FLASH! Sneak Peek of this week’s installation of our Pondster™ at a trailer park in Troy Alabama! Then, Ken showed us how clean, safe water can become a massive job and wealth creator that saves lives… What is Water 2.0? And what's its massive potential for accelerating a disruption? Find out here in the replay!

Transcript from recording

Introduction

Riggs Eckelberry:

Good evening, everyone. And apologies for the delay. We've been having trouble getting the Spanish recording up and running, and that is being resolved, but I didn't want to wait any further. We will start in English. The Spanish is in real time, but the recording will start up a bit later once that's up and running.

Again, apologies for the delay. And I'm just going to quickly share a screen and we have some very cool stuff. Just to start off, of course, Water is the New Gold. "Helping you thrive in the world's ONLY vital, scarce and recession-proof market."

Of course, you can listen to Spanish by just clicking on the globe down below, and we'll be adding more languages as we get more international, even more. Excuse me.

As usual Safe Harbor statement. We want to let you know that we try our very best to say how it is, but of course, it might not work out that way. In which case we will correct ourselves rapidly.

Biofilm Menace

All right. You may remember that there was an article about biofilm, how we can tackle it. And this is an article by Mr. Dan Early in a magazine called Water Innovations. Where he talks about the problem of getting that biofilm out, which is really hard to get out.

There's the ultraviolet, there's chemical disinfection. There's reverse osmosis, various ways to do it. And we have a special way to handle it, which you're going to see shortly because we now have a marquee site that has been launched. I'm very proud of what we've done here. I'm now going to shift into video mode. You're going to get a little sneak preview.

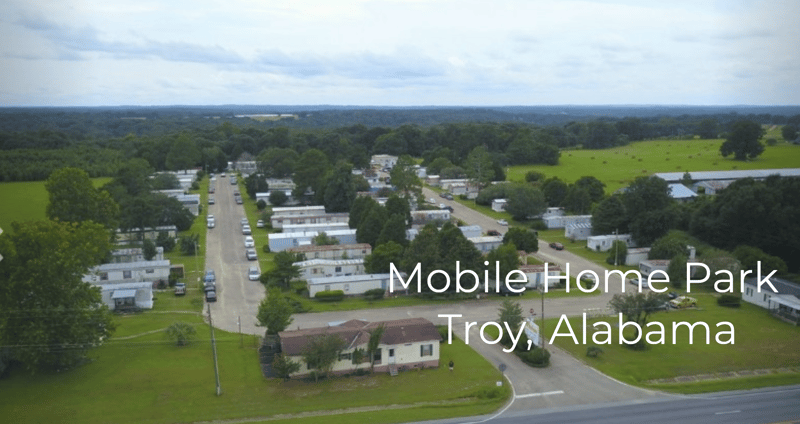

And what this is, is that, remember that trailer park I've been talking to you about for so long? Well, it's up and running with a state-of-the-art Pondster™ as we call it, that treats all this nasty stuff to a point where it's treated and it can go into the sewage system.

And we're so proud of what Dan got done here and how this is a future for the entire trailer park industry. This is just a sneak preview of what was shot yesterday.

Start of video presentation

Dan: We are onsite at a mobile home park and we are installing the Pondster 30K, a biofilm bio-reactor system as part of an upgrade to the lagoon treatment system that's been in service here for over 50 years.

Trailer park waste lagoon

Trailer park waste lagoon

This is a classic example of what de-centralized wastewater utilities look like 50 years ago.

Not much has changed when, if you don't have access to public sewer, you have to provide your own onsite wastewater treatment prior to disposing of your wastewater.

Arial view of bioreactor module

Arial view of bioreactor module

The Future of Wastewater Treatment

The Pondster system, the treatment methodologies and the treatment capabilities that we are promoting, these are going to be next generation technologies that are going to allow us to deliver much more cost-effective treatment solutions and equipment packages to those de-centralized customers that need it.

The decentralized world is the future when it comes to wastewater. The large, centralized, municipal public utilities, like the city of Atlanta, the city of Montgomery, Alabama, Washington, DC, Philadelphia, those central utilities, they are committed to the path that they started down 100 years ago.

But when you get into regions where they don't have public sewer, but there is a need for a wastewater utility. Well, that decentralization offers us this opportunity to deliver these technologies and to basically, pay as you go, pay as you grow. To deliver emerging and more advanced next generation technologies and do so, so that you can accomplish the three things that are most important to decentralized wastewater.

A Pondster lagoonside will transform this lagoon within a few months

A Pondster lagoonside will transform this lagoon within a few months

Affordability, Sustainability, Durability

First off is affordability. Second thing is sustainability. And the third thing is durability. When you commit to a decentralized wastewater utility system, you don't want to be thinking five or 10 years. You need to be thinking 50 years, 75 years, 100 years. And that is the vision and the mission that we have with the Modular Water Systems™ program and products like the Pondster 30K system.

End of video presentation

About Trailer Parks and Pondster

Riggs: So that is super cool. And we're very proud of Dan. As you see there, there is some very cool drone shots. But what's going to be the full reporting, is we're going to get some of the tenants of this mobile home park that have been living with this. I mean, literally the poop goes into that lagoon and nothing happens to it. This is standard for the entirety of the trailer park industry. It's been that way for the longest time.

It's slowly being upgraded. And what the Pondster is, you saw how it's like that creamy white box. Well, that is a special plastic we've upgraded to. We used to have these black pipeline type sections. Now we've upgraded to this much lighter and more easy to fabricate white corrugated plastic. It's also reinforced. It's very long duration. And this is the new state of the art.

And so what you see here is the Pondster is a standardized machine, which can deliver. Very economical. And it just sits there by the side of that pond. And it just recycles it through, recycles it through, until the pond is crystal clear. And that's a beautiful thing. We're very proud of this.

From the Audience

And we have Ron Chevallier, I think it is. Unfortunately, the system won't show me the full name. "I installed a mound system back a few years ago in Washington State. Know about this very well." Right on. Well, that's excellent. And then, thank you, Ron. Okay.

For some reason it goes Ron C... So I'm glad I guessed well. Anyway. Let's move on to the main story. That was a little taste and you're going to get a full report. It's going to be a big deal. A lot went on for this commissioning. All right.

The Money Show

Now... All right, we got the money show. So the Money Show is super cool. And what it does is it has various speakers about markets and trends and so forth, as you can see. And it's a big deal. Now, of course, for the longest time it's been virtual. Now, it's finally physical again.

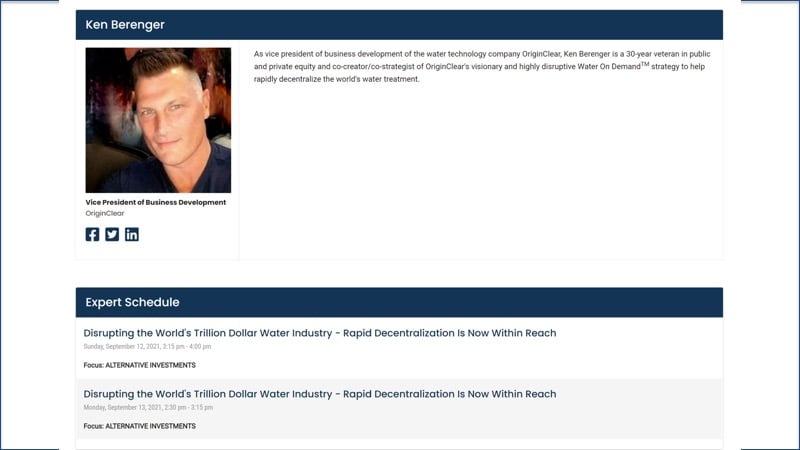

And so, our very own Ken Berenger is speaking. He's speaking on Sunday, 3:15 to 4:00 PM Vegas time, and also on Monday at the same time. And we are going to be recording that so that we have some coverage of it. But meanwhile, let's take a look at what we got here. Mr. Ken Berenger. There he is.

Ken: Hola.

Riggs: The man, the myth, the legend.

Ken: The lighting's not quite as good as in the photos. Sorry, folks.

Riggs: Well, we'll forgive you this time.

Ken: All right. I can turn the camera off if it's easier.

Riggs: It's not quite that bad.

Ken: Okay, good.

Riggs: But anyway. All right. Here we go. We're going to go back into share mode. And what we're going to do here is Ken Berenger is going to preview his money show presentation. And I'm going to have it on screen right here.

Start of presentation

And this takes off from what is currently on the website, but it definitely kicks it up a notch. Let's kick it up a notch. Remember that show? Let's kick it up a notch. That cooking show. I'm going to go ahead and turn it over to you, my friend. You are in charge.

Ken: You're going to move the slides for me, I take it?

Riggs: Yes sir.

Ken: Okay.

Riggs: Yes.

Solving the Global Water Crisis

Ken: Just to speak to our audience for a minute, what I suspect we're going to be speaking to is a combination of what I would consider general accredited investors, and also very high net worth individuals. Folks that really, I think will be incredible candidates to seek the safety of our Series V or these subsidiaries that we're going to set up through the Water on Demand™ initiative. I'm going to speak to both facets of our business. So if this seems to jump around a little bit, it's because I'm trying to cover a lot of material in a short period of time.

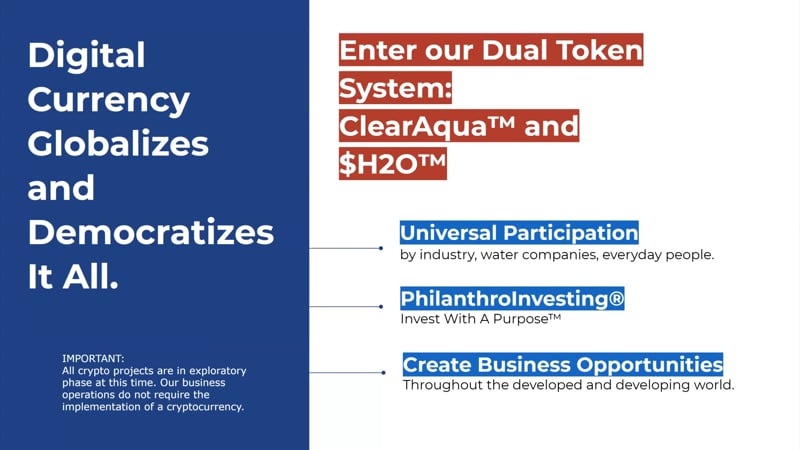

I'm going to start by making a declarative statement. It's almost like I'm prosecuting my case in court. I'm going to make the case how our Water on Demand in conjunction with our dual coin strategy can solve the global water crisis. And decentralize water, the way cell phones decentralized telecom. Cutting the cord.

Cutting the Cord

The way things like streaming services disrupted cable television, the way cell phones disrupted telecom, I think we can take this initiative and combine it with our... Get a globally adopted digital currency around a brand new asset class. And I think it can trigger one of the most exciting wealth creation events in the past 20 years. Okay. And let's go to the next slide.

So no one really needs to be told that the world's water is really bad, and it's getting worse by the day. Couple of scary stats. Now, most of you folks have read the broken water report. 80% or four-fifths of all wastewater is dumped into our water supply. Sewage is dumped into our water supplies. Over 3 billion people live under severe water distress that's getting worse by the day.

And lastly, 84% of all of our fresh water is consumed by and polluted by agriculture and industry. Okay. That's setting the pace here. Now generally, the solution has been this, like Dan described earlier, an in-ground solution, centralized water solution. Water infrastructure spending is no longer being handled by government. In fact, the spending has cratered.

Over the past 40 years, it's gone from 63% of taxpayer money going into water infrastructure down to, I think it's about nine or even seven at this point. But the shift has taken place now where it's with the private sector. They've picked up a lot of the slack, which is a good thing. But because we operate entirely in the private sector space, that's really where this massive opportunity comes from.

The idea is how can we fix this thing? Would it be possible to use the current paradigm? No. We know for sure that the current century old public works utility model would be impossible to fix this problem. It would require almost constant capacity upgrades, millions of miles of pipes. Both of which will never happen. It'll take decades and cost trillions.

DIY Water Treatment

o give you an example, New York City just completed tunnel number three. We featured that. Tunnel number three took 50 years to complete, and it cost $6 billion. Okay. That's not going to happen on a global scale.

But the solution does lie in using modern technology, privatization and FinTech. We're certain that we can crack the code. Okay? So here's the thing. Businesses can do their own water treatment. That modality to treat water at point of discharge has existed for years. Our Modular Technology makes it more nimble than it has been previously, but still, making it cost-effective, making it painless to the end user was the breakthrough that was needed. And we've done that. But market forces at work are driving this need much more urgently, and here's what I mean.

Rising Water Rates

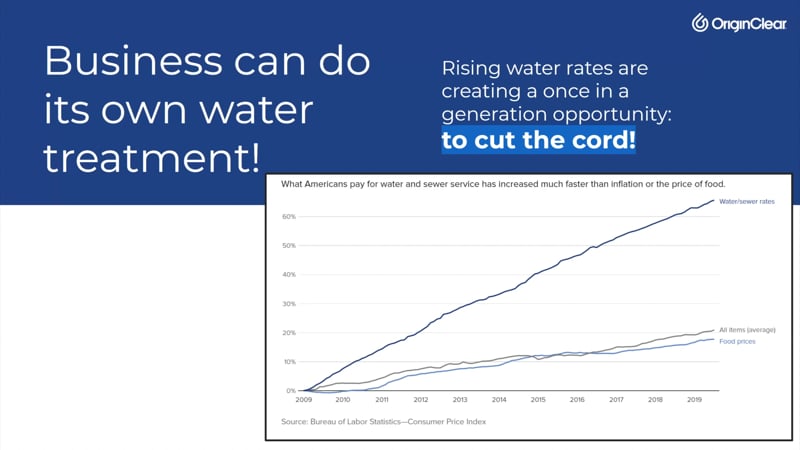

If you can look at the chart with water rates, Riggs on the next slide. There we go. So what we've got here is a perfect storm for major disruption is brewing. We've got this massive shift to privatization, businesses doing their own water treatment. We combine that with increasing scarcity of fresh water, water rates rising much, much faster than inflation as you can see in the chart here and water rates being unregulated, this creates what could be a once in a generation opportunity. And what is that?

That falls on the private sector to cut the cord. So this would be distributing water treatment systems places where there's currently nothing. So that's what we call the unfulfilled market. The unfulfilled market for water right now is about $4 trillion. The most dire need is at a point of discharge in small to mid-sized businesses, remote locations. So there's a market in the trillions, literally waiting for a dropped in solution.

Global Disruption

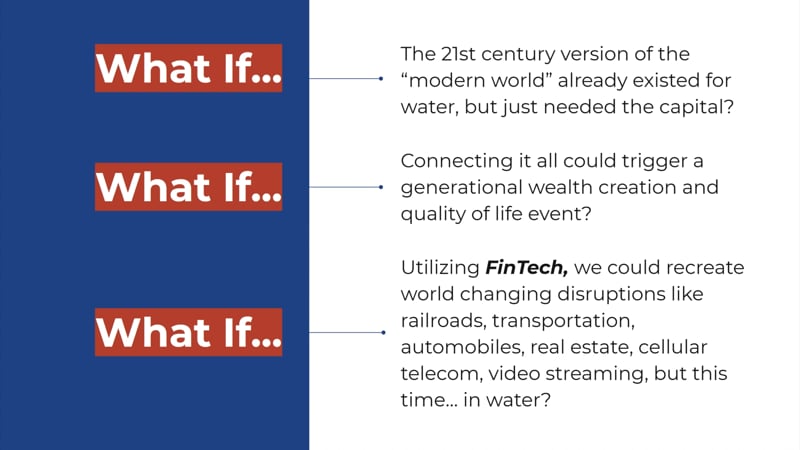

Now, the hardware to do it has existed for years. Dan showed you that he's been doing this for a long time. What's prevented clean water at every point of discharge is capital or credit or remote location or all of the above. So the truth is if we can fix that problem, solve that problem, we can fix it all. It changes everything. And we think we have. Okay?

So what if these micro utilities, Water 2.0 is what we're referring to it as, but I've always referred to them as micro utilities. What if they've already existed up until now, but were sold as big capital expense solutions that priced out the majority of those who needed it? That's been the case. Then the capital would be the only barrier. Right? Okay. So connecting that thought, if we could simply connect at all, that would be the trigger.

So let me give you an example. 20 years ago, Amazon began connecting every consumer in the world to every retailer in the world through an online platform. So the early Amazon, early Tesla, early Mobile telecom investors, they knew they were onto something, but they had absolutely no idea what would exist today. Okay? Today didn't exist yet.

Now, we have the benefit of hindsight. We know these global disruptions can happen, how long they take, what's necessary to do them and that they can be life altering. And we have now the track record to do what we think is the next one. So utilizing FinTech, right? So I'll give you an example.

The Answer

It took the better part of 20 years to change everything. Shopping, communications in the case of Amazon and cell phones. If we use today's FinTech and digital currency, things that did not exist 20 years ago, as a massive potential accelerated to disruption, we already know that Fiat currency and autopay, what that can create over a 20 year period. The Amazon of the world in 20 years could be decentralized water. Okay?

So the potential to do this in a fraction of the time lies in smartly utilizing FinTech and smartly utilizing digital currency at a time that could also serve to be very, very defensive against a weakening dollar. And it has the potential to disrupt a trillion dollar business. Okay? This time in water. And we think we have the answer.

It's called Water on Demand. So you see all these businesses, craft breweries, housing developments, animal farms, mobile home parks, RV campgrounds, I can answer that. Resorts, luxury hotels, our own wholly owned subsidiaries of PWT and MWS have sold thousands of these systems over the past 25 years to these exact type of customers over the last couple of decades.

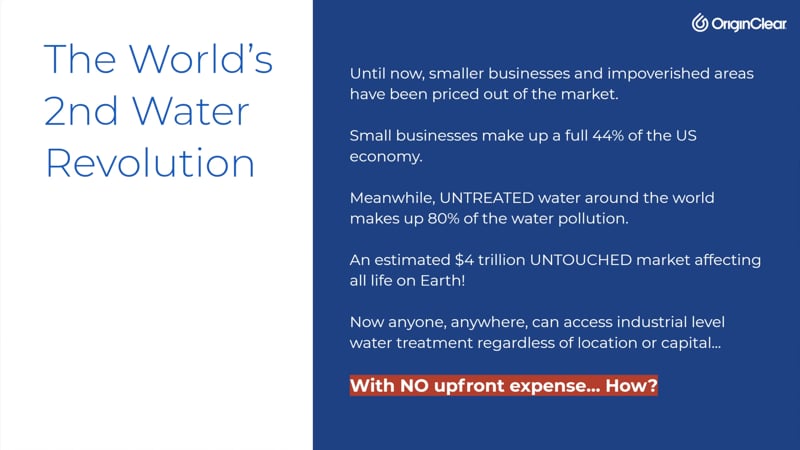

Now they did it the old fashioned way, which is extremely limited. Bid on it, build it, sell it. You're out of business again, you move on. Okay? Now, our personal experience in doing this is as good as 80 or 90% of all the bids that they did. Those fellows never bought from anybody. They didn't lose the business to someone. They couldn't buy. And it was because of capital or credit or both. Water on Demand eliminates the capital obstacle.

Eliminating the Capital Problem

So instead of maybe getting that two out of 10 that you hope to accomplish, you can successfully convert 10 out of 10 by simply taking yes for an answer. Think about it like this. It could be a global expansion of privatized investor owned micro utilities that in the beginning at least will specifically cater to and empower small to mid-sized businesses, even small and remote communities. Now, this is the exact place where water is badly neglected due to remote location, lack of capital or both. So we undo all of that. Okay?

Excuse me. So anyway, what we're doing now is we've introduced Water on Demand. So we've created water 2.0, the second water revolution. It's a globally scalable, totally painless water treatment model by subscription. No one's priced out of the market. So again, we go from eight out of 10 to 10 out of 10, and we can solve the problem with no money upfront. So how do we do that? Okay.

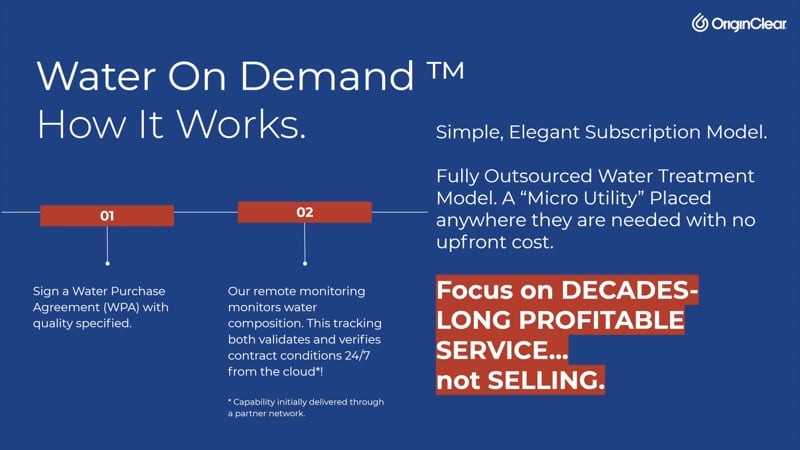

Total Outsourced Water

It's a pretty straightforward process. And unfortunately, I'm not keeping up with you, but it's okay. Basically what happens is an end-user signs a water purchase agreement very much like solar. Basically it operates very similar to your current telecom service, your current electric service, your current water service. There's two main differences.

Those facilities deliver service to you from offsite. So you're buying the milk. They own the cow. This service will be delivered to your location from a machine site because water has to be solved at point of discharge. We're going to own the cow. You only pay for the milk you use. Now, the contract quality is contracted into the agreement. It makes it riskless to the end user. Okay?

So we can make this riskless and cashless, and here's how. 24 hour a day seven day a week monitoring guarantees every drop of water that passes through the system meets contracted quality standard, or you don't pay. So that's the second main difference.

All those services that I mentioned earlier: water, internet, phone, electric, regardless, you pay that monthly bill regardless of the quality. I'll give you a perfect example. Stay on this slide for a second Riggs. Because I'm going to pontificate.

We're all communicating right now over a Zoom call and we're all paying for our thousand megabits per second service, our broadband service. Very rarely, if ever, is it ever running at a thousand megabit bits per second. Usually it's close enough for this to function, but very often it drops off.

Creating Accountability

The point I'm making is if I wanted to change the internet service business, I could put a meter on everyone's router and tell them, "Mr. And Mrs. Jones, you'll pay by the minute, but you'll only pay X amount of dollars per minute only when this is running at a thousand megabits per second, whether that's an hour, a week, a day per month." I would be the only internet service provider in a year or more realistically, what I would do is I would force the market to be accountable. That ability has existed in the water business and we plan on deploying it right here and right now. Okay?

So we go to a simple elegant subscription model. The end user goes about their life, runs their business. They never have to worry. We handle everything. Total outsourced water, anywhere it's needed. We go from salesmen, focusing on a one-time deal to focusing on decades of service where we know the margins are many, many times higher than that of a one-time sale. Let's move on.

New Asset Class

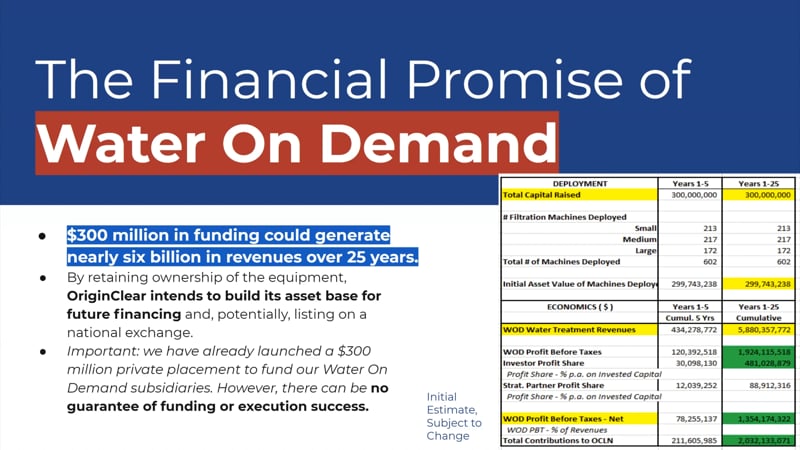

So the benefit to the client? Riskless and cashless, that's obvious. The benefit to us, to our shareholders, to the water industry more broadly is that the model is phenomenally profitable one and it provides access to everyone in the world where access currently does not exist. Okay? So what we're going to do is we're starting off with a $20 million pilot.

We want to expand that to a $300 million SPAC-like funding initiative through an investment banker, and it'll be basically funding of new subsidiaries. So the Water on Demand initiative, as you can see here starts off at $300 million, generates 5.8, almost $5.9 billion over 25 years, even delivers almost $2 billion to the bottom line for origin clear.

So these Water on Demand subsidiaries that own these things are going to be, we think, very powerful, yield bearing new asset class, perfect for the conservative asset investor. It's got a good cap rate, but believe it or not, the safety and cap rate is just basically the icing on the cake. Okay. We think this is kind of ideal for your high net worth asset investments. I'll get back to that in a minute.

What we do is, Riggs comes on weekly and talks about everyday people who are concerned about water around the world. So you want to have an instrument that caters to the 1% of course, but we also basically want to deal with all the folks who truly are passionate about water around the world. The water industry outside of us generally isn't interested, but there is a way for everyone to help and to benefit. And it's also the fun part. Okay?

Massive Job and Wealth Creator that Saves Lives

So enters our new dual currency, dual token of ClearAqua™ and $H2O™. So in its full, it will allow for any quality water company anywhere to build or service these systems where they're needed. It creates an almost instant global community. Okay? It allows philanthropists, people that have been donating money for years for water projects in Africa and Asia to actually make money on their philanthropy.

This puts the companies that operate in the second and third world, it puts them toward building this new modern world. It lifts those companies and workers into a global middle class. It removes governments from the equation. This helps spark what I think can be a true global scaled "new deal", but it's not funded by taxpayer money or by printing money, it's all investors in profits. So the new deal reference was really just describing the scope. The bottom line is: clean, safe water is not only a massive job creator and wealth create it, but it also potentially saves millions of lives.

Building at Home

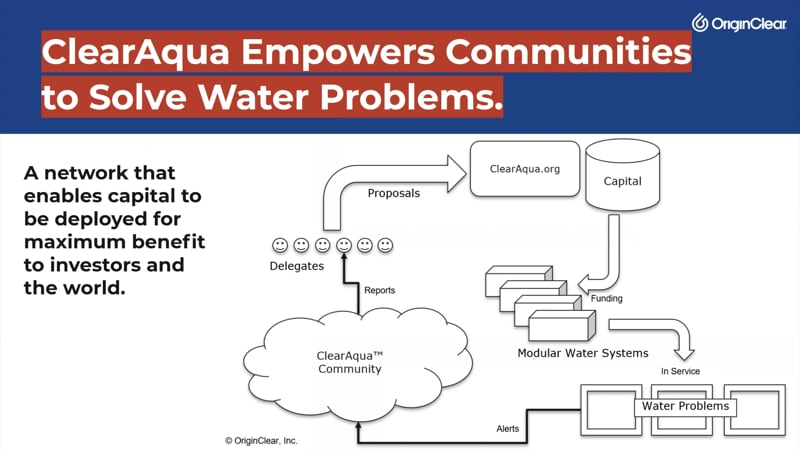

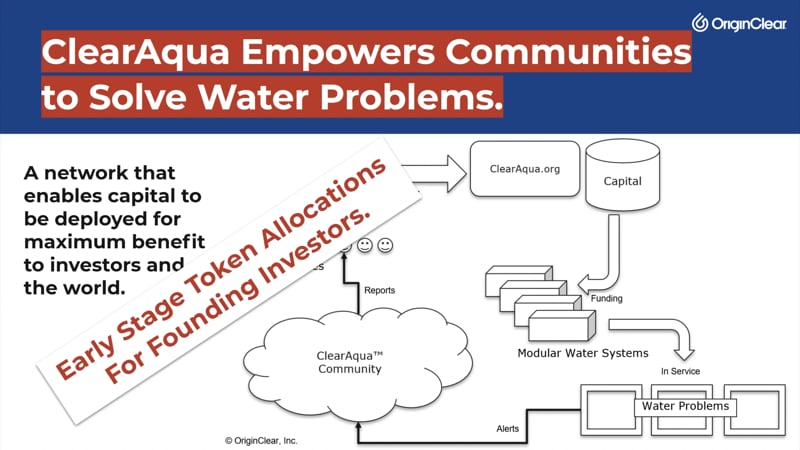

So the ClearAqua Community is basically token holders who are in some way, incentivized to report or suggest water problems that they are in touch with. There could be a hundred thousand of these suggestions into the ClearAqua community. Now, obviously you can't process a hundred thousand problems. What they'll be doing is they'll be filtered up to the delicates almost like a representative democracy.

So the delegates will filter it down a smaller number, a reduced number of proposals to clearaqua.org, we'll own that subsidiary. This clearaqua.org will initially be started out with a handful or maybe even a single ombudsman, someone who's impartial who will be a water expert, who can actually look at the feasibility of what projects can go where with his expertise and decide which of the final projects to be put down, utilizing the capital that's raised here on the right-hand side by the Water on Demand investors.

So these fully funded projects are down at the bottom right here. They're going to be manufactured immediately at Modular Water, but eventually at companies all over the world. So this will truly be a build at home. Home will be anywhere the local problems exist.

Turns Charity to Capitalism

And that turns charity into capitalism. It creates jobs. Water problems are then solved on site with revenue-generating vehicles in the bottom right there, which then turns into dividends to capital. We see the sparking of second great infrastructure building projects. And of course, I would be re-missed if I didn't mention that we will in fact going to be giving token allocations to our investors that helped fund this initiative.

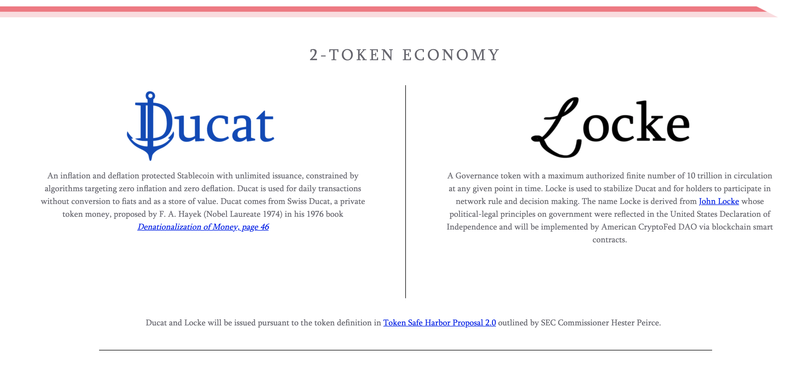

Token/coin Model

So this is going to be very similar, and you can look it up for yourself guys. It's americancryptofed.org, and it's a dual token system. You'll see something called a locke, L-O-C-K-E. It's a community token where holders participate in network rules and decision-making... Hold off for a second. Very similar to what you'll see with our ClearAqua, and backed by the way, development of ClearAqua has begun. And then the Ducat, which is their version of a stable coin, it's very close to our $H2O. And ours will be planned as a security token, which is a dividend package that could deliver over time and create a secondary world water market. So the potential is absolutely vast. All right. So... Ah, he went to it. Okay.

Riggs: Yeah. I think we should add that a couple of slides with this if you're going to mention it. That sounds good like a good idea.

Ken: Okay.

Riggs: Left-hand side is Ducat with a stable coin. And that's our $H2O. And locke over here as a governance or community token.

Ken: Right. Now, we just don't know if it's tomato or tomato. We don't know if it's Ducat or Ducat. Okay. That'll be a whole different CEO briefing.

Riggs: That's funny.

Ken: All right. So, I mentioned two slides back that clean water is a massive job and wealth creator. Keep going.

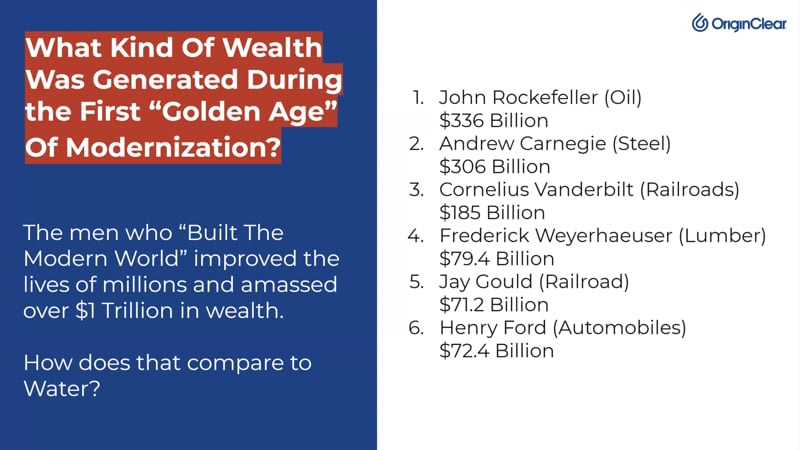

Clean Water

Ken: So I mentioned two slides back that clean water is a massive job and wealth creator. Okay. We have historical examples. So 100 years ago, a group of what we refer to today as Robber barons, right? They owned everything. They essentially built the world that we all grew up and the people in their forties, fifties, and sixties, the 20th century world that we... The modern world we grew up in. They created in that initiative 50 years prior, more individual wealth than any point in human history, even by today's standards. Zuckerberg, Bezos, Musk, they don't compare.

So the top six are listed here. They're over a trillion dollars in personal wealth. There's a dozen more that, or more than a dozen more, I don't even mention here because you don't know them. But the wealth was very concentrated in a handful of people.

This was almost entirely in the US and Europe. What we're proposing by decentralizing this through a dual token system is a modernization of the world's water everywhere. Now, if this kind of wealth could be amassed in the US, what could be reduced in the other 80% of the planet where no system exists? Keep in mind, there's no upfront cost to this. Move on.

Accelerated Adoption

We think that this dual token strategy can create adoption in a fraction of the time it took major disruptions like, let's say cellular in Africa and Asia. Carlos Lim today is a multi-billionaire from that. Okay? And, instead of it creating this initiative we're doing, instead of it creating two or three trillionaires, digital currency can democratize this to the point where we can potentially create tens of thousands of millionaires, build a true global middle-class in parts of the world where it was never going to be possible before, like we did in the US in the 20th century. Let's move forward.

Building the World's Second Water Revolution

So, what are your choices as a water investor? Well, right now you can buy an ETF in big water. You can buy American Water Works. You can buy Avoca. Great companies, very slow, steady growth. Now, with the dramatic rise in water rates that I've already demonstrated, and they're unregulated, I think they'll do fine for years to come.

But they're going to operate in their little world. The problem is, as Riggs just forwarded on the slide, is that they're all in this group chasing after water industry 1.0. So it's like, "Hello, 1950 called." They want their big concrete water system stack. We're not calling you on a rotary phone. We're looking to the future. Okay?

So, your other choice as a water investor is to build the world's second water revolution. The life-saving ability of what we can do with water is undeniably attractive. But the wealth creation opportunity is also enormous.

Sears or Amazon?

20 years ago, you could have bought into retail in the market. You could have bought Sears, or you could have bought Amazon. So Sears had a hundred year track record as a major worldwide retailer. Amazon didn't. Which one ended up changing the lives of all of its investors? Which are the ones that we're talking about today?

We believe that's what we're talking about here with water 2.0. So, building the next major revolution... We've had a partner that we featured on this show a couple of times named Mohammad Sadiq. He's called us Tesla in... He called us the equivalent of Tesla in 2004, where waters is concerned.

So let's look at that for a minute. Elon Musk joined Tesla in 2004, invested $30 million of his own money. We plan on doing $300 million, okay? So make a direct comparison. And the company went public on June 29th, 2010. It's $17 a share. Let's look at it today. Move forward.

Past the Early-Tesla Stage

I'm going to save everybody the cliche of saying, "And the rest is history." But for years, however, he built the capability while investors held on for dear life. People that believed in his vision came in early and hung on through thick and thin. I personally believe, and I'm not the only one, that we are well past that early roller coaster stage. Okay? Let's move forward.

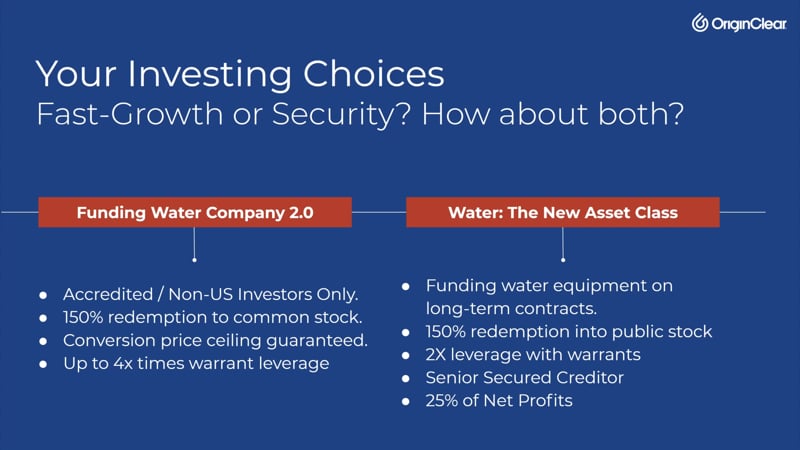

Investor Choices

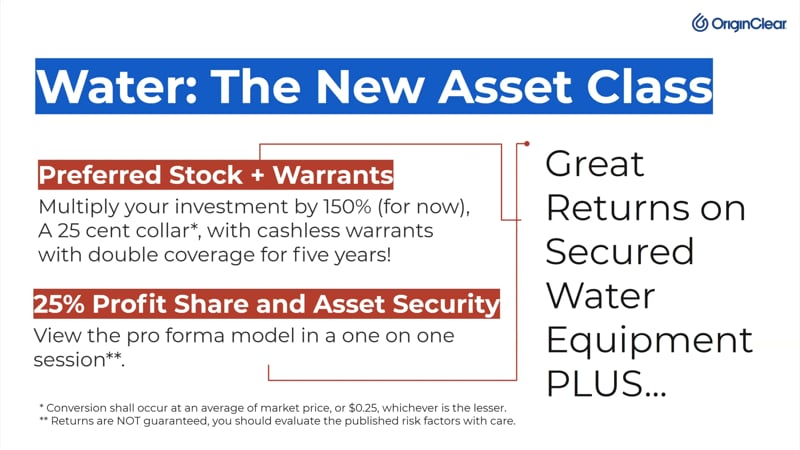

So, here's the choices for the folks at the Las Vegas money show in investing in our company. You can fund water 2.0. You can fund the initiative itself, the cryptocurrency launches. But the funding comes in two forms.

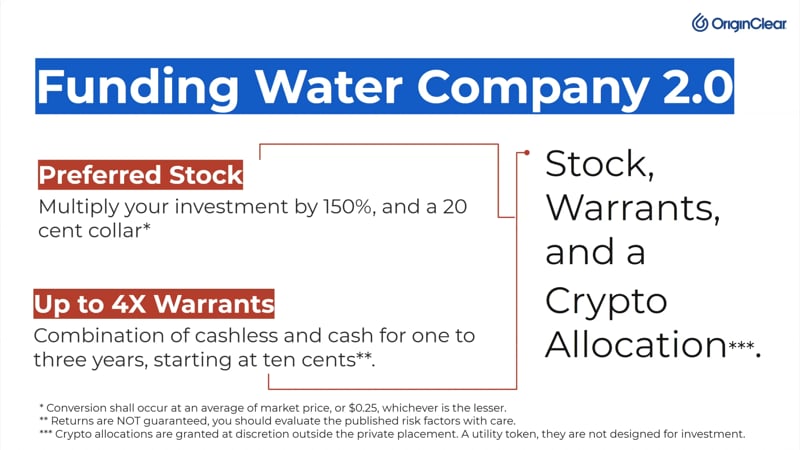

The first is what we refer, what you folks know as our Series U. It's for accredited non-US investors, 150% redemption into common stock. You can take advantage of the market price when you convert. Where the stock is trading the day you invest means nothing, it's where it is when you convert that means everything.

So you have total price protection and a collar where you can convert no higher than 20 cents. So if it takes off on us, that's a great thing. You're not left with opportunity loss. And it also gives us up to four additional trips to the well, if I want to use a water pun to take advantage of with our warrants. Let's go next. So that's kind of your average accredited investor type of play.

Series V Expanded

Now, the next is this $300 million capital development program for water company assets. So, this is going to look and feel like a group of specs if you will. Imagine oil and gas limited partnerships. But for water, everywhere.

No minimum investment. And these are typically a million dollars, fractional units we allow. The percentages of these redemption, you see 150% redemption into public stock, that will step down as the fund matures and as it fills further and further.

We'll probably maintain two times leverage with warrants. And the investors will, at all times, maintain senior secured creditor status. They'll get 25% of the net profits. They'll be an owner of the subsidiary that owns the equipment. And, they'll have a lot of other bells and whistles in terms of stock and warrants. So that's another really, I mean, as an asset investor, you can get the best of both worlds. Okay.

Let's move forward. So, breaking it down, company 2.0, 150%, 20 cent collar, four warrants, you're getting stock, you're getting warrants, you're getting crypto. Let's move forward.

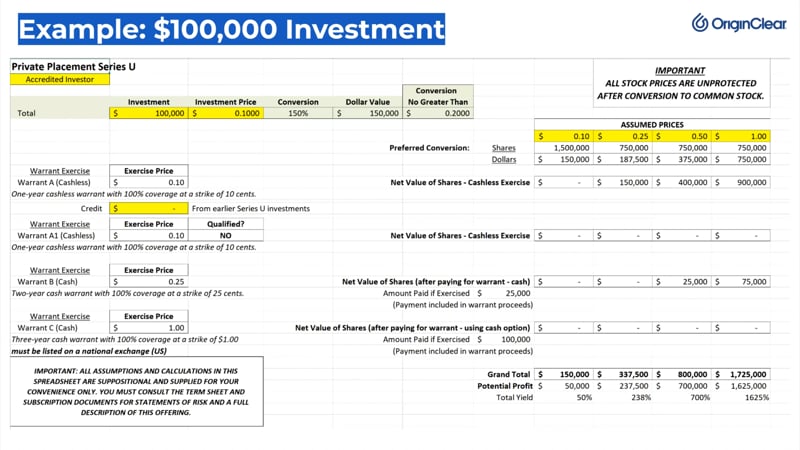

Typical Series U

So, this is our typical example of our Series U which I will demonstrate to the public how in a hundred thousand dollar investment means a minimum $150,000 upon redemption regardless of stock price. But as you get to this 20 cent price where the collar is 25, 50 cents, even a dollar...

We have some events coming up over the next year or two. I think these prices become extremely realistic later this year and early next. And I'll describe those processes shortly. But you can see that it's no joke. A hundred thousand dollar investment, just a 50 cents a share between the stock and the warrants puts the investor at $700,000 in net profit. Let's move next.

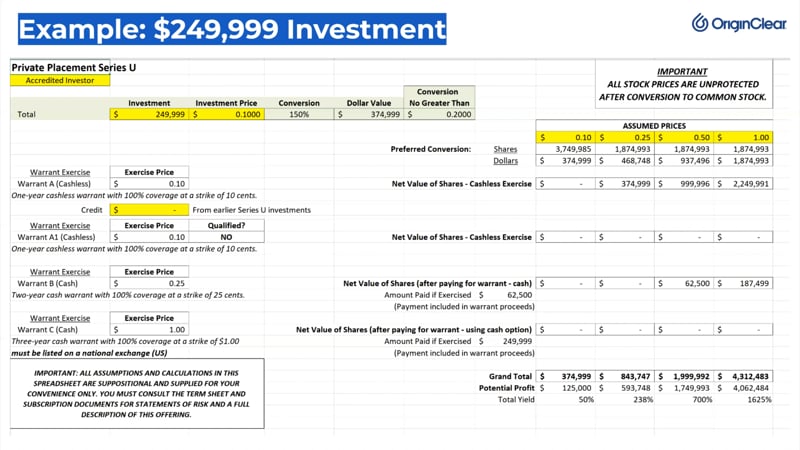

Powerful Trigger

Now, this is my devious trick, right? At $249,000, you can see it's $1.7 million at that same 50 cents because it's a large investment. But we stuck in this fourth 10 cent warrant, as you could see, they're warrant 1A or A1, which is cashless. And what could happen is if the investor goes above that $249,000 threshold. For an additional dollar, the profit goes from $1.7 to $2.7 million and 1100% ROI. So it's a very powerful trigger at the $250,000 mark. Okay. Let's move forward.

Great Returns

So, again, we've got multiplied, we've got warrants, we've got 25 cent collars on your large asset investment. You've got profit shares. I have a pro forma that I'll show the public, that I'll share with you in a more one-on-one setting. You will drill down on it because there's a lot of details to it. You get great returns. You get security. You get water equipment plus... Move forward.

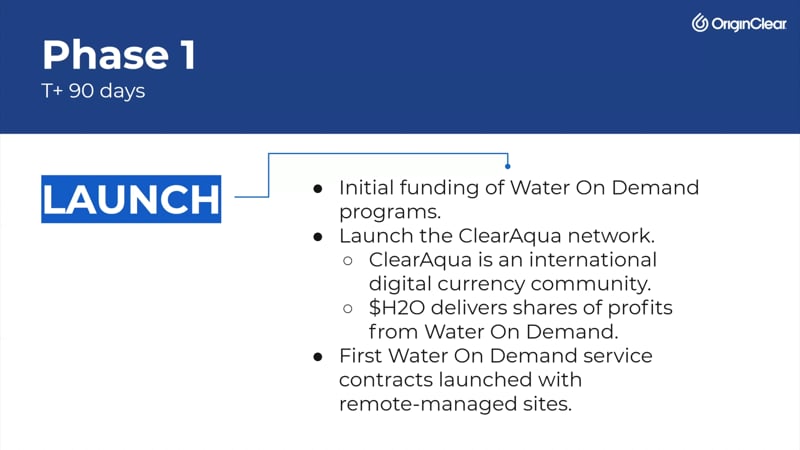

Launch Phase

This is the rollout. This is what we anticipate over the next, I would say two years. So between now and the end of the year, we're going to initially launch Water on Demand program. We're going to launch the ClearAqua network. We believe that in late 2021 here, we could have both ClearAqua and $H2O beginning to take root, starting to deliver some profit shares. ClearAqua is starting to be getting a little bit of international community. And we think these first water on demand contracts will begin to be announced.

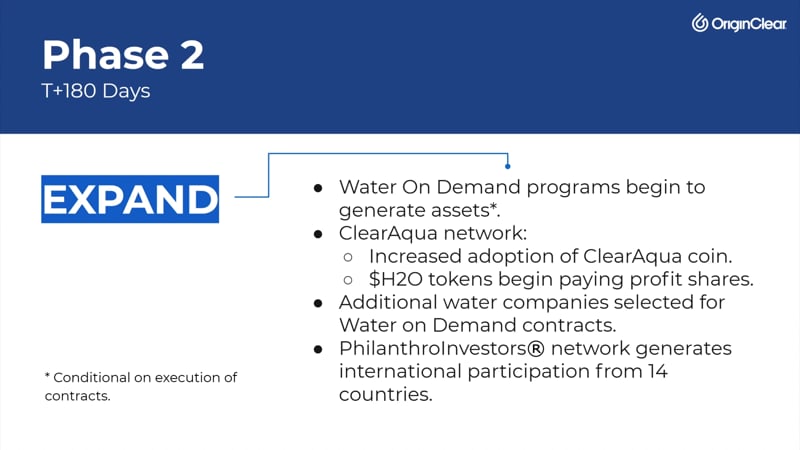

Expansion Phase

Moving next into early next year to mid late next year, we're going to start to have real assets. Remember that's a $300 million spec. Okay. If we're halfway there, this little water company has got $150 million worth of assets that would be slated to generate just shy of $3 billion over 25 years. It makes the company really attractive for a lot of different players.

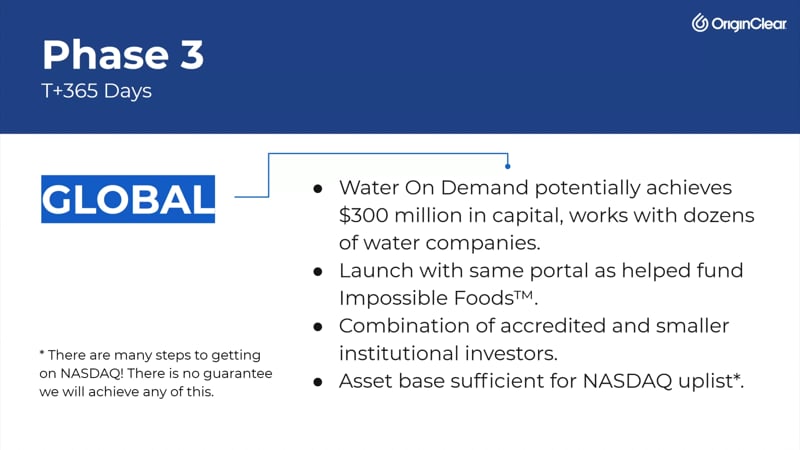

Global Phase

Lastly, okay, going into next year, 2023, I think that we can achieve... late 2022, early 2023, I think we can achieve that $300 million capital. We'll be working with dozens of companies around the country, maybe around the world. The portal through Manhattan Street Capital will be launched, same guys that did Impossible Foods, I think we can do tremendous crowdfunding and institutional funding to it.

And I think at that point, we may even be in a position to announce a NASDAQ uplist, or at least the future hopes of a NASDAQ listing. So again, speaking to you from the site date, the future is very exciting. I feel we're in the eye of the storm in changing the whole water industry.

Some Investor's Returns

So, those of you who helped us make a reality are potentially putting yourselves in a tremendous position, but, our direct investors over the years have always been top of our mind. We've gone to great pains to make sure that they did well through thick and through thin, so let's take a look at what some of our direct investors have seen in terms of upside so far. We've got Brendan he's turned $160,000 into 416 right now.

Okay. We've got Clay, who's got a $565,000 total investment worth 1.1 million, 96% gain. We've got, Joyce, 381,000 now seven 0 five and 85% gain, that's fairly recent. George, 600 and change to one, just shy of 1.4 million and 120% gain. We've got Bob, 382 now worth 838 at 108. And we've got Keith and Linda. So there's 350,000 is now worth just a touch over a million dollars for a 203% gain. So moving forward.

Call Ken

Now, you know that guy, you can obviously this'll be for the money show, but you guys already know how to get in touch with me.

And the next slide just talks about how you should be on this CEO briefing. So, that's pretty much it guys.

End of presentation

I mean, it's still very rough, I put it together about five minutes ago, Riggs and I were a little out of sync. I have a couple of...

Riggs: That was beautiful. No it was great. No, no, it was fantastic. I think it's very

Ken: It's very raw. It's very real.

Riggs: It's raw, it's real, it's real, it's raw, but here's the thing we're going to drop in a couple of slides, 'cause you were talking about important things like the American, the Crypto Fed, which is a great example of what we're doing.

Ken: Right.

Riggs: So this, this was a great run through and I really appreciate everyone staying a bit longer for this. And it looks like, wow, everybody stuck around. So thank you.

Ken: We had some chats. We had some questions, lets take a look.

Riggs: No, we had somebody raise hand, but we don't take raise hands. We do chats. So if anybody wants to drop in some questions, I'm going to obviously...I just want to give everyone the opportunity to... Let's see, here we are.

Call Ken

This is the contact information to speak to the... While he's willing to talk to you because now he's a celebrity who knows, right? I mean...

Ken: A legend in my own mind. Yes.

Riggs: Exactly. Well, your family thinks you're great and that's important, but just type oc.gold/Ken in the browser, or schedule a call, discuss some of these things. We'd love to hear from you, get some feedback on this presentation.

Feedback

I have a chat, let me see who spoke up. Oh, Chris Wirth says good presentation Ken. So, bada bing bada boom, you've got a fan.

Ken: Thank you Chris.

Riggs: I slid Chris at 20.

Riggs: I made sure that you had something.

Ken: He splits half of that with me anyways.

Riggs: Ron Chevallier says, "We'll be able to assist in closing clients, such as governments, et cetera, that we already have relationships?" Absolutely. Please send an email to invest@originclear.com and what we have is a separate division that deals with that.

What we are very wary of is unfunded opportunities because there's too many of them. And we have many funded ones. Nonetheless, if you have relationships and you have to personally introduce things, just send an email to invest@originclear.com and I appreciate it. Okay.

"What location, where you are starting in the region. Nice presentation?"

Well, Benjamin, most of our activity is in the Southeast of the U.S., our operations center is in Texas; Dan Early, whom you saw on TV there is based up in Roanoke, Virginia, but he does work up and down the seaboard of course, all over the U.S. and now we have this trailer park system. There is tens of thousands of these mobile home parks. Most of them are below the Mason Dixon line, that is in the south.

Riggs: And then Kenneth, Kenneth wants to know...Ken Fernandez Tailor.

Ken: Yeah, there he is.

Riggs: Well, okay. So here's, here's the investment... And Bob, I'll get to you about the non-accredited stuff in a second. All right. Really fast then, the crypto thing is very early. We just signed a contract with the development company, so we now know what the milestones are going to be. I will cover it more next week, but basically, we could have a launch in Q4, but it's not about the development, it's about the marketing, right? We don't want to fall flat on our face.

Ken: I think he was referring to investing with crypto, using crypto to invest in the company. Some sort of transactional...

Riggs: Ah, how people can contribute crypto. Well, obviously. Bring the Kraken. No, but seriously, we have a corporate account at an exchange and we can, of course receive crypto it is a very liquid resource, so, that's not a problem.

GRAFTs

I also wanted to say that right now, we are doing something called a, a grant of future tokens, a graft, which is an estimation of what it's going to be, and we're doing it now. And it is not, and does not have a tangible value. Remember ClearAqua is not a security, it is a utility. Nobody's expected to make money from ClearAqua over time. I mean, just like all utility tokens, it could, you know... I own a lot of data, for example, right? Well, data is going up. It's not a security, but it has its own built in demand and supply, but nobody bought it as an investment. Let me put it that way.

Regulation A Offerings?

Anyway... So, now Bob progress on non-accredited investment instruments? Well, related to that, of course, is the fact that we need to file the new regulation, a unaccredited offering. Once we have filed the 10 Q and the second quarter Q, I reviewed it today, it's in final draft form, we have imminent filing of that and then we'll be able to launch the lawyers on filing the new Regulation A offering.

And then the good news is with that, our amazing Prasad Tare, CFO, has identified some of the issues that were structural about our filings and we believe that Q3 will be absolutely on time and I will breathe a sigh of relief. I can tell you that. So, it's been a long one, but you all have been super, super friendly and helpful. And look, here's, what's great about the unaccredited thing.

It was a yield instrument, but it didn't have the convertibility to stock, we're going to add that feature it's going to make it very exciting. All I can say about it right now. But it means that people will be able to enter in through there and do well. It's going to be a nicely, nicely packaged thing and everyone could into.

Ken, you've been a rockstar. I think there was a good run-through and we're going to pursue it. You'll be on TV for that show. So, you know...

Ken: It's always good to practice in front of a live audience when you've ever done it before. I mean it's, you know...

Riggs: We'll probably shoot you at the Monday one.

Ken: Let me smooth out some of the burrs. Gotcha. Okay.

Riggs: All right, everyone. Well, thank you very much. It's been wonderful, Ken. I appreciate it. You have a good night and maybe next week I have more exciting stuff happening. So go ahead. I'm going to switch off video so that the Spanish can catch up and thank you everyone for a fantastic briefing. Really great. Everyone, have a nice weekend.

Ken: Goodnight folks.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)