The clip we aired from New To The Street presented Water On Demand™ extremely well, And aligned with this briefing's segment on the rapid rise in water technology investment… How does that plus the demand for a secure asset investment make Water On Demand the perfect unification of Fintech and Aquatech? Find out in the briefing!

Transcript from recording

Opening

Riggs: It just comes down to raw simplicity. And our energy grid and our water grid have been set up with a great deal of simplicity, but we need a lot more sophistication now. It's not going to come from the central water system. Why? The government is just not paying attention to water, and yet it's a major problem. The Lake Powell is draining out to nothing. Hoover Dam, you've seen all the stories. So there's just tremendous water scarcity. At the same time, a tremendous amount of lack of change. So lack of funding for central systems also, where are you going to locate them? There's populations. All that stuff says we're not going to see giant, multibillion-dollar centralized systems being built anymore. What's the solution?

Build them at the place where you're using it and therefore you can reuse it and have control over your fate. Increasingly, people are understanding they need to control their own fate. That goes for water, energy, you name it, food. There's this tremendous sense, rightly or wrongly, that there's a security problem, right. That extends to water.

Introduction

Riggs: And hello, everyone and as you could tell, I'm speaking to you from not the Office. I'm actually in Whitefish, Montana. Behind me is a picture that I took just today from the top of Mt. Whitefish. Once a year, we take my wife's school kids on a school trip. It's become quite popular. They call me Hans because I teach them how to ski. Anyway, so unfortunately, I am dealing with dual dual cameras. Don't ask. Well, the fact is that my laptop webcam is not working. Long story, but I think it'll work out If anybody has a problem with it, just let me know. But we're going to get on it. Robert Baxter. Hello, sir. It's a pleasure. All right.

So let's get right on with it. Thursday, January 26, 2023. Briefing Room 195 Water Like an Oil Well™ is the emerging income asset. James Wright. James Wright. Good to see you, sir. Let's keep it rocking.

Safe Harbor statement [and Disclaimer]

In The News

Tom Liakos, "Hello, everyone." Here we go. Okay. OriginClear in the news. We are in, not just any news. Not just any news. How about US News and World Report? Not bad, huh? Nine ways to use less water. Saving your water bill. Well, let's just take a look while we're at it here. "Water costs are soaring. Here's how to reduce your monthly bill."

The average combined water/wastewater costs have jumped 43% since 2012. We've been saying this a lot. That, by the way, is very bad inflation. And the problem is even worse. For example, San Francisco. Right. Price of 227%. Houston residents will pay nearly 80% more over the next five years. This is ridiculous. Right?

Switch Out Your Toilet

We're obviously handling it. We have the strategy to handle the problem. But meanwhile, let's see how residents can reduce their costs. Switch out to a new toilet. That's a no brainer. Why? Because toilets are very inefficient. Unless they're brand new. So water sense toilets are very important. They require no flushing and they work quite well.

Get New Showerheads

New showerhead, low flow showerheads. And that can save money and water rather and money. And they can also save enough electricity to power your house for 11 full days.

Monitor For Leaks

Leaks. Now, leaks are a problem in the home. They're a problem in our infrastructure. They're a problem everywhere. So here's a good little thing. Just add some food coloring in your flush tank and see if that color appears in the toilet bowls without flushing. And then you'll know. Interesting. And then you have leak monitoring systems for the whole home. And that really works well on housing developments, apartments and so forth.

Programmable Sprinklers

Outside a programmable sprinkler system to do the right time. Do not need water every day. All that good stuff. Don't water as much. For example, in our condo we have all desert plants. I got tired of watering all the time. Desert plants keep life simple, right?

Greywater System

And here is a gray water system. And they've got to spell both ways g r e y, and g r a y. I think it's g r e y. Anyway, the smartest thing you can do is invest in an at home greywater recycling system. These are incredible machines and allow you to get the most out of your water. They capture and clean water from bathroom sinks, washing machines, bathtubs, showers and dishwashers so that you can reuse it for secondary purposes, such as sprinklers and so forth.

So obviously, you know, two years ago, I was in tech and I was hearing about what Australia did. They had a huge drought and they went ahead and went into a big, big binge of putting in gray water systems and it served them very well. Gene Tully says, "Beautiful country just don't like the cold." I love the cold, but I love the warm too. I've been everywhere. As long as it's God's country, I'm good with it.

All right, personal I'll habit changes. Use the dishwasher. This is something I can't tell you how many people think that it saves water to wash things by hand. Not true. Use a dishwasher and also don't wipe off the food. I mean, get the big chunks off, but don't, dishwasher can handle the stuff. People like, they rinse the dishes until they're completely clean and then they put them in the dishwasher. That is ridiculous. All right. Turning off the tap while brushing your teeth. These are all things and you'll see me make a point later about this in the show that I'm going to play and finally monitor your water usage, consumption, etc.. Okay, That's that.

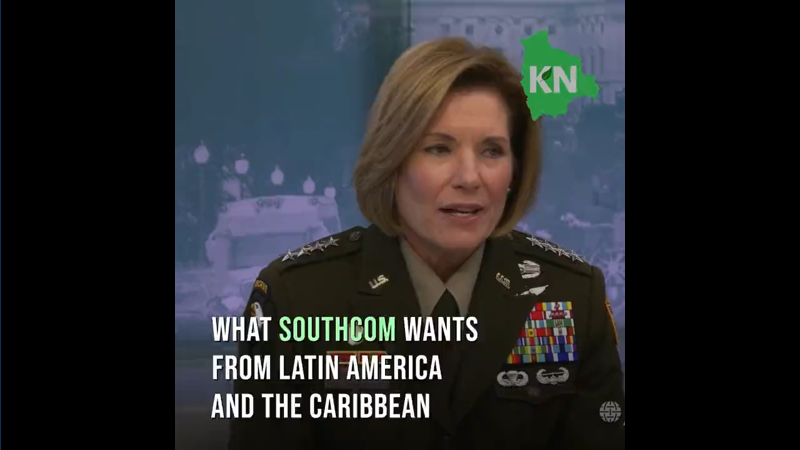

Now, this is a really interesting video clip by SOUTHCOM. This is a general who's with SOUTHCOM and it's really interesting. It says a lot about the importance of commodities in our world because this has become a military issue. Let's take a look.

Start of presentation

Gen. Richardson: This region, why this region matters with all of its rich resources and rare earth elements. You've got the lithium triangle which is needed for technology. Today, 60% of the world's lithium is in the lithium triangle. Argentina, Bolivia, Chile, you just have the largest oil reserves. Light sweet crude discovered off of Guyana over a year ago. You have Venezuela's resources as well with oil, copper, gold. China gets 36% of its food source from this region. We have the Amazon, lungs of the world. We have 31% of the world's freshwater in this region too. I mean, it's just off the charts.

But then when you talk about trade. Trade is unbelievable. The trade in the region, you know, I talked about all the ties that we have with this hemisphere. But the PRC in a lot of our countries in this region is the number one trade partner with the United States number two in most cases, not in most cases, I would say in some cases, however, to see the increase in investment and trade from 2002 from China, 18 billion up to 450 billion now and on its way what is predicted to be about $750 Billion in the near future. And so I think we have a lot at stake.

End of presentation

About De-globalization

Riggs: It's really interesting. Notice 31% of the world's freshwater is in South America. And, you know, I'm a big fan of Peter Zeihan, he's a great thinker, although I think he's well, he clearly does work for Langley. He he lectures at Langley. So we know that he's got a certain bias. But one thing he says is that in the coming years of deglobalization, the US will do well. Argentina will do well. France a few other places because they're self-sufficient for energy and food and water access, fresh water, etc.. Brazil is in deep trouble without any kind of fertilizer, but the water. That's an interesting story. Anyway, so I thought you'd find that fascinating. I did. So let's continue here.

All right. ClimateTech Rundown a GreenBiz newsletter. Water tech catches a wave. And there's, this is GreenBiz Group's 16th annual State of Green Business. You can download the report. So this water plan is a software firm that consults to various large users. And really, what they're there for is to make sure that these users don't get in trouble for improper use of the water that they're using. For example, as you know, Nestlé gets in trouble all the time about that. So they're saying that it's becoming a hot space. So let's take a look here.

Aquapreneurs

They're calling aquapreneurs. Of course, we have the trademark waterpreneur. I have it nearly completely registered in the world and we'll start using it. Look at that Zwitter company got $33 million Series A. Now Series A is very early stage. That's when you have almost nothing, right? And yet this is Zwitter is implementing water reuse. So we've been talking about this for the longest time. And here is the largest early stage infusion to date for water tech. And that's what we're doing. We're literally enabling the water recycling for these decentralized users. Why? Because they can reduce their costs, etc..

Now, it's been a small space. Venture capital has not been a lot. 2021 is only half a billion dollars. ClimateTech had 27 billion. But look at how the number is changing here. And digital water technology is a big deal. That's going to happen more and more because, for example, in our case, Water On Demand, which is a service, has to have digital tracking, otherwise it doesn't work. Next week, I'm going to bring in Colin Sherman, who's our new project manager for Water On Demand. He's got extensive experience in project management for energy and so forth. And he's going to talk about some of the tools we're going to implement. So it's going to be very useful.

No Incubators

So various innovations across the world. You notice that, again, there's no incubators in this space. That's why it's so important in the role that we play. A lot of users are working on big users like Tesla in Germany, but also in the US I happen to know are really working on making sure that they reuse their water. Climate change is water change and whatever you think of climate change, it's clear that that drought patterns are changing rapidly for reasons that don't even need to get into, and it's changing how everything goes. All right. So that is that part.

Now, I'm going to play the clip from two weeks ago, the 17th, rather. We were in the Nasdaq marketsite interviewed by New To The Street, Jane King. So we've signed a six part series. Every month, one of us execs go up and I'll probably bring people like Dan Early Ivan Anz, people who are closely associated and will do interviews, and then they get resyndicated. There's, for example, we know that our clip is going on on Newsmax shortly, also Fox Business and Bloomberg. That's all happening right now as I speak. So that distribution is happening. But you are going to get an early look at the interview.

Ken: Early release.

Riggs: First look. First look for you only.

Start of presentation

Jane King: OriginClear provides water treatment solutions worldwide, and they call themselves the first Clean Water Innovation Hub™. And with me is CEO Riggs Eckelberry and Ken Berenger, the executive vice president, co-creator of Water On Demand™. They're going to have a lot to talk to you guys about because I've actually been watching the water market for a while. But let's just start with what is the current state of the water industry? I feel like we take water for granted, but we really shouldn't. So Riggs, could you start?

Riggs: Well, the real question is what water market, right? It's all one big governmental monopoly being served by large water companies and a few mom and pops. That's basically it. unfortunately, it's going very badly. You've been hearing about Flint, Michigan, Jackson, Mississippi, Compton, California. Notice that they're all poor places, and that's part of the problem. So water is actually a big problem. Why It's underfunded by $100 billion each year. It's falling behind. And what's going on? Business, industry and agriculture is using most of the water 90%. And then we're telling the rest of the people, you better take short showers. Excuse me, Industry and agriculture is part of the problem. But guess what? They're also part of the solution and that's why we're here.

Jane King: So you're really offering a private solution or at least an accompaniment to the current state of water and how it's processed and used nationwide, right?

Riggs: Think about AT&T. When it broke up, it created a vastly larger market. I mean, MCI was only at the beginning. I mean, look back. It's the baby bells.

Jane King: Oh, yeah, right.

Riggs: So actually, when you have this big monopoly that breaks up, it creates new markets. What's happening is businesses who are having problems and the water rates are skyrocketing for everybody. They're moving away from the centralized, doing their own water recycling. And guess what? When they recycle, they don't pay for that water. So it's a good deal for them. They like it. And so we're helping them. Of course, there's two challenges. The first challenge is how to miniaturize the water systems from municipal down to a business. You're in a brewery, you got 300 square feet, what are you going to do? Right? And the second problem is they don't necessarily have the capital. And we're here to help with that with this new concept called Water On Demand.

Jane King: So let's start with that. So explain the concept Ken.

Ken: Okay. Well, Riggs did a really good job of the intro of the High View, but essentially you're a business. 89%, we'll call it 90. 90% of the water pollution happens upstream at agricultural, commercial and industrial locations. Why don't we drink tap water? Why don't we drink our tap water? Because it's bad. It's got a lot of stuff in it because right now the current municipal system is set up to treat one size fits all. It all comes in, all effluent, comes into one location and they try to remove all these contaminants, which they can't.

So industrial, agricultural and commercial locations are the ones that are polluting the water. Now sometimes they deal with it. If you're Pepsi or if you're Anheuser-Busch, you buy a $10 Million system, you hire 3, on a 24 hour basis, you have three water engineers that you adopt, each one at a quarter million bucks a year, and you have the capital for that. So you're going to have a beautifully maintained private utility owned by yourself. That's not an issue. 99% of the businesses that are discharging unclean water or contaminated water are not Anheuser-Busch and they're not Pepsi. So it becomes, they need three things: they need capital, they need technology, and they need expertise. Water On Demand essentially provides all three.

Picture a miniaturized private utility placed at the at the point of discharge. You're a farm. Here you go. Here's your million dollar system. Oh, by the way, don't worry about paying for it. We're going to own it. We're going to manage it. You're going to have a remote monitored 24 hour a day, seven day a week monitoring system. If something breaks, of course, they'll be there before you even know there's a problem. We'll control the effluent. We'll know exactly. You're only paying for the, for the water quality that you've contracted for. And we'll know if it immediately doesn't hit that mark. We'll have someone immediately coming out and it'll be regular maintenance as well.

So we'll own it, will maintain it. You'll have almost a permanent presence monitoring the quality and you just have to pay by gallon. So instead of paying some public utility, Right. You're paying us. You're, we're now your private utility. Oh, and for the company side, what's great about it is we own the asset, we own the contract, and now we have a multi-decade relationship with the end user rather than a one and done. So from a, from a problem solving solution it's ideal, but from a business standpoint, it is an incredible, I would call it asset-rich model that allows us to have, you know, starting out in the beginning just some, but then of course, many, many more of these systems that are producing royalty income.

Riggs: We call it "Water Like an Oil Well™".

Ken: Water Like An Oil Well.

Jane King: Okay. So, say that I have a small brewery or a farm and I can go to you and you can help me with the water situation. I don't have to invest all the money, but you can help make sure that whatever water I'm using...

Riggs: The first thing we did years ago, was invest in a technology for miniaturizing these compact long life systems that drop in place.

Jane King: Okay.

Riggs: Modular Water Systems™ it's called Water Systems in a Box™. Now that's essential. Why? Because you don't, you don't want your brewery taken up by a bunch of pipes and, you know, filters and so forth. So that's number one. And then we found out during COVID that nobody had cash, and that's where we went, "It's the money, stupid."

Jane King: Okay.

Riggs: Right.

Jane King: Yeah. So how big of a market could this be? You want to chime in on that?

Ken: Yeah, the existing water market... So, Riggs made a reference earlier to the breakup of the monopoly of the telecom industry. Now the telecom industry is orders of magnitude larger than it was. So the whole industry, an early investor had a, it was literally a life altering event if you invested at the beginning of the breakup of the monopoly. We see a lot of similarities with water. So the current water industry, in other words, the traditional municipal market with the pipes and the main structures and all that stuff is $1,000,000,000,000 a year in just commerce.

Now, 80% of all sewage is not treated worldwide. Obviously, America does much better. We still don't drink our water because we're trying to do this one size fits all. So if, theoretically, without the, without that force multiplier that happens when you split up into smaller units, which of course creates greater than the sum of its parts. This could be a four or $5 trillion total addressable market.

Jane King: So everybody uses water. I mean, it's absolutely necessary for life.

Riggs: And crazy thing is that you can't actually trade water. Isn't it crazy? Water is the most important commodity there is, and yet there's no markets really to speak of. Why? Because it's a monopoly. Well, that's just how, remember, you don't, I do. Back when AT&T was the only solution, and the princess phone, and that was it. You have no idea.

Jane King: I've heard stories.

Riggs: Exactly.

Jane King: Yes.

Riggs: So no, but think of what, so much has changed.

Ken: She read the history books.

Riggs: So here we are. Fast forward 50 years and it's, everything's changed. We believe the same thing is going to happen with water. It's an asset play. That's why we say 'Water Like an Oil Well', literally. Investors are able to come in right now and get a piece of a bucket of assets that returns royalties, shares in the parent company and founding shares in this new thing, Water On Demand, which is the financial play. See, everybody's talking about AquaTech, which is very interesting. But notice how hard it is for technologies to come to market in water. Why? No incubation. That's part of our mission.

Jane King: And that's what you're doing.

Riggs: Exactly. Now with the incubation, now these, the aquatech comes, but you still need money and the finance is key.

Jane King: Okay. And what makes this timing right? I mean, is it environmental concerns? Is that some of the issues we've seen with municipalities and their water system, I mean why is this a good time for water to be broken up and for it to have...

Ken: I think it's all of the above.

Riggs: Well, I get hot under the collar. I'm sorry. I'm going to get, I'm going to get passionate here because we have all these problems with water in America. And notice that they're poor places. Why? Because they're all the way downstream, literally relays and relays and all the way out there in Flint, Michigan. The people that just don't have great water. And why is that?

It's because industry and agriculture is taking 90% of the demand. They're basically squatting on our water supply. And I think it's a scandal. Do you know that in Ireland, water is free and it should be. Now, imagine if businesses which are happy to go off the grid and do their own water treatment because why? It's better for them by a number of reasons. Imagine if they do that, now the cities are only servicing people, homes and they'll do a better job because it's only 10% of the load.

Ken: But it's also what they were designed to do in the beginning. 100 years ago, there wasn't massive amounts of industrial productivity going on within the city. So this was designed for household waste. 100 years ago you flushed your toilet and it really was okay. As children, you know, I'm a child of the sixties and seventies. We drank tap water, we drank out of the hose. I would never let my kids do that today, why? Because I know there's stuff in the water. And what is that from? Is it from households? Of course not.

Well, here's what's happening. You have an upstream and then you have a downstream. So who's getting the downstream effect? The the Flint, Michigan effect. You're getting the households, usually lower income households. But who's at the top of the stream manufacturers, right? Now, a manufacturer who may use millions of gallons of water a day or a month or a week, they pay the same per gallon as the poor guy downstream, but they're the ones dumping the contaminants in. And, business, listen businesses want to do the right thing, but they also want to survive. Taking on a very scary CapEx or potentially existential threat in terms of being shut down or fines or something like that is not something a business wants to take.

If you can provide a business away where they can actually reduce their operational expenses, right? By charging by the gallon to avoid fines, to avoid regulatory shutdowns, things of that nature. Make it part of their business model where they actually save money, they are happy to help. And what happens is you're now delivering a end product to us as consumers, much cleaner, much purer and potentially free. The difference is the one size fits all couldn't accomplish that, right? Because you get 50 different sources feeding the area that's being treated. But if I, if we're catering your specific water contaminant, if we're catering our system to get that right, the end result is much better overall water. So it's been a century bending the curve to making contaminated water...

Riggs: And now in California, they're telling people to take short showers.

Jane King: Yeah.

Riggs: But they're less than 10% of the load. What about the 90%. It's a scandal.

Jane King: Plus, they've got the computer chips, all the companies.

Riggs: Very toxic waste. In addition, we have a problem in America of no recycling. Do you know Israel recycles 90% of its water? Spain. Number two is 20%, US 1%. Why? We have a one way system. Treat it and dump it.

Jane King: Yeah, that's true. I wouldn't even know how to begin recycling the water that I use.

Riggs: Well, not only that, the city is supposed to do it, but it's not built that way. It's not their fault. The cities are trying very hard. Yeah, I don't want to totally savage them. They're wonderful people, but they're stuck with just like the energy grid. It's a one way system, right? But businesses, once they have their own system, they can recycle, they get more turns, they don't pay for that new water, and that saves vast amounts of money for them. So they're like, okay, we're good now. We control it, we have great rates, we're happy. And guess what? The cities can focus on the people.

Jane King: So explain your solution. How does it work then?

Riggs: It's very simple. First of all, miniaturization. We have these amazing compact Modular Water Systems. There, and by the way, 100% American, no supply chain problems. So we're killing it right now, believe me. Secondly, we have the finance solution. And this is where Ken and I created this thing called Water On Demand, which is a way for investors to go in. This is the only place investors can invest in a productive water asset is right here where they put their money into, typically like a master limited partnership with oil wells.

Ken: Just uh, water.

Riggs: And it goes in to this bucket and they get residuals, long term, as well as stock in the mother company, us and stock in this new finance vehicle, Water On Demand. So they get the best of all worlds, plus some warrants. Why are we being so generous? Because this is the beginning and we're only going to do a limited amount of funding this way because we need the pilot plants, we have the technology, we have the money. We're now rolling it out. Well, you know, rolling these things out is like building a housing development. It takes time. While that's happening, we're being super generous. If you're accredited, it's the way to go because, you know, you only have, as I say, there's really no opportunities. Our competitors are in the venture capital world or they're being run by JP Morgan. You can't invest in them.

Jane King: Yeah, and we've talked about how it's difficult to find a place to invest in water. There's like three places where you can go.

Ken: And they, and they have limited growth and they grow like, they just absorb smaller companies. You know, if you want to get geeky and do a Star Trek reference, they're the Borg. They just keep, you know, they keep absorbing smaller companies. The idea of globalized water as a service didn't work until some of our innovations. So there are companies that do it very, very well. So the miniaturized systems that Riggs is talking about, we know have worked magnificently because our business units have been selling them for decades, Right?

Riggs: And we tripled our business last year.

Ken: Right. So there's no secret, this this works, ok? And this is well adopted technology that any engineer is going to be happy to have. We can discuss about how this makes consulting engineers lives, well, incredibly good in a second, but I want to...

So the idea that water is a service didn't work on a globalized scale simply because these massive systems were being supplied to, entire islands were desalinating water using a per gallon, and it works great. But they're big systems dug into the ground. So the risk to the water service provider, they had to be perfect borrowers, perfect credit, giant companies or municipalities that could not default on the system because if they did, you're not going to show up with a giant earth mover, dig out... It's a total loss to the water service provider.

Only through this drop in drop drag in drag out modality that we've created did we create a movable asset, a movable or removable asset. So, if the if the customer went out of business, you just take it away. You know, businesses, that happens right? Now, now it's not a total loss. So we can do that pay per gallon thing. It could be a smaller, a smaller end user. And if let's just say they have somewhat shaky credit, it would be something along the lines of maybe doing some additional security.

Riggs: Well, it's the Rent-A-Center model.

Ken: Right.

Riggs: You're basically renting the machine, which is very much lower credit requirement, right? You're paying as you go. You stop paying. Sorry, machine goes away. Now you're in trouble with the city because you're back where you are.

Jane King: Yeah. So fine, let's wrap it up with how can investors find out more about the company and learn more about it is that you're doing actually.

Riggs: Very simple OriginClear dot com and there's a big green invest now button and the good news is that we will soon have an offering for unaccredited investors. It's in the works. But in the meantime we're welcoming accredited investors who are interested. You know, the new thing is income bearing assets and this one's just at the beginning of its run and we're very excited about our new investors.

Jane King: I mean, it's very interesting company and addressing a need that's out there so thank you so much.

Riggs: Thank you.

Ken: Thank you.

End of presentation

Riggs: Well, there we are. That's the full length thing. And of course, they're going to do a lot of sub clips like, you could tell they were like all these topics that, clear almost chapters, right? And this enabled them and us to market these different clips. We're going to be recording these once a month and it will constantly bring new updates and make us really, really visible.

We would never have done this before until we reached a certain stature where it became realistic, like, "What the hell is OriginClear doing at market site?" Well, we know why OriginClear is at market site because we are ready for the Big Apple.

Freewheeling Discussion

Well Ken, join us because we have arrived at the the free wheeling conversation while I'm here freezing in Montana, literally making me stay outside. I'm joking, it's dark and I'm inside, but I don't have a hat on.

Ken: Your ears would get cold. So that's what my mom would say. Look. So I watched the raw originally, and when you're in the moment, you don't realize what a great interviewer she is, right? Because you're, you know, you're formulating your responses, right? So you're not really looking at the entire, the interview itself.

But Jane was a phenomenal interviewer. She covered, she seems to have great intuition on kind of what we do. We didn't give her war and peace preview, right? We basically gave her some very basic highlights and I thought she did a phenomenal job. And more importantly, I think that, that moment in time, I thought we covered a lot of, I mean there's a lot of things that I agree, we have to delve down into into silos on. But that was a good first pass on everything. I was really happy with it.

Call Ken

Riggs: No. And it's clear that, Ken you and I really have worked this model over.

Ken: And we've talked about it a couple of times, so we communicate it.

Riggs: Anyway. It's been our obsession and that pays off because we put a lot of work and attention to detail. So things are moving fast. We're continuing to bring investors into Water On Demand, the investment vehicle, which is capped at $20 million for the lifetime of the fund. And we've raised around 7 million. I lost track, something like that.

Ken: Well, if you ask me tomorrow, it's a very different number.

Riggs: No, it's moving fast. A lot of people are making investments.

Ken: So ask me Monday. Ask me Monday. I have a very busy week.

Riggs: Keith Roeten says, "She drew out good answers from you all." I agree with that.

Ken: No, she's great.

Riggs: By the way, I want to mention, Larry, Judge, our administrator. And Bob, I'll get to you and your question in just one second. He has asked that we do a survey at the end. The zoom will present a survey. We actually pay attention to those. So please feel free to give us your feedback. It's really appreciated. OK Regulation A offering, Bob?

Ken: Drum roll.

Riggs: I cannot say one word about the regulation A offering. That should tell you something. So you're just going to have to grin and bear it, because we are at that sensitive disclosure moment where we can't get into it. But you're going to be very happy with how things go.

Ken: Would that be considered our quiet period Riggs?

Riggs: Correct. Reg A is a registered offering, so I can't disclose the status of the registration because I would, it's material nonpublic information. I know it, Ken knows it, but we can't discuss it. All right.

Future Shows

So yeah, Keith, "More interviews like this?" Yes. Every month we will do an interview similar to that. Obviously, it's going to be on different sides, like we'll bring the wonderful Ivan Anz who's been helping us expand internationally and he's been roaming all over Latin America. Bob with the mastermind network and he's going to be able to discuss this.

I want to bring Dan Early up from Virginia to New York and six monthly interviews. That's that's the contract. And then we'll review it. We'll see how good it was you know. The Price Is Right. It's a very reasonable deal and we think it's got good exposure. So, Ed Campion just joined. Well welcome here. Talk to Ken if you are interested in hearing more about the accredit offering and you will soon know more about the unaccredited offering and I think that's where I have to leave it.

Ken: Yeah, we're really at an exciting and kind of pivotal phase for us and now would be a really good time to talk to me about it and in a more confidential setting.

Riggs: Oc.gold/ken. All right, everyone. Well, it's been a great pleasure and I am going to go back to drinking excellent coffee in this condo here in Kalispell, Montana. And my son joins me tonight. He arrives at midnight and will be getting together to ski. So, it's going to be a lot of fun.

Cherise, "Thank you." It's been a pleasure. Everyone continue to do all the good stuff you do for us. We really appreciate every one of our supporters. Stay tuned. Jean, "Enjoy Riggs." I will do my very best. You know, I have a hard time enjoying things, but I'll try because like whatever Tom says, "Thank you." All right, everyone, have a good night and stay tuned. Next week: project management. Thank you.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)