We reviewed the rate of inflation, which is a bit frightening. Add to that cyber attacks on water infrastructure, overstressed water systems and serious water shortages. Is water security possible? We watched our CEO lay out Water on Demand™ for a top podcaster to reveal one BIG part of the solution… And finally, covered the mega-trend that's booming the exurbs, the importance of secondary cities and just how Water4Us™ directly connects to it all! Get the full story here in the replay.

Intro Video

.I'm Riggs Eckelberry co-founder, chairman, CEO of OriginClear. The government needs to continue to provide a lot of abundant clean water, but what happens to it after it's used when it's dirty? Do you know that 80% of all sewage is never treated, it's just dumped? That leads to water scarcity, but it also leads to a lot of disease and pollution, the ocean turning into something horrible.

The same time, the cities and counties are not getting the funding they need to really treat the water and so they can't keep up. The solution is let the people who use the water clean the water.

Water on Demand™ is investment in actual capital assets that earn income. Sign up to hear my weekly briefing every Thursday night. 5 p.m. Pacific, 8 p.m. eastern. Just put oc,gold/CEO in your browser. Register for the briefing and look forward to hearing more from you.

Welcome everyone to Water is the New Gold Thursday, May 19th. And briefly, number 160. Clean Water for a world in crisis. It's clear that we've got problems with water and we hear about them all the time. What to do about it is the big question, and we're really focusing in on that because it's not enough to take care of a pump station that some insurance company is building somewhere. You've got to really take care of people's problems with clean water. And I think that's the mission that we've really focused in on. So that's Water4Us. And the important, vital engine, of course, is Water on Demand capital.

Q1 Quarterly Report

All right. Well, hey, we filed on time our Q1 quarterly report was filed on Monday, the 16th, which made it on time filing. In previous times, we have taken that, quote unquote grace period of five days for quarterly, 15 days for an annual. And we just said, no, we're just going to do this properly. And the team pulled together. I'm very proud of Prasad, Eric, Gwen, the auditors and the board all did a great job.

So what are the results? Well, fantastic, because revenue was up 55% for the three months ended March 31st to 1.234105 million. I'll tell you in a second what that means for as an annual run rate compared to just 800,000 for the first three months. So typically the first quarter of the year is slow and it revs up and it ends up the fourth quarter being high. It kind of grows throughout the year as budgets get approved and things get done.

Recognized Revenue

So there's a lot of companies and cities are on a calendar year, financial year. So that is amazing. As I told you last year, our booked orders tripled to 12 million, but then it has to actually be delivered. Revenue is a key word, also called recognized revenue where you have to actually, if you make a sale it's actually a liability to deliver it. Think about it. If you give your credit card to someone and they don't deliver, will they get their money back? Right. So but then when they deliver and you accept it that they've earned it and your longer is a liability for them, it's money in the bank for them. So revenue is what that is. And it's the actual achievement. It's the true number.

All right. Let's take a look at if this pace continues, we will achieve close to 5 million this year, which is far better than a long, long time. And I think we will do even better yet. For example, I saw that Modular Water Systems got a, I believe that they'll easily exceed $1,000,000 in booked orders this month which is fantastic for Dan Early. And Eugene Tully says, "Good evening Riggs. GAAP, generally accepted accounting practices." Exactly. GAAP that's recognized revenue, he's absolutely correct.

All right. So that's fantastic. Now the cost of sales increased and gross profit decreased, and that is really a fact of, in Q1 we were dramatically trying to deliver that $12 million in orders. So we're just spending, spending, spending to deliver. And that's how come the top line was much higher. But the cost of sales and gross profit was on an interim basis. As you can see, there were higher expenses and that cut into profits for the quarter again, because we were just basically throwing money into it.

And in fact, as you remember, the Water on Demand unit was able to lend money on a secured basis to Progressive Water Treatment. I think was about 250,000, which was repaid I think 45 days and returned royalties to our fine investors because it's not yet the true pay per gallon thing, but nonetheless it was money and they got royalties, which was great.

Now as you can see, losses from operations increase and that is because we are investing that's the capital and the expenses going into Water on Demand, which is going to further, this is what we're working on to really biggy up our activities and go from just selling machines to blessing people with a solution that they don't have to pay for upfront.

OK and Tom Marchesello. "I continue to see great performance." He commends Marc Stevens, the president of Progressive Water Treatment. Mike Jenkins, the president of Sales, Dan Early Chief Engineer and the entire team's. They're doing an amazing job, and this is what I like about it is this thing with the quality that if you if you were to visit the McKinney operation, you would see a completely jam packed with equipment being built. It's quite a sight.

Now, a Word From Elon Musk

Now, I admire Elon Musk and he's really been expressing himself lately. Well, this week he spoke at a summit tech summit, and I thought I would excerpt a little bit from it. That I think is really, really worth listening to is short and sweet. But I think it really speaks to the to our own philosophy and what we're about to. So let's take a look at what Mr. Musk has to say.

Start of presentation

Elon: My default inclination is to start things from scratch. I mean, I'm not really I don't buy things like this this this sort of. Like. Like SpaceX was started from scratch. You know, in the case of Tesla, you know, it was like five people. It was still this guy, Eberhard, who's the worst guy I've ever worked with, who tries to claim, like sole credit, essentially, for creating Tesla. And if he's so damn great, why didn't he just go create another car company when he was fired? But anyway.

Jason C: So I mean, that's a pretty good story. I mean, yeah, I remember. I mean, no, but I remember having this conversation with you. We were having a conversation about the Roadster. I think I can tell the story. I said, How's it going, pal? And you said, Well, I got one problem. It turns out the Roadster parts and putting it together cost 190,000. And I said, I gave you 150 for number 16. So if you make 2000 of these, you're going to lose $80 Million and you're like, yeah, or double that. I mean, they basically the parts of the car cost more than they were selling it for. When you were starting to get involved that it was this.

Elon: No, no, I've been involved well before that. Before that, yes. When Twitter, when Tesla was nothing but a piece of paper. Let me be crystal clear, crystal fucking clear.

Jason C: They brought you in.

Elon: No, they didn't bring me in either. I was going to start, I was going to start an EV company with J.B. Straubel and based on the the AC Propulsion tzero. And when I, when I asked AC Propulsion if it was okay to do that, they said, well, there's also some others who want to create an EV company but have not created one yet.

Jason C: Yes.

Elon: Would you like to join forces with them? And I said, okay, well we'll do that. That was a huge mistake. JB and I should have just started the car company ourselves. Instead we teamed up with Eberhard, Tarpenning, and Wright, big mistake. The actual moral error here was me trying to have my cake and eat it too, which is like, I just want to work on the technology and the product and have someone else be the CEO and sort of run the business operations. Because I just like working on technology and product and design and, and also as like doing SpaceX, you know, at the time in our ops were blowing up.

So it seemed like, okay, this is like I always wanted to an electric car company. This is how I can have my cake and eat it too. That was a huge mistake and fundamentally a moral error. And so in the end, I had to friggin be CEO and I didn't want to be basically. So, but it's either that or company's going to die. So so we started with really just nothing and the tzero prototype from AC propulsion not, if that's the precursor to Tesla. To be 100% clear, once again, when we created Tesla, when I joined, there were no employees. There was no intellectual property. There was no prototype. There was no nothing.

Jason C: Yeah.

Elon: To be crystal fucking clear.

Jason C: And it almost bankrupted you. I mean, that sent you to the cliff of insolvency. I mean, that was.

Elon: Yes, we were on the ragged edge of bankruptcy so many times. It was ridiculous. So I one 2008 was one of the worst years where basically GM and Ford, GM, GM and Ford almost went bankrupt and, you know, trying to raise money for a start up electric car company in 2008 while GM's going bankrupt was difficult, to say the least. You know, people were angry that I even asked them for money. They're like, fuck you hang up.

So the only way that Tesla actually made it through 2008 was a subset of the existing investors, which includes like people like Antonio Iglesias and, you know, Steve Jurvetson and a few other key people, Ira Aaron Price, who I've hold a debt of gratitude to this day. And and I put in all the money I had left, and they sold everything, literally everything. I didn't even have a house. So my ex-wife had the house.

So I was like staying actually in Jeff's girls bedroom, spare bedroom. And, and but that a subset of the investors would say, okay, if I put as much as I put in. So I put in everything. And then we closed that around 6 p.m. Christmas Eve, 2008. It was last hour of the last day that it was possible because after that people were like breaking for the holidays and we would've bounced payroll til two days after Christmas.

Jason C: It was pretty death's doorstep. I mean, it was an incredible moment in time. And people also forget at the time that the first two rockets SpaceX sent up didn't exactly make it to orbit like.

Elon: The first three.

Jason C: Now, the first three and I remember having dinner with you at that time and I asked you, Hey, how's it going? I heard Gawker says you got four weeks of payroll left and you said That's not true. And I said, Thank God. And you said, We have two.

Elon: Yeah.

Jason C: And I said.

Elon: Both SpaceX and Tesla in 2008, if we'd simply paid our suppliers on time, we would have gone bankrupt immediately.

Jason C: Tell us. Tell us. Actually, it was it was a pretty crazy moment, because I also remember asking you, we were having dinner at Boa and I said, well, certainly it's got to be some good news. And you took out your BlackBerry to date. The conversation. I don't remember it. Yeah. And you said don't tell anybody, Jake. I said, no problem. And you showed me the clay version of the Model S. Yeah, the most beautiful car I'd ever seen. And I said, Oh, my God, it's stunning. How much is it going to cost? You said, I think I can make it for 50,000. I remember it was yesterday. I said, If you make that car for 50,000, you change the fucking world. And you did it.

Elon: Yea, it was a little more than 50,000, but. Yeah.

Other panelist: Let's ask about SpaceX.

Elon: Okay, we'll ask about SpaceX but I want to ask one more personal question. Has life gotten easier for you as these companies have hit scale, or has the complexity made life even more challenging? Because those early days it was just fighting to survive. Nobody knew who you were. You were anonymous, and it was really just about the work. And now, let's face it, you're the world's most famous guy and everybody's watching everything you do. But these companies are also very big. So what's life like for you today? Are you enjoying what you're doing every day?

Well, I mean, it's somewhat of a roller coaster. So there are like good days and bad days and there was a crisis issues and, you know, like sort of, you know, knock on wood, like we're not like facing death in the face. Like, it's definitely like quite stressful when like, you know, death is like trying to eat your face off and like the foam is like just and, Right there, you know, you know, that's it's pretty stressful in that situation.

So like, you know, both SpaceX and Tesla have significant cash reserves. So like, you know, it's not we're staring death in the face. We can sort of see it over on the horizon, you know, so don't want to get complacent or entitled because but if it's not, like, just sort of foaming at the mouth and trying to eat your face off on a daily basis, that's definitely, we've moved on from that point and hopefully never, never return.

But there are a lot of issues that need to be...It's just like if you're the CEO of a company, the chore level is high and if you don't do your chores, then the company goes to hell. And I hate doing chores, frankly. So who does? So that's the real like there's a whole bunch of sort of personnel issues and legal issues and, and things that I, I don't find enjoyable to work on. But if I don't work on them, the company suffers. So it's more like just the sheer volume of work is insane. That's the and then and then, you know, go do some go add to it with Twitter or something like that. Yeah. I mean, honestly.

Jason C: An extra processor.

Elon: Yeah. I mean, I have a habit of biting off more than I can chew and then just sitting there with like chipmunk cheeks.

End of presentation

Audience Questions

Riggs: So there was so much that was interesting about that. So I quickly address the chat questions here and then I'm going to talk about the Elon Musk video. First of all, Wayne Snyder wants to know, "When will OCLN be on the Nasdaq?" Very, very good question. And we have a very tight schedule tonight, but I have a Gantt chart. That's one of those things that looks like a bunch of spaghetti stuff that lays out. I did it this week. It's fantastic. And it is for Water On Demand to go on the Nasdaq probably before OCLN does. Right.

Incubator Model

Remember, OriginClear is being configured as a launch pad and at the end of the day, all we want to be is own a substantial piece of four or five amazing water companies, starting with Water on Demand. Eventually we want to do the crypto. We want to do probably a pump station launch. We want to do a launch of Modular Water Systems itself. We want to launch Progressive Water Treatment.

All of these companies will end up ultimately, I believe it's public companies. And just the same way that Yahoo! Was saved by owning 30% of Alibaba, we will have a substantial amount of value. Whether we'll take OriginClear to the Nasdaq is a secondary question. What's also great about this is it will make OriginClear itself cash positive and not require funding.

It's the spinoffs that will require investment funding, but that will be very specifically for the spin offs. So this is a very smart way to go with taking a pure play and going, okay, here's a targeted thing if you want to invest in it and it goes out as opposed to its big blob because we were like packing value, packing value, packing value.

And I think it's better to be sort of an idea lab. Springboard for Water Innovation™, as we call it. So that's that answer. And next week, I will run through that venture with you and you will see we do have Nasdaq in our future, I believe.

Shorting the Stock

Now, Michael Anthony says, "I thought this is something to do with insider buying. I'm not sure why I did get an email about this meeting. I just did get here. I don't know what this is about. And I would like to know." Well, Michael, there's no insider buying or selling going on.

There is, we believe, a lot of shorting going on. And we hired a company called BuyIns.net, which is the premiere, they are the only people out there who are able to get a handle on short sales because we see a pattern. You can see I'm not going to get into the stock a lot, but we see a pattern, the stock does great all day and at the end of the day, boom, there's somebody hitting it. That's short selling and it's not very nice.

So we've got Tom Ronk of buyins.net that is extremely good at this, he's done it for years. He's got the only database that generates that kind of information. And so we expect that we will have this, will clean itself up over time, obviously. Otherwise we would not have retained him. But I can't guarantee results. The number one thing that drives stock price is performance. And as you saw, our quarterly report showed a 55% increase. So, Michael, thank you for coming.

Managing Startups

We're going to get on with the show because Elon Musk. First of all, what was great is people don't realize how horrible it is to have the startup. You literally, you know, the ragged edge of bankruptcy as he says. Every single successful startup I've seen. Afterwards, you find out that there was disaster all along, being sort of hammered by the jaws of death that the whole time. It made me laugh and really going down to the very, very edge. I mean, I've been down to my credit cards.

I've been there with this company lending a ton of money, just as Elon Musk did. I remember lending one time over a quarter million dollars to the company and took forever for the company to pay back. It's what you do, right? That's how it is. So. And when I first started the company, of course, I took a major pay cut. And I think I would have done far better as a consulting high tech dude over the years.

And Michael Anthony says, "He did say he was going to buy Twitter." Well, I'm not going to comment on that. The Twitter thing, if you watch that video of the All In Summit. He talks about this. It's a wonderful, it's one hour thing. Listen to it while you're while you're doing other things. I strongly recommend it. This is Elon Musk the All In Summit, its on YouTube.

About Spin Offs

So. All right. Now, Stevan's 521. "Investing in a spin off when there...dilution...." All right. "Help us understand how we don't go broke." What is a spin off? Let's talk about that a little bit. Let's take a moment. The reason why we decided to do spin off is this. You try and push four or five things at a time. And where do you find the resources for it?

Progressive Water Treatment is cash positive. And Modular Water Systems now, is operating, I think, cash positive. They've been doing that for a while. It is hard to tell because they're all been bunched in, Progressive Water and Modular Water had been all bunched in. We're separating them out and by the time they're separated they will both show that they are cash positive.

So what's cash negative? What's cash negative is our efforts to create something huge, something amazing, something different, something that actually changes the water industry as opposed to being a little five or $10 million water company in Texas that you would never hear about. Now, maybe that's what I should have done. And I'd be sitting there in McKinney, Texas, with my little shop floor, and that would have been another life.

Original Investors

But what we've done and this is another thing that Elon Musk made clear, his original investors came back and saved him. And this is exactly what happened. Ken will tell that story. 2018, he came along and we went back to our investors. At the time, we were doing a lot of toxic financings, horrendous. So this is why we had a tough time with the stock and so forth, which we haven't had to do it since.

Why? Because our investors came back and we did the right thing by them. The people who came back are well, I believe well in the black, so they did well as a result. But it did mean that they had to commit to help us, and they did. And so that's why it's so huge. What Elon is telling you is that at the end of the day, it's your it's your original investors that matter.

Pure Plays

And and the final thing I want to mention is he says Tesla builds all its own stuff. It does not... Like a car company that, they just basically they delegate the sales, this, that and the other thing. Water on Demand is a pure play in finance and we will, we are doing it all ourselves and we're letting the water industry build these systems for us. And that, I think, is a very clean way to go.

So going back to the spinoff concept, if you can create targeted companies that are what we call pure plays, then people know what they're investing in and the mother company can now operate cash positive and the only investment is in that subsidiary. Now the subsidiary itself will go public. And that over time you get a series of public companies.

I believe it's much more value than trying to kind of take this sort of amorphous thing down the road. It's as a long time marketer I believe that. "Elon seems like a personable being, not some stickup CEO. Very much like you Riggs." That's so nice. And Michael Anthony says, "People and anything that is living must have water." Perfect. Great segue for me to move on because I've got so much more good stuff for you. You're going to love it. But I thought you would enjoy this Elon Musk thing.

In The News

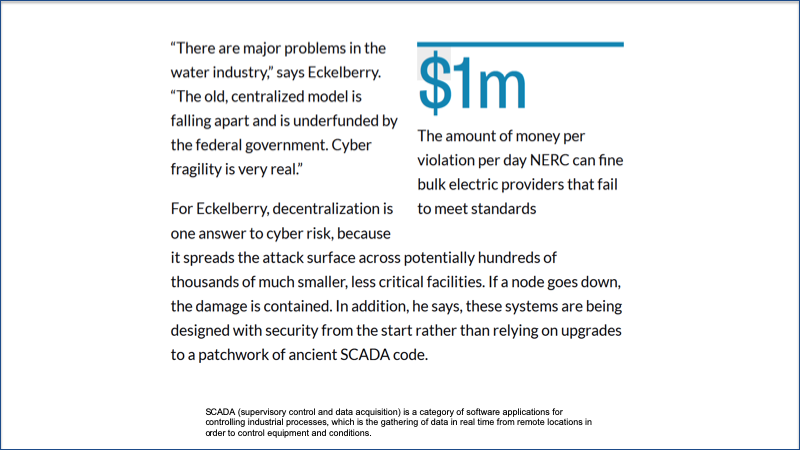

All right. So I'm going to jump back in here. And we just were in the news. We had an article I was interviewed about cyber attacks on water. And Endpoint is an excellent magazine. And it's about the danger of a critical infrastructure, cyber attacks on water treatment plants. So what about that?

Well, here's what I said. It's like, well, how about not having big centralized systems, right? And so we're disrupting the water industry with this idea of a futures market that's like crypto. Water as a service, Modular Water Systems, etc. and do it yourself water liberate customers, consumers from the aging, vulnerable utility grid? Right.

And the old centralized model is falling apart, is underfunded by the federal government. Cyber fragility is very real. Last week you heard this interview when the writer was interviewing me for this article and this is what came out. And decentralization spreads the attack surface across potentially hundreds of thousands of much smaller, less critical facilities. And so this is the smart way to go.

And it mentions SCADA, supervisory control and data acquisition that's for controls, water controls, equipment controls. So what I'm basically saying is if you want to have safety. Don't be all centralized, right? Don't huddle together. Yeah. Disperse. Kind of like guerrilla war versus a standup mass war, that kind of idea.

And this idea of utility independence is new. There's a bunch of different ways that these various activities give more security in a world in which blackouts and water rationing are on the rise. I'm going to talk more about this.

About Chris Null

Christopher Null, Chris Null's an amazing writer. You can see he was the founding editor of Mobile magazine, top editor in a bunch of competing magazines. He's been around and a great interviewer, as you saw in last week's clip.

Now, we also had a, I'm going to do a short excerpt from, this is one of the very top 1% globally of podcasts in the world in entrepreneurship. And so I was very honored to have been interviewed by Priyanka and she was quite good. Here's a short and sweet and you'll see how our story is so persuasive. Here we go.

Start of presentation

Priyanka: Hello, everyone. Welcome to Shop Up with Priyanka. This is your host, Priyanka Khandalker and I'm so excited to talk about this new topic and it's all about investing in the new gold. Let me introduce my new guest. His name is Riggs Eckelberry. As founding CEO of a public company, Riggs has found a completely novel way to rescue business owners faced with fast rising water bills and build a new investment market in the process, he's even begun to build water. Stablecoins.

I know you are passionate about water. I know you're passionate about serving for good and like passionate about seeing the issues in the world around water scarcity. But I wanted to understand, like, what made you like, click like you're the core values, right? This is bigger than what I see right now. Like what? What was that aha moment for you?

Riggs: Interestingly enough, it happened, COVID was for us the the moment where we had to figure things out quickly because we were building a conventional water company all the way to the end of 2019 and, you know, doing things. And then I remember February of 2020 when Wuhan shut after Wuhan shut down, then there was a ripple effect into the energy markets and investors freaked out. This is early February. I remember it very, very well.

And we went, Oh, we need to do something to really make a change happen because. To my mind, the COVID disruption accelerated change. If businesses were going to fail, they failed. If they were going to survive they survived. And there was also all these changes in how business was done.

And so for us, we had to really look intensively at our business model. And why is it that we had all of this stacked up potential business, tens of millions of dollars of business that was stacked up and it was not moving closer. And we were spending all this staff time talking to clients, blah, blah, blah. Well, how to accelerate this, right? How to make it faster. And we realized it's the money, stupid. It's the money. If you can inject money into the front end to say capital is not a problem, just sign here and you've got your system.

People go, okay, right? Your blessing instead of selling like here's your system, here's a solution. By the way, it comes with full managed services. You don't have to have an expert on board. Well, that creates a lot of of acceleration. And we started creating this thing that today is called Water on Demand, where a business owner and increasingly business owners are having to do their own water treatment like breweries that are expanding too fast, etc.

So, or there's a lack of sewage services for whatever reason, they can just do a service contract and just pay by the gallon as they're used to doing already. Right. This is nothing new for them, but they don't have to put up the $2 million and they don't have to go hire the water expert. That's all taken care of.

And, you know, the strangest thing is this is a new concept in water. This is not yes, water services has existed for very large systems like entire islands. Right. But for you or your business down the street, that has not been a case. And so we are providing, we suddenly realized that this was a need that business owners needed on the one hand. And the other thing was investors could now invest directly in water projects where they have not been able to.

And we realized that it was what we call water like an oil well in the sense of the same way that people can invest in oil projects, people can invest in water projects and get royalties, asset, assets safety, right? Because we know what's happening in the world and we have a shift from currency based finance to commodity based finance. And it's not because anybody wants it or doesn't want it, it's just happening.

So that means that obviously risk assets are not great, hard assets are great. But because everybody's going after assets, they've been priced very high already. Look at real estate, right? So and gold and all these things are expensive already. Well, what about an asset that has not yet begun to make its run? And that is water. Water is a new income producing asset.

And so anyone can come to www.originclear.com click on the invest button. Currently they have to be accredited or outside of the US. Soon there will also be an offering for unaccredited investors to get on the list. But they can go benefit from a very tangible investment in water systems. And that to me is a breakthrough because it brings a whole new cohort of investors to help fund the water industry that have not existed until now.

Priyanka: Wow. And can you have multiple investor in a water project or is it like, like how is that segregated?

Riggs: Well, it's a lot like in 1981, Apache Corporation founded MLPs, Master Limited Partnerships. Right. And Master Limited partnerships are a bundle of properties. Oil, gas, pipelines, it's all bundled together. And there's about. I don't know. I think there's 60 MLPs out there that are worth $300 billion plus in revenue. And that segment is very stable because it's not dependent on a single oil well. Right. It's it's a bucket of properties and some of them are dry.

Fine. But the good thing about water is it doesn't run dry. Right. There's always demand for water. You're not going to have a problem finding a productive water project. So what we put people into is a Water on Demand subsidiary with other investors. And now we have capital. And this capital is then put to work and they get their 25% of net profit for the life of the project. And then when it's wound up, they get 25% of the proceeds of of the wind up and they can reinvest it or whatever.

And in the meantime, they have the ability to place a lien on the equipment that we still own. We don't sell it. We don't sell the equipment. It's, this is a service, right? They have an ability to place a lean on the equipment, to enforce their royalty. And so they have asset protection and they have the royalty. And because it's early for them, they get a very generous grant of stock in the mother company, the public company, OriginClear. And so I have to tell you, Priyanka it's extremely popular.

Literally when people figure out what it is, they go, I'm going to do it because it's so obvious. Now it's going to become thinner, it's not going to be as generous. But because it's early days and it's like the early days of Tesla, right? I mean, if you were smart enough or an Airbnb, Stripe, if you were early and smart, then you made out really, really well, you know, and we're a microcap, which means we're a penny stock.

But and, you know, rightly so. People have like, well, I don't know about penny stocks and rightly so, because there's a lot of penny stocks that go nowhere. But because it's an asset based thing, we believe there's less of a risk and there's a lot of upside from the penny to the dollar, right? Mm hmm. And assuming that we get there.

So what I'm saying is it's an attractive investment. It's fueling this new generation of sign and go kind of water treatment. And we think it's going to spread. Now, one decision we made was, let's not try to build all these systems. If there's a water, there's a brewery in Portland, Oregon, that needs our system, our system. We're not going to go to Portland, Oregon. We'll call up a water company in Portland and give them the job, and then they can build it and maintain it. They're happy, like, whoa, this job just showed up, fully funded, right? Because we're funding these things. And so it makes us very popular with the water industry and it enables us to scale.

Another thing I learned from the dotcom was never try to compete with your natural partners. So let's make the water industry our partners and we take care of the finance. Now we'll go up like I would like to set up financing centers in, Water on Demand financing in Dubai, in Delhi, in Singapore and Tokyo and London. That will do that will finance Water on Demand for their regions.

Now, we've stepped up even further and now we're scaling worldwide. And it has, it's very, it's something we can do because we're not trying to do everything. We were initially for a long time. We're thinking of adding more capability, buying more companies here and there. And then we realize, wait a minute, no, let's give that up and let's instead export our capabilities.

So Water on Demand is now a spin out and soon there'll be other spin outs. We're planning a crypto spin out and which is fascinating. And then we're also planning to launch a technology company in these box, water in a box type systems that we have. So all kinds of fun stuff happening and it's all done by not trying to be big. You know, I think the new era is to be is to not achieve sensuality, but decentralize and be highly focused. Do what you do really, really well and and get synergy with others in that way. I think that you can survive well. Do what you do well. Don't try to do everything.

Priyanka: I love that. I love that. Riggs Is there anything you want to share that I might have missed?

Riggs: Well, what I want to share with your audience is that we should none of us take water for granted. I was in technology, and for me, water was about turning the faucet, flush the toilet, and that's it. Well, it turns out that behind the curtain, there's a lot of need for modernization of our water systems. And relatively speaking, Europe is in good shape. Israel is in great shape for us, not so good. But then third world countries almost have no infrastructure at all.

But here's what's interesting. Those Third World countries having no infrastructure, they can do what happened in cell phones, which is just bypass that old infrastructure and go to the new light model. And so we have an opportunity to revolutionize water quality and eliminate so many, so much disease. You know, there's billions a year die or get very sick. Like I think it's 1.6 billion people get very sick each year from diarrhea.

Priyanka: Yes.

Riggs: Right. So these things are can be eliminated with clean water. And we should not sit on our hill as as entitled Westerners and not take care of this because the solutions are there. The finance is there and we can do it and by the way, make it a good portfolio. Why not? These are good things.

Priyanka: Yeah, yeah, totally. I love that whenever work is involving good for better world, but also like there's a hope there and it's a hope for everyone who is involved and who is going to get impacted. So beautiful Riggs. Thank you so much for being on my show today. I had such an awesome conversation with you.

Riggs: Priyanka it's been such an honor. Thank you. I love talking to people who are looking at new things because I learn so much myself.

End of presentation

Audience Questions

Riggs: So that was really, really great and an enjoyable discussion for sure. Now I've got some chat questions that I'm going to answer real fast, Keith says. Keith Roeten says, "With all the news on water shortages, can we possibly get more exposure for OriginClear and Water on Demand?" This is so on point, Keith, because today we had a major meeting with a PR agency where we said, listen, let's focus in on the collapse of water, the water crisis and how we are directly helping with that.

So you're so right because we've been trying to say, "Oh, we take care of the dirty water." No, we're taking care of the critical need for water continuity, for maintaining water supplies of safe, clean water. And that's this new Water4Us thing. So I will cover that. And now also David Johnson wants to know, "What is the status of the Envirogen® agreement?"

So we have an agreement in principle with Envirogen. We've already started working with them excuse me, already started working with them. And at this point they are basically exchanging contracts with us and going through all the details, learning how they like to do the different tariffs and so forth.

Because what we have to do is make sure that they have their way of doing it, that the customer, the customer can handle. And then what we do in the middle, it all has to jive. Otherwise it is discontinuities. Somebody is going to lose out, Envirogen, the customer or us, we want everyone to win. So it's a lot going on. Manuel is doing an amazing job with that.

Regulation A Offering

And Emil George says, "How come you limit the early investors to accredited only? That leaves out people like me that have been paying attention for a while now." Well, the great news is we have once again... From April 27, 2020 to April 27, 2021, we ran a Regulation A unaccredited offering, It was very successful. We are now setting up the next one. It will be in that chart that I will show you next week. And. Super exciting, so you will have a chance to be part of it.

In fact, we're going to base it on the whole Water4Us campaign. It's going to fuel Water4Us. So, Emil, stay tuned. You will get your chance to get a really great offering that does not require you to be accredited. I never like to have only accredited investors. Fortunately, that started changing, which was called the Jobs Act in 2013. But even after that, it took many years for these regulation A offerings for unaccredited investors to really mature and to a point where in 2020 we were to start it. So thank you and I couldn't agree more.

To me, it's the most virtuous thing is to have a very wide base of fans in the thousands who've invested, you know, 500, $1,000 and then a few people who kind of become key investors. And that's a good balance. It's not all on the shoulders of a few people. And when the company succeeds, it isn't just those few people like what we've showed you before with Airbnb, with Ashton Kutcher, came in super early and made 50,000%. No, it should be spread out. So, I strongly believe in that.

About Inflation

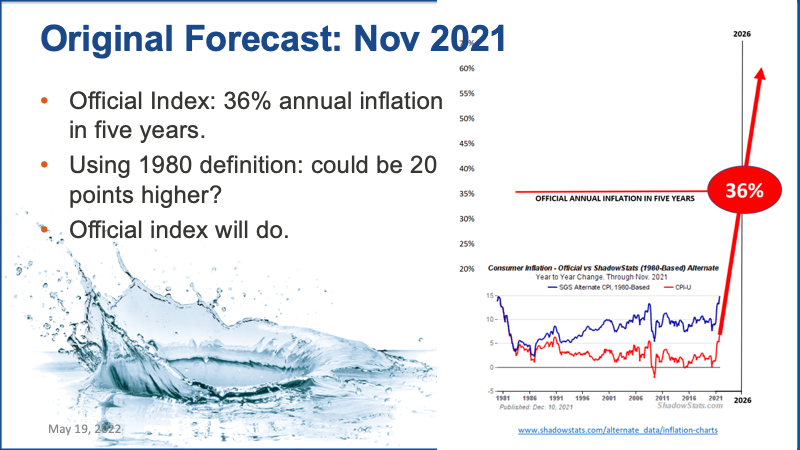

OK, continuing, let's talk about inflation. Earlier we originally said back with the November number so that we came out in December with this and we revisit the November trend and we predicted a 36%. In five years from then, which is 2026, a 36% per year inflation. And with the 1980 definition, which is they changed how they defined inflation 1980. So if you take the blue line that at the time I was predicting it could be as high as, in other words, it could be 56%. But staying with the official index is bad enough.

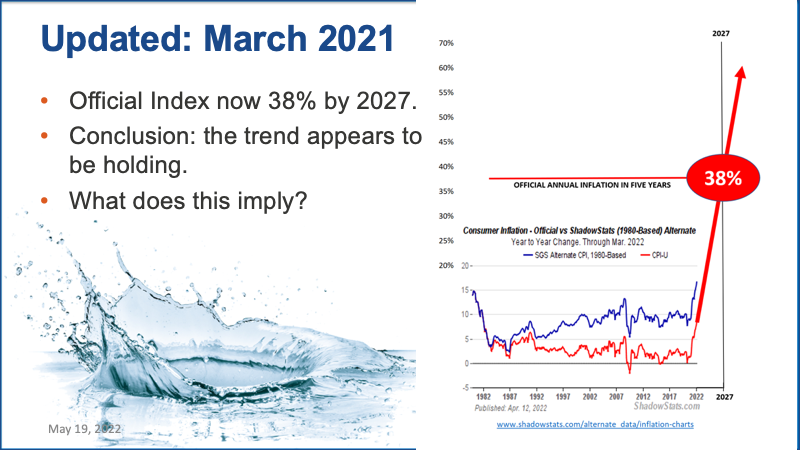

Well, let's take a look now at. The update, 38%. So trend is holding. Between 36% and 38%. Not a big deal. Right. So the flip back and forth here is 36% is 30. So the trend is continuing. Both the current and also the red one is the current inflation number. And this 1981 is a shadow stats one use the 1980 calculations. Personally, I think that the difference is going away that they're kind of, in other words, this doesn't become a difference of ten, 20, 30, 40, 50% kind of trend, that the difference kind of remains the same, 38%.

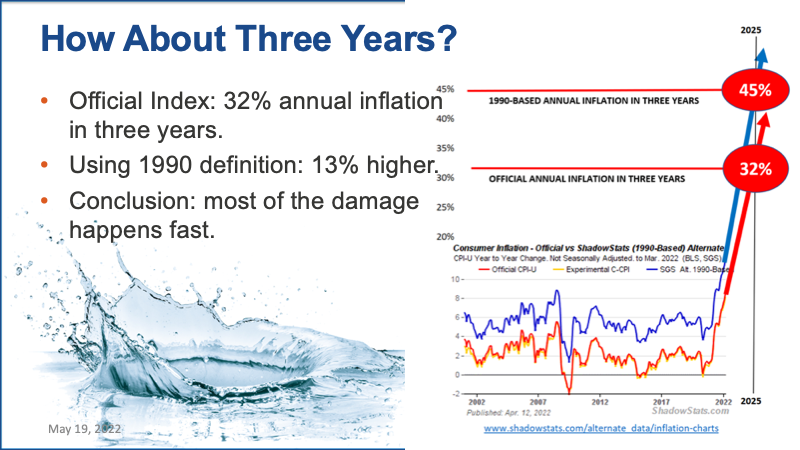

I mean, we're starting to see it, right? So now that's five years. What about three years? Let's take a look at that. Three years is 32%. So most of the damage occurs right there in the first three years. Now, there was a change in 1990 as well, of course, was beneficial to the government. So using the 1990 based inflation number, it's 45%. But let's say again, with the official number, 33%, most of the damage happens early and fast.

What Can Be Done

It's going to be a big shock. Now, what can the government do about it? The only thing they can do about it is do what Fed Chairman Volcker did back 20 plus years ago, and he just basically just went bang. They just raised rates dramatically and created a recession.

We did not do that in 2008, 2008, we flooded we just basically flooded the system with money. We did not take the medicine a lot of economists thought we should have. But here we are. So now, will the Fed be able to do it? I don't think so. I think it's going to continue as this continued. They're just not going to be able to do it. And here's why there's so much debt. If you raise the interest, then the interest on the debt goes crazy. And so it's kind of a catch 22.

Again, get into commodities. Commodities will hold their value. And of course, this is why we like talking about getting into a water, productive water asset, because that hasn't been the price has skyrocketed for this asset. It's just beginning. All right.

The Downside of Carbon Removal

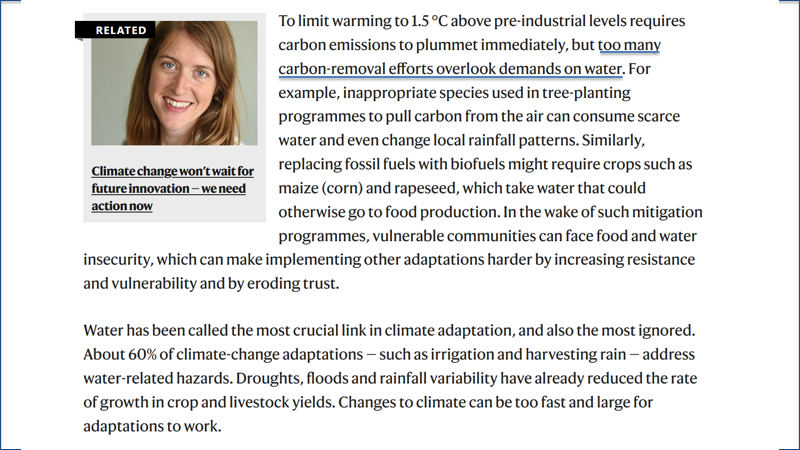

Now, here's something interesting that I saw on Nature magazine. Was sent to me by one of our, Paolo, one of our fine ambassadors. And there's a downside to doing these carbon projects. It was in nature.com.

And it says right here that the return to pre-industrial levels, too many carbon removal efforts overlook demands on water. For example, planting the wrong trees or creating biofuels from crops that cannot be eaten because they're burned.

And so these are these are things that are very concerning. And about 60% of climate change adaptations, such as irrigation and harvesting rate address water related hazards. So it's the most crucial of climate adaptation, but it's also the most ignored. So it's time to really get smart about water is the moral of that story.

So let's get quickly into Water4Us. Clean water for a world in crisis powered by Water on Demand Capital.

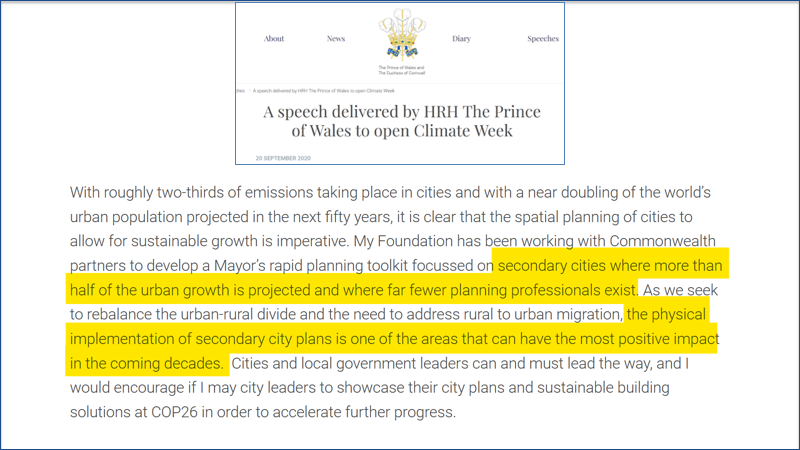

So as I was saying, it's a massive migration away from the cities is creating these remote communities. And what used to be called regionalism and was Prince Charles secondary cities in fact in 2020, September 2020 he specifically said this. Here's a short paragraph of what he said. So let's take a look.

Prince Charles: With roughly two thirds of emissions taking place in cities and with a near doubling of the world's urban population projected in the next 50 years. It is clear that the spatial planning of cities to allow for sustainable growth is imperative. My foundation has been working with Commonwealth Partners to develop a mayor's rapid planning toolkit focused on secondary cities, where more than half of the urban growth is projected and where far fewer planning professionals exist.

As we seek to rebalance the urban, rural divide and the need to address rural to urban migration. The physical implementation of secondary city plans is one of the areas that can have the most positive impact in the coming decades. Cities and local government leaders can and must lead the way, and I would encourage, if I may, city leaders to showcase their city plans and sustainable building solutions at COP 26 in order to accelerate further progress.

Secondary Cities

Riggs: So this idea of secondary cities is a very interesting one. What he's saying is that these big mega cities are not workable. And where we're going to have the second, he's saying half of the urban growth is projected in secondary cities. So, for example, where Ken Berenger moved from the New York City area to the Pittsburgh area, that's a secondary city.

And even further, I mean, you could imagine even smaller cities. Tom Marchesello just told me that he's moving to near Charlotte and that is another secondary city. So a lot of moves to smaller cities from the big urban things and that's very good. As Prince Charles says, "The physical implementation of secondary city plans is one of the areas that can have the most positive impact in the coming decades." So this is has a lot of support, this idea.

So self-sufficient communities. I've covered this already self sufficient water for detached communities.

And these various candidates where we have clientele already.

These combinations.

I reviewed this last week.

We're working with Ivan Anz that's continuing.

Now we have a potential product, project with Ken Berenger, who's got a development community plan for 48 acres outside of Pittsburgh. A model development for water independence, energy independence, self-sustaining produce and we reviewed this project this week with Dan Early. Let's take a look at a short excerpt from that discussion.

Start of presentation

Dan E: How many acres is up? You said 47.

Ken: 48.

Dan E: 48 acres. How many homes are you trying to put? Between 30 and 40 homes on the on the project, on the property?

Ken: This, I would estimate, is on a 50 acre lot. This is a good 15 acres. This is a plateau. This is at 1240 feet. And you see it goes down to 1200 and then 140 and 120. You can see it goes down grade pretty, pretty rapidly. Got it. This is a very large lot that I, my original thought was up in my house up here. Right, right up towards the back here. And have all of this is just, you know, ten acres for me. And then essentially we could build homes all around the periphery here.

And, you know, you've got to figure you're one acre. I'm guessing these are one, this is, would be about, this would be probably more than one acre. But, you know, these would be acre lots all around the periphery. Right. And you've got to figure, this is at least 20, 25. So you figure you're figuring between 25 and 30 homes, maybe one acre lots, which would be a three or 4000 square foot home on a one acre lot, but a whole bunch of them up. Right. So you're maybe your system would probably lie somewhere in between and it would feed to both up the hill and down the hill.

Dan E: I'll tell you on this one right here, the technical solution for the water, the wastewater system is not going to be your critical path. Size of it, I mean, we can very easily quantify what the what the water the potable water system is going to be and what the wastewater collection treatment disposal system will be. I'm not worried about that. I see it bottom right there where it's kind of flat. You put a, you put a produce garden, co-op produce garden down there where people can grow stuff and have a gardener on part of the HOA for the whole way.

Ken: Absolutely.

Riggs: Create self sufficiency for produce. That's killer.

Ken: It's a very rich, growing area too.

Dan E: Lower right front next to the highway. I think that right there would be an awesome place for having this like this agrarian, this agrarian or local produce or local garden, community garden center.

Ken: You can see there's a stream here.

Riggs: And the other thing is I want to make, well water optional. In other words, as a feature, you build it in like, hey, take water from the city, but if the water fails, you've got a fall back. And I think that'd be very attractive.

Dan E: I agree with that totally if you're looking for sewer.

Ken: I can tell you right now there's water under this ground. Yeah, for sure.

Riggs: But I mean, what I'm saying is it's easy just to take from the city because it's done and it's standardized, but then you've got the ability to become self-sufficient any time. And I think that's going to be a lot of people be like, Yeah, I'm fine water from the city. But hey, what if, what if there was cyberattack on the municipality, blah, blah, blah, you got your own water.

Dan E: Exactly. I agree with that. If you're looking for water security on that, if you can build, if you could drill and develop your own onsite wells, then properly engineered, developed and ready for use that right there, that is a value. There's a value add that comes with a couple of good things for us for the for the wastewater micro utility.

This is in Pennsylvania. If I were to, if I were to propose a wastewater micro utility with having this community garden center or this community agrarian open space or green with, green space, I would I would plan the wastewater utility so that you could use you could treat and recycle the water through proper, proper Pennsylvania DEP permitting, and you could use that water for irrigation on that produce on those open areas. I would definitely do that.

But in the wintertime, obviously, you don't grow a garden. You're not harvesting crops in the wintertime in Pennsylvania, plus the weather. The weather is freezing. So you'll get a you'll have a dual purpose permit so that you can go to direct discharge because you are treating to a tertiary level for irrigation, for crop, for crop watering and for your irrigation purposes, you're going to have it you're going to be treated to an exceptionally high standard by default that will get you to a point where you can discharge to that stream.

So that's not going to be an issue there. So I definitely would do that. If you've got public water available, you can check that box. You can drill your wells for water security as Riggs mentioned, that's a value add.

Ken: I believe that would be preferable.

End of presentation

Riggs: I'm going to have to cut this short the because of discussion early on, we ran out of time and it's already 9:00 Eastern. I apologize. It was a quite a fascinating discussion. Basically, we're putting together this idea. Here's some of the notes from Dan Early afterwards about this.

Basically water utility would probably be the biggest risk factor for them. This has been my experience for the past 30 years.

And then if Water4Us can effectively solve water and sewer utility service the developer can check that box and feel comfortable.

Water4Us can answer all the questions related to micro utility planning, permitting, engineering, etc. Very few individuals understand how to solve this Rubik's Cube.

Here is the most important: development over the past 30 years has taxed the large central public utilities to the point where they can't keep up and or provide service because they are constantly expanding. Outward from the central treatment facilities, and that service model grinds to a stop due to size, complexity, cost, lack of capacity, etc.

So literally the water issue is holding back the infrastructure and that is a major thing. I'm also going to be able to discuss a little bit more about energy. I will cover that next week because we have a big problem with the electrical grid. But again, we are out of time. We don't really have time to have much of a discussion. But Ken, I'm excited that you are actually going to just jump in and you're going to get a developer involved in PA and you're going to make Water4Us work?

Development Opportunity

Ken: One thing I would mention that property is absolutely pristine and a third of what it would cost if you could run water right to it and no one is jumping on it because they can't see that big plateau is that's the only place you could build. We could, we could open this up to a market of bright home developers that could develop the undevelopable. All right. So yeah. And I coined it and you heard Dan saying a couple of times I came up with another great phrase, luxury agrarian communities. Right. So they gonna come up with a...talking about.

Riggs: It's like glamping, glamor camping.

Ken: If you call it living at a 4000 square foot home, glamping, sure. But I disagree with Prince Charles is I don't think people are moving to secondary cities. I moved from a city of 10 million people to a city of 300,000 people. But I'm in Westmoreland County, the whole county, thousands and thousands of square miles. There's only 300,000 people. So I'm in that community where when everyone freaked out with COVID, I got my meat, I got my vegetables, I got my my life was normal, right? There is no power failures if every home had their own power generation system. There is no water, what would you, water vulnerabilities if every home is able to take it directly from the aquifer and treat it.

Riggs: And James Wright says, "Why am I thinking of Logan's run?" And well, hey, we can think of Mad Max. I mean, we're we're taking civilization to the place where we really need to be able to assure our supplies of vital commodities, food, water, energy and we will continue this next week. I really, so much more to discuss. The energy side of things is huge as well, but we are just so you know, the focus now is definitely on how we directly help with the problem of the water crisis in the world.

Talk to Ken. oc.gold/Ken, and he will be happy to walk through it. We are, investors are taking a percentage of the spin off and it is a very smart thing. Tom Liakos says, "Thank you." Thank you all. Again, I'm, I like to keep it under an hour. You've been very patient. Thank you for sticking around. Have a great weekend.

I will have much more next week for Keith Roeten. We are getting press, as you saw in point. We're getting more we're going to get more and more press and been working on doing a TedX talk, perhaps Ted one day, but for sure TedX. So more to follow. You'll be hearing exciting things. Thank you all. Have a great evening. Thank you again. You guys are great. Enjoy your weekend.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)