Insider Briefing of 10 June 2021

Just how POWERFUL are our technologies and technologists? You'll really get an idea when you see this presentation of our DBOO model! Tom gave us a glimpse of a new robust and efficient method for scalable asset management...And how in demand Water on Demand™ is already. When you factor in Ricardo Garcia, our new Advisor and what the new $H2O™ coin means to all that...Come see why it's catching fire!

FEATURED/COVERED IN THIS VIDEO — QUICK LINKS

- Ricardo Garcia joins our Board of Advisors.

- Riggs presentation at the LC Micro Invitational XI event.

- Video presentation of Tom Marchesello talking Progressive Water Treatment.

- Operations update from Chief Operating Officer Tom Marchesello.

- Infrastructure funding and who is getting the money.

- The peer groups that we work with and the strategic advantage of doing so.

- Our Design, Build, Own and Operate (DBOO) capability and Water Tech Support.

- High-tech equipment remote monitoring capabilities and asset management.

- Our vision for asset management and field support.

- How our planned asset management and operations platform can be a new profit center.

- Dan Early's update on his DBOO pipeline.

- Dan's view of the future and a springboard for accelerated expansion.

- Talent and resource shortages and how we are bridging a 25 year old industry gap.

- What it is that makes OriginClear a vital connector for the water industry.

- OriginClear investment offerings and how to participate.

- Live interactive audience and investor feedback.

Transcript from recording

Introduction

Riggs Eckelberry:

Good evening everyone, and welcome to the briefing. It's such a pleasure to be here. We're going to have a wonderful show. We'll get into what's going on with how we're going to really help people with the infrastructure, because big company... The big trend that we're seeing is a lot of small systems, small to medium systems, and the big companies have a hard time dealing with it. We are veterans of that.

So without further ado, I'm going to share screen and give you some of the standard stuff while people are arriving. Water in the New Gold, and we are for sure a recession-proof market. Water just keeps on trucking, and the worse it gets, the better we are, unfortunately. I hate to say that. There's a German word called schadenfreude, which means pleasure at people's pain. Terrible word, very German. I don't want to try and profit from things being bad, because there's lots of things to handle in water without it getting worse.

Forward Looking Statements

Anyway, it is the 10th of June and it's briefing number 114. Of course, we have the usual safe harbor statement where we tell you that we're doing the very best we can to tell you exactly how it is, but it can occasionally occur that it does not. Okay.

New Advisor

You saw this morning that we announced the arrival of Ricardo Garcia. He's been on the show before. He's now officially on the board of advisors and what I thought I'd do is just review the announcement a little bit.

About Ricardo

Here he is, here's a picture of him. He says, "I'm excited for the potential to use blockchain technology to help manage payment systems on OriginClear's outsource water programs now being developed," and he's going to help set up the road map and choose the resources for this project.

Ricardo of course is a good friend of ours. He's also a major investor in OriginClear, and he is a senior program manager at Red Hat. Red Hat was launched many years ago to commercialize open source Unix, which is called Linux.

He has done a lot of amazing things, including he set up Hewlett Packard's... He helped set up Hewlett Packard's managed services offering in the... Like a WebEx type offering back in the day when it was very early, and so he understands managed services.

He retired from the Marine Corps as a sergeant, and he is a master in systems engineering. That's the story with him, and we're very pleased to have him on board. With that, we will continue.

LD Micro Invitational XI Event

As you know, we presented on the eighth at the LD Micro, and what I'm going to do is... By the way, if you're raising your hand, it's better to chat because I won't be opening up your comments live, but I will read off your comments in the chat. What I'm going to do now is quickly, Akus says, "Hey," and I say, "Hey." All right.

What I'm going to do is reshare the screen with video optimization, as we know how to do here. I'm going to play a brief... Since you know this presentation, I'm just going to go ahead and play this quickly at the beginning of it.

Start of video presentation

Host: Water is broken. Washington is allocating more than a hundred billion to fix it, but we know that runaway inflation will doom that effort. What can we do? The solution is direct action by local businesses to clean their own water, but they want to pay that by the gallon with no capital expense up-front.

So with a few select accredited investors, OriginClear is building Water on Demand™. It's a fund that can operate water as a service and to streamline payments. The company intends to develop $H2O, a digital currency which could develop into the world's first water marketplace.

OriginClear is helping to make water the next great asset, combining great gains with great good for the world. Speaking with us today is CEO, Riggs Eckelberry. Riggs, take it away.

Riggs: Hi, I'm Riggs Eckelberry. I'm the Chairman and CEO...

End of video presentation

Well, you know the rest of course, so I'm not going to make you go through our presentation. I graded him nine out of 10 because he said SH2O as opposed to $H2O. He's going to go back to school on that. But anyway... But nonetheless, exposure is a good thing, so I'm going to continue here.

Now this is a very good intro to our gentlemen tonight. Here we go back into share mode. Welcome everyone. It's great to have you here.

Start of video presentation

About PWT

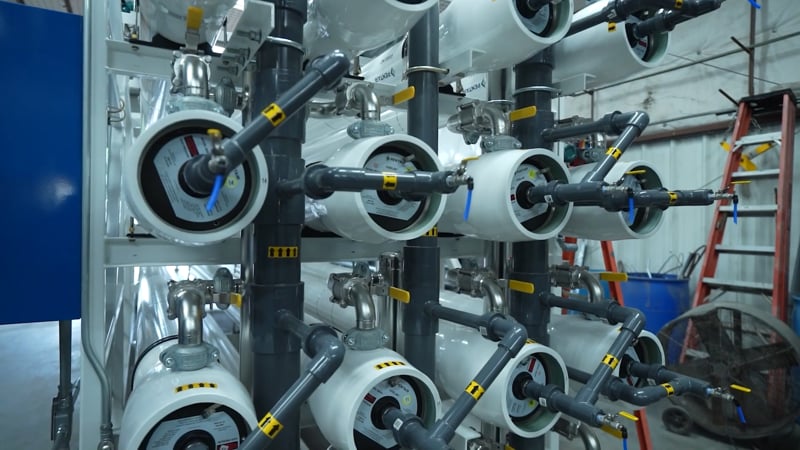

Tom: Progressive Water Treatment, as we know PWT, down in McKinney, Texas, right outside of Dallas. I love that group. They are those hardworking guys, they just get in there and do the work, and the machines they're making and the quality of the work they produce at that facility is phenomenal.

It gets all the way down to the simplicity of the welding they do on a machine. They do butt welding for example on the valves. The precision of the quality of that detail work, that little thing that might be about this big, is so exceptionally good. It just is an earmark of how detail-oriented they are on something that simplistic.

But now you then expand that across the size of their machines, whether they're making a reverse osmosis machine with 20 filters on it, or they're doing a pumping system or a booster skid platform, and these machines range all the way from the size of a Volkswagen car up to the size of a tractor trailer.

They're impressive machines, and they have handled it like champions all the time. They do everything in a way that just is so easy to them. They're just like, "I want to do that today," and then a couple of weeks later there's this beautiful, incredible machine that you'll see on our site all the time, which is like, "My God, that thing's insanely cool," and it's a really sophisticated piece of technology actually, but they just make it look so simple.

End of video presentation

Riggs: Great little show. We just pulled that together to introduce Tom Marchesello and Dan Early, and what I'm going to do is I'm going to stop sharing so that we can get out of the video optimization and say, hello guys.

Tom: Hey, how are you?

Dan: Good evening.

Riggs: So Akus said... I see a chat here. I don't know where to begin. No, I don't know the rest. I never saw any of this. Well, okay Akus, you just hang in there and watch, it's going to be fun.

What I'm going to do now, the people we have on the screen here, Tom Marchesello, Chief Operating Officer and Daniel Early, our Chief Engineer. We're having all these Star Trek jokes. "She cannot do it, Captain." But nonetheless, he does a wonderful job. So without further ado, I'm going to let Tom take it away, and just turn off the video optimization here and bada bing bada boom.

Incredible Technology

Tom: All right. Well thanks Riggs, I appreciate the intro. Every time I see myself on video, our team that did it, it makes me look good. I'm like, my gosh, we did so much work.

The truth of the matter is our equipment sells itself. When you see our photos and you see our videos of these incredible machines that our team does, you just got to be impressed.

I think we've all gotten caught up in the whiz-bang of cell phone technology and internet technology and we forget these big machines out there are technology also, and they've been maturing for decades and decades to the point where it's 2021 and we've got some incredible technology and technologists for our industry, of which Dan Early is one of those gentlemen who's on with us right now, our head engineer. We're making fantastic machines that go out in the field and do a water treatment job.

Tonight we're going to tell you a little bit more about what are we doing, how's our operations going. We're going to specifically talk about some of the things you've been discussing, which is who's really going to benefit from this big infrastructure plan, and how does our machines and our business model fit it, and then how does our DBOO (Design, Build, Own and Operate) capability and process work? And then Dan's going to go over some of our most recent engagements that we've had with people.

Infrastructure Funding

To get it going, we'll talk a little bit about infrastructure. Yeah, I call it tapping the keg. Joe Biden's out there telling us there's billions and billions and billions of dollars coming our way for the water industry and the energy industry. Sustainability is big thing, ESG's a big deal and we have infrastructure that's failing all over the U.S.

Riggs: In fact 35 billion already got passed by the Senate, I think unanimously.

Tom: Yes it did. Those dollars are because there's critical infrastructure that has to happen. People need to drink clean water, and we all have wastewater that has to make it to the actual treatment plants and you don't want that stuff spilling all over the road, so there's real big things out there.

Local Underserved Communities

The question we've always asked is how do we fit in? Where does OriginClear come in to participate in this new spending spree that the government's putting the tab on? Dan and I have been talking to some of our peers actually to ask them where we fit a little bit and where they see it coming, and we've got it down to what we call positioning. This really has to do with where are you in the supply chain, so to speak, how far up and down you are, and what part of the market you're serving.

We looked at the infrastructure plan. We noticed a lot of it was earmarked to try to hit what you call local or small or rural underserved communities, which is great because our equipment is so perfectly suited for small to midsize corporate or industrial or small rural towns where they don't have the big infrastructure and they need it so desperately. So our size and our price point is the perfect fit.

Working with Peer Groups

Now, the way we go ahead and get people to buy our stuff and then participate with us is we work with our peer group. And sometimes those peer group are our engineering partners, and our architectural partners, and construction engineers specifiers, who need to know who we are and what we're doing right now. So they say, "Oh yeah, that piece of equipment, that's perfect. And that really needs to go right here on this project."

So that's a lot about what we've identified as to who's getting the money. It's not, no one is going to write a check to us, but they are going to write a check to this group of people who are already positioned. So one of the things we were looking at was with our DBOO model and moving up the food chain.

Riggs: Design, build, own, and operate.

Moving Up

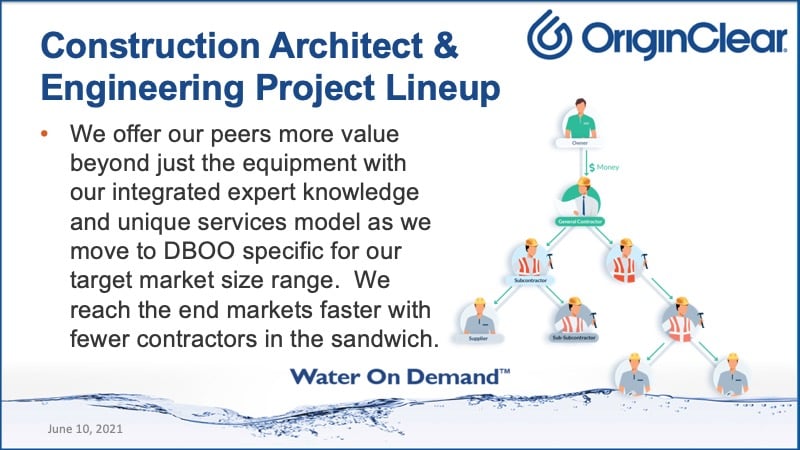

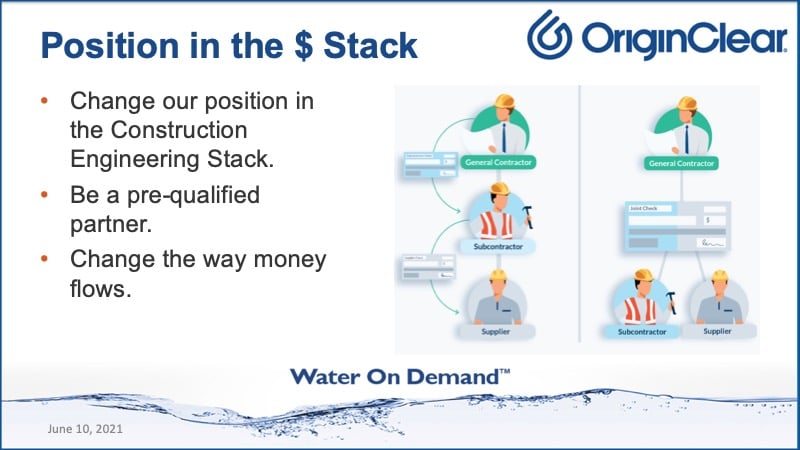

Tom: Right. Because we're moving out of just, I'm just a manufacturer making a product, into we're making a product, we're also operating it and servicing it. So in the old days, you'll see these architectures of general contractors and engineers and architects, and everybody is like this hierarchy lineup.

And you don't want to really be on the bottom of the pyramid because you may or may not get on the project. So what we're doing is changing the dynamic a little bit, and we're saying, "Well, we can change this a little bit to our benefit, so we can flop to the next slide and just move up the food chain."

And by doing that, we can basically say, we can partner to these construction architect and engineering firms. And because we're coming in with a servicing level, they actually treat us more like a partner and a peer group relationship, which basically makes it a lot better than being a vendor relationship at the bottom.

So, that helps us move up the channel. The way I illustrated it here was basically in the way the contracts are paid out. As opposed to the hierarchy or the pay rolling downhill, you actually get to move yourself up on the pecking order and actually get paid sooner and actually be part of the solution set, because that's where guys like Dan Early come in. He's actually providing a solution. So they want to talk to him, not just buy a piece of equipment.

A&E Firms

And in so doing, a lot of the people we're talking to are these, what's called A&E firms. Now, A&E firms are architectural engineering firms. They have professional design services, and they have the engineers on staff. And they're basically looking at these big construction projects, and they have to figure out everything for, where is this piece of equipment going? How is that building it will be built? How is this land going to be managed?

So now we get involved with them so that they know that our equipment can now be specified as the basis of design. And what that means is once their firms specifies it, now that equipment is check-marked off as something that was approved for a project. But now, it could be shared with the thousands of engineers that they might have in their firm, and we can then repeat that process in the future.

Riggs: Repeatability. Yep.

Tom: Exactly. And Dan has been fantastic at making sure that we are lined up for this style of selling as well as contracting.

About DBOO

So, that's what I wanted to share with you. So, that's one of the processes we're doing. And I want to get into the details of why that worked. Now, DBOO as we put it out there for Design, Build, Own, Operate, a lot of us obviously, we're great at design and build that we just demonstrated that all the time.

Now, own and operate becomes a little bit different. Now, the own part you're working on with the finance, but we haven't talked about the operate enough. So I want to talk a little bit about operating things.

Support Center

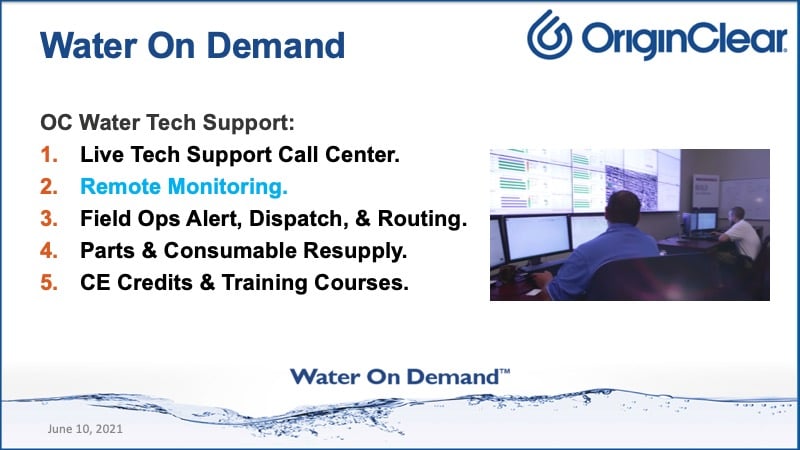

When we have a machine out there in the world, I have to maintain it. So one of the ways we want to do that is with like our water technician support center concept. We're going to do more than just have the machine out there.

Full Stack

We're going to basically say, "Water on Demand says I can have a live tech support center. I can have remote monitoring on this machine. I can make sure I have my field operations alerts and dispatch and routing coordinated. I can make sure I get my parts and consumable resupply chain back out to the machine."

And, of course, "I can also support all the technicians and the engineers who are working on our machines with CE (Continued Education) credits and training courses, so that they're educated on how to maintain machines and how to pick the right solutions out there." So we have a full stack of Water on Demand for the entire industry.

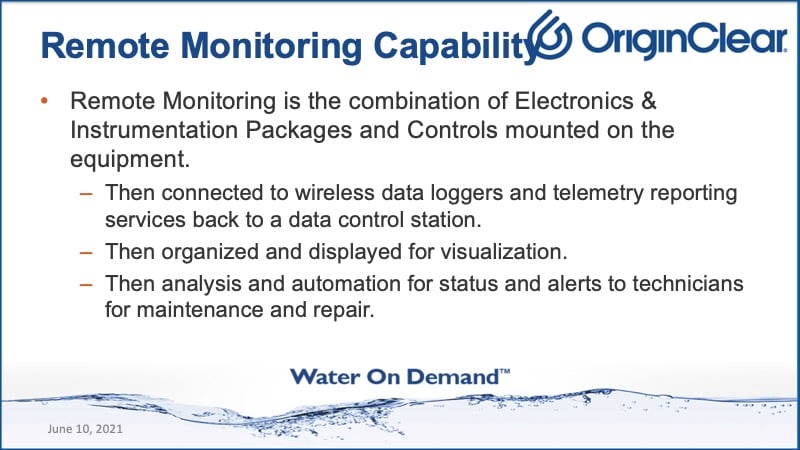

Capability

Today, I want to talk to you about what is remote monitoring because of the cool aspect of it. Remote monitoring is not just my phone chirps a message and says, "Hey, the machine is on fire today." That's not really what it is. It's a much more complicated topic. You're basically talking about an electronics package that's mounted our machines. That's our PLCs and so forth. There's actually data loggers on the machines as well as instrumentation packages.

And they're constantly telling us, here's what the water is that's going through it. Here's how much is going through. Here's the quality of the material that's moving through it. Here's the status of your machine if it's good or bad.

Our Vision

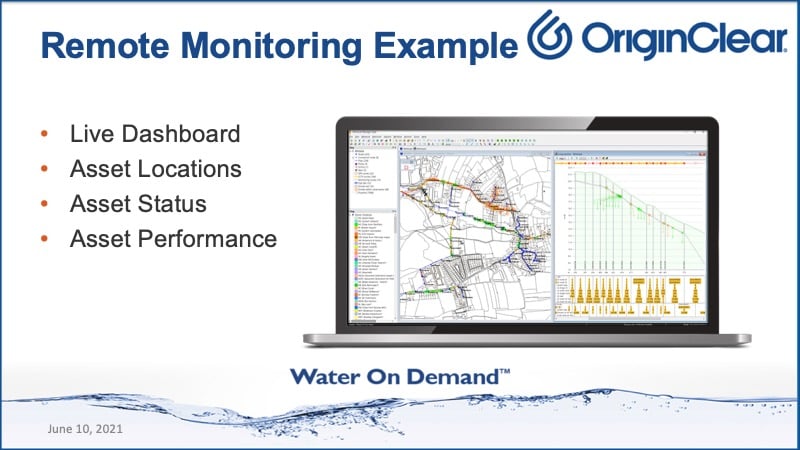

And then that's connecting to wireless networks as well as getting back to a data center, so we can analyze the information and then get back to people. So our vision for the future of how we want to do remote monitoring is really a big upgrade to the way it is now.

I want to have much more of a live dashboard environment where I see the asset locations and the status and the performance, while I'm also looking at how do I maintain the machine? Who touched it last? What was actually being done to the machine? And if there's a log of information, the people in the field can be writing notes in real-time on their mobile devices and actually getting that data back to us.

So that's a lot of what we consider remote monitors, such as the monitoring and the data view of its status, which has all the SCADA and GIS data. It's also, whether or not I can control it remotely and or whether or not I'm controlling and or communicating with the people who are out in the field. Can you flip to the next one?

So that's a lot about what we see as a more robust version of asset management. It's making things more efficient because basically the more efficient you can make the machines in the field to perform better, to be maintained better, that reduces the cost of the machine on-site for the user, as well as makes it much more strong and more profitable for us to manage.

Embedded QR Codes

And so, we want to make sure that these tools are in place to make this a very scalable thing. Now, let's get all the way down to the field technician, right? Let's assume I have a machine on-site, which you're seeing in image number one. I'm going to go maintain this thing. Say an alert went off, and I said to the field technician over there.

So now they're armed with mobile devices like everybody else. So that my machine now itself will carry information on it, because not just the PLCs and data loggers, but say I go up to them like, "What is this machine? What is this pump?" I can take out my phone and scan a QR code that's actually embedded on my machine, and it'll actually pull up real-time data as you can see in the next slide.

Real Time Support

And by doing that, I can make things at people's fingertips in real-time for support. So this way, the field technician is just connected. So they can basically use more modern technologies while maintaining our modern machines out there. And then, right in the palm of their hand, they'll have support. ]And if they need to call back to our tech support center, they can do that.

QR Code Applications

And so matter of fact, I put a little demo together for us to play with tonight, which was... it's an actual live QR code. This would be an example of something where you would actually add to a machine as a sticker. And if you want to, you can actually just open up your camera view on your thing and just point it right at the screen right now, and it'll basically let you pop straight to a website where it will take your information.

Now, in this case, I embedded actually last week's video briefing, but it could in the future be a how-to video, and or it could be the actual documentation that they needed to maintain this activity. So this becomes perfect for quickly accessing documentation in line with the actual machines. So, that's a little view on how we think about DBOO being streamlined in a more modern technologically advanced process. So just wanted to give you a little snippet of that.

A New Profit Center

Riggs: Thank you very much, Tom. And Dan, you've been patiently listening to all the wonderful things being said about you, and you really are the finest person around. Can we say anything more that will completely embarrass you?

Dan: No, man, you will make me blush.

Riggs: Nice. Nice.

Tom: All true. It's all true.

Riggs: So first of all before we go on, Tom here has really shown us, not just that this is a... He's doing so much more than what I expected of him because we wanted to implement, of course, the operate part of DBOO. Well, he's actually going, "Well, wait a minute. We can actually turn that into a profit center, servicing larger water companies." And that's been the message of this slide show. Amazing and it's a great leap forward. So thank you for that, Tom. I appreciate it.

Tom: No problem. Just trying to be innovative.

Riggs: So I've been relaying Dan's updates now for weeks. And so this time he's here to tell us himself, so take it away, Dan.

Update on Projects

Dan: All right. Thank you. Thank you, Riggs, appreciate that. Now, Tom, kudos to you, man. I thought that was a very, very good presentation. Very good overview on the DBOO model and the remote operations and service capability. You did an excellent job.

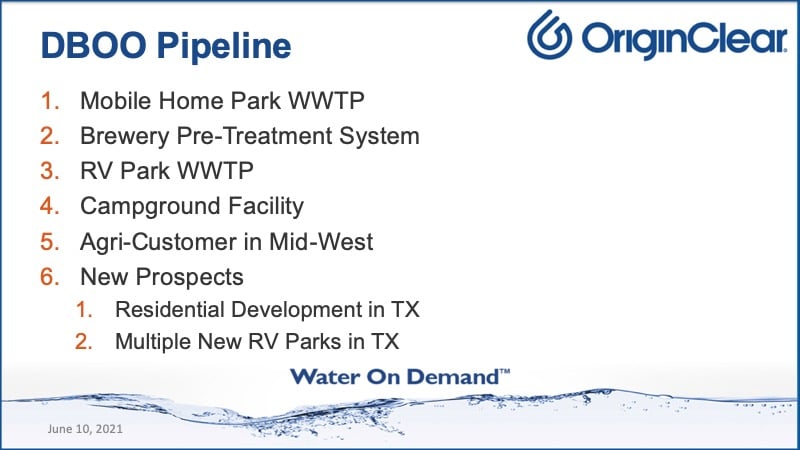

I just want to share with the audience tonight that things are continuing to progress very, very well with regards to the prospects that we're pursuing under the DBO and DBOO model. I know that Riggs, over the last several months has sort of given you periodic updates and weekly CEO briefing. So what I thought I would do is I would take just a couple of minutes here to just run through a couple of these or a few of these current prospects and just give everybody an update on.

Trailer Park

First one that I think that we are at the doorstep of inking out a deal is this mobile home park project located in Pennsylvania, been very actively engaged with the consulting engineers working on that project. They are wrapping up their phase of the project, and so that means the next step at this point is to set up just to execute a purchase order with the owner and to get started with the equipment fabrication and delivery. We are at basis of design, and we are at the 11th hour. So it is for all intents and purposes. It is a done deal from our perspective.

Brewery

Moving on to a brewery, a craft brewery customer that we're working on in the mid-Atlantic. This customer they are still actively moving forward. They're in a situation where they have to pretreat. They have no ability to discharge the local public sewer. Their wastewater is too strong, so they have to implement a pretreatment plan.

We're very actively engaged pursuing that opportunity as a DBO. We are partnering with a DB firm, a design-build firm in the mid-Atlantic. And their specialty is the engineering, and permitting and also coordinating the on-site construction. So we support them as a strategic partner, as a vendor.

RV Park

Next one is an RV park customer down in Texas. They are wrapping up their vesting right determinations and getting the rezones in place. I anticipate that one is going to ramp up very shortly, probably within the next 30 days. I feel comfortable that probably by the end of the summer, we should have that one inside the house under contract and moving towards delivery. That one's very close to our factory in McKinney, Texas.

Campground

One has really accelerated since last week and over the last month is a campground facility out in the Midwest. Existing facility. It's been around 30 years. They are at odds with the local regulatory agency. The consulting engineer working for the campground called just this morning and said please hurry up. We need every last bit of help from you as a design-build partner. We have to get a system under construction, underway so that they can be open next year and not be in a state of violation.

Agriculture

I'm working with an Ag... Moving on. I've got an Ag customer in the Midwest as well. I should be delivering...

Riggs: What kind of Ag.

Dan: It is in the poultry industry. It's an egg producer. It's an egg producer customer. Very unique situation. It's an egg producer, so obviously they're preparing eggs, packaging eggs, and getting them out to the marketplace. Quite a bit of waste water generated in a facility like that as you can imagine. I guess a lot of broken eggs per se, but they have to treat the water...

They have contaminated their local soils. It's a 35-acre farm. It does have some verge zoning capability. The state regulatory agency basically said cease and desist, you shall no longer discharge your untreated water. So these guys, they have no other options. They've been pumping and hauling now for about six months, but that is basically an enterprise killer. So they are looking very, very seriously at a hybrid-advanced technology that we are proposing is one we're also proposing for the pork industry as well.

Riggs: By the way, you were also proposing this as an upgrade in Spain for Depuporc. It's the same technology, right?

Dan: It's, they're sister products. Not quite exactly the same, but very, very similar. They have a lot of similarities.

Commercial Real Estate

As far as the new prospects. I like to share this and this is the exciting part and this is the part I really love about the job.

We had a residential customer reach out to us today, existing residential complex in north Texas. They are in trouble with the local regulatory agency. They have to replace and upgrade their facility, but they're also in a unique situation where the surrounding farmland is prime development real estate.

The development world, the commercial real estate development world, is looking at their property and saying can we come in and upgrade your facility? We will take care of this for you. We will our remedy your problems and in return, we get access to a much larger treatment facility where we can service the adjoining real estate. That one, that's a very promising prospect there. More to come on that one as we get deeper into that one, again, first contact this week, but it was very, very positive.

Very Big Future

Then through some referrals with some of our other customers, though, we've got several new RV parks that are very, very interested in the design build and the design-build operate or ownership utility model. So this, Riggs and Tom, I will share with you that this is the future. I mean, there is a very, very big future, a very promising future for us when it comes to this. Now this is all the wastewater, by the way. We haven't even touched on the water side of it. So when we can bring both of those entities together, that's an even more powerful model.

Dan: Back to you Riggs.

Funding is Springboard

Riggs: Well, thank you very much, Dan. This is really fascinating. So really what you're telling me, it's a recurring refrain of these businesses now being fined, being told to stop operations, et cetera, and this is happening all over America. You are getting these people needing the help.

Now, as I understand it, a lot of them, I think perhaps all of these on this list, are interested in the system being financed through the owning thing, but we can just as well just do it as a classical system, but the finance, I think, would probably accelerate it. What would you say that?

Dan: It will. It definitely will, Riggs. Being able to bring the funding model to bear and being able to fund a project and to streamline that process at a reduced cost, that is going to be the springboard for a lot of deal, a lot of projects in the future.

Riggs: It's going to be like a dam breaking. It's going to be amazing. I agree.

Dan: It is.

Getting Prepared

Riggs: The biggest concern we have as we start lining up the finance, we start doing these big deals to bring in capital through the offering I'll show you in a minute, but obviously, Tom and Dan and Marc Stevens who runs Progressive Water are bracing for this and making sure that they can deliver. Because once these deals starts popping, it will move quickly.

Here's an interesting twist, and that is that supply chains are tough. Right now, it's getting harder and harder to buy stuff. The prices are rising constantly, and so it's a very interesting time to be in the water industry. I would say.

Meeting the Demand

Tom: It is definitely interesting. We do see all those changes. They're all happening at the same time, but the interesting thing, though, Dan and you and I have been talking about was the industry that we're in is so fascinating because it's been doing this business for decades, right?

Treating water, helping people, making the environment better, keeping things clean. Yet, it's like the unsung of the benefit to society. All of a sudden, now you're getting this big spotlight being put on it. It's pressure. You're on the stage now and you got to sing. Hey, we got to make water great for everybody.

The industry's looking around going, we're really old. We had our shot like 10, 20 years ago. Now, they're, they're like oh my god, all this attention for these old guys in the water industry, which brings up this really quirky situation right now, which is the young people need to be brought into our industry and technologies, like what we're doing have to be brought into the industry plus new process to actually keep up with the now new-found demand for everything.

Talent and Resource Shortage

Riggs: Yeah, and it's another area where we have the, we and our fellow smaller water companies, have the speed... We can get going quicker than some of these larger operations.

Tom: Exactly.

Riggs: We're getting starved for talent. You're absolutely right.

Tom: Right now they can rely on folks like us because we made things easy.

Dan: That's all right. We actually are very uniquely positioned. Our in-house engineering and expertise in water wastewater system design combined with our manufacturing capabilities, those are very, very powerful.

When we put both of those two together, we become a mission-critical, strategic partner to a lot of these big regional, these national and regional A&E firms that are working with these decentralized customers and working with the small rural facilities.

I want to share this, too, real quickly if I have about a minute. We're all working on a national basis, and I'm talking to our manufacturers reps around the nation and also talking with consulting firms around the nation. There is a developing common theme in that there is going to be a talent and a resource shortage.

Riggs: Wow.

Bridging the Gap

Dan: It's going to stress the ability for the water industry to be able to meet the demand and to utilize the funding that is going to be distributed to all these customers, all these public and municipal customers that need it or industrial customers. There is going to be a huge shortage.

Now, that makes it really good for us because of our expertise and some of the standardization and the processes that we've created, especially from the engineering perspective, it makes us so easy to become basis of design. We solve and bridge a gap with the engineering world that exists, that has existed for about 25 years now.

Riggs: Well, it's feels great to be in the right position. Quick question, BC asks, is there any list of chemicals the system can filter to recycle? He's mentioning NPK, chromium, and PFAS, asbestos, things like that. Sulfuric acid.

Tom: On sulfuric acid, ironically, we're working on a quote that came in. There was a very legitimate inquiry of whether we could remove different issues like hydrogen sulfide and other things and sulfuric acid. Obviously, the answer is yeah. These are all of the chemicals and all the situations that our machines do deal with. Now, each of them requires its own analysis to come with the right solution, but our team down in Texas and Dan Early are exceptional at this. These are exactly the kinds of things we do for industrial wastewater treat investment.

Dan: Correct.

Riggs: Yeah. I mean, here's the bottom line, BC and everyone else, we are super light on our feet. We have all these... We play the keyboard basically, and we have all these different technologies we can pull on. The real question is, I think is that, and this is what's emerging from this fascinating conversation, is that there's a resource shortage at the water companies and the general contractors, et cetera. We can fill that gap, and that's really exciting.

A Vital Connector

Tom: Right. Think about it from the standpoint of efficiency. Dan and I joke around because it's like you're playing a game with cups and a string, like Telephone, as a kid. I'd ask one question, and it'd go through the string, go to the next guy to go to the next guy. Sometimes finding problem solutions in the old part of the water treatment actually felt like that. You'd ask a guy who asked a guy who asked a guy and he'd get back to you like a week later.

That just doesn't cut it in today's day and age of fast data industries and millennials who want instant answers on Facebook. The truth is you have to have smart people like a Dan Early on staff, and you have to have a Marc Stevens who can problem solve in real time in the shop. That's what our guys are doing. It's literally like that.

Riggs: Well, you guys make me look smart, so that's great. Gentlemen, thank you very much. It's been really instructive, and a whole wave of new opportunities have come out of this. So thank you so much. It's really, really fascinating time. I'm so glad that we are, with the help of Philanthroinvestors®, driving this capital formation.

Also, our Wall Street efforts, et cetera, so that we can finance these systems. But regardless of that, we're also becoming more and more a vital connector for the water industry, and that is so exciting. So thank you again, I appreciate it. And we will continue. Oh, Khadijah says, "It feels great to hear smart sounding people." Well, count me out. These guys are smart.

Tom: It's all relative.

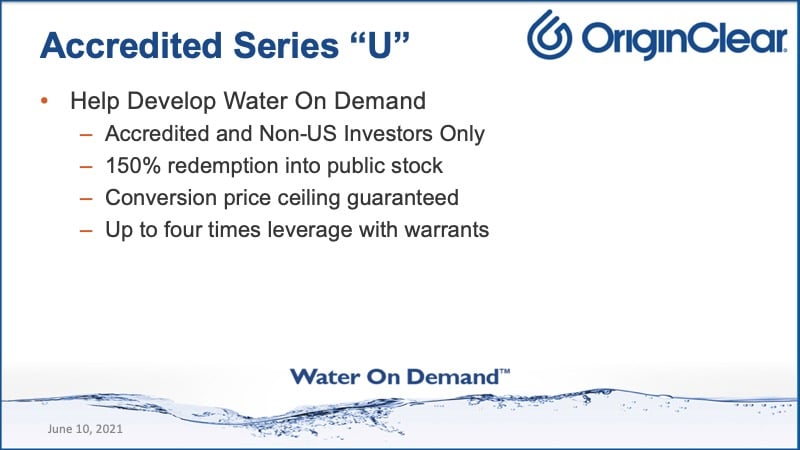

Standard Accredited Offering

Riggs: Well, thank you gentlemen. We're going to quickly wrap it up with the part that really talks about the own part of it, which is, there's the standard accredited investor offering, which helps pay for the efforts that Tom and Dan are investing in, the staff, the teams, the contracts, et cetera, and Ken can go into it further.

But what's really important about this, we realized we used to be more worried about people being able to redeem their stock at a price that would be adjustable to the price going down. Well, that's not happening anymore, cross my fingers. And instead, prices have been going up and then investors get really worried that they're going to convert with less and less and less stock.

If you went in when it was five cents and now it goes to a dollar, well you're getting a lot fewer shares. And so this offering now has a 20 set limit. You could wait until the stock is $5 potentially, and it was still converted at 20 cents. And then there's the warrants, which give you up to four times leverage. Unbelievable package, it's very, very popular and Ken can tell you more about that. You have to be accredited or accredited from outside the U.S. and technically it's $100,000, but we will break it down for you.

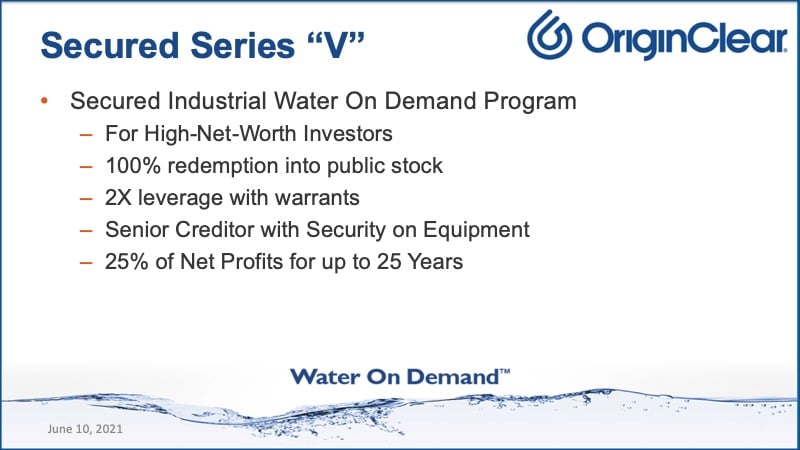

Senior Secured Creditors

All right. Now, this is the offering that is going to help us build the actual program with the capital. And this is with high-net-worth investors. It is more conservative than the series U, because if you get security, you're a senior secured creditor, you're in a separate subsidiary that is independent, it's wholly owned by us, but it's a separate subsidiary, and you get a security agreement on all the equipment that we send out.

Now, it still has a great leverage with the warrants. I mean, the money is fantastic, obviously, and 25% of net profits for up to 25 years. Remember, last year, the week I told you about this $20 million fund, because this is a $20 million series turning into half a billion dollars in revenue over 25 years. The net profits from that, which are less, are nonetheless very substantial. And you get, if you invest in this, you get 25% of your share of net profits.

Where $H2O™ Comes In

Here's the interesting part. Remember that coin we're developing? Our hope is that we can accelerate the payment of the net profits by using the coin. That's something that I'm working on with Rick Garcia. That's why Rick is on board. We're super excited about that. And that's where the coin comes in. The coin is a game changer because of the ability to take these really long payouts and accelerate them. We'll make that a topic of next briefing, in fact.

Call Ken

And Ken will give you his masterclass. I call it a masterclass because really, it is a mind blowing session you'll have with him. He is so freaking on fire, and he will discuss it in a way that is not like, I'm going to close that deal. No, he's there to help you understand how you can profit from really helping in the water industry. And he's done a wonderful job with all the people that have come into us from the Philanthroinvestor network, for example. And so, we're loving where it's going.

I'm seeing that there's some chats, but for some reason, Zoom has decided to delay that. Next week, I plan to bring Ricardo Garcia on board, and I've teased you that we might be making some of these tokens real time on the show. Wouldn't that be wild? So, that could be definitely a lot of fun.

Regulation A Offering

Oh, Bob Roos asks, "What about the series A replacement?" The answer is that's forging ahead. We have got the legal team working on that. Very simply, just to give you an idea, what it is, is that we previously had purchased what's called the series M. It will be a different series number, X whatever. And you then got dividends, 10% per year paid monthly and 150% cash redemption.

Well, now we've added, and I think this is how it's going to be, you can also convert 150% to stock, or if the company decides to convert you, 200%. And instead of fixed conversion price, that over time we believe, will become, this is not going to change. If it changes dramatically, we'll have to rechange it, but the idea is to not change it.

And then let's say, the price is 10 cents. And now the stock is 20 or 30 cents, whatever, you're still converting at 10 cents. And you get that multiple 150% or even 200% if we convert you. So it's a very good little offering that's coming, I'm very excited about it. It's going to take a month or two for it to come together.

Feedback and Chats

And we have an investor whose name I won't mention, but Ivan just tells us that this is an investor who is very happy with his investment after almost a year that he started with us. He sees a highly brighter future for the company. He thanks the entire team.

This is a gentleman who has a net worth of over $100 million, and he not only invested, he invested again, and we are grateful for him having done so, and we're grateful to Ivan, Artie, Vendi and the whole team for what they're doing to assist us. So thank you for that.

And Star says, "Great water industry, getting more exposure thanks to you guys." It's true. The water industry is an unsung hero, but it's time to point the finger at the fact that water needs help. So, Bob Roos says, "Count you out," about my smartness. "You are plenty smart, it's just a different kind of smart."

Thank you. I'm not a mathematician. Last week, I was talking about $20 million turning into 488 million and saying that was 118 million shy of a half a billion. And I got called out on that. It's actually just 12 million shy of a half a billion, but I'm not a mathematician.

And okay, Akus, "I accidentally logged out. Can you repeat everything you just spent an hour talking about?" Akus, we have replays. If you are registered, you will get the replay. And it's very simple, we'll send you the link right now in the chat, but the link is, Kevin has it originclear.com/briefing-replay. It will come to you. And not only that, it will be edited down from all the ridiculous things that we say, just to have fun.

Anyway, I appreciate your time, everyone. It's been wonderful. I see that people have stuck around. You're the best audience. Thank you so much. And next week is going to be so much fun. Benjamin Davis asked, "What's my minimum investment?" And the answer is there's technically no minimum. Here's the reason why. People tend to invest more.

So we're very happy with you coming in with toe in the water, as long as you're accredited or non U.S. We don't want you to do 12 cents, we would like, I would say ... Well, I'm going to let Ken answer that question. So, Benjamin, would you mind going to oc.gold/ken and have a meeting with Ken, he'll tell you all about it. And you can do less than 100,000, there's no bottom quote, unquote, we just don't want it to do it for hundreds of dollars. This just doesn't work. So oc.gold/ken.

And then, well, I'm not going to keep you guys going because BC says, "Keep up the great work," which I appreciate. Thank you very much. And this is going on. JRW says, "I'm going to move to Canada just so I can invest." JRW there will be an unaccredited investor offering soon.

Anyway, thank you all. It's been wonderful. I appreciate your chatter. Have a wonderful evening. Enjoy your weekend. See you next week for a very exciting and different one. JRW says, "Washington, DC is not part of this country." Not going to comment on that. Good night.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)