With annual revenues up 250% it's crystal clear that the demand for our point of use solutions is growing! The real challenge is moving fast enough to leverage that demand… Can the new synergy of Water On Demand with Modular Water Systems do it? Find out in the replay!

Transcript from recording

Opening

Riggs: 90% of all water demand is by industry and agriculture. And the people are being short changed with that 10%. Basically, the system is overloaded. Now what have we done about it?

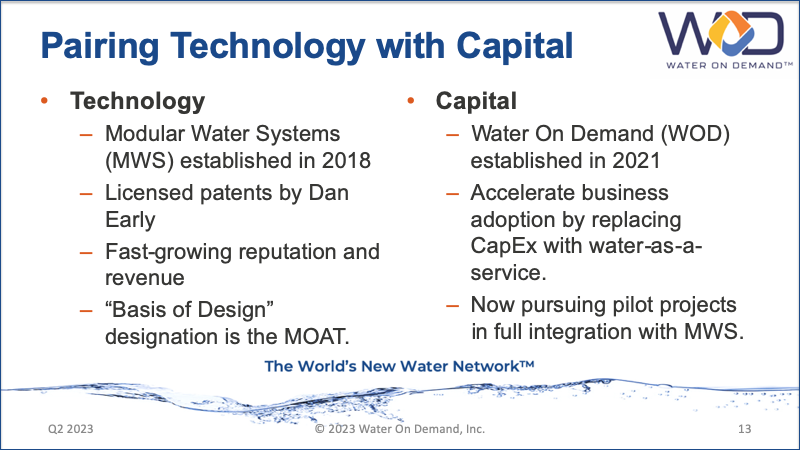

Number one, we came up with technology starting in 2018. We brought in Dan Early, a guru of what is called decentralized water. Meaning water done at the point of pollution. And so we created something called Water On Demand. So you can come to Water On Demand and they will offer you a service contract, typically long term, 10 to 15 years with all maintenance covered.

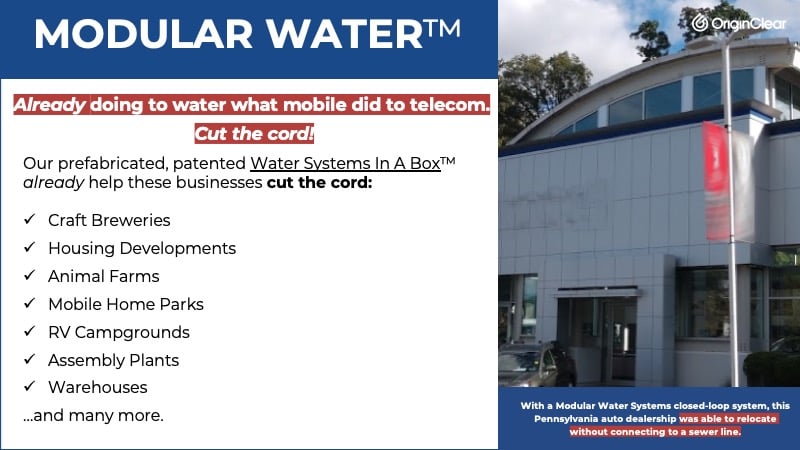

Our equipment is mobile. It goes on a pad, you plug it in and it goes to work. So it's a Rent-A-Center model which makes it easier on the credit for the company.

Here's where you're saving money. You have the potential to recycle that water, which currently is not being done. It reduces the cost of your incoming water. So that's number one.

Number two, you're saving on the water expert because our water experts are shared. And finally, we believe that over time you'll save money because water rates are skyrocketing right now.

So this is a way forward that's rational self funding. It's not going to rely on government and it's not going to rely on big civil projects. It's just going to get the job done.

Introduction

And good evening, everyone. All right. Thursday, April 20th, 2023, Briefing 207 The World's New Water Network™. We have some amazing news to announce, so let me get right on to what's going on here.

Of course, the usual disclaimers.

I wanted to give you a little look at what the Hill just reported, very interesting story. And kind of it's meaningful because The Hill, of course, reports on what happens in Congress. And so it's a mainstream source. So here we go.

Global Water Crisis

So they get into, of course, water crises throughout the world through global warming, climate change, increased natural disasters, droughts in Somalia, monsoons and in India and Bangladesh becoming much more severe. Unfortunately, man has helped really make things worse through deforestation, which creates these heat islands. And of course, that turns, that creates deserts. So that's we have to have better practices around forest forestry.

Deadpools

All right. So now we unfortunately have not escaped that fate. We have like, you know, the lakes and Nevada, Arizona, Utah and Utah are turning to deadpool's, quote, unquote. Now, this has been somewhat alleviated by lots of rain. And publicly there's increasing acknowledgment that cloud seeding is happening aggressively. It is helping. Unfortunately, so much rain has been falling that not all of it got anywhere.

Infrastructure Failing

As I've been saying for many years, water infrastructure in North America is aging and will keep deteriorating and our drinking water infrastructure has D minus or D grades. It looks like close to $1 trillion to improve the water infrastructure and that that actually supports a lot of economic activity and jobs. Okay. So 14-18% of water is lost through leaks. Some water systems are reporting loss rates exceeding 60%. So that's really tough. As I reported last week, water rates are very, very high as it is.

Underfunded

Okay. Now there is support for this. But, you know, as I've been saying, also, $55 billion does not do a heck of a lot. There is certain unfunded mandates to establish policy protocols, which is needed, but unfortunately is not funded. And then also we're looking for manpower, which is, you know, there's a silver tsunami going on in the public utility space and that's tough. One good reason why everything's being privatized. As you can see, businesses are stepping in. And that's our business. That's what we're about. And we need bipartisanship, of course.

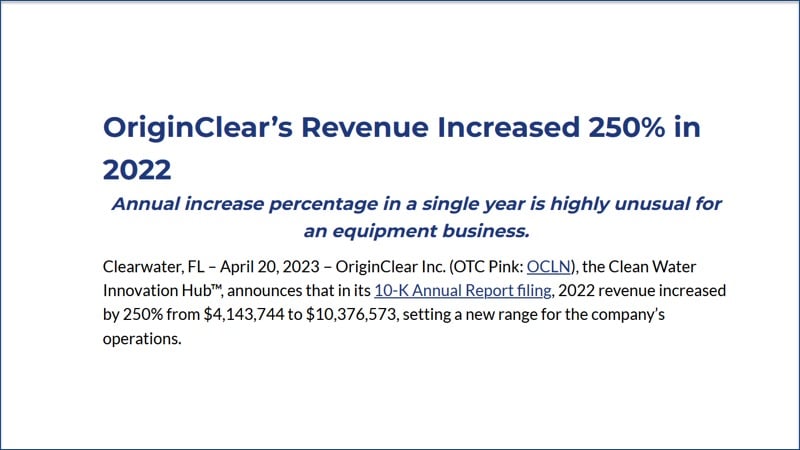

2022 Annual Report

All right. Well, let's jump right on to the financial news, the 2022 annual report. This just came out on Monday, but we are reporting on it in today's financial press. So what happened here?

We had a 250% increase, so from about $4 million to about $10 million in revenues, which is astonishing really. Revenue is not just money in, it means you have to get complete jobs and percentages of jobs completed. This is very strict.

Gross Profit Increase

Also, gross profit, increased cost of sales pretty much stayed the same. Loss from operations, that reflects basically the half million dollars a month we are continuing to spend to keep driving certain initiatives that were incubating. We'll tell you more about that a bit later. Net loss is an artificial number. It really tracks with, weirdly enough, it tracks with the stock price. So it's hard to tell where it is. It's called a derivative liability. Okay. So that's the news. And I think it's excellent.

Natural Synergies

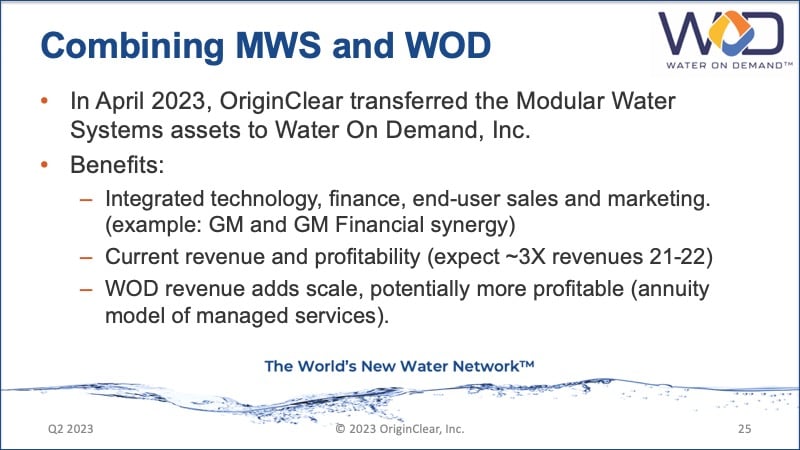

Now. OriginClear transfers MWS to Water On Demand. We felt that Water On Demand and MWS were natural, had natural synergies and so we have transferred Modular Water Systems to our Water On Demand subsidiary. You'll see that coverage shortly in a PowerPoint and 6 million shares of Water On Demand stock. That's not formally priced because one of them is a private company. But I can just point out that the current crowdfunding prices a share at $5 each so you can do the math. That's the best thing I can tell you.

Valuation

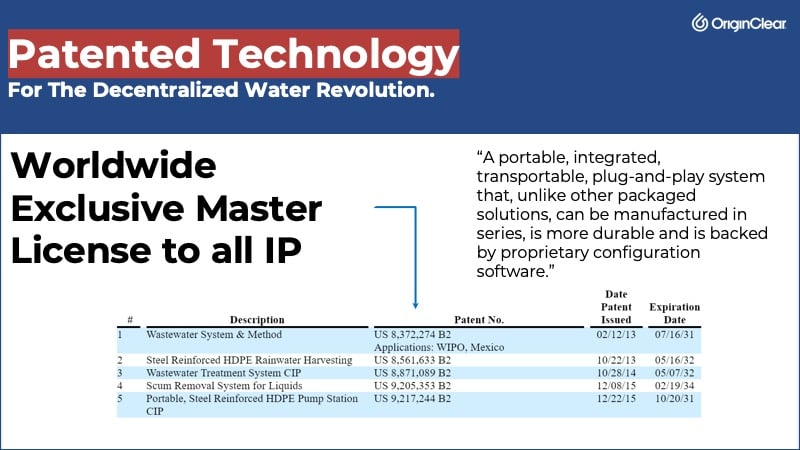

It includes a license to the five patents, and there's a valuation of the patents between 26 and $53 million, with an available market exceeding $8 billion in 2026. So this is a win for us in incubating. We started this in 2018 from scratch and built it doggedly over the years until now. It's had some really good outcomes and you'll see from the deck that their numbers are outstanding as well. All right.

Powerful Combination

We're going to continue here. So why are we doing this? Is because of scaled down technology and capital. We want to combine technology and capital. And so we've now created this pair of Modular Water and Water On Demand. So with that, we now have what we think is a very powerful combination. And this press release goes on to talk about the letter of intent we have with Fortune Rise Acquisition Corporation. We're not going to get into that, but obviously that is a related piece of news. All right.

Riggs: Let's take a look at the new presentation then. This is the one that presents the new corporate structure. All right. So water as the next major asset class. And now industry is solving the water problem, which is what we've been saying.

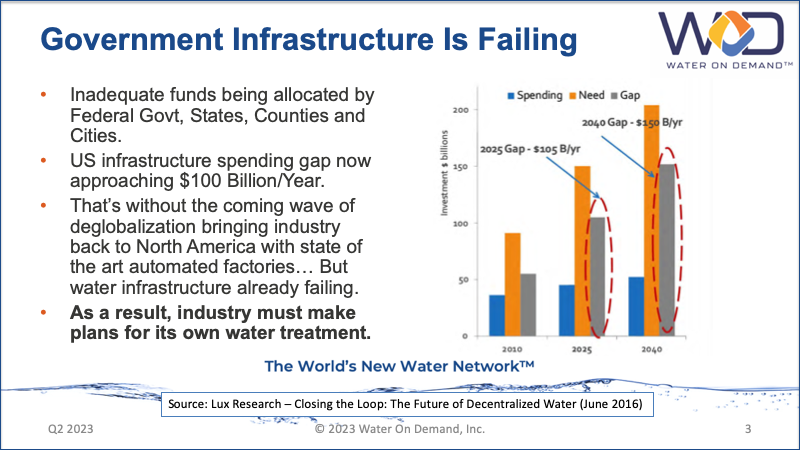

So with that, obviously, government infrastructure is failing. Funds are not being allocated properly. And, you know, there is now a gap, almost $100 billion. In addition, Deglobalization is bringing industry back. There won't be any facilities to treat their water. They're going to have to have integrated water treatment. This is a huge trend that is on the way.

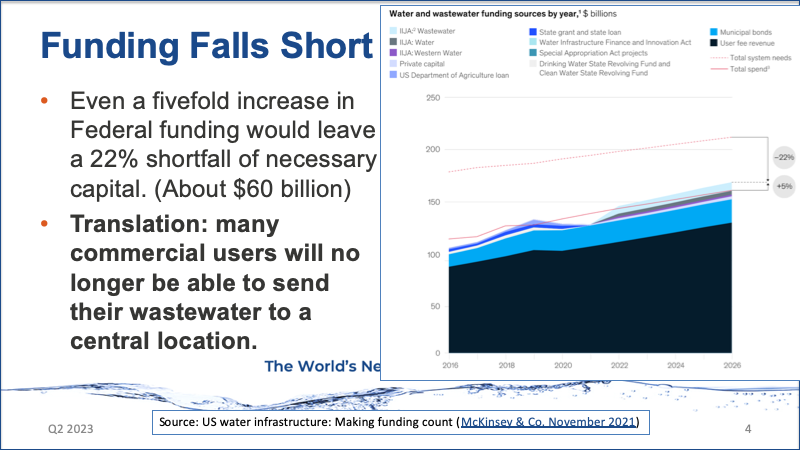

Funding falls short. We have here, you know, 22% short, even five fold increase. I've been presenting this, but I wanted to just show you how it says it officially here, because now there's a slide that's been added that's very important.

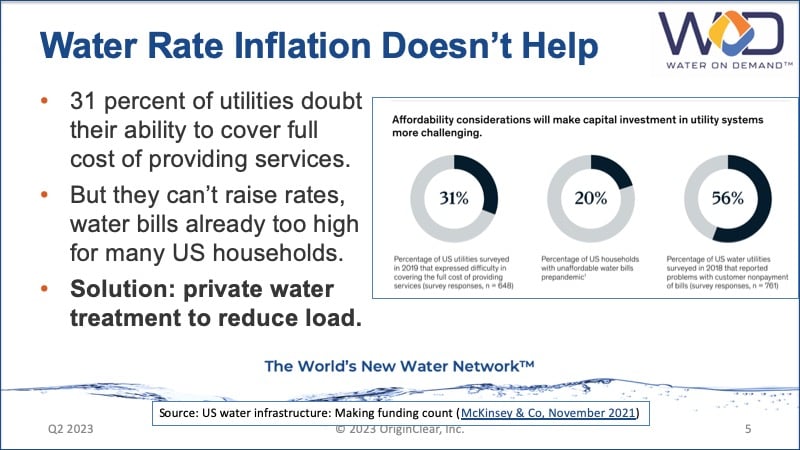

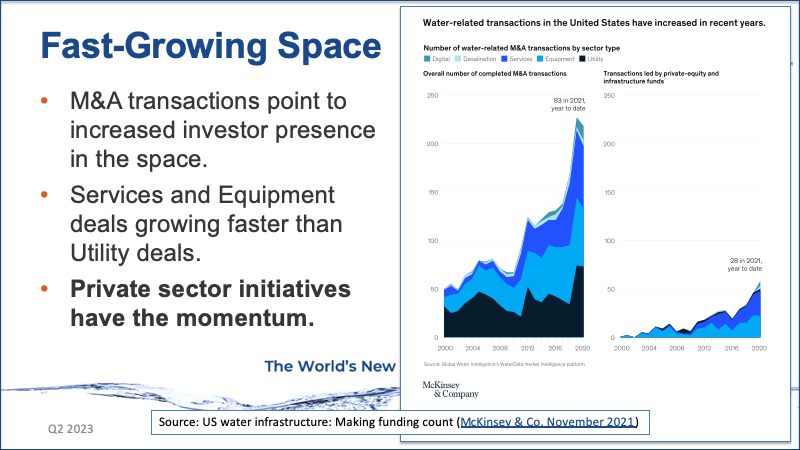

Water rate inflation doesn't help. I covered this last week and. There's increasingly private activity in the public space and the equity space where the dollar value of equity transactions is high because these are expensive transactions.

But the actual number on the right hand side, the black on the right hand side, is low. So why go private? These are all the reasons cost control, recycling, control over waste, etcetera.

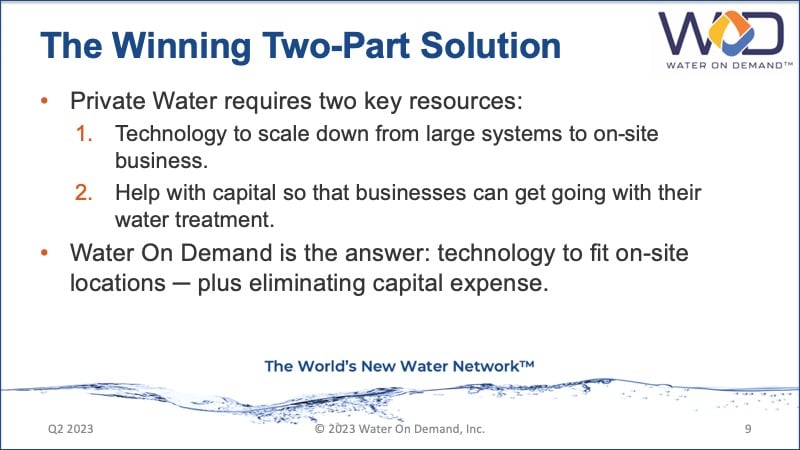

And we have now a two part solution. It's a winning solution. Technology to fit the on site locations plus eliminating capital expenses. First, of course, the technology with the modular construction. Secondly, fixing the capital barrier.

New Power Play

And now we have a new power play where Modular Water Systems and Water On Demand are coming together into a network with unique patented technology. And we have this combination where Water On Demand is highly accessible to investors and also a pure play in water as a service.

We have worldwide exclusive patent. And what I'm going to do, I'm actually going to, we actually need to reinsert, I had taken this out last week because it wasn't yet news, but we actually in this presentation we announced that the two have come together.

We're already doing this, we're making it happen. Complete modular solutions. Full pump stations. There is the tripling, nearly tripling of revenue from Modular Water Systems, which we are going to be announcing publicly as well.

And here we go. This is the slide I was talking about. In April 2023, I was not able to put this out last week. OriginClear transferred the Modular Water Systems assets to Water On Demand, Inc. Now we have integrated technology, finance and user sales and marketing like GM with GM Financial.

Profitability

And the current revenue profitability. You know, again, we have growing revenues and finally Water On Demand revenue as more scale in the long term.

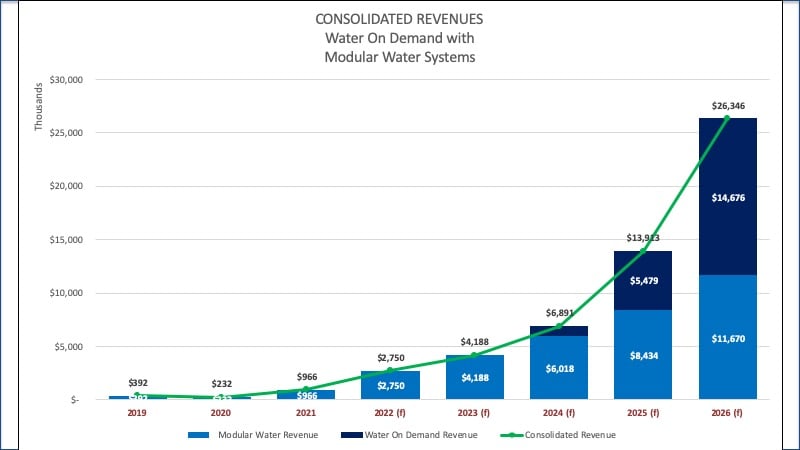

So what does it look like? Again, I've gone over this. We have the revenue of the Modular Water Systems now fleshes out the early years with the light blue and then Water On Demand has the leisure to kick in 2024 and onward. And this is what we needed to make this whole thing gel. And then here is the gross profits again.

We have Modular Water Systems showing gross profits and then it starts kicking in with Water On Demand profits in 2024. Looking at net profits, we have Water On Demand, Modular Water rather, showing it has been able to sustain its own existence. But now it's starting to show some real net profits. And in 2024 we see a hockey stick as Modular Water starts making some real profits and overcoming the investment we have to make in Water On Demand in 23 and 24. And of course things really take off in 25 and 26 with the addition of Water On Demand.

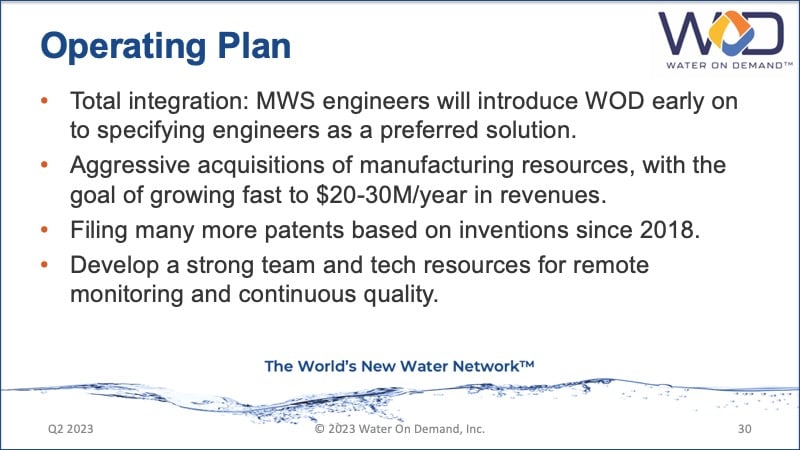

So total integration. We're now going to be, and this is really important from a marketing point of view, we're going to be adding Water On Demand early into the specifying process for Modular Water. We're also going to be acquiring fabrication companies, which is very, very important. More patents are going to be filed and develop a strong team. Et cetera.

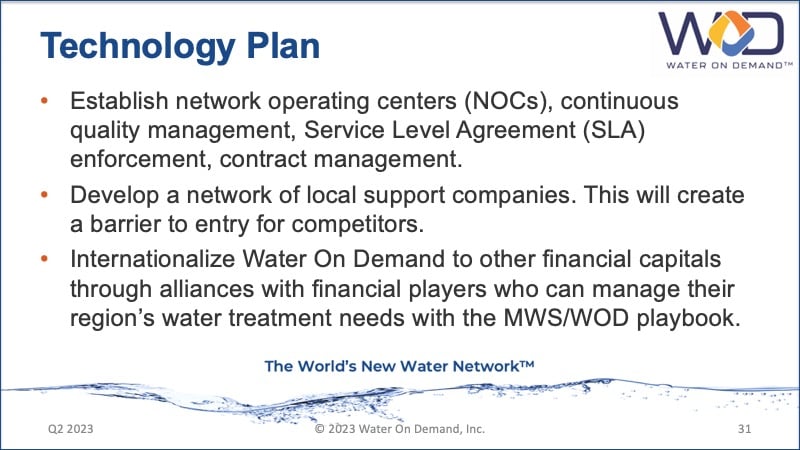

We need to have network operating centers, local support companies and internationalize Water On Demand to other financial capitals through alliances with financial players. And so that will create more clusters of Water On Demand throughout the world without us having to build them out. All right.

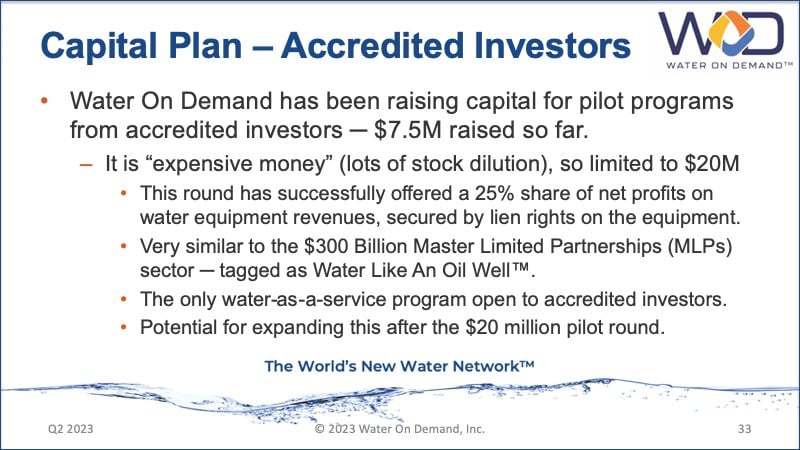

Now, as you know, we've been raising money for Water On Demand and we have an OriginClear round, which is raised about $7.5 million because it's very generous. We've limited it to $20 million only and after that we don't do it. It does offer a 25% share of net profits secured by lien rights in the equipment, very much like Water Like an Oil Well™. And it's the only water as a service program open to accredited investors. And it could be expanded after the $20 million pilot round. But we will have to see.

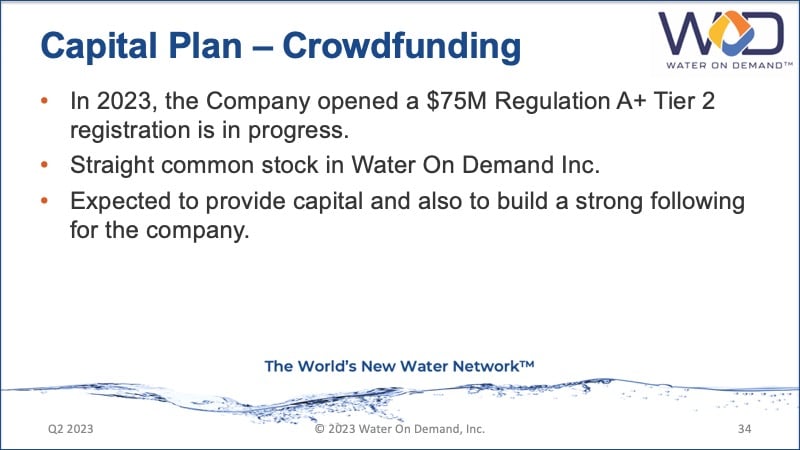

In 2023 the Company opened a crowdfunding round and this is actually in a preview, limited preview right now, because certain things which I can't discuss will cause it to pause at the end of this month, but it will restart. All right.

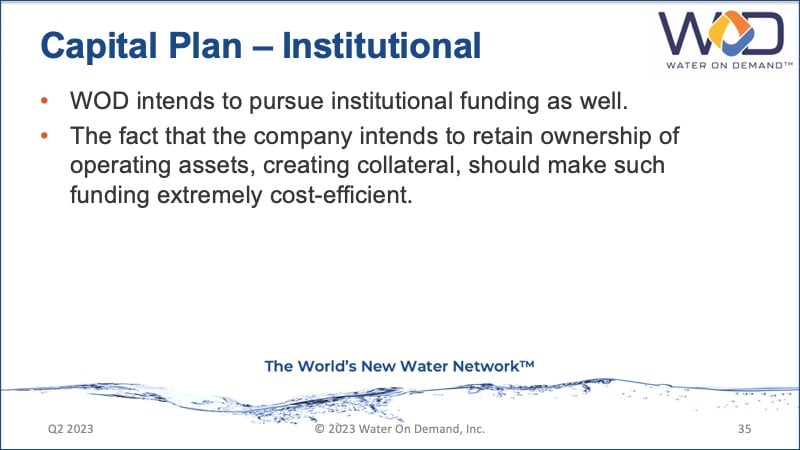

And finally, of course, we'll go after institutional money and it will help the fact that all these assets that we put out there in the field, we retain ownership and it makes it much easier to raise money against them on an efficient, low cost basis. So it's a very good financial model. All right.

Team

And, of course, the team is composed of myself and then Ken Berenger as the EVP and co-creator of Water On Demand, the Amazing Dan Early, chief engineer and Prasad Tare, our CFO, and a new arrival, Colin Sherman, operations manager, who has. I'm going to get him on the show and have him talk about his experience in a multi-billion dollar Sydney transport system, which he was very effective with. He's doing a lot of good right now, figuring out our job costing, which is complicated. It's for Modular Water. So that's Water On Demand and we're very proud of where that's going.

And here's Ken presenting Water On Demand. He was just in New York. And so let's see what he's got to say.

Start of presentation

Ken: Hi, I'm Ken Berenger coming to you from the Nasdaq market site in the heart of Times Square. If you're an accredited investor and the idea of being in front of billions of dollars of pre-market money ahead of an asset class that has $1 trillion existing market, if that's not for you, keep scrolling to the next ad. But if it is for you, come inside the studio and I'll tell you more.

What can we be involved in that can really grow and protect us in the future? Well, look, here's the facts. While we were out selling before the next bubble popped, $1 trillion market was being eyed by professional money. Now that market is water. Now water. Think about it as a commodity. If it's done right, it could trigger the biggest wealth creation event of our lifetime.

Now we think Water On Demand can do just that. So here's what it comes down to. If you're an accredited investor and you would like pre IPO pre institutional pre smart money and you want to find out how more how that could work for you, I want you to click the link below and go to oc.gold/callken. Now if being ahead of the big money, if being ahead of the smart money isn't your cup of tea, scroll to the next ad.

End of presentation

Freewheeling Discussion

Riggs: Oh, yeah. Macho man. Macho man. All right.

Ken: Aye. We had our coffee.

Riggs: We had our coffee.

Ken: Coffee, yeah. You want another coffee, sir? I said yeah. I'll have another coffee. It was like talking to my wife.

Riggs: That's funny.

Ken: Yeah, I got to say, wow! For figuring that out like, three hours ago. Uh, Stephen, wherever you are, sir. Your name should be written in the stars. Um, that was, I mean, this thing was as raw as raw got, like, two hours ago, so. Really, really, really good. Um, we had a lot of fun.

Uh, you know, and we talked about those financial hubs, Riggs, you know, more and more as we spend more and more time kind of traveling into the financial center of the United States, I think our first main. I have a good for a reasonable suspicion that our first main financing hub for Water On Demand will be New York. Right. It'll be that, you know, kind of that East Coast Financial Center hub.

Riggs: I'm going to have to regular coffees. Regular coffees.

Ken: Right. Light and sweet. Exactly.

Riggs: Listen, we have some time. I have a really speaking of banking, I have a really interesting YouTube that I want to share, so I'm going to go ahead and do that. I was saving this because I had another podcast I wanted to run, but this is very interesting. Let's take a look. This guy is interviewing a banker called Rick Rule, and we're just going to go right, We're just going to cut to the chase here.

Start of presentation

Mark Moss: The dollar is under attack. From the United States? What the heck does that mean? Well, it means what it says. Is the United States dollar under attack from within? Well, my guest today, a living legend, is Rick Rule. And he says that it's not China and not Russia attacking the dollar. It's happening from within. So we're going to dig into the banking crisis. We're going to explain what happened.

Now, he started a bank, sold a bank. He started another bank. He knows what happens in banks. We're going to talk about the banking crisis. We're going to talk about what's happened in the investing market that's driven people and banks and consumers to this point. We're going to talk about what the, what the bank and what the governments are doing to restrict the flow of capital and keep it trapped in the system.

We're going to talk about the move from fiat currencies, how the dollar is dying and the move to commodity money is changing. We're going to talk about energy markets. We're going to talk about central bank digital currencies and even his view on bitcoin. We covered a lot of ground. This is an amazing conversation with Rick Rule.

Ignorance and laziness, I suppose, right, are the two things. But, so what do the banks do? So, the world changes and it seems like the banks need to change. Now, typically, competition would make the banks need to change. The banks haven't had any competition, and maybe to Caitlin Long's bank, the Fed has purposely kept competition out of it, but they don't have any competition. I mean, now they sort of do with the Fed, but it seems like they're going to have to offer me a better deal than what the Fed is doing.

Since the bank typically the model, I think most people believe that the model would be I give my money to the bank in deposits. They loan that money back out and make somewhere between probably I've heard it's an average of about 17% when you take high interest credit cards down to mortgages or whatever, and then they pay a percentage of that back to me. So should they be paying like, you know, short term Treasury yields plus a premium on top of that?

Rick Rule: I don't want to say what they should pay because I think that depends on what they do with the money. Banks that take more credit risk, which is to say banks that are making, as an example, credit card loans where there's an expected 6% default, should pay me more.

Mark Moss: Right?

Rick Rule: Banks, like Farmers and Merchants Bank of Long Beach as an example, that have a lot of their own money in very short term Treasury securities, that run very high cash reserves relative to their deposit liabilities, should probably have to pay me less. But, they should have to pay me something, particularly because there's so many banks out there that are solvent that will pay you something.

Pause presentation

Riggs: So that's, this really gets into the fact that we're starting to see some real interest rates being paid by banks and some other factors. And by the way, if I were putting money in a bank, I'd put it in farmers and merchants in Long Beach, which is in short term treasuries, as opposed to these fools who went into long term. But that's just me, I guess. Let me try and find this thing about gold that I was taking a look at earlier and see if I can get on top of that. Here we go. I think it's right around here.

Resume presentation

Rick Rule: I think that the US dollar probably is the world's reserve currency for a while. The biggest enemy of the US dollar isn't the Chinese, it isn't the Saudis, it's Congress. We're doing our very best to debase our currency. We're doing our very best to limit its ability to be a reserve currency by weaponizing the dollar and by the export of US values and politics across our borders. There is nothing that our "competitors" are doing to devalue the dollar that comes close to matching what we're doing to ourselves. And I think it's important that US, that US citizens, that generate real value from the US dollar as a reserve currency and the ability to export inflation is, as an example, understand the damage that's being done to the US franchise by the US Congress.

Mark Moss: Yeah, that's a good point. I've often thought about that. I mean, it's the United States race or position to lose. And so to your point, they're doing the most to damage it. You know, I know, I don't want to say I know, I suspect that you have a long term perspective. I know you're deep into gold and resources and so you must take the long view on this. Directionality wise, I mean, it just seems like that's the direction we're going in and they're only going to continue. It seems like, back to kind of maybe earlier, I said at the end of this empire, they start to squeeze and try to kind of restrict. And so potentially maybe, you know, what they're doing, having to print, for example, I mean, that's only going to continue. This is just the direction we're in.

Rick Rule: Maybe true, maybe not true. But why take a chance, Mark? With some part of your portfolio, I think you need to own insurance. You need to play defense. Gold has traditionally done well when investors were nervous about other forms of savings. So, let's look at the arithmetic of those other forms of savings. The US ten year Treasury, they pay you three and three quarters in a currency that they acknowledge is depreciating in value by seven and one half percent.

Mark Moss: And that's understating it.

Rick Rule: One would be wise to be nervous about that, wouldn't they?

Mark Moss: Yeah.

Rick Rule: The second thing to understand about gold ownership today is the value proposition associated with longer bonds, from two perspectives. A large institutional investor who has 40% of his or her portfolio in long bonds has two problems: The first is that as interest rates rise, the capitalized value of their distributions, which is the bond prices fall.

Mark Moss: Yeah.

Rick Rule: The second is that the yield is insufficient to make up the actuarial assumptions that will provide for the benefits of those pension funds 20 years from now. What that means is that I think we're going to see disintermediation from long bond portfolios into other asset classes. One of those I think will be gold.

The most important part I think of the case for Americans owning gold is that it's under owned. Precisely when the wind ought to be in its sails, the market share of gold is one half of 1% of total savings and investment assets in the United States, the four decade median is between two and a half and 3%.

Gold doesn't need to win the war against the US dollar. It doesn't need to win the war against the US Treasury. It needs to lose it less badly. If the market share of gold merely returned to mean demand for gold would increase by 4 or 5 or 600% in the largest savings and investment market in the world. That I think, is the case for the gold price. 100% of your net worth, of course not, but more than half of a percent.

Mark Moss: Yeah. What does that, how does that stack up to India and China, which I know the people buy a lot of gold in those countries.

Rick Rule: I don't think that the statistics exist.

Mark Moss: Okay.

Rick Rule: One of the reasons why the US dollar is the world's reserve currency is relative to other countries. We're pretty transparent. The data exists. It might not be good data, but at least it's data.

Mark Moss: Right. Yeah, and of course you have to keep in mind that gold is a global asset. So, you know, Russia's central bank doubled their reserve requirements for gold from 20 to 20 to 40%. And so those are big, those are big demands for gold as well. We see, I think it was Turkey, was one of the biggest buyers of gold. So there's massive amounts of demand all over the world. What would you say to the fact that since 2011, the money supply has gone up by about 50%, yet gold's price is the same?

Rick Rule: Well, a couple of things. I think that we live in a very benign time. I think the fact that we've lived through 40 years of benign economic climate means that the Fed has been able to counterfeit without people taking refuge in gold. I also think that while markets are messy, they ultimately work. And I do believe that as long as we have negative real interest rates, which is to say as long as the rate of inflation is substantially higher than the rate of the long US government bond yield, that we continue to compress the spring for gold.

I'm in the odd position, Mark, of owning a lot of gold when a financial planner would tell me as a consequence of my other investments, I probably didn't need to own too much gold. But it allows me to sleep nights and stay calm. Um, which as a 70 year old is a very good thing. I suspect that the statistics will tell you, given that the market share of gold across the length and breadth of the country is one half of 1%, that other investors aren't as well invested in gold as they should be.

Mark Moss: Yeah.

End of presentation

American's Owning Gold

Riggs: I think this is about as much as I want to cover about this because what's, what he's basically saying is that there's been a great deal of reliance on long bonds and the reign of the long bond is coming to an end. It's clear. So what does that mean? It means that commodities, other asset classes are going to benefit tremendously. He is, he likes gold, and I do too. I think it's brilliant. I think we should all own more gold. We are as Americans, we are very complacent and we are not owning enough gold. So that's for sure. I mean, I don't want to make less of that.

Pioneering a New Asset Class

But at the same time, it also says that there's going to be a general move towards all asset classes and that this is going to benefit one that to date, we have been the only ones really making this point in the marketplace. So we're a pioneer. We're first to market saying, hey, water is becoming a commodity, an investable commodity, and that's a huge deal. So with that, we're going to, I think, see a disproportionate benefit from the adoption of water as a commodity.

Ken: And what did he say? They need to find a new asset class, I mean, you know, and it's just so serendipitous that we've happened to have developed one.

Riggs: Well, yeah, I mean, it really is because, you know, we looked at water and like what we as a relatively small company can possibly do to change this huge mammoth business. What can we do?

Ken: The Leviathan, right?

Riggs: Yes. Well, what can we do? Well, what we can do is find the points of leverage. And the primary point of leverage, as we've discovered, is capital. Not only can you do a lot of projects with capital where you are, but you can create a capital network. And that's what I got into in that presentation briefly, the creation of Water On Demand networks. And now we're doing financial networking and over time it's going to become sexy. And the day may come when we come back to a water coin. However, we leave that for now.

Now, I've had a lot of comments in the webinar chat about Water On Demand, for example, Marcus Walker wants to know when Water On Demand will be trading. Okay. So I'm just going to explain something very simple. We have a couple of ways that Water On Demand, obviously there are plans because we're an incubator, it's where we're going. This is going to become, we believe, a very strong public company. And adding Modular Water Systems to it, I think just made it incredibly sexy and exciting. One path is the crowdfunding, regulation A.

Now, we are not permitted to say that we are going to be going public through regulation A. That's not allowed. But I can say that it is a legitimate path for going public is via regulation A. And the second thing is, of course, we have an announced letter of intent with a Nasdaq Special Purpose Acquisition Corporation, which is already on the Nasdaq. And about that, I can say nothing more. So those are the two things that if you want to know more, then you're going to have to get under NDA with with Ken, because we are out of of disclosure. We're done.

About US Currency

Right. Um, what I found very telling is, is you and I. Six, eight months ago, a year ago, we're jumping up and down about the, the destruction of the US currency. And it was very interesting and we you know, forget China, forget Russia. This is all about. Um, as he said, what America is doing to its own damn currency, right? It's frightening, you know. They're talking about, right now the national debt is 32, 31 or $32 Trillion. You know, $1 trillion among friends, I suppose. Doesn't matter.

But the current budget that they put forth, would put us in ten years. At over $50 trillion. So within, Yeah, I know, right? So within I think it's 2 or 3 years we will be spending more on paying the interest on our own debt than our own national security. So this, you know, whichever side of the aisle you're on, knowing, you know, everybody who runs a household knows if you owe way more than you can ever pay back, that's a problem.

Okay. So the truth is, the very wealthy, they're not going to stay in cash. They're already buying up, you know, they're buying dirt, right? They're not buying high rise offices because that's kind of a toxic market right now, right? We know about the the massive foreclosures in those. But they're buying raw land. They're buying individual, individual single family homes. So this is an asset.

So being able to deliver an asset class that will be able to face off against inflation and not just survive, but, you know, as I, as I do on my Tuesdays and Thursday nights, get the guy on a ground and pound, is something I think is going to be irresistible. To, especially to smart money. You know, we've talked about, you know, accredited investors. So, accredited investors are kind of your average affluent fella who generally gets to be involved in situations kind of after The Street has already had their fun with it, you know.

The fact that we've developed this in such a way, that folks can get involved before the smart money, but the reason we do these briefings, folks, is because, quite honestly, we're showing you that the handwriting has been on the wall for a long time. They're now saying the quiet part out loud.

They've been saying out loud now, what Riggs and I were saying a year ago. Now, are we, were we ahead of the curve? No, I think we were just voicing what was obvious to a lot of people earlier on because we were developing this new asset class. So once again, I've often said we have an angel on our shoulder. I think we've developed this at a really incredible, incredible time.

Full Interview

Riggs: Yes. And I want to share a screen just to show where this full interview is because I think it's really valuable. Rick Rule gets into discussing crypto. He gets into discussing CBDCs. And you know, central bank digital currencies will be used to cure the whole problem. Quote, unquote. Jean Tully says, "$90 billion to service that debt per day." Well, guess what? When it's all digital, who the hell will care? Right?

So right here, Mark Moss's channel, Um, which is fairly specialized one, it saw 94,000 views for this from Rick Rule and he will actually review your portfolio for free, your precious metal portfolio for free, and yeah. Here, your personal grade right here. So if you if you go here and click on this, you will be able to get a personal grade of how well you have been managing your resources. Anyway, so, just wanted to be helpful to everyone on that. And now Estrella must be having trouble because she's on the host list.

Ken: Yeah, I know. I see her, but I don't see her.

Freewheeling Discussion continues

Estrella: Hi guys. How are you?

Riggs: Good. Well, we were starting to worry. It's like, Wait a minute.

Ken: You're still just voice in the dark.

Estrella: I'm here. But I'm not only here, I'm also on social media letting everyone know what is happening. I've taken tidbits of you talking. I got the the Wall Street interview on here. It's just letting people know. So although there was a glitch in the system, we're one step ahead.

Riggs: Fantastic. Well, then, because people need to catch up and watch the replay, there's a link for that that you can share. And I'm going to go ahead and put it in I guess the chat. Yeah.

Estrella: Awesome.

Riggs: So. www.originclear.com/briefing-replay?1. The question and the one resets it for the new show, not the last show. So that now this will show basically people should just look tomorrow morning because Kevin publishes his stuff overnight. I'm terribly sorry for the glitch that we had tonight. We had a continuing series programmed in, we got complacent about it, and then all of a sudden it ended. And that's what happens when you're complacent. Funny things happen. So but believe me, I'll be looking at this for sure. So, thank you everyone for coming. Thank you, Estrella, for being the... Shaking the rafters while we're here discussing this.

Estrella: Of course.

Riggs: We, I'm feeling more and more excited about how, you know, we're part of this trend away from currency based finance to commodity based finance. And we are going to be, as Ken says, we have an angel on our shoulders. So. Thank you all. Thank you, Estrella. Ken. Great, great trip you did to New York. We're getting a bunch of material coming in. We got Ken to, while he was on the set at Nasdaq, to turn to the camera and ask a series of searing questions that we used. Like. I don't have them yet, but I'll have them.

Ken: Inquiring minds want to know, right?

Riggs: Yes, he had full impact. It was excellent.

Ken: More to come.

Riggs: More to come for sure. All right, guys, thank you so much. A pleasure seeing you. And have a good night. Let's have some fun.

Ken: Good night.

Estrella: Awesome. Good night.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)