We covered exponential growth as promised… So, how does it apply to OriginClear? Hint: It has to do with the mega-trend of people migrating away from big cities, And the Water on Demand™ focus called Water4Us™… But how can they meet the growing need for clean water planet wide? Find out in this briefing!

Transcript from recording

Introduction

I'm Riggs Eckelberry, co-founder, chairman, CEO of OriginClear®. The Government needs to continue to provide a lot of abundant clean water, but what happens to it after it's used when it's dirty? Do you know that 80% of all sewage is never treated, it's just dumped? That leads to water scarcity, but it also leads to a lot of disease and pollution and the ocean turning into something horrible. The same time, the cities and counties are not getting the funding they need to really treat the water and so they can't keep up.

The solution is let the people who use the water clean the water. Water on Demand™ is investment in actual capital assets that earn income. Sign up to hear my weekly briefing every Thursday night. 5 p.m. Pacific, 8 p.m. eastern. Just put oc.gold/CEO in your browser. Register for the briefing and look forward to hearing more from you.

Riggs Eckelberry:

Welcome everyone to the CEO briefing. It's a pleasure to have you on board and we're going to get right on it. Robert Baxter says, "Let's go, Rangers." Right on, right on. And I'm actually mastering clicking the things without restarting the video.

So here we go. It is June 9th, briefing number 163. Who would have thunk? And by the way, there were many more before that. I remember back in the day I used to do these little Squawk Box phone calls for brokers. That's how it started. I would do a broker call back when we when they were brokers. Anyway, then one fine day, about three years ago now, we started doing the videos. I remember very well. It was actually very interesting.

And Bob thanks, says, "Thank you, I got connected with Ken today." Fantastic. Yeah. I mean, Ken, Ken is, well, you know, Ken is the man who knows too much. That's the truth. So with that, I'll leave it at that.

All right. So now there was a great, great podcast on the Wealth Exchange, which is a top, top podcast by our top advisor, Ivan Anz. And Ivan heads a program called PhilanthroInvestors®, which is already on the Inc 500 in real estate and now stepped over to water. And he talks a little bit about this and about us in this very revealing reportage. So let's jump right into it, shall we?

Start of presentation

Wealth Exchange Host: Ivan, thank you so much for joining us today. You've got a really interesting story. Can you tell us more about Philanthroinvestors and how it came to be.

Ivan: In the future people will be more conscious with their money. Money will not be going to places where it's just throwing money for money. Money will be going to places where it is improving the humanity and growing at the same time. So like capital growing while helping others, making money while changing people's lives. Investing, not just investing, but investing with a purpose.

Wealth Exchange Host: One of the industries that your company is focusing on now, though, is water. And maybe I just want to talk about that a little bit. What's happening with this resource? How is it affecting people and businesses around the world? Maybe tell our listeners a little bit about that.

Ivan: Yes, Ron, because I started philanthropy investing with Housing First and I did housing for ten years and I, very strong. The company that represents housing, philanthropy, invest in is called Equity and Help and it's an INC 500 company for three years in a row and so on. Established in Florida CEO, you know, 250 team members between employees and independent contractors and so on.

But in 2019 so I go to the Internet. I remember that night like it was like 11 p.m. and I stayed like until 1 a.m. in my laptop. I started researching and I find 6000 kids die from water related diseases every single day.

Wealth Exchange Host: Wow.

Ivan: And 80% of the water is released and treated worldwide. 80% and 1%, only 1% of the water. The U.S. recycles only 1%. And the water structure is crumbling. And there is right now, in the next decade will be 3 million jobs needed just in the water industry to be able to keep the infrastructure that is needed in order for us to have clean water and for the farming industry to have clean water and for the industrial industry to have clean water and for us to drink clean water. 3 million jobs just in the U.S..

Wealth Exchange Host: Wow.

Ivan: And then the US needs a budget of 150 billion in order to be able to keep up with the needs, the necessities for the water industry in the next ten years. And the budget that the government, the U.S. government has is only 40 billion. So we are missing 110 billion.

So I started researching and I say I need to find the most innovative, because I love innovation, and if you research my companies, every single one of them is very innovative.

Wealth Exchange Host: Right.

Ivan: It's like, yes, it's very innovative. And I need to find the most innovative water company in the world. I need to find a founder that is a disruptor. I need to find the Elon Musk of water. And then I look and look and look. And I found that it's kind of God sent it to me. One day I was on Facebook and I see a briefing by CEO and founder for OriginClear, Water is the new gold. And I say, Oh my gosh. And I go to that webinar. And I just discover this amazing entrepreneur, Mr. Riggs Eckelberry, creating the most disruptive company.

But he's not only creating this most disruptive water company, he was creating the only water companies incubator worldwide. And it just blew me away. And I just get with him and I start learning more, and he tells me more about and he says, we are launching this different. And that was the beginning of 2020. We are launching these different spinoffs. We are launching the most innovative water companies in the world. And the first company was Water on Demand. And I say, what is this Water on Demand? How is that? Well, he tells me, do you understand what happened with Tesla, how they disrupted the energy and the car industry and the energy industry? Yes, I say well, it tells me that is what we are going to do.

Ivan: That is OriginClear. You see, like what OriginClear is the motherhood of all these different spin offs like Tesla did with the car industry, like Tesla did with the solar industry. And then they went to the homes, every place where energy is needed. And I say, okay, yes, tell me more. Well, Water on Demand is one of the spin offs, and Water on Demand is similar to how Netflix converted the movies and disrupt and caused Blockbuster to go bankrupt because they didn't innovate. Right?

Wealth Exchange Host: Right.

Ivan: Imagine. Imagine a "Waterflix." Imagine that residential, in housing, in self-sustainable housing developments that have their own high water quality that do not depend on the city and that they have their own "Waterflix" subscription. Right.

Wealth Exchange Host: Right.

Ivan: And imagine all these water companies worldwide with their own Waterpreneurs™ that are certified by Water on Demand to receive funding and to create what they call water bank. And this water bank is financing the local what the local water companies that manufacture using the technology patented by OriginClear to give the equipment necessary to that housing development, farming industry, commercial industry for everybody to don't depend on the city and have really high quality FDA approved water, even for the animals if needed, you know.

Wealth Exchange Host: So what I'm hearing is, again, water is the new gold. But it's not just gold for investors. It's actually gold for the users. Right. It's an end user product for the people themselves. Exactly.

Ivan: Yes and I, yes.

Wealth Exchange Host: And so some of the things that you just mentioned, could you elaborate a little bit about what what your team is doing, what they're uncovering, what they're seeing in terms of opportunities to better the usage of water and the sustainability of that?

Ivan: Yes. And that's something else that we had conversations with Riggs. I remember we said, it's not about the water, it's about the people. Water is the New Gold for investors, but it's also the new gold for the people. It's not about the water. It's about the people. And. These self-sustainable communities is the future. Because if you look at it. Imagine a community where it's not dependent upon the government, it's not dependent on the government. It's not dependent on the government for electricity. It's not dependent on the government for water. It's even not dependent in the in the government for food.

Wealth Exchange Host: Right.

Ivan: And imagine these multi communities of 100 to 200 families that they are all together and they interact with each other. And then the self-sustainable community has the capacity of self-sustainable water by Water and Demand. High quality, but instead of paying the water bill to the government, they pay the water bill to Water on Demand.

Wealth Exchange Host: Right.

Ivan: And now let's take it over to the side of the investor. The side of the investor is very unique because you are very familiar with the crypto world, right?

Wealth Exchange Host: Yes, of course.

Ivan: Everybody's familiar with Bitcoin. Do you know that in Bitcoin you have multiple ways to invest in crypto in general? You can buy the bitcoin and you can hold the Bitcoin. You can trade bitcoin like be a trader and buy and sell and buy and sell and buy and sell. Right. Or you can mine the Bitcoin and you can buy these mining machines and you can have a third party, which is an outsource service that basically holds your machine and controls your machine. And make it produce and make sure that the electricity is there. Or you can have that machine at your home, right? You can say and you can manage it yourself.

But you are an investor. You don't have time to be managing that Bitcoin machine. So that's Bitcoin mining. So there is this third party, third party companies that services machines and what they produce, they produce, they produce a certain amount of bitcoins and the managed service company gets a percentage of that profit and gives you another percentage of that profit, isn't it?.

Wealth Exchange Host: Yeah.

Ivan: Okay. So now that you have that Bitcoin mining machine. For $100,000. normally you now buy like five of that machines if you want the powerful ones, right?

Wealth Exchange Host: Yeah.

Ivan: What you are, what value are you adding to the world. You are adding more bitcoins, more digital currency. Is that right?

Wealth Exchange Host: Yes.

Ivan: Okay. So now imagine if with $100,000, you can buy a Water on Demand, water recycling or water mining machine.

Wealth Exchange Host: That would be very valuable, I would think.

Ivan: Exactly. Now you're starting to get to get it, because now you are adding to the world the most valuable asset and the most valuable resource that the world can have. Better water for all for the people.

Wealth Exchange Host: Absolutely. We can survive as a species with less bitcoin. We can survive even with a little less food at times. But water is that which sustains all life.

Ivan: This water mining machine is outsourced by Water and Demand. This machine, the Bitcoin, the Bitcoin machine will be there for two years max because then you need the technology changes and so on. But the water mining machine is there for 25 years or maybe more, and it's recycling water and water, and Water on Demand is sharing the profit with the Water PhilanthropInvestor™ that is supporting that cause in the planet, which is the water for people. It's not just about the water, it's about the people.

End of presentation

About Ivan and PhilantrhoInvestors

Riggs: Well, that's a short clip from that podcast, but I thought you would enjoy it because I think Ivan does a great job of breaking it down. And I love that Bitcoin analogy in the sense that Bitcoin mining is something that essentially mines Bitcoin and here know mining water. That's kind of cool concept. So I really appreciate Ivan and clearly he gets it. He understands what Water on Demand is all about.

And in fact, this week, PhilanthroInvestors hosted a group of 109 investors presented to by the president of PhilanthroInvestors, Wendy Rios. So we're very pleased at the continuing hard work of the PhilanthroInvestor team.

Keith says, "Ivan is a very enthusiastic and positive, positive influencer. He's cool." That is for sure. Well, he's not only enthusiastic, I think that he's obviously very to use a long word, perspicacious. He's he's got perspicacity. He understands things, which is super cool. Wow. That was a 25 cent word.

All right. So with that, I'm going to jump into an article that was just published with the efforts of our PR agency, Finance Digest. And they wanted to know about how intuition plays a part of this. This is kind of one of these human interest stories. So let's see what what they had to report.

Intuition

So. They were looking for, "What about intuition? What part of that is it?" And, you know, really what it's about is how do you get the smoke signals? I know I get and other CEOs get it to huge amount of data just flowing across, flowing across. And how can you just sort of get the little indications that something that you can pull the string on and and maybe find out what's really going on.

So that's in this article, it's about the intuition. And of course, data is vital. But the fact is, is that, as I said here, the truth about business is that is a continuous creation and you have to recognize new trends. And pattern recognition is one thing, like I see what's happening, but then you actually have to make it a business decision.

Going all Out

And I tell a story about this thing that happened early on when we we're still in the algae industry and we made our first, first big sale of an algae processing algae harvesting system. There was $1,000,000 sale. It's a big deal. And all of a sudden we had this really tough guy. And even though the machine had already been commissioned and approved in LA before it was shipped to Australia, he said, "We're going to ask for our money back." And they were even stealing our patents, and so we went all out.

And, I was told not to do it and what's crazy is that the CEO, Andrew, to this day is a Facebook friend and very cordial. He came and visited the our site and really made the point to me that again, that was an intuitive thing that everybody was telling me, "Oh my God."

The New Trend — Water4Us™

The most recent thing that, the trend that we saw, was this thing about how all of a sudden on our existing business, we're starting to get all of these human communities showing up. Housing developments, RV campgrounds, high-end hotels, travel stops and all these and trailer parks, of course. And, the Alabama one is only one of them, there's more. So we're seeing all this traffic show up in all these human communities.

We realized that there's an opportunity here to help people who are migrating away from the big cities and don't get good service where they are and we can make them independent. And that literally created the Water4Us™ initiative, which we're launching right now and we're busy developing. So that kind of told the story behind how we decide things very rapidly.

Now, I wanted to, while we were on the topic of megatrends, that migration megatrend. Well, here's an interesting one. Let me just pull this up on CNBC.

Start of presentation

Andrew S: New data from the IRS showing that the wealthy and their high incomes moved at a much faster rate in 2020. Robert Frank has more on the Great Wealth Migration. Robert, what's going on?

Robert F: Well, Andrew, new report from the IRS showing that the Northeast and California lost over $40 Billion in income in 2020. New York losing nearly $20 Billion in income from outmigration that year, more than twice the losses of 2019. California also nearly doubling its losses to $18 billion. Connecticut, New Jersey and Illinois losing a combined $11 billion in income. Now, most of the winners, as we might expect, were low tech states, especially Florida. Florida adding a net $24 billion in personal income in 2020. Texas adding about $12 Billion with Arizona and Nevada also seeing strong gains.

But if you drill down, you look at specific state to state migration, taxes actually become slightly less important. Now, New Yorkers did go to Florida. That was their top pick. But their second most common destination for New Yorkers was New Jersey, which gained $5.3 billion from New Yorkers who move there. California also gained $3 Billion from New Yorkers. They, of course, have a higher tax rate. But California ended up losing more than twice that to Texas and Arizona. And the average income of those leaving high tech states continues to push higher. New York lost about 1.6% of its population, but nearly 3% of its income. So that shows that the people who left were the biggest earners and some of the biggest taxpayers. Andrew.

End of presentation

Water4Us

Riggs: This is interesting that the economic impact of these migrations is greater than the actual number of people because these are the earners. And that's not a very good thing for these megacities. I think that we're going to see transformation of the megacities and more and more movement towards the secondary cities. And that is really borne out by what we're seeing with the, the what we're calling Water4Us, which is the new initiative to serve these human communities that are springing up often in underserved areas for water.

Real Estate

All right. Now, I've been telling you about commodities. And, you know, real estate is interesting because it's been booming. Of course, now we've seen that the price of mortgages is rising fast and as a result, there's big layoffs happening in the mortgage industry.

Lumber Bubble

But here's another thing. Did you know that lumber, which took off, is now dropping fast. And that really goes to show that when you have commodities that are at a high price, and this goes for all of them including oil and gas, you're in danger of bubbles bursting. So sure enough, the lumber prices have fallen almost 50% year to date, 65% down from the high. They're saying it should help the housing market. Well, good luck because here's what's going to happen. The drop in demand in the housing market is going to further impact demand for lumber.

And so people who were going crazy for lumber and bidding high for scarce lumber supplies are now seeing a glut. And the very last sentence here, that there's decent underlying demand that will support housing construction. Well, we shall see, won't we?

Water Wars

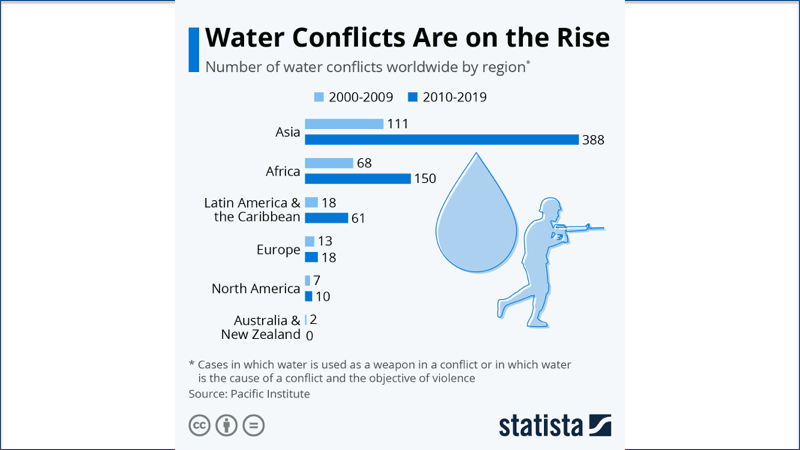

All right. Now the war is in the headlines, but actually water is a major source of wars. And we have that going on. A very good article in ZeroHedge where there's two kinds. Three kinds, rather. One is over control of water. The other one is where water is used as a weapon. Like, for example, somebody building a dam upstream and keeping the water from the downstream and then water being lost because of violence.

For example, when Iraq drained all of their swamps in order to scare out all of the rebels before the US came in. And that was a terrible destruction of the the delta there. That was typically a casualty of the efforts to eradicate the rebels, right? The Tigris and Euphrates. Delta. Delta.

So as you would guess, Asia is the hot spot, not only Asia proper, like the main part of Asia, but also China.

And China is very difficult because they are doing that, holding back of water. They keep, they're more and more trying to dam water that is supposed to go down stream to India and Bangladesh.

Same thing is going on with Ethiopia. Ethiopia, building a dam that could really hurt Egypt. This is some nasty stuff. And here's a chart that shows that a tremendous rise in water conflicts. And what that says really is that water is in a scarce situation, right? That scarcity breeds conflict.

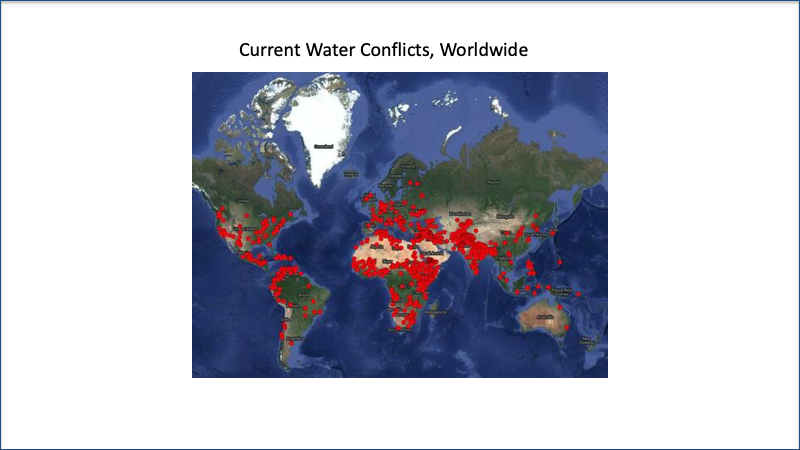

Here is a chart that shows how many conflicts are going on worldwide.

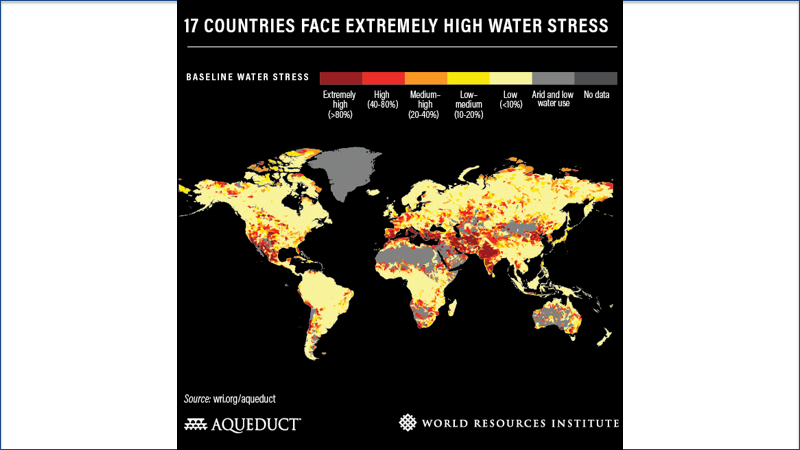

And I'm going to show you immediately here a chart of the water stressed areas. And if you were to split back and forth, you can see that they kind of match.

Right now, if you look at this chart of water stressed areas, the American southwest, the west and southwest are hugely stressed. Interestingly enough, a lot of Europe is. I'm talking about the red spots. And then look at India. India, with the largest population in the world, has the most water stress. And then all the way through the the Fertile Crescent, as it was once called, where the crescent is actually dark red, it's no longer, no longer fertile. Right. So we have a problem there.

Proper Stewardship

It has a lot to do with, of course, land management, because proper stewardship of water is a big part of land management. So this is a really interesting chart because it shows some quite, quite amazing areas where water is a major issue. Look at South Africa, for instance. China has got a big problem. Big parts of Russia. Look at Italy. Italy is completely red, as is Greece and Turkey. So that tells us a lot is is contributing to these conflicts.

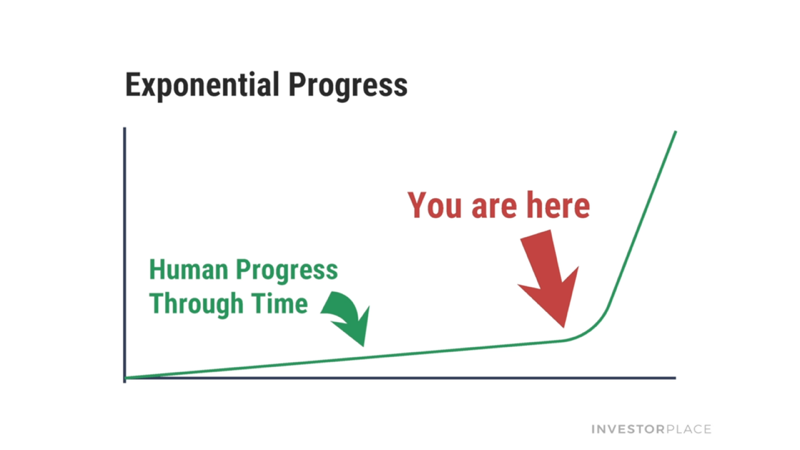

Now, I wanted to I had promised to cover exponential progress. And this is a good little video that I saw from Investor Place, which is a good source of information.

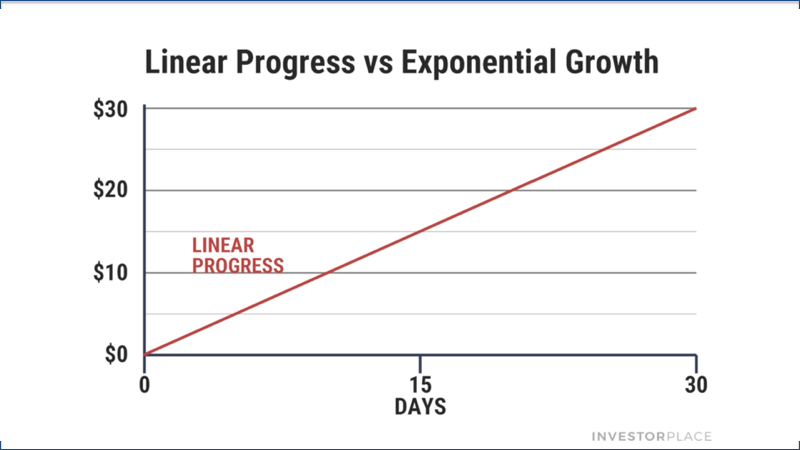

Now, this is linear progress and you sell one, then another, then another. And you kind of grow. You grow. You grow ten, 15, 20% a year and just kind of keep growing. And that's perfectly good. And that's what we've, the water industry conventionally is in linear progress, but we're not satisfied with that. We want to see exponential growth.

That is progress that multiplies in power with each step. So it's one on top of the other. There's a famous story about the, there was a very wise man who the emperor of China wanted to reward. And the wise man said, All I want is I want a grain of rice that doubles for each box on this chessboard. And the king said, Is that all you want? And the wise men said, there is not enough rice in China to fill that board if each one doubles. So that's kind of what exponential progress is all about. And here it, here it is.

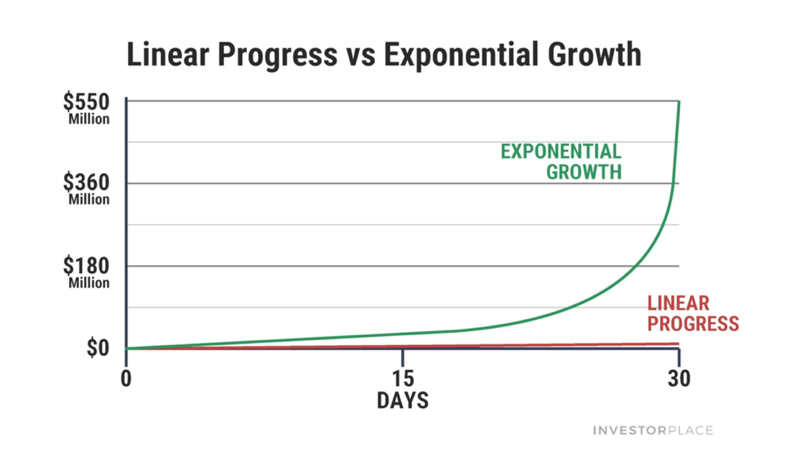

Now, what's interesting about this is, is that it snowballs, it starts slow and builds, and you get sort of technology on top of technology. This is what we've been doing at OriginClear, innovating on top of innovation, on top of innovation, on top of innovation. And it starts to get some momentum. This is why we're up. Revenue is up 55%, which is huge for a water company in Q1.

When a small number grows at an exponential rate, the first stages of growth aren't incredible and it doesn't soar upward. And that's why it's hard to see. And it's not until the later stages that these big gains are noticed.

So the there's something called an inflection point where things really start to snowball and you see the change. You can see that in in history. Right now, we're only beginning the exponential progress. And we know that there's been a tremendous amount of technology gains. It's only the beginning. So that has tremendous business and investment ramifications, of course. And you also want to think always about what it means for how the economy works and how to build wealth.

Open Discussion — Wealth Migration

I also promise that I would tell the Michael Burry story, but first, I'm going to invite Ken to join me for the freewheeling discussion. We're going to we're going to get into it. So fascinating stuff, right?

Ken: Yeah. And you're looking at two refugees, the folks that are out there. And we're you know, I was a New York escapee and you an LA escapee. And I have conversations, you know, I have I live in a great neighborhood with wonderful people who are business owners, very affluent folks. And they and they bitch and whine about taxes. And I just go, Shhhh.

Riggs: Yea, right?

Ken: Just, it's fine. Just let it go. Let it go, Elsa Yeah. So what I found alarming, not alarming for us because we're out, but that's an unrecoverable loss of when, when among your wealthiest are leaving. I mean, these are not middle class people by average, right? I would imagine that they're probably in your top two or three % of incomes that have left. I think that was $20 billion of income left New York. That's a stunning number. I mean, they have a 3 billion or so dollar shortfall on taxes, now. What's it going to be when when the catch up of those revenues?

So I think a lot of these high tax states are going to have to rethink because places like California, Florida and Tennessee are going to eat their lunch. And now that lumber is down, I mean, it may start building those two homes on that lake in Tennessee that I own those two lots. So that's interesting. So thanks for the update on that. I wasn't aware that it had dropped that much. I stopped calling. Contractors after a while. I just said, I don't want to hear it, you know?

Riggs: Right. But I think there's going to be a lot of building going on and it's going to be specialized building. For example, the we're helping to build a tiny homes development in South Dallas, and that's going to be a very good model because here's what's going to happen, especially when cities get hollowed out, you end up with poor populations, more homelessness, etc., and they've got to take care of people. And so that's when these special projects, you're no longer you know, we had the projects in Manhattan. Well, we're not going to get those anymore. It's going to be tracts. It's going to be housing tracts.

Ken: You mean the great society type stuff, right?

Riggs: Yeah. Well, the stuff even before that, remember wartime special projects.

Ken: Oh, right, right. Sure. I mean, the entirety of Levittown. Levittown was built. Levittown, Long Island was built post-war to house all the home, all the homecoming soldiers. Right. It was an entire community of these little, little homes.

Riggs: Cracker boxes.

Opportunity for Builders

Ken: Yeah. They really why they would, you know, the little checkerboards. Right. So the as you mentioned, the slowdown in in new construction will depress prices even further on the building side. I think this represents an absolutely extraordinary opportunity for Water4Us and here's why: Builders aren't going to really be able to make, they're going to be building homes to just stay busy and keep even and keep and make their payrolls. Right. They're not going to be earning money. They're not going to be making a lot of money in these depressed times because it's going to be Slim Pickens.

I believe that Water4Us communities, completely independent communities with water and so on and so forth, we'll carry significant premiums. By the way, who's moving? Relatively rich guys, right? Right.

Riggs: Exactly.

Ken: Like I was talking about that big community that I wanted to work on and that's going to be upper echelon earners. That's going to be fairly affluent people. So I think the Water4Us, for builders, I think it could be an absolute boon for them. And what a great way to really get out the message because I think that they could be the best carriers of our message, you know what I mean? Because they'll be it'll be very self promoting.

Riggs: Gene Tully, says Ken, fellow New Yorker, remember how Mario Cuomo drove so much business out of New York when he was governor? You know, he was a master at that.

Ken: No, he told me. He told me, hey, mommy, they're anywhere. I went, okay. Mario Cuomo said, If you're this, this we don't want you. I said, "Okay, bye."

The Big Short and Water

Riggs: Right. I was going to tell the Michael Burry story because I can't tell you how many people go, "Oh, yeah, water. That's the big short. At the end of the Big Short, Michael Burry is going to go into water." Well, Michael Burry did go into water. And what he found was, the existing legacy world of centralized water was so political it became disgusted.

Ken: Right.

Riggs: He bailed and he went into farms, agricultural, which is an indirect use of water, and he did very well. I mean, he's doing extremely well. But here's the thing, is that and that's the problem with centralized water, it's so tied up with the politics and the big, big water companies and the municipal bonds and so forth, whereas decentralized water democratizes the whole thing. And I kind of think that if Michael Burry had stepped into Water on Demand, he would have been, "I like this."

Ken: It might have been good for us too, I'm thinking.

Riggs: Eh, Michael Berry, you know...fine.

Ken: Tell him I'll return his call.

Riggs: Him and Elon Musk.

Ken: I'm on with Elon right now, I can't take Michael's call. I'm on with Elon. So, the what I had a conversation today with actually it was a couple of PhilanthroInvestor folks, ended up being more than one person, but they immediately said, "So you're doing this in the cities and you need us to..." I said, "Negative." And he said, "Why?" I said, "Simple. You could take a three month project. You can make it take five years that way. Besides, there's so many layers of bureaucracy and then you get to the bad stuff, which is the nepotism, right? You spend two years bidding a job, wining and dining, right? And then he goes, Yeah, I gave it to my cousin or my friend or something like that."

Riggs: That, or the lobbying big water company, right?

Ken: Or the guy, right. Or the guy who took me to the, to the fancier restaurant. Right, exactly right.

Riggs: Madison Square Garden. Exactly. For those those hockey games. Sure. They used to take me there. You know, the bankers used to take me to there.

Ken: And I was asked I was going to ask Gene Tully if he watched my Penguins beat the Rangers a couple of weeks ago. I didn't know if he caught that game, but we'll talk about it another time, Gene.

What's Going On

Riggs: So, really what's going on here is yes, reports. Yes. So, just quick update about what's happening on the front. I was yesterday I showed some pieces of the institutional pitch deck that is now close to done. Tomorrow we will be finalizing the five year forecast of all of these spin offs as to how they are going to break out.

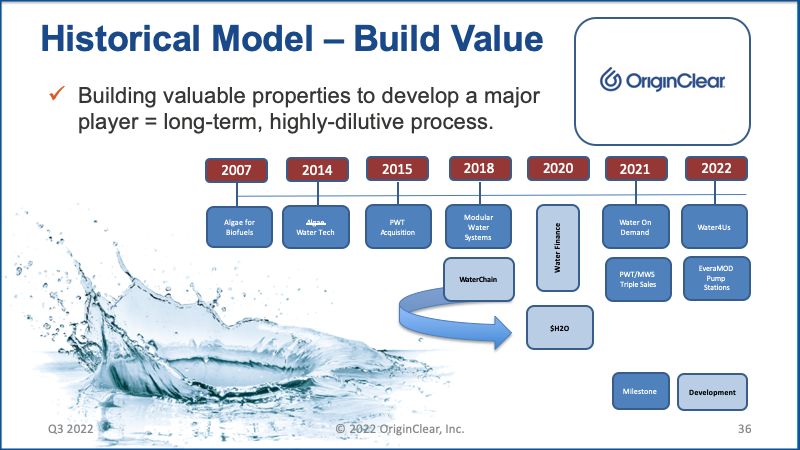

And I was going to quickly show the two graphs that I was that I made the other day to kind of illustrate where it's going. And here it is. So this was our old model, which everybody knows it was long term, highly dilutive. We kept packing more value in, packing more value in, and we ended up with all the stuff we're kind of like almost obese with value. But the problem with that is many things get neglected because you can only...

Ken: Attic is full, right? Your attic is stuffed.

Rise of the Regulation A Offering

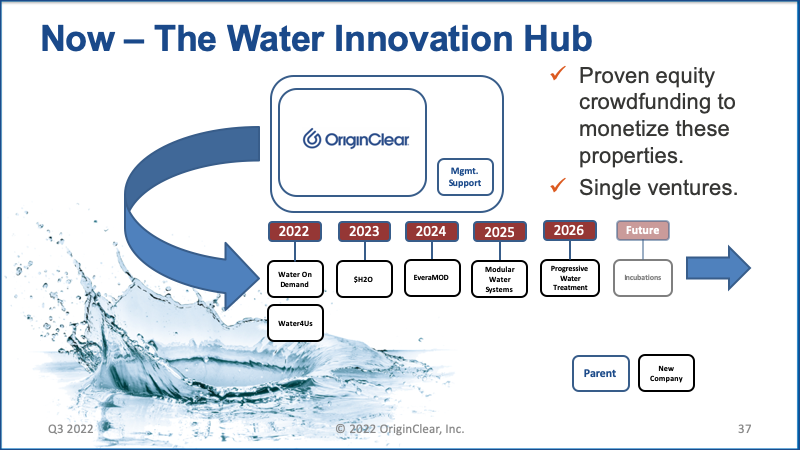

Riggs: Exactly. So now the new model is take these and export them and do it in series so that you can focus fully on one at a time. Now, what does this do to OriginClear? Well, of course, every single one of these properties, the revenue and assets, consolidate into OriginClear. As long as we're a majority holder, it's 100% consolidation. And even when it goes to a large minority holding, it's still considerable.

And so we end up with OriginClear having a tremendous amount of value. But the reason why we can do this has to do with one important factor, and that is the rise of the Regulation A offering because, Knightscope really showed us that, it is a robotics startup that was done through Start Engine, and they raised over $100 Million in unaccredited funding.

Ken: Right. Thousands and thousands and thousands of investors.

Riggs: Right. So healthy.

Ken: It's really good.

Riggs: And they and of course, you create demand for the product and the process. It's really a smart way to go and so...

Ken: Elon Musk said that there were three guys that saved Tesla. If it weren't for the right, you know, the bench was so, was so shallow, right, he faced disaster. So with a wide investor base, of course things aren't going to...

Riggs: And we have a similar story ourselves. You and I were talking about that today, that back in 2018, 2019, 2020, when really, we were strung out on experimentation, and then our investors came to the rescue and we did the right thing by them. The people who stuck with us, I believe, are happy. But now we have all that value that we paid so dearly for in terms of dilution, in terms of...

Ken: Blood and treasure, right?

Riggs: The grey hair you can't see. And but here's what's beautiful.

Ken: Kept mine so they can see it here.

Modular Water and EveraMOD™

Riggs: There you go. There you go. What's a beautiful thing is, is that we can focus on one at a time and the rest, keep on trucking. Modular Water just had a $1.5 million month of May in booked orders. That used to be more than the entirety of the company did in a quarter. So and this three people this is a three person division.

Ken: But isn't that, isn't that more than they did last year?

Riggs: So they did. Yeah, no question, yeah, absolutely.

Ken: It's but then they did the entirety of last year.

Riggs: But how things have changed. So it's a beautiful thing because Modular Water is standardized. It's not these, make them by hand. And so because it's standardized, we can ramp it up. And yes, last week I showed that video of the visit to Houston Polytank, our partner there, with whom we're finalizing a very close and preferential partnership. We give them our business and they don't circumvent us, which is great.

But that showed a standardized pump station. And we can they can knock those things out, badah-bing badah-boom. And in fact, Water on Demand can even help do what is called flooring, right? When car manufacturers put cars on dealership parking lots, the dealership hasn't paid for those. The dealership is just paying a small interest rate for it. We're not even going to do it on an interest rate basis. We're thinking of doing it on a simply a bounty when the machine is sold. And that's going to get but we'll get to that with a EveraMOD™, right? So that's future plenty of time yet. EveraMOD is the pump station play.

Ken: And just zero customization with that. I mean they literally the same thing just in varying sizes, right?

Riggs: Yeah. Three models, basically.

Ken: Right.

Parting Commentary

Riggs: So with that, I'm going to start wrapping it up. But we're very happy with how Water on Demand is going. Like I say, next week I'm going to go through the five year forecast for the multi line for what you see here. And as a result, you're going to be able to see, I think, some pretty interesting numbers. Robert Baxter says, "Thanks, guys." And we want to thank you all for having joined us tonight. As always... "Go Rangers, right?" As always, it's a it's a great opportunity to get together.

And here's, I'm going, to I'm going to say one little thing. I was interviewed by Fortune this week. Fortune magazine. You've heard of those guys? Small, local town paper?

Ken: Yeah.

Riggs: Normally, the interviews run 20, 25 minutes. The guy kept me for 47 minutes. I looked at my phone.

Ken: When do we when are we seeing that?

Riggs: Quien sabe? But they have a pretty fast publication schedule. Gene is still going crazy about islanders, Mike Bossy.

Ken: We'll talk about hockey some other time.

Thank You!

Riggs: All right, everyone. Well, thank you very much for joining us. It's been wonderful again. Enjoy the rest of the week as it's winding up. Do come next week and I'm going to clue you into some very interesting forecasts for the next five years.

Ken: Goodnight, folks.

Riggs: Thank you, Ken. Thank you, everyone, and goodnight.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)