We more than covered the crypto news — and it really IS moving fast! But what about Water on Demand really taking off... Is there a way to jumpstart it? And did you hear about the sweet spot?!

Introduction

Riggs Eckelberry: Welcome to our webinar, The Water is the New Gold CEO briefing. Our mission is to transform the water industry.

Dan Early: Decentralization offers us this opportunity.

Rod Turner: The plan that you've built here is super impressive.

Investor Ken: The world is experiencing a crisis in regards to water. It's a great opportunity that you are giving us investors.

Investor Larry: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Riggs: Hello, everyone, and welcome to the CEO briefing. We're testing a new open and that's basically because we're exporting this to an audience, to these recorded webinars will be repeating them and these people will not know what hit them. So this is kind of the first draft of history, shall we say. They'll be. It's kind of the Mission Impossible theme, right? So that's how this starts out. I'm going to go ahead and start the actual. Thing is can be a little bit fuzzy because I go straight into a video.

So, Water is the New Gold, of course, "Helping you thrive in the world's ONLY vital, scarce and recession-proof market." And here's that famous coin picture that's being seen all over all over Facebook these days.

Remember that you can always listen to Spanish. Heather is doing a wonderful job of giving life in the Spanish language to our presentation, and I appreciate it.

The Safe Harbor statement, of course, says that we do our very best to tell you how it is now.

On Wednesday, yesterday I was on the Nick Bogacz show. Nick is basically a self-made, small business story success story. Now this is a podcast, so it's radio only, but I did a grab on my computer. It's very rough. It's got sink issues, but I think the content's very good and it's worth listening to. So let's jump right into it.

Start of presentation

COVID Hits

Riggs: And early in the first quarter of 2020 and then the COVID disruption hits and we're like, OK, you know what? We'd better do this right, and that's because all investors went into fear. They went from greed to fear and they went, Oh my God, what's going on? And we had to make sense, and we had to recognize that our slow growth model was a slow growth model.

And what it was was simply. Trying to build systems is fine, but it takes forever, and we had like, you know, I don't know, 40 plus million dollars worth of of quoted systems sitting there of people. Yeah, I'm going to go with you. I'm going to buy a system. And they would take years to come around. And so we had this big, big asset. That had drained all the staff time to build, but it wasn't being monetized. And that's when we went wait a minute.

It's the Money Stupid

Eventually we had this realization. It must have been about 11:00 at night when somewhere in March when we realized it's the money stupid. What if we made it so that all they had to do was sign a piece of paper? And we charge by the gallon. So, you know, like like Microsoft charges us for Microsoft Office, but in this case, literally every gallon has a has a bill attached to it.

Water on Demand

What if we did water as a service and it was an epiphany, it was like, my gosh, and our ability to raise money as a as a penny stock turned into a real asset because we know how to do it. And so now we began to work and what we now call Water on Demand, which is basically a water managed water as a managed service. And that is what we've started to roll out.

Finally, and and what's weird is that our base business, the one that was so just constipated, has actually blown up as well. It's totally ironic and you know, we're sitting in a great place with that. So the basic business has finally taken off but, we still don't feel it's enough.

Now Water on Demand is great because it's a pure money play. If I've got the capital, because it requires capital to build the systems, to put them out on a service contract? Well, if I've got that ability, then I don't have to just rely on my center in Texas. I can give the job to an Atlanta water company or anybody else because I'm the the entity that's actually doing the capital side and billing and returning monthly annuities and so forth.

Managed Services

So I think it's an exceptionally strong model and it's we're easing into it by raising the capital for it and learning how to do that, managed services, which is very high tech, right? And of course, I'm in my element there now. The water industry knows water as a service. It's an obvious thing, but they've always done it for very large installations like desalination for an entire island. Nobody's been doing it for local businesses.

So quarter million dollar, half million dollar, million dollar systems. Nobody has done them as a service. There's one small private company that does a good job of that. But aside from that, it's been kind of a wasteland, primarily because the big water companies, it's too small for them, right?

And there we get into the problem of legacy companies like American Water Works, Veolia, et cetera, that are wedded to these big, big high ticket municipal deals and they're kind of being caught unawares. I think with the migration towards these small local cut, the cord type operations that are being built today anyway. That's what's super exciting. And then, of course, there was that icing on the cake with the coin, which is a whole other story.

Cutting the Cord

Nick B: More in the layman's terms. I guess as far as like what I'm trying to catch, what it is that you do with the clean water, if you can break it down a little bit more for me.

Riggs: Well, it's dirty water, right? So this is wastewater treatment. Remember that 80 percent of all sewage created in the world is not treated. It's dumped untreated. Now. That's not true in the U.S. we treat most of our water, but in places like Bangladesh, it's just dumped. And so we've got to fix the clean, we've got to clean the water.

So let's say you're a brewery and you're pushing out a lot of beer water. You know, beer effluent and local city won't take your water anymore. This is a very common these days. What do you do? You better start treating it yourself. You can't just dump it in the local river. And so that is creating an opportunity.

You know, there's housing subdivisions that are know because more and more rural development is happening. They are disconnected from sewage. We just fixed a trailer park problem in Alabama, where they just could not. The city would just not let them connect to the sewage. Just not going to happen. Well, what are you going to do? You got the poop coming out. And so that is what's happening throughout America. And I believe the world, but we're really focusing on North America right now is to make it possible for people to who have a business to treat the water.

Water Contracts

And that's where the financing comes in. Because if I'm a brewer, I'm capitalized to make beer and I make money from beer. I'm not capitalized to to spend a half million dollars on a water system. But if you tell me "Riggs, I would like, I would like to treat my water," and I hand you a 15 year service contract. You'll sign it. Problem goes away.

You'll pay more for that water system, it's very profitable for the water company, but you'll be happy. The problem is taken care of and you're only paying for the water if it's properly treated. So it's a Win-Win all around. And that is the future of water treatment in this country and I hope the world.

Nick B: For a fifty your contract?

Riggs: 15, one five. These systems can last 50, 100 years, but realistically contracts these these water. It's like, you know, these solar power purchase agreements. They are water purchase agreements, and these things are typically in the 15 year range. You're not going to ask a business to sign a longer contract than that.

Nick B: Ok, now if somebody could purchase a water system if they were just over capitalized, then we're just going to purchase our own half a million dollar water system. They could do that.

Sea Change

Riggs: You see, what's happening is water is going from a career that I'm in the water industry and I treat water to. I've got a business and I got this water problem. Well, that means I just need a black box that's serviced that just takes care of the problem. I'm not making water my business.

And so that is really a sea change in water, where people just need the problem to go away. And it's been identified by a number of of think tanks in the water industry that this is the new trend. But the funny thing is, is very few people like you even know that this is going on. Many people assume like, Well, you know what? The city is taking care of stuff, but increasingly it's not.

A Rent-A Center Model

Nick B: How much money would you make of a contract for 15 years compared to just letting them buy it outright?

Riggs: A $20 million water equipment fund such as we're building right now generates over 25 years half a billion dollars in revenues and pushes about $135 million to the bottom line for us. That is better than selling $20 million worth of equipment. So the annuity is what's important, and Wall Street loves these long life cycles, right? So it's very good.

We have an ambition to get on the Nasdaq. Here's what's great. When we put these machines out to work, they remain ours. They remain our asset. And Nasdaq wants to see assets. Well, you end up with that $20 million of equipment fund that's generating the revenue, this 20 million dollars worth of assets that you still own.

And the beauty of it is we are, ours are modular. They roll in and roll out. If the client stops paying, we just take it back. So it's more of a rent to center model, which is what we do with everything is what we do with, you know, renting offices is what we do with software. It's really the way things should be done and it's what you expect, you expect to do with the municipality, you expect to just pay on the meter. The problem is the municipality increasingly is not doing its job and now it's dropping down to where you're doing it yourself. We're creating, in a way, micro utilities.

Is Crypto Like the Internet?

Nick B: Are you seeing similarities between the internet and what's going on with cryptocurrency now?

Riggs: So here's what I believe is happening. We know that the the finance system is pretty wrecked and getting worse. The U.S. dollar, I think, is going to continue to be in trouble. But because we've got a parallel universe of cryptocurrency that's being built out, I think we will avoid the worst of the hyperinflation.

We will not end up, in my opinion, with a Weimer style hyperinflation. Why? Because increasingly, people, businesses and investors will take refuge in crypto and just come out. You're going to pull out a couple couple pieces of, you know, fractions of bitcoin and pay the rent this month. That's whats happening in Venezuela. Right now, they're surviving with crypto, right?

So more and more, it's going to be, I think, a life jacket without a currency being an honest currency. And isn't it ironic that bitcoin is an honest currency? But it is because it's limited. It's it's got all these safeguards that it's actually, you know, got more long term value. So what I think is that you're right, it is it is like the internet was to the legacy world of, you know, telephone systems and so forth. It is. It takes money. It abstracts money out into something that is virtual is take.

Global Water Marketplace

Well, I tried doing a coin back in twenty eighteen. It didn't work. Why? Because at the time, we couldn't figure out how to attach value to a gallon of water. Well, now that we have water as a managed service, every gallon has, is monetized. And now we start trading that and eventually you get a market.

Now it's going to take time. It's not something happens overnight, and it's certainly not the core to our business model today. But I believe strongly that water deserves to have a marketplace because think about it, there is no global water marketplace because water is local, you're not going to carry your water from Atlanta to New York, it's too expensive.

But that also means because his lack of a marketplace, if you stuck with really high water rates in Sonoma County, you can't hedge your bets with Singapore water. There's no there's no way to buy options and whatever, right? So in the future, I believe that a water marketplace can occur, but it's going to be a digital digital marketplace, and it's going to be, I believe, on the crypto layer. So that is where things are going. And I think it's going to be very healthy for water consumers all over the world.

Dual Token Environment

Nick B: The technology of blockchain, you're more interested in creating a a marketplace for water coin or water in general. Is that fair to say?

Riggs: That's fair to say. Basically, it's a dual token environment. One is a simple wrapper for those monetized gallons that's called $H2O™, and that's a pure investment product. And on the other side, we have something called ClearAqua™, which is a community coin that anybody can own, and they can make small amounts of money by hey, alerting,

Hey, guess what? There's a problem in Fort Lauderdale with a sewage, whatever, and they they send the alert up, and then the alert turns into a proposal at a higher level and eventually becomes funded. So our idea is so many people want to help with water, and they have a limited set of options and this is a way to get everybody involved. It's kind of Kumbaya, but at the end of the day, participation is key.

People need to feel that they can have a say in what happens to the quality of water in the world. More people die from water than war. And you know, there's all kinds of bad stats. Well, now you can do something about it. So it's a good futurist kind of thing.

I run it entirely out of my office. I don't want to distract anybody in my company with it because it's kind of, it's real, but it doesn't have applicability yet to our business. So we're making the investment. But really, where we're at is this managed services for water.

Crypto Potential

Nick B: Was there a point that was provided that you realize that this was something that's going to have a long term state kind of based off of your past experiences?

Riggs: I had this epiphany when a friend of mine, Alex Lightman, who's a big influencer, it turned me on to it. So it's these alternate alternate coins and fall of 2017, and I put some money in one of them. The money quadrupled. I was like, What's this all about? It's just kind of went nuts, right? And I realized that there's something going on here, and I the more I got into it, the more I realized it had potential.

So my realization in 2017 propelled me to do a coin way too early in twenty eighteen. Called WaterChain™, and but it was, you know, that was our MySpace, that was our learning experience. And now hopefully we're doing the next generation.

Nick B: I wish you nothing but success. I had a really great conversation with you. Thank you.

Riggs: Well, it was a pleasure, Nick. Thank you. And Jason, stay cool. And I look forward to seeing this come out.

End of presentation

Chats

That was astonishingly bad sink, but I was like, you know, it's like those Japanese movies where the guy talks, talks, talks and he goes, No. So but hopefully it told the story kind of what's important, what's happening. This is literally, as of yesterday, how an interviewer kind of distilled our story. So very, very good context here and a good background.

I've got some chats showing up here. Let me see who's saying here. What from? Ulugbek: "What an incredible idea to save water in the long run. The coin idea makes a lot of sense." Well, thank you so much. But look back, I appreciate it. Anybody else want to say anything? Just speak up. But in the chat window, if you raise your hands, I'm not going to do anything about it now. Let's continue here.

Blowing it Up!

All right, let's I'm going to bring on Mr. Ken Berenger. Ken and I have been doing dangerous things again. Here we go. We're making trouble. making movies on location. And as you guys might know, we have something called the Water on Demand offering, right? And it's a huge offering. It's the three hundred million dollar total offering. But we decided to make the start with what we're calling the $5 million club. Now that's important because. Let's let's imagine five million dollars put to work with water equipment that's paid up front.

So it's an immediate stimulation to our business with cash because remember, a month ago, two months ago, we did a five million dollar deal, but it's going to be paid over a period of two years with various three power plants. It's a whole thing well here because the money's coming in and being coming in from investors. It's literally being put to work to build water equipment and sent out to end users who start paying on this service contract. It is our dream. So instantly it blows up our business model. Instantly, it just makes it happen.

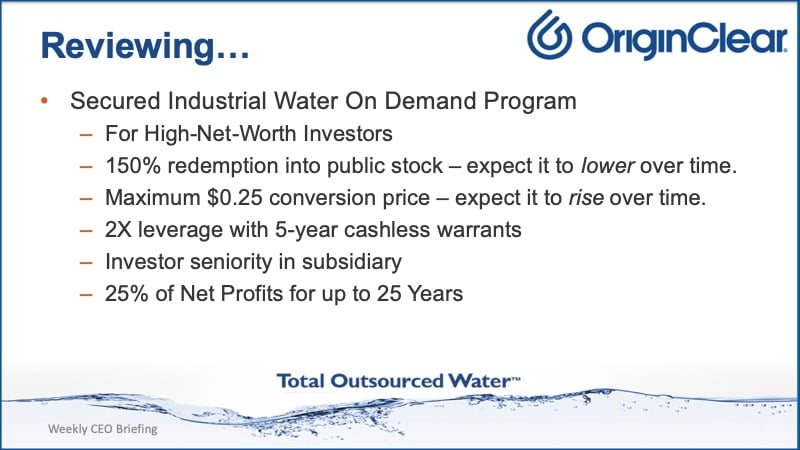

Early Adopter Benefit

So I'm going to review quickly the the model. Which is. This is what we call the Water on Demand program is for high net worth investors and. There's a couple important parts about it, because it's so huge because it's 300 million dollars, it's going to start high with redeeming your investment for one hundred fifty percent at the time you are ready for it. And then but it will low over time as it gets filled, we will lower that multiple. So it it benefits people to come in early, right?

Price Protection

And also this maximum conversion price, you see, the redemption to public stock means you can you're kind of protected on the downside because you're let's say that you invested at 10 cents and when you redeem your stock, the stock price is five cents. Will you get twice the stock to make up for it? So that protects you on a downside.

Conversion Cap

But then on the upside, what about, you know, being able to convert on the, you know, let's say that the stock goes to a dollar and you didn't convert? Well, now you're getting you've lost a lot of opportunity. So we guarantee that the conversion price will never be above twenty five cents. That will rise over time. So let's say when the stock does go to 50 cents or a dollar, the conversion price will rise to right.

Cashless Warrants

Ok, so. Then. Very important five year cashless warrants with two hundred percent coverage. That means, let's say you invest $100,000, you get one hundred eighty thousand redemption to public stock at the time you want it. So you've got that protection it converts at that price no higher and you get up to $200,000 in leverage and it's cashless, which means you can use the warrants to pay for the warrants.

Security Plus Profits

You have seniority in the subsidiary. What does that mean? That means that the water on demand subsidiary you invest in. If there is a default, you can seize the stock in that subsidiary and own, thereby own the water equipment and you have this protection. And finally, twenty five percent of the net profits from this, which are going to show you shortly. All right. So that is what that's about now.

Jumpstart for Water on Demand

There is a secret sauce. Let me see if if my main man can is able to join me because. I'm hoping that you can, but if you can't understand,

Ken: I'm here, I just I can't activate my camera, but I have a great face for radio, so this is good.

Riggs: It's totally fine to do it. Don't hate me because I'm beautiful. I'll be the one on the video. And and so can what we've been putting together. Here is a a jump start for the Water On Demand program because we've identified that we have investors in the company. I'm making the table shake. I apologize. I'm just going to move. There we go. We have investors who are ready to go. And so there's a benefit and this is the secret sauce part which I'm not going to actually talk about. I'm not going to disclose the secret sauce, but there is a secret sauce.

Ken: Otherwise no soup for you.

Sweet Spot

Riggs: Exactly. There's a hidden feature in the offering for multimillion dollar investments of first sweet spot is $5 million. So. The idea is, is that we're putting together a consortium of investors, right, that who will basically be a virtual $5 million investor to benefit from that sweet spot. It's very, very nice and we're working with trusted investors for this because that's kind of how how we're doing it here.

Because. In a way, if you've been a long time investor in OriginClear you've done well, if you've listened to Ken Berenger, you've done well now. But it's still paper gains, so how do you make those gains real? It's by making the Water on Demand program work, and I'm going to show you exactly what that means.

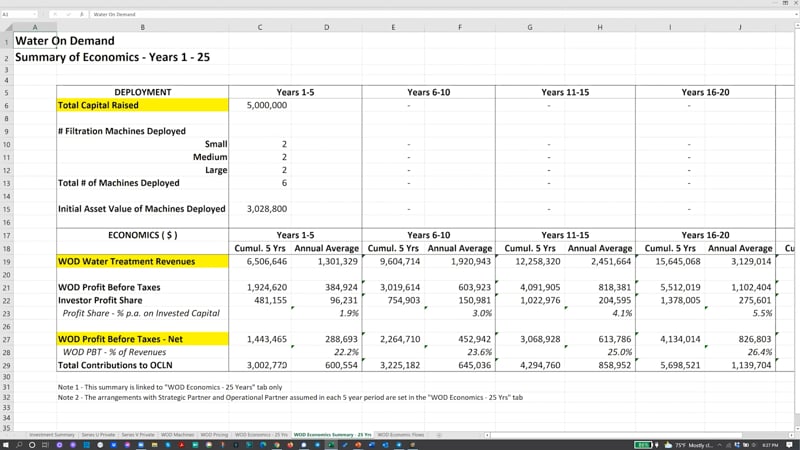

What Happens at Five Million Dollars?

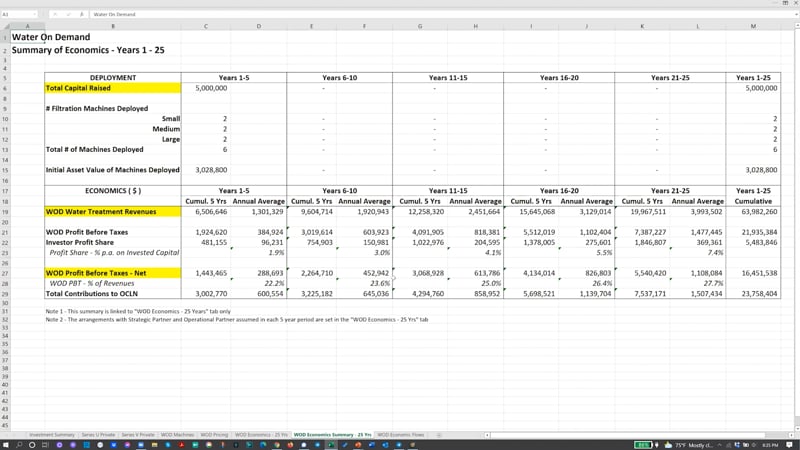

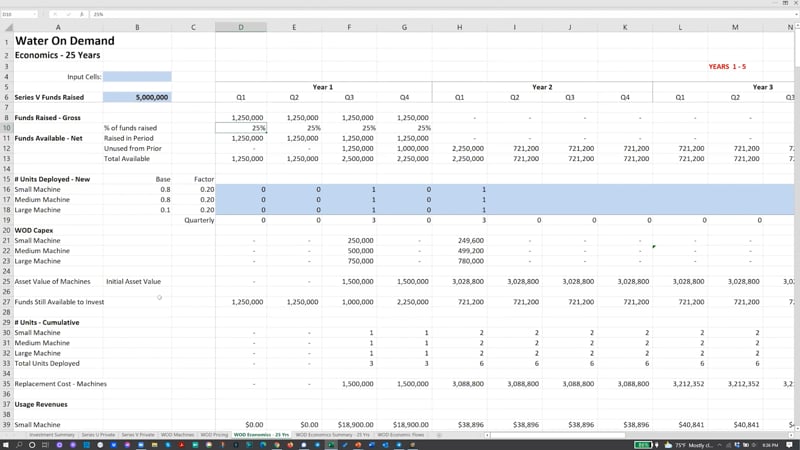

All right. So I'm going to flip to the spreadsheet now, and let's see. Let's take a look at a $5 million offering a capital raised. And so I've downscaled everything. And so you get x number of machines; small, medium and large. Now what is that? What does that mean? Small, medium and large? Let's let's take a look at these machines here. A small machine is 10,000 gallons per day. Medium is 30,000 and large is 100,000. We've kind of pushed the limit here.

We've kind of figured it up, as you can see. And that's because it's more efficient to do larger machines. They're still relatively small for the water industry. And then you look at the pricing, you get the average throughput, the price from or OriginClear in Texas to actually build it and as a discount, et cetera, et cetera. So these are calculations of what the expected market rates are for the per gallon. So this is all worked out. Inflation price adjustments, all that stuff is and also double checked against expected rental revenues and so forth.

Cash Positive at all Times

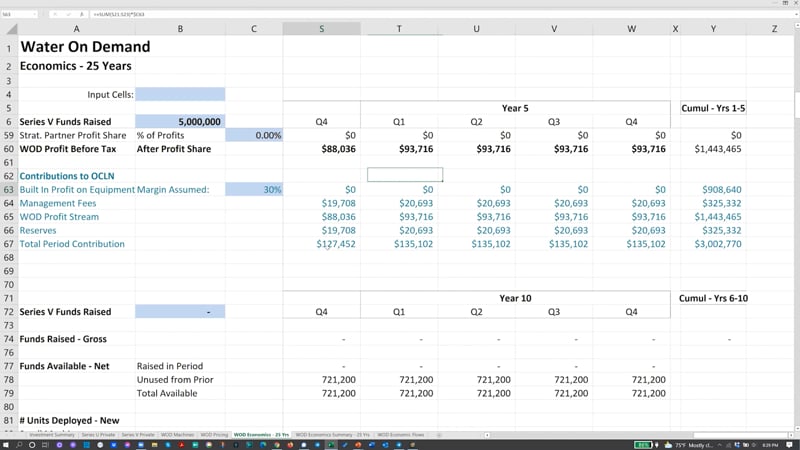

So it's all kind of worked out and we have an amazing analyst who's been working on this. Ok, so what this gives us then, is we're just assuming that all the $5 million is raised in the year one. Now we believe it's going to be even faster, but I'm well known for sandbagging, so I'm not going to tell you it's all going to be raised tomorrow, but we'll give ourselves a year to raise it and we'll start making machines in the latter part of the of the first year and a total of six machines. Which is actually very conservative only, I believe raising what are we? We're only deploying $3 million worth of machines. But by doing that, we're staying cash positive at all times.

So if we look at the funds available to invest, we're always actually left a little bit. And this is because you want to reserve now everything is paid for in this model. If you look down here, you will see and I'm going to make it bigger just so that people can see what the heck I'm showing. There we go.

Is all the operating expenses are in here, so whether it's us in Texas or one of our partner companies in Atlanta or California or whatever, this is paid for? So no muss, no fuss. And there is what's called SGA, sales, general and administrative, which are the various things it requires to run the operation.

Profit Shares

And then we have the investor profit share right now if we take a look at the investor profit share. Here we go five years, well, I'm going to go ahead to the summary. Here we go. And. We have the twenty five year total now who sticks around for twenty five years, right? But this is just like buying a house. Very similar. So we have against $5 million. The total rental revenues have been about sixty four million and against that we have the Water on Demand profit drops down to the bottom line.

And then we have the investor profit share. And finally, what is this? This is. Net of the profit share, what's left over and total contributions to OCLN, twenty three million. Now why is it more than 16 million? Very simple. We built the machines, right? We were not only running the machines, but we built them and so those got paid for. Now, for granted, you know, we have to take a look at what if we farm it out? We're going to make less money, but we don't mind at all about that. (Daryl, you need to do a chat because we don't do the raised hands thing)

All right. So let me come back here. So we come down here contributions to OCLN. There are. Um, is profit from machines built? Well, let's say there's zero percent because we had to farm it out. Therefore, that makes it. A lot less, especially over here, right? But it's still because of some of the management fees is still a fair amount more than the pure Water on Demand profit. So that's what this looks like, and it's very exciting. If we take a look then at the Series V offering. Let's take the person who committed today.

Series V Offering

Ken: Right? You know, we had a couple, but the one at the end of the day was the gentleman that so let me get. Let me give you the kind of the overview. What it occurred to me was that we have we've spent three years making sure that our original investors are in phenomenal shape now with their faith and our hard work, right? So most of these folks are up like one hundred seventy five hundred percent, two hundred percent in these paper profits.

So the idea was to be able to make that a reality and then kind of jumpstart what happens with our markets. So this a lot of investors have invested fairly heavily in the common stock, right? So you know, it's the high risk, high reward thing, right? But when I approached him about being an asset investor, you know, he he committed to doing more than he's ever done. He said, Yeah, OK, no problem. Right. Because he saw that this was first of all, he was placing control over the outcome of the overall investment in his own actions, and he was able to put his money into something that had a much, much lower risk, but a still comparable reward. Right.

So this was someone that over three years invested about $180,000, I think their account right now, if they convert all to common today, is about 393. So pretty good, right? $400000 in value, but only 180 eighty invested. And I said, look, we should start with one hundred thousand. And he said, Sure, let's do it.

Coming Launch

So I think, I think that the appetite has been phenomenal for it and we've got hundreds of investors that are in this position. So it occurred to me that Manhattan Street Capital is going to build this thing over the next several months, maybe launch it in February, March. And people who have not supported us for the past 10, 15 years are going to get first crack. Right?

Syndicate for Loyals

And I said, Well, that doesn't make sense. So what I want to do is I want to build a $5 million syndicate and put the people that have kind of took us to the dance in front of institutional investors. Right. Because generally speaking, that's a pretty good place to be. And the response that I had gotten has just been really, really good. Very excited. And they would be really, really happy that they're going to be part of... their kind of playing a major role in their own success of their of their long standing investment. That makes sense.

Long Revenue Tail

Riggs: There's no question that a $5 million, first of all, that drops, you know, at least three million dollars to the assets to the bottom line, it creates all these annuities. Wall Street loves the long revenue tails, as they call them.

Ken: And isn't that around $100 million long tail? I mean, doesn't that throw off about $100 million, just that little five million in that formula?

Riggs:And they show you, OK, right here. I went and broke it out. Summary. Here we go. So.

Ken: Total Water on Demand, oh, 63 million, OK.

Riggs: This is true because I had to adjust the number of machines, right? So. And so here's the beautiful part. It does. Twenty three million dollars, we're paying five, we're paying net profits to the investors more than what they put in. That's great. In addition, they get all the stock and all the warrants, right?

Ken: With with incredible leverage.

1200% Gain

Riggs: Right. Then there's $23 million that drops to the bottom line for OriginClear. So it's a very healthy business model. Now I'm going to come back to the 25 year issue, but let's take a look at the math here for our gentleman who committed today and so hundred thousand for him, when he converts, he will end up with, let's say, the stock is at well, I'm not going to say $8. It's kind of wild, but let's say, let's say we're right here at a dollar.

So he's now got $600,000 and he's doubled his money with. In this case, I'm using the cash option. He could use cash less, but the cash option preserves the maximum upside and then he gets $110000 again more than what he put into it. And so he ends up with 12 hundred percent, which is, you know, it's kind of OK, right? But because because it's secured, it's a secured investment.

Get Paid to Wait

Ken: That's about the same. Nobody, nobody just walks away from twenty five percent per year, plus all of that security. They just don't, right? Because what are you going to put money into right now as an asset play that's going to be richer than this without being at the whims of whoever holds office in that moment, right?

Not only that, but this is ideal for our our previous and the reason this is so attractive is see that $2 and $4. He can wait. You know why he's got six million shares of common that he's going to convert, that he's going to convert, you know, five cents. So, you know, it's some very modest multiple. He's already done very, very, very well, and this can turn into more of a long term portfolio performance for him.

Riggs: Beautiful. So now the the the other part of it, of course, is that they they have the security, which is super important, you know, for their investment. It kind of, you know, gives us this huge this huge bump. So that's key. Let me just see. So what happens with $5 million? That is the picture that's really interesting.

Where $H2O Come In

Now, the question about twenty five years, who wants to wait for twenty five years? That's where dollar H2O comes in. Remember dollar H2O, as I explained in that out-of-sync interview. And the reason is out of sync is because I was just grabbing it. It's it was. It's it's a podcast. It's a radio thing that they happen to do on Zoom just to see my face. But I grabbed it for you and it's out of sync.

But what it does talk about is is that the dollar H2O Coin is a wrapper for dividends. Imagine there's a there's actually an NFL player who put his contract into a coin. People bought it so that he got the money right away at a discount. Discounted cash model, right? Net present value. And then they got the future revenues. So you could take with this coin because we give you your your dividends are paid out to you. Just like that NFL player. And now you can say, you know, there's an informal market in these things. I'm not going to get into the mechanics of it, but literally, Coinbase yesterday announced that that they're doing exactly this kind of asset.

Ken: Yes, an NFT.

Riggs: Yes. And tokens, right? I'm not saying that initials, because then I'll have to explain. But nonetheless, these asset base tokens that have, you know, royalties built in, you can now buy and sell the royalties, right? That's the beginning of that water marketplace I was talking about.

Call Ken

And this is how our investors can can see some of that future revenue today, and they don't have to wait the 25 years. They can kind of lay it off into the future. That's what makes it super exciting. And you know, Ken you know who you're going to talk to. But if anybody is interested in hearing about it, who Ken is not currently planning to talk to just go ahead and schedule a call, oc.gold/ken and.

And in fact, email works just fine, of course, invest@originclear.com or reply to one of my CEO updates and they'll come to my inbox now I'm going to quickly take a look at chats here. There's been a bunch of stuff coming along.

PhilanthroInvestors Update

So a big update from PhilanthroInvestors® and I'm going to read it out here. Ivan is in Puerto Rico right now as I speak. We broadcasted OriginClear in the Mapable podcast in Vegas, broadcasted Water PhilanthroInvesting to two hundred people in San Juan in an event for entrepreneurs and crypto investors and presented to a potential investor to jump start the series, this Water on Demand. Excellent. So that they're doing a fine job and really, really, really great partner.

Chats

And Earl Dixon wanted to know, how can you get? How can I get a copy of this recording? And you will see in the in the chat window. There's a link, but also you will receive an email that says, Hey, here's the briefing replay. And if you don't get it for whatever reason, just go to the originclear.com. click on the CEO briefings and you will see the replay.

All right and J.R.W.: Good evening, Riggs and Ken hope all is well. Hope all is well. Well, things are amazing. We're really, you know, we're really kicking it old school.

Four Way Stack

Here's what I think. I think that we have positioned ourselves with this four way stack the basic engineered solutions that you know, you saw the sales booked sales triple so far this year. The Modular Water Systems™, which is prefab long life systems, the Water on Demand, water as a managed service and finally, the crypto. This four way stack is really what we call Water Company 2.0, and that means that we have the ability to own the small to medium marketplace out there, which the big guys are not doing, but that's where the growth is. And with Water on Demand, we don't have to build it all ourselves. We just handle the money part. And so it's a money play and that's what's so exciting about it.

This is why we're we're talking to my good friend Jamil in Puebla, who wants to do a $700 million project to fix the river there. And it's a whole thing I'm not going to get into tonight. But you know, if you can start flexing your muscles for finance that it's interesting.

Enlightened Self-Interest

So I'm going to start wrapping it up here, and I just want to say that please fill out the survey that comes up because we do read it. And as usual, I think you guys are the best, best, best support as possible because you're making it possible for us to do these things.

Do you realize that if we can do this, I don't have to go to Wall Street and get a registered offering because what happens with registered offerings? You raise the money and then they sell the stock. I could show you company, after company, after company. If they're not super strong, they get hit.

So instead of that, we have our own investors and doing these large investment syndicates enables them to do well. And we don't have to go to Wall Street and see the stock be hit. So it's the best of all worlds. I'm super excited about going. And Ken, yes,

Ken: Enlightened self-interest too.

Riggs: Enlightened self-interest. No question about it. It's it. Really, it's money that goes directly into these, these hardware systems. The investors are directly creating a self-fulfilling prophecy. They're investing in the asset-based revenue that's going to drive the success of the company. So all around, it's it's just really, really the way to go.

And then for me, the crypto is just a an unknown factor, as as I explained in the podcast, is something I'm doing out of my office. I'm not bothering anybody else in the company. And that way, it's an investment in the future. But we're building fundamentals and that's what's going to make it work.

Ken: So one quick comment on that. Just a quick comment on that. So so the crypto is this guy is exciting and it can be a masterful force multiplier for us. And in globalizing, that's all very, very possible and very, very exciting stuff. But what the street will respond to right now is assets is balance sheet, right? Adds $5 million tomorrow that will throw up sixty three million. You're a different company overnight, and that's why I was excited to start this thing the other day, and that's why I've gotten such tremendous response.

Riggs: Yes, I'm amazed by the response that you've had in the last few days, and I see that Ivan's getting the same response with his efforts, so, you know, I so think we're on the right path.

Thank you all for joining us tonight. It's been a great briefing as usual. I feel the energy in the room, even though I can't see you guys. But join me next week, I promise you another great update. So thank you again. Good night!

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)