginClear

When OriginClear came aboard, they exposed us to a lot of waste water type of applications and customers. Customers we would never have come across on our own and use in our equipment to help support reclamation projects. Other kinds of products they have can be used in front of some of our equipment to enhance the performance of that. Just exposure to more of what the U.S. has to offer as far as people who need our products and who also sell and work in the same field.

End of video presentation

OriginClear Chief Operating Officer

Riggs: That is just a taste of what is going on in Texas and it gives you a little flavor. We have a guest, Tom Marchesello is joining us. Hey Tom, how you doing?

Tom: I'm doing good man.

Riggs: Excellent, excellent. Well, Tom, you've been crazy busy in the middle of tropical storm Eta.

Tom: Eta.

Riggs: Etha.

Tom: Eta. It was the E-T-A, the storm that hit Florida four times or whatever, three times I guess.

Riggs: I know. Make up your mind will you please, crazy.

Tom: Last night it was a little wild out. I'll be honest you had those 30, 40, mile an hour gusts and you're feeling and you're like, dang, that's some stuff.

Corporate Progress

Riggs: It was, it was crazy. So this is the Tom Marchesello report and there's progress at corporate with the Water As A Career™ program in Texas with a Progressive Water Treatment and of course in Virginia, where Dan Early and Robb Litos are based, the Modular Water people. So tell us, just give us a little update.

Tom: Yeah, sure. Absolutely. So, the team's doing really well. I really give them a lot of credit and that video you just showed was awesome. I mean, I'm so excited that we got some of that coverage. When your brother was able to go down there, I was like, "Absolutely, get on a plane right now." Because, our shop was full of machines at the time where we really wanted to get some good coverage.

We had a couple really large scale reverse osmosis machines, we had some pump stations, we had some pump skids, and at the time the shop literally was full. There was just tons of stuff taking up the floor space and so it was really a nice moment to get a lot of that coverage, really get the story of everything and follow the guys around.

In Depth Coverage

So we have some really in-depth stuff there that really gets into like, "What's your job?" And it's watching one of the welders get his job done, while one of the guys is working on the pump schematics and so forth. It's a real pleasure to see the team represented the right way, where people understand what we're doing. So that was a nice thing.

Stacks of Bid Requests

And that's reflected too, because even when I was talking to Dan Early earlier today, we were going over some of the bids that we were doing. And they're just so busy where we just have a stack of people who want bid requests from us right now.

And that's coming from those engineering presentations we're doing as we get in front of more of the engineers, and we get in front of the sales repping network guys who are out there, they're like, "Oh my gosh. I've got a deal where I need a product like that, I got another guy who needs this machine over here." So we're getting a lot of in-bounds just on every time we show people what we do, they're like, "I got to have that."

Riggs: So really he's an evangelist. As from what I can tell he's amazing that way.

Standardization

Tom: Yeah. It's a really good thing for us. So, and the rest of it it's like standardization. I go through it just like you do where we basically say, "Let's pull that product forward, that's a really interesting product." And all of a sudden now we realize that there's a lot of demand for that. Maybe just in a different state.

And so now we pull that product forward, we standardize it up, we put a new presentation around it, I get the pricing crunched in a little bit better because now if I could make multiple units of that I can basically get my economies of scale in. And now we've got something we can roll out, specific to an industry.

So we just did that recently with a certain industry which you're aware of, and now we're looking at how do I make more products for that industry.

Trailer Park Project

Riggs: So, and I heard that it looks like we're about to finalize the order for that trailer park project.

Tom: Yeah. Finally our wonderful mobile home park partner had contacted me as I was changing some of the addressing information for them just to basically tighten up that last invoice. Their financing is arranged, so they're ready to go. And we actually have to start working on a report that goes to the state, that says, "We'll be doing this project." And make sure all the approvals start lining up.

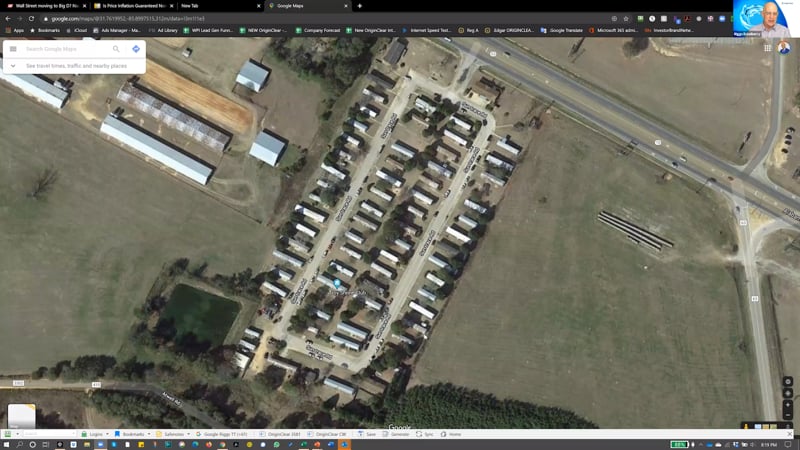

Riggs: Yes. In fact, we have, I think I've shown it before, but we have a satellite shot. I love showing off the satellite shot of this Alabama trailer park which I'll pull up shortly.

Water As A Career

So while I'm doing that, related to that of course is the whole, Water As A Career program and you just got an update on that from our man Tom Burton.

Tom: I did. So, we've been working with Tom Burton who's a wonderful guy who we've had do some marketing and advertising work for us in the past. So Water As A Career has a couple of different components as to what we're going to do there. One was obviously introducing the concept that, "Hey, you can work in the water industry."

Waterpreneur Academy

Then it's about being a water entrepreneur. So we created a concept called the Waterpreneur Academy™. And so the idea is that, we want to incentivize people to really work within the water industry and be entrepreneurial.

And so one of the ways of doing that is not just about saying, "Oh, work in the industry." It's about, "Work with our products. Here's how you take this product, build a business around it, here's how you market that business, here's how you advertise that business, and here's how you basically get your bookings, do your pricing, and then here's your technical manual, here's your maintenance support, and here's an environment basically that allows you to tune in, get all your stuff at your fingertips, like FAQ's and so forth." And that's basically what we're building for somebody.

So when somebody works with us and basically engages as a waterpreneur, it's more than just saying, "Here's the machine, go figure it out." It's us actually saying, "Here's a template. Here's a way of doing this."

Generating Clients

So now we've taken our successful gentleman in Arizona and actually helped him one-on-one and said let's now use the template and basically pattern after what he was doing with the Pool Preserver™ and we started actually managing Facebook advertising and Google advertising and actually actively driving leads, which, of course, then turns into clients.

So I actually have some results for that because I've been pretty much bird-dogging a little bit and I can tell you what we've been able to do is pretty darn amazing. We did a full marketing report for him.

We generated in just a number of weeks well over 50 leads, up to a hundred leads for him, which was actually a pretty good. We were getting at the point of generating around 10 to 15 leads per week for his business. And we're getting an average price point, get this, of less than $10 per lead of our cost of acquisition. And that is it.

Riggs: For an $800 work, job that is fantastic.

Tom: Right. So you know how hard it is to drive leads because, gosh, we've done it in the past and so has any other business but I've been in businesses where it sometimes cost 45, 75, 150 bucks a lead to drive qualified participant in. And this is basically, we're trying to get that thing way, way, way, way down. So sub 20 and here we are actually driving leads on social media, on the sub 10 basis and they're turning into people who pick up the phone call, email, and say, "Hey, I'm interested in what I saw here. Tell me how it works. Can you come to my house and do this?" So that's pretty solid.

Tuning the Funnel

Riggs: And so what you're telling me is that we went ahead and we were basically the concierges. We were the marketing service company for Ryan Kooistra, helped him do it, and then taped it along the way so that we can repeat that successful action for the next guy.

Tom: Right, because now what we're doing is we're tuning the funnel. So you create a lead gen funnel. You basically figure out what words are working, what ads work, what image with the text is working, how to get the SEO rank up, all the little things that kind of come into it. And that's where Tom Burton and our team in marketing come together and say, let's try this, let's try this AB test. This one worked better, this one didn't. Let's try the next one out.

Response Time

And so, we're at the point now where believe it or not, we're actually training Ryan a little bit and working with him on how to respond to the lead. Because we learned was that if you don't call back the lead immediately, you lose the business. So when somebody contacts you, you got to be like, "Hey, I'm available, let's get you booked." But if you let it linger too many days and you lose a lead.

Riggs: I've learned that when I call around for services, if somebody picks up on their mobile and says, "I'll be right over," it's done. Everybody else loses out. So that's what I know.

What People Care About

Tom: So it's pretty exciting to be able to have that. And I'm really proud of the team for like pushing that forward, because I think it's an important thing because you know I've been handling a lot of the Pool Preserver, direct contacts that have been coming into the company because I wanted to really make sure this thing got off the ground as we brought our team into it.

And what I've been doing is like through trial and error, figuring out what people cared about. Sometimes it was technical questions, other times there were marketing questions, but consistently now we're definitely getting a lot more the marketing/advertising questions because people who are getting close to the decision point, make the obvious transition where they say, "Great. And after I have the machine, how do I go make money with it?" So, then they immediately start thinking, "How am I going to get clients? How many clients will I get?"

Riggs: Yeah. They're going to have to come up with a commitment and now they...right?

Scalable

Tom: Yeah. So it's cool. It's like, it's, it's interesting. And we even had like the opportunity where we can do a turnkey website for people. So it's like if they're going to be in the Pool Preserver business, we can take and stamp out a lot of the materials we have for like a WordPress site or a Wix site, where they can basically just be up and running within hours, with a website that says "Here's my business." And then they can custom tailor it for some of the stuff they want.

Riggs: You will see the financial model and what I'm committing you to.

Tom: Really?

Riggs: You're going to need that kind of scale. Right. You will be like, "Dude, why did you do that?"

Next Pilot Program

But just quickly just for fun, here's the Mobile Home Park in Troy, Alabama, and the bottom left, you can see the pond and this is where literally where all the poop goes. So the units at the bottom left, you might say that they are Lake side units, lake view.

But of course that's no longer legal in Alabama, it has to be remedied and that's the project that is our next big pilot program on our path. So, very exciting to move ahead with that as the client has apparently decided to commit. So that's wonderful.

Financing Future Waterpreneurs

So moving right along here, I'm going to go ahead in fact, talk about this whole thing about finance, because at the end of the day, we've known now all year long that if you can't handle finance, then you're joking. So our GM finance and you see at the bottom right, we have Philanthroinvestors®. Why is that? Well, we have our own high net worth investors, but Philanthroinvestors is coming in with more. Let me share with you what this spreadsheet looks like.

Start With $10 Million

We are looking at a fund and I'm going to go ahead and minimize the masthead here, so you can see better, fund that has, we're saying $10 million to start. Now what this is, is a subsidiary of OriginClear that is strictly there to be basically a bank. And the exciting part about it is that, this will build an asset that ultimately we believe can get us onto the NASDAQ. I was going to go find our document about that, but basically it takes a certain amount of assets to go into the NASDAQ and we believe this can be done.

So here's how it goes in summary. And I'll break it down, start with $10 million. At the end of the first five five-year period, you have spent over $10 million and you've ended up with nearly $10 million. You've gone ahead and spent that and made it back. That's the key. You've had $18 million in rents that are being paid out. And these are also various expenses related to buying machines and so forth. Okay.

Then there is a profit, investors will come in, get their percentage along with stock and so forth. They end up making over, if they go out 25 years with us, which we think they will, they make $8.7 million. We end up with $16 million net that the fund has at the end of that period. So that's very, very exciting.

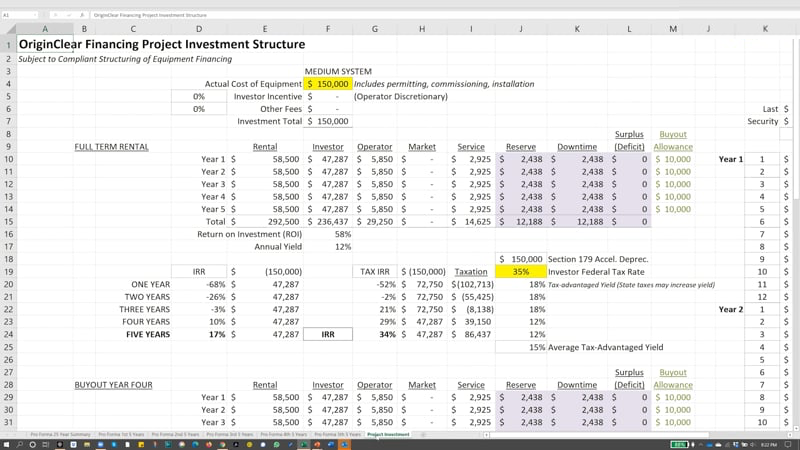

12% Yield — 17% IRR

Now, let me just take it from the bottom really fast. It's all based on a basic system, the medium system that I've put here is $150,000. A small system is 50% of that or 75,000. For example, the trailer park Pondster™, as we call it, is about that price. And then, medium system would be for example, a high-end Pool Preserver, and then a multiple of that is going to be for things like an animal farm type system. Okay. So this is how it works.

I'm going to go over to the right here where the action is, and you can see that it's very, very simple. We've allowed for a percent going to service, a percent going to the operator, in other words, the person who's refurbishing these machines over a period of 25 years and so forth. And we have a reserve for downtime, so that the machine, when let's say it's down for repairs, or somebody decided no longer to rent it, then we've allowed for that.

And so we go ahead and we take these rentals and the investors amount, and we get a return on investment annual yield of 12%, which is excellent, an internal rate of return (IRR), which is basically making back all that money over five years is 17%, which is excellent. And tax based is say 34%.

Keeping the Asset

But, I want to tell you, we're not going to let these investors have this. Why? Because we're going to keep the asset, that's the key. So they're going to be fine with 17% and the reason is that, they're also getting a piece of OriginClear for their efforts because it really will transform the company.

The Pro Formas

So let's take a look at these pro formas. Now, a pro forma is something that's based on financial assumptions or projections, and this is what it is. So let's take a look at year one. We have, start with $10 million. We have fees, which we're still playing with and here's those units that we put in service.

So month three, we put two of the small ones, month four, month five...Tom, this is where you're having to put a lot of machines in service. Because in this model, we put everything in service, year one. The medium machines, right here start a bit later. But they are more aggressive. And then the $225,000 ones, 150%, are the large ones. And they roll out as well. So that by the end of year one, we've got 74 machines in the field, financed.

Profits After 1 Year

This very aggressive, but what allows us to do then, is to start making money. So these things generate, what's called rents. Here are the rents that it generates. And as you can see, our investments taper off. We're no longer making them.

And our profit, here starts. We're negative here at month 12. Month one of year two, were positive. And we just keep getting positive, positive, positive, positive, positive. And from the day that we're positive, the investors get their percentage.

Beautiful Numbers

Now, we are in talks with three investors, who are capable of helping with this. Only people willing to invest a million dollars, at least, are invited into this. Okay. And so, we ended up going all the way down to the first five-year period. And what do we see? I keep on going here. And these are beautiful numbers, I'll tell you. So sure enough, we ended up at 107% of what we were at the beginning of the five years, and we've generated over $18 million in rents, out of the original $10 million investment. Profits are roughly 35% of the original 10 million, which is great.

And the investors make very nice money. And there's a small balance left afterwards. Now, as I showed you with the summary, is that this grows. So there's a small balance here, at the end of first five years, but then that balance grows, and grows.

I mean, it doesn't grow more and more each five-year period. But remember, you paid for this long ago, you invested $10 million in the beginning, in year one. And over a period of 25 years, you've generated $16 million in revenue.

Key to Financing

Now, practically speaking, we would then let this thing run, and we would start another fund, and another fund, and another fund, and keep doing these things. And this is the key to Water As A Career, and ultimately to financing systems.

So this is really, really exciting. We working very hard on this. I'm telling you right now, that this is not guaranteed. We are not saying that this is going to happen, but we are in serious talks, and doing the legal work on that. So very, very exciting.

The Trends

So let's see, I'm going to go continue now with our little story. Because, I wanted to talk a little bit about, why would people invest in something like this? All right. And it is all about the trends. So what about the economy?

I wanted to quickly play a video that I pulled up, and this was back in early October, from Ken McElroy. Very smart. And this is a brief excerpt from it that we've taken, just so you can get an idea.

Video presentation

5 Things

Ken McElroy: So I'm going to give you five things that I really want you to look at, over the next 12 months. The first one is, I really believe that prices are going to go down, as inventory goes up. Evictions are a real thing. There's going to be a number of people that will never be able to pay their rent, as a result of their financial situation.

Mortgage Defaults

Three, you need to watch your mortgage default. Mortgage delinquencies are already happening on commercial buildings, retail buildings, malls, office space, multi-family and residential, already.

Migration Patterns

Four, I want you to pay attention to migration patterns. People are moving all over the place, and it's causing small bubbles in some areas, and depression in others. Be very, very careful here, but just pay attention to migration patterns, and try to get as much information you can on this, before you buy or invest in the next sub-market.

Business Closures

So fifth and final, I really want you to take a look at these business closures. Okay? You really need to look at this. Because if let's say, for example, that you own property in and around American Airlines, as an example. Who already just announced that they're going to lay off 18 or 19,000 people, immediately. And it could go up to 40,000 by October, Just a couple of months away.

Economic Downturn

So obviously, that's going to have massive economic downturn in that particular area. You're going to have a massive economic downturn. Those people are people that go to coffee shops, they go to dinner, they go to lunch, they rent, they own homes. They drive cars. They do all of the things in a community that they would normally do. And now, potentially, they're going to move, or go out on unemployment, or find another job. Okay?

So all this stuff is happening all over the place. And I personally, have witnessed this over the years, through the different cycles. As employers come and go, they shrink, they merge, they go out of business. They relocate, it always has a financial impact on a neighborhood, on a sub-market, on a town. It just will.

I've seen it on military bases. When military bases go away, and they close them, or they relocate them. It kills an area. This is no different. This is exactly what it's about, ready to happen. These business closures are something that, not, a lot of people are watching right now. But you really need to take a close look at this, in your sub-market, and see, and just determine, how much financial impact might you have?

End of video presentation

It's All About Real Estate

Riggs: So that is a really amazing thing. Is that, not a lot of people are thinking about, as we get these waves of shutdowns, that are being planned by people like American Airlines. And so in their Metro area, let's say, for example, the Houston hub. They're going to have some real issues, and they'll have to think about all those service businesses around that.

So there's that issue, which is obviously, all about real estate. And it's no longer a great thing to be in real estate. Unfortunately, it is the way it is. Although, I must say, it's not that it's bad to be in real estate. It's that it's, as he says, you have to really, really watch the migration patterns, and so forth.

So I'm going to now, take a look at some of the other very, very important stuff that's going on, that you need to think about with relation to the economy. Now there's some big changes. I was talking about movement migration patterns.

Stock Exchanges Relocate?!

Well, here's an amazing one that was pointed out to me, a couple of days ago was, "Oh my God, stock exchanges want to relocate to Texas." Talk about an earthquake for New York and New Jersey, because the trading, and the exchanges are all... They might be based in Manhattan, but the trading happens mostly in New Jersey. And so, they have this problem, where New Jersey wants to charge more taxes, et cetera.

Well, businesses can move. So that's a major issue. And think about this, in relation to where trends are happening. Right now, for example, Texas, a place like Texas and Florida are desirable, and people are moving there, as we just did.

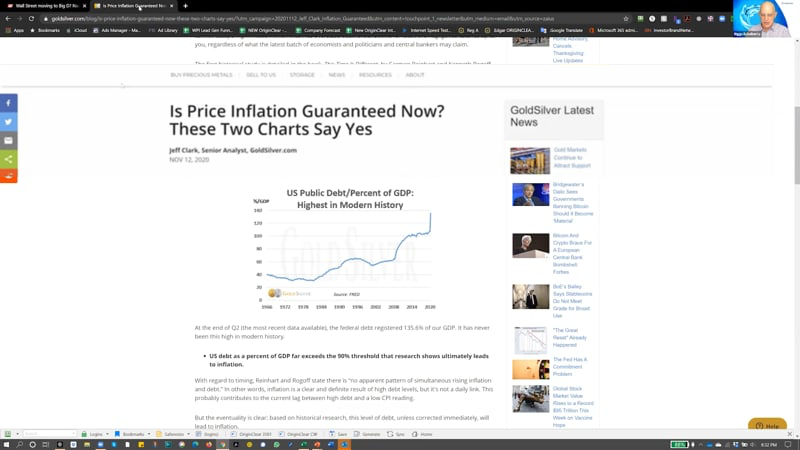

Price Inflation

Okay. The other big thing is, price inflation. Oh my gosh! Is price inflation guaranteed now? And I have to say that, high levels of debt, as it says here, lead to inflation. This is the way it is. "When US debt levels met, or exceeded 90% of gross national product, inflation rose to around 6%", et cetera.

Well, we're not near 90%. We're way over 90%. We never recovered from the big jump that was caused by the recession, the 2008 recession. And we stayed flat for a long time, and along came COVID. And now, it's ridiculous.

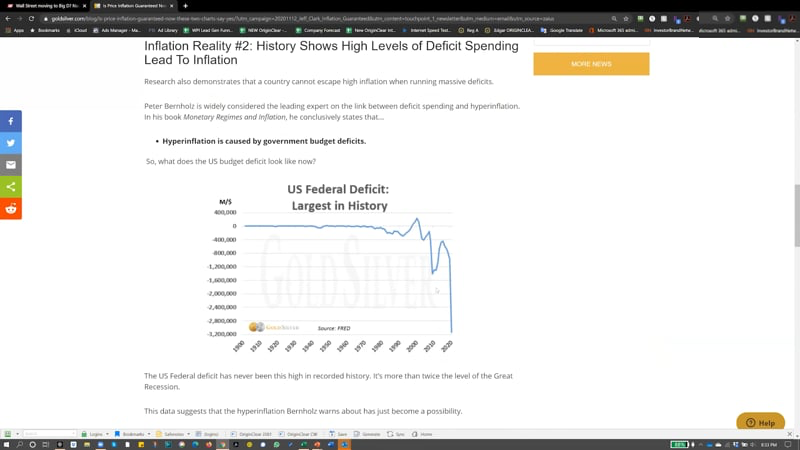

Federal Deficit

So there's that. And then, here's the other thing that's a super big problem. The federal deficit. Hyper inflation is caused by government budget deficits. So this is an issue, because we're stuck with the value of money, and what you have to do... Yes, you should get gold and silver and Bitcoin, and I have no idea what's going to happen with Bitcoin, I'm deeply skeptical.

But I think gold and silver are good, absolutely. You should also make money from your money. If you're making 20, 25%, 30%... Well, 30%'s high, but if you're making in the high teens on your money as an investor, then with OriginClear for example, you're doing extremely well. I strongly recommend that you think about how you can make money with your money.

How You Can Participate

So we have a, obviously, as we always do, we have an offer that allows you to participate and it's extremely beneficial. There is actually a new offering that's opening up which investors are going to find very, very interesting.

Contact Us!

I'm not going to get into it in this call, but I will next week when it's live. In the meantime, Ken or Devin can brief you on it, or just take a call with Ken, oc.gold/ken in your browser, and boom, you're on his calendar, and that's the fastest way to do it.

That is pretty much it for today. I like to keep it short and simple. Paul Fetscher says, "Heavy leveraged real estate is not the place to be." And that is a fact. In fact, we're literally talking to a real estate investor who has a lot of real estate that he does not owe money on. He's free and clear, and he is looking at using that real estate to invest in this program that I was just talking to you about with the GM Financial. It's very, very important that we have a captive financial entity in order to move ahead.

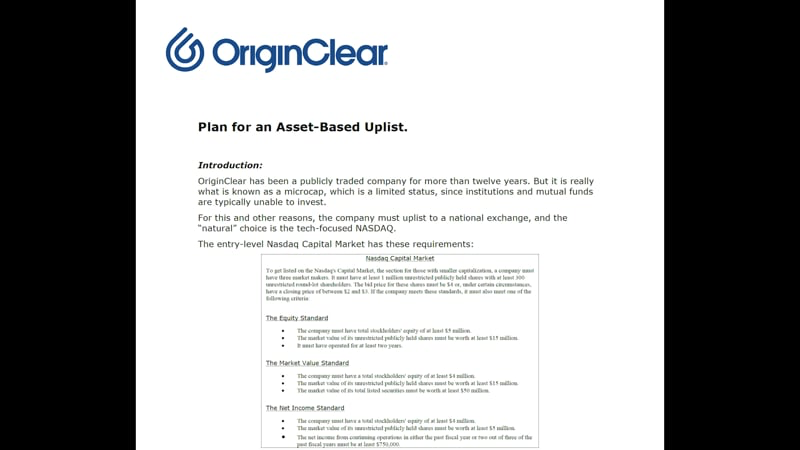

Getting on the NASDAQ

That's the last part I want to talk about is, what it means to get on the Nasdaq and I'm going to show you a couple different slides and these are very, very interesting. Okay. This is an internal document, which I'll be happy to share with you now, it's not confidential. We have been a microcap, which as we know is a limited status, since institutions and mutual funds are typically unable to invest, and so we believe that it is imperative that we uplist to a national exchange. What are the requirements?

Well, the requirements are basically that you have to have what's called stockholders' equity, which means that you have to have, basically it's $5 million, that's what we want to meet. Total stockholders' equity of at least $5 million. Stockholders' equity means hard assets like cash or equipment, and it could be certain kinds of preferred shares if they cannot be redeemed. It's a very complex thing, but you can... A preferred share can be equity in a company, so that's very, very important.

I do have a graph of what happens to a company when it gets on the Nasdaq. I will not show it in this public presentation, but Ken will be happy to show it to you. We don't want to imply that we're going to meet these things, and so it has to be done on a very private basis. Of course anybody can see it, I just would rather not just create misunderstandings.

Why is it important to get on the Nasdaq? Well, because you have the ability to get things financed. A company which joined us is a fantastic example of that. They're called Sunworks, and they were a small microcap just like us, and then they did some very good things and ended up on the Nasdaq. Since then they've become about a $40 million company and so forth. I'm not saying that we will do all that of course, and I'm not even claiming that we're going to go on the Nasdaq, but this we believe is essential, and we have a plan now with this fund. So it's very, very exciting times and I believe that this is the key after 10 long months of reworking the company, that we are now arriving at it.

Thank You!

Thank you all for joining us. I took a little bit of a freelance step there just to talk about this cool stuff. I'm super excited about it. Tom, thank you for being on board and hopefully you're completely freaked out about the number of machines I'm going to make you buy.

Tom: Look, yeah, you know my standing. I've never met a problem that revenues doesn't fix, so as far as I'm concerned, let's just do more business. It's all good.

Riggs: More business. I love it. Thank you, Tom. Thank you very much, and everyone, if you want to see more about our planning to create this fund and so forth, talk to Ken. Thank you. Everyone, have a great weekend.

Thank You!

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)