The filing we mentioned isn't just big news — it's HUGE. Hint - It involves unbundling the funding of water treatment from the execution of water treatment... And could become a gigantic, legendary FinTech play! What does that mean for early investors? Find out in the replay!

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

And welcome everyone to the briefing. So it is April 14th already. Wow. We got this weekend. We got Easter. Briefing number 155 and we are helping the world invest in water. This is our breakthrough. And you're going to hear a lot about that today with the status of things. Karen Kirk is good. Thank you for that. So and it's stable and inflation-friendly and it's an asset class that has just begun its run. How exciting.

All right, then, quickly, obviously, we are constantly reassuring you that we try our very best to tell it like it is, but we have to qualify our statements. And we do have things that don't bear out as we expected, but we try and correct it as fast as possible. I think we've been very good about doing what we say and saying what we're doing.

The Wave

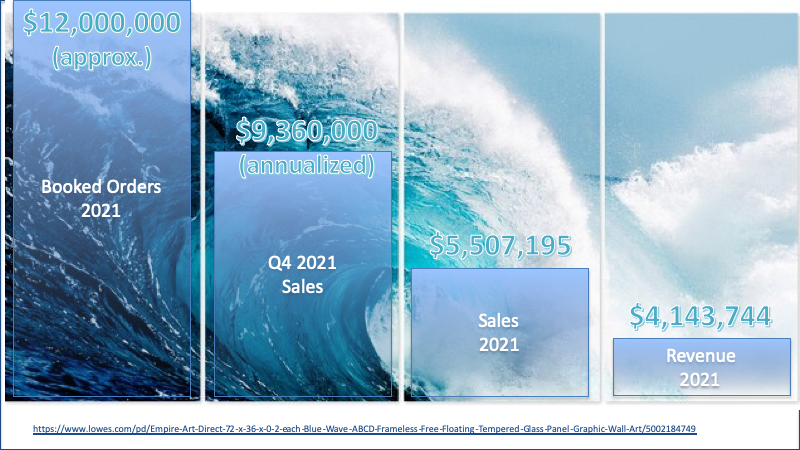

All right. So I did a little graph today to visualize our annual growth. And this kind of gives you an idea of where the company is going in terms of its ordinary business. This is not Water on Demand™. This is the selling of either standardized systems in Modular Water or engineered systems which are custom systems over Progressive Water.

So this is an interesting graph because it shows in a far right our 2021 revenue, which is basically flat as we reported last year that last week rather and sales were higher, about over 5 million, well over 5 million. And then Q4, it got up into the $9 Million range annualized. And for the whole year, the book daughter's was 12 million.

So I see this as a big growing wave that starts low and just grows, grows, grows, grows, and that is what's happening. What is the determining factor here? The passage of time. The team in McKinney, Texas, are nose down, tail up, in there, stoop labor. Oh, my gosh. They are working so hard and delivering as fast as they can. Cash flow is good, lots of business and they can afford to not worry too much about sales just now because they've got so much to catch up on and they really, in order to make their public happy, they have to do that.

Here's what's going on. They are actually turning away from low margin jobs. If it's not a high margin, they just don't bid it. It's a wonderful position to be in. And clients understand this. This marketplace is one where there's a a shortage of good, reliable hardware given all the supply chain issues and all the ups and downs of the marketplace.

So Progressive Water treatment and Modular Water are benefiting from a tremendous amount of momentum. And I'm so happy that they don't have to shave their prices that they can say, well, now we're not going to book a deal just because it'll give corporate a big number. And I'm happy with that. So that's just a good thing overall.

So with that, I'm going to run a video first is going to be the second part of that podcast that I played. It's just going to give some really interesting statements that lead up to our big announcement.

Start of presentation

Eric: Hey, everybody, welcome back to the Build Your Network podcast. Today's guest is Riggs Eckelberry. He's the CEO and founder of the innovative water technology company OriginClear. You know, it's almost funny reading in a bio like because you think about big tobacco and big alcohol and all whatever, all these different things we throw. And then you read like the big water industry, it's almost like it's almost funny reading like that. But are you getting a ton of pushback from organizations that already have this cornered a little bit? Like, is that been the biggest roadblock to making this something that is decentralized?

Riggs: No, there's a lot of excitement about it. And here's why. In energy, all the big energy utilities are fighting solar because it's revenue to them.

Eric: Yeah, right..

Riggs: In The water industry, it's different. They don't have, they're dealing with lots of rate problems. The municipalities are being mandated to reduce toxins and do this and do that. And and there's COVID has caused all this rural growth. So you have these tiny municipal systems all of a sudden being overburdened by yuppies, showing up and working out of their home office in rural nowhere. And there's all this disruption happening. They don't have the budget. Water rates are exploding and that's hard on populations. So they can't do it a lot.

And so they're like, okay, great, you're going to treat your own water and give us treated water. Great. That's fantastic. Let us know how it goes. Right. And so there's a lot of acceptance of that now in the water industry. I'm talking to companies that are like, Hey, great, you're raising money from investors. I got a project for you. Today, I spoke to a friend of mine who we worked with in the early frack days, in fact, and called him up and he said, "Riggs," I was still in a speed dial. And, you know, more than ten years later, he we're in touch again and he says, "I've got a golf course in San Diego, and they need what we call Blackwater recirc," which means taking care of the sewage without having to go to a sewer, in other words, being completely offline. "They need it and they are stuck for money. You want to do it?" I'm like, Yes, right.

So there's pent up demand for funding these projects. And we don't do we're not going to make you lease it or finance it. No, just pay for usage. Right. The same way. Know I took a picture this morning of, I was getting an espresso and the guy at the counter said, I said, "How much does this thing cost? Because I'm in market for an espresso machine." He goes, We don't pay for that machine. We pay by usage. And the thing is maintained and the coffee shows up and if it's broken, it goes away. He's a happy camper because he doesn't have to maintain the thing, right? Mm hmm. Now, is he paying more for that cup of coffee? Yes, but he doesn't have to worry about all these issues, about breakdowns and so forth.

So anything is a service, is the new new thing. That's just how it is. And so people are delighted to go like that brewery. We have a very, we have a competitor called Cambrian Innovations. It's great company. They're, they do a lot of work in Northern California with breweries. And they come along when these breweries are literally don't know what to do next. They're trucking their wastewater to another county. Right. And they go, "Here. Sign here. You've got your machine. It's all good. Pay us by the gallon." And the brewery goes, Ok, fine, they sign. It's so simple right now.

Cambrian is funded by VC funding. Which is great. But what we've chosen is to open it up to the world's investors, similar to master limited partnerships in oil and gas, where you and I, we can invest in an oil well and get dividends.

Eric: Mm hmm.

Riggs: Well, why not do it with water? And so what we're doing is we're doing a much broader and essentially building this this Water on Demand thing is inherently open, a democratic approach. And here's the interesting thing, Eric. Every single asset has been grabbed by the elites. We hear about, you know, Bill Gates owning all the farmland and so forth and so on. In fact, Jeff Bezos has more land than Bill Gates does. But that's, fun fact. But there and, you know, price of gold just took off and oil and gas took off. Everything took off. Water hasn't taken off. And we don't want to have one Jeff Bezos. We want to break Jeff Bezos into 10,000 investors. And it's still. Still lots of money, right?

Eric: Mm hmm.

Riggs: It's good. So we want middle class investors to benefit from helping water. Right. Isn't that cool?

Eric: Yeah, well, it leads to my question, which is, I mean, obviously there's a benefit there for businesses or organizations using it for those wanting to invest. I mean, what are you looking for in an investor? What's the what income range are you wanting for someone to be able to put into this? Because sitting here, much of what you said went over my head and I'm sure I'd have to listen a few times to put it all together. But for someone sitting there that goes, you know, this makes sense, I would like to find out more, get a piece of this, but I don't even know. Like, is this a $100,000 investment? Is this know half a million? Like, what am I putting into this? How can people find out more about that? What's the step someone should take if they're interested in what you're doing?

Riggs: Well, that was a great setup question.

Eric: Yeah, a slow pitch down the middle so you can knock it right out.

Riggs: Right? It's very simple. Just go to originclear.com and is a big green invest button on the top, right? Occasionally we have these offerings for unaccredited investors, but right now it's accredited investors. What's that? It means make $200,000 a year or as a joint investor, 300,000. Now it can be a spouse or cohabitant, but that's the rule. Or have $1,000,000 in net worth excluding your primary home. Those are the requirements. If you're non-US, it's not the same. It's much, much easier. Basically, if you represent your accredited, you come from non-US then we accept it. But if you're US, we have to verify that you are.

Nominally its $100,000 investment, but we were happy to take smaller amounts because what we find is that people tend to reinvest, they like the experience, they like those dividend checks. They're like, Oh, this is cool. And so we're not worried about, okay, you've proven you could invest 100,000, but if you only want to start with 20, it's perfectly fine. Not a problem. Now, if you're not accredited, then we are a public company ticker symbol, OCLN. It's a cheap stock. It's a penny stock. Feel free. It won't. It won't bankrupt you. Just jump into your little trading app and pick up some shares.

And what that does is, public companies, people think of stock price as being key. It's not, it's how much it is traded. Right. The the amount of trading volume is the key to how much of a currency you have as a public company. And the more people are invested, the more I don't even look at the stock price. I'm interested in how many people are stockholders, right? Because the more we have, the more it's a movement. And that's my opinion. For example, Tesla. Tesla made it because Tesla became a movement.

Eric: No.

Riggs: Right?

Eric: Mm, hm.

Riggs: It wasn't just Elon Musk. A lot of people believed in Elon Musk. And that's what made it go, right?

Eric: Yeah, exactly. Yeah. It's when it becomes people that are just passionate, rabid fans of what you're doing. I mean, Apple like I mean, you mentioning cults. I mean, Tesla, Apple. I mean, the people that support them, support them to the dying end. I mean, it is it is an incredible movement of people behind it. Yeah. Well, I really appreciate you sharing so much of this. And I know we have just a few minutes left, so I like to take everybody through a quick random round, ask a couple fast paced questions and let people get to know you just a little bit better before we close out the episode. First and foremost, do you believe that who you know or what you know is more important and why?

Riggs: By the way, before we go on to this, I love how eclectic this has been. It's been completely outside the box. So thank you. Really interesting. It's not my usual business podcast, but I love it. So thank you for that.

Eric: Yeah, absolutely.

Riggs: All right. Who you know and what you know. I'm a strong believer, having done the exact opposite, in apprenticeship. Learn the trade you're going into. I can't tell you how many times I've gone, "Well, I can do that."

Eric: Yeah.

Riggs: Eventually I worked my way through, but it's very costly to me. To the people that, like, "Sounds like a good idea, Riggs. But, jeez, you could have figured it out a while ago." So you learn a trade. I think that's the number one thing that one should do. Now, who, you know, does get you in the door, we know that.

But I think it's vastly more important to become really, really conversant with the space you're going to go into. And, you know, like, for example, let's say you're starting an Amazon business, really learn how to run that Amazon business, you know, and all the ins and outs of it and the cost per click and etc. and then it takes off. It's fine, right? The importance of who, you know, I think has dramatically reduced since the advent of technology.

Eric: Hmm. Hmm. I'm kind of curious on that front, because there's there's two different angles here. Like, one, it's good to educate yourself in improve where you are lacking knowledge in a certain area, but also in business, you can't learn every role, you know. So what's the balance between working to improve something you're not naturally good at versus hiring someone else to do it for you? Like, do you think there's should you try to have a basic understanding of every aspect of your company? Should you focus on learning the things that are aligned with your strengths and then hire out the rest? What do you recommend there?

Riggs: Well, I think that people who want to make it fast and with a lot of upside in business should focus on sales. Right. You can hire engineers. You can hire accountants. It's very hard to hire good salespeople. And I think that if you can master the transactional side of your industry, let's say you go, okay, I'm going to real estate. Well, you can again, you can hire a property appraiser. Right. But can you sell those houses? Right.

Eric: Right, exactly.

Riggs: You can do that. Then everything else is fine. So, you know, now it takes what? I don't know if you're allowed to say it anymore, balls. It takes a certain amount of gut to go out there and do it. But if you can do that, then you can you can bring in your partners and the technologists and so forth.

You know, I come back to L. Ron Hubbard. He had a saying, complexity is proportional to the degree of non-confront or simplicity is proportional to the degree of how much you've confronted something. The more you learn about, confront something, the simpler it gets. Something seems complicated. It's because you haven't mixed it up with it. You haven't gotten involved with it. And as you get involved, go, Well, okay, you know, this is not the end of the world. I can figure this out. You know,

I got stuck with the tax problem the other day. Well, I just. Okay, fine. I don't want to know about it, but I have to. And eventually it turned out it wasn't that complicated. So I think, you know, confront things that seem complicated is the way to do it. And of all business challenges, the one that people have the hardest time with, in my opinion, is getting out there and selling.

Eric: And selling solves the problems. If you can make enough money, you can hire the person that knows how to do it. At the very least. Yeah. What profession, other than your own, do you think would be fun to attempt?

Riggs: Well, you know, I. Personally love to teach people how to ski. So, okay, I could do that all day long. I love the dynamics. You know, because skiing is a physical activity, but it's also highly mental. And and you have to do all kinds of counterintuitive things. If when I get somebody, I do it as a hobby. My wife runs a tutoring operation and we take the kids to the mountains and and I teach the kids. But I love, you know, because people get this joy, like, wow, I can do this beautiful thing. I can fly down the mountain. Complete safety. How cool is that? So that's what I would be if I could. I would make a dime doing it, but that's what I would do.

Eric: There you go. If you could sit on a park bench with anybody past or present and talk to them for an hour, who would it be and why?

Riggs: I would say the most interesting person that I can think of would be Antoine de Saint-Exupery, the guy who wrote The Little Prince. Fascinating. He was a pilot. He was involved in the early days of aviation. The stuff he wrote down was probably 1/10 of what he went through it. And he had these amazing stories about night flight, vol de nuit, the night flight. You know, these pilots traveling in the middle of nowhere and sometimes disappearing and never coming back. In fact, I think this what happened to him.

So I could sit with Antoine de Saint-Exupéry for a long time and. And I would want to know what. What is it that you're still trying to figure out? Because he was so out there. And I believe the more out there you go. The more questions you have. And I'm interested in those questions.

Eric: Yeah, love it. How do you like to learn best? You mentioned reading, but what's your favorite way to consume new information?

Riggs: You know what? These days I have become a telegram addict, I must say.

Eric: Interesting.

Riggs: I have. Because it's the problem we have with conventional media is that it's so owned by sponsors and so commercially taken over. That is hard to say what's true or not. And I can tell you that the stuff on Telegram is just as crazy. But at least you have a chance to sort your way through it and figure out who's who and the, Jeremy, the person who owns Command Your Brand, that booked this podcast has a telegram channel and you know, I'm on it because he's kind of cool guy.

So I think that the new opinion leaders, new influencers are coming out of this interesting era where there were attempts by the mainstream social media to to quell misinformation. And I think it created a lot of, I'm not going to say whether that was right or not, it's a whole that's a whole other topic, but it create a lot of alt media. And we're in that period now where people are sort of figuring out what's what. And I think that we underestimate people's ability to see the truth. People do figure it out. If you give them enough information, don't try and pre digest everything for them all the time. I think that's kind of counterproductive.

Eric: Yeah, absolutely. Yeah, we could do a whole podcast upset on that censorship in general, but alas, we have to keep moving through. Give me a glimpse of your morning routine. What does that look like for you?

Riggs: I have an interactive rower. I'm a big if I could roll on the water, I could. I would. But it is what it is. So I try and get in my rowing and then I've learned that, get ahead of everybody else. Start, start lapping other people. Get way ahead of other people so you're controlling the conversation and email and zooms and whatever and that way... Because, I hate like, Oh, here's the next call. Oh, my God, here's the next zoom, here's the next. And I feel like I'm being overwhelmed. So getting ahead of it is where it's at. And then I do like to end up with a dinner with friends. I, I've missed that and we're coming back to it. Thank God we're back into that. Small groups serving the risotto with friends. And isn't that right? That's so needed, right?

Eric: Yeah, absolutely. What's your go to pump up song?

Riggs: Anything by The Clash? I love The Clash.

Eric: Clash.

Riggs: They're great.

Eric: But I told someone earlier, anybody that doesn't say Eminem, because that's always the default entrepreneur answer Eminem, anything by Eminem. So any time anyone does anything else, they get a point. So, so congratulations on that.

Riggs: Down At The Grove.

Eric: What is one thing that you're not very good at?

Riggs: I'm not good necessarily at teaching people.

Eric: Hmm.

Riggs: I think I'm a good coach for physical things. I'm a I, I've coached crew rowing, I've coached skiing, sailing. I'm a really good teacher of sailing. So it's physical, but I'm less good with theory. And my wife is fantastic at that. She's a child whisperer. What she does for a living. And I'm less good at that. I tend to get a little bit ahead of people I noticed. So but then again, I like doing the physical stuff with people. That's what I love to see them, you know, take control of their body and make it do things. That's kind of cool.

Eric: Yeah, that's awesome. Last question here and I'll let you get on your way. What is the number one place for people to connect with you? If they wanted to reach out to you, if they wanted to follow your journey on social media, what's the best place to do that?

Riggs: Well, the first thing you should do is go to originclear.com and sign up for my newsletter because when they get my newsletter and they hit reply, it does go in my inbox. So it's not one of those no reply type emails. I do get the replies and we tried to actually like to hear from people and see what they think and reply to them and so forth. That's number one.

Number two is Facebook. Facebook.com/originclear is a great place to go and I try to post personally as much as I can there. The truth is, is that if you become too removed from your audience, then they feel it. They know it. Right? I think that's where Elon Musk is. So he you know, we look up to him so much because he's he's personal, right. I'm not going to let Starlink censor. I'm like, alright, I like that. Go for it, dude.

Eric: No, absolutely. It makes a big difference and and I think it speaks volumes when somebody who's dealing with a large company is responding to people and taking the time to hear other perspectives. I think that's huge. But yeah. Thank you so much for for coming on today's episode and really interesting conversation. There's a million threads social media censorship to all everything we talked about. I mean we could go for hours I think, on all this. But I really appreciate the conversation and learned quite a bit. So thank you so much.

Riggs: It was a great privilege. Thank you, Eric.

End of presentation

Chats

Riggs: I hope you enjoyed that a little bit. That's part two of this really great podcast. These podcasts are great because you get a chance to sit down and kind of be in the Joe Rogan mode of just discussing things at length. I personally think it's really, really valuable. And yes, I see that Clayton was interested in the ticker for the company, which is OCLN, as Kevin pointed out. And Rick Garcia says, "Love that book." That was one of Saint-Exupéry's great books. There were so many.

Ken Berenger says "My whole life has changed in a week." Well, we're going to find out more about that. Let's get into it. I'm now going to review the announcement that we're talking about here.

And here is the new tagline OriginClear A Springboard for Water Innovation™.

Start of presentation

Hi, I'm Riggs Eckelberry, co-founder, chairman, CEO of OriginClear and the board of Directors of OriginClear have decided on this day the 13th of April, to make a whole new structure to what we're doing here at OriginClear. Until now, throughout our history, we've been working to aggregate value to create a more powerful company. In the process we've felt that it wasn't quite doing justice to the individual pieces. Most importantly, this amazing Water on Demand project, which is now turning into the most promising way to expand the production of clean water in the world by a significant factor.

And so we decided to start with Water on Demand and to spin it off to its own entity and then to build it up with the capital that it needs to do the job that it has to do. We think it's something that is truly world changing and lots of work ahead, but big things are happening. And I'm so grateful that you're here to hear about it and to hear more every single week. Thank you very much.

Form 8-K

Let's take a look at the actual information, the Form 8-K that was filed today. And based on the events of yesterday and , this thing says right here is we the Board of Directors approved the plan to spin off its Water on Demand business into a newly formed, wholly owned subsidiary, Water on Demand, and it also approved the issuance of rights to receive shares in Water on Demand Inc. as a bonus to the purchasers of its series Y preferred shares, which are currently being offered. That's a typo there, pursuant to a private placement series Y. And we're going to complete the incorporation very shortly. So that's that's the short part of it. But I thought I would show you the board consent.

Here it is. All right. Let's take a look at this thing. So, whereas we got this series Y, which if you want to know the details of this, talk to Ken. I'm not going to get into it now. And whereas we reached the $1 million milestone on March 23rd, and whereas we got this agreement principle with Envirogen, a 30 year international provider of basically a lot of good stuff, including operations and maintenance. So then when we resolved that, we were going to pursue a spinoff strategy designed to maximize shareholder value with a pilot program being Water on Demand.

Water on Demand is First

So first of these is Water on Demand and then that we're going to incorporate Water on Demand business unit and determine the capital structure, which I'll tell you more about. And it is further resolved that we're going to create the bonus preferred shares on a pro rata and pari passu basis. Pro rata that means in proportion of pari passu means equal, treating people equally as a further incentive to subscribe to the offering. So and this also applies to people who have the people who've invested a couple million dollars already, they get retroactively this benefit because obviously we treat everybody in the series Y the same way. But there's going to be a limit to this, which I'll tell you about.

And also there's going be a funding plan for Water on Demand, which will include unaccredited investors, who-hoo! Finally we're going to do more subsidiaries such as Modular Water Systems™ and maybe it's pump stations business. That's how you move water around and we're very good at that. So that is the totality of the announcement.

Let's Take a Look

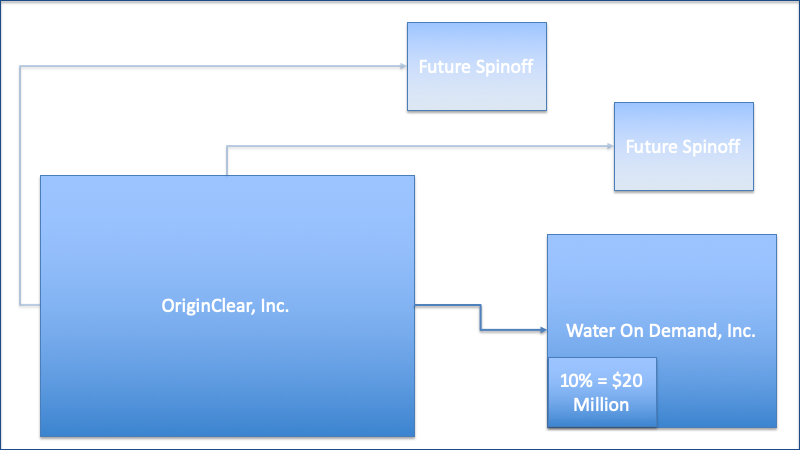

And so to take a look at what it means, basically what we got is, is these things coming out. And what we're doing is we're setting aside 10%. Of Water on Demand, Inc for the first $20 million of investment, which includes the $2 million raised so far that the series Y people put in. And once that $20 million has been raised, that's the 10% it's done and it's a permanent 10% also. Now that we're going to raise a lot more than that to capitalize Water on Demand. But, you know, it's the first 20 million that's going to be everything. We do that with the beauties of leverage and so forth. The rest of it is going to be, in fact, Ken you and I, we can't get paid after that because it will be so easy that we'll have to pay the company to let us do this fun stuff.

Ken: Just be throwing money at me and I am not worthy.

Riggs: Exactly. The future spin offs, etc.. But go ahead.

Ken: Yeah. No. So, this is interesting. We were in a conversation, you said, "I want to show you my flow chart." And I think you got a call. It was like 5:00 today. And I said, "Oh, yeah, that's great. Let's see it." This first time I'm saying it to folks. It's beautiful. These are the things that we've worked out over the course of the last several weeks. I don't want to over disclose in this conversation, but the details that we have already kind of figured out here are really amazing.

Like Earlier Giant FinTech Plays

They're super exciting and they really fit in keeping with if you look at the last two or three super duper, I'm talking gigantic FinTech plays, that were kind of legendary, kind of legendary made people wealthy type thing. Things like Stripe and things like Airbnb. This is keeping very much in line with that overall strategy, right? Because Water on Demand is a FinTech, after all. But I can't stress enough, I think the most exciting part of FinTech just makes the movement and the velocity of money virtually infinite, which is why they're valued so high. Right.

But the fact that we've wrapped FinTech around this amazing new asset class. When I talk to people about it who think more of generationally in terms of their investments, they're blown away. Because traditional assets right now are always subject to the next controversy. Right. Whether it's a massive rate hike or if it's a war with Russia invading Ukraine with respect to oil. So this I'm so excited about this because this gives us a chance to kind of birth the baby. We're in, holy week. So we're kind of giving birth to the baby without original sin.

Riggs: Well said.

Like Kutcher and Thiel

Ken: It's we're it's good. It's Holy Thursday today. My kids are at church right now I'm working. Daddy's working. But it just. It allows us look. I can't tell you. And I told you this, Riggs, how many conversations have I had where people were like blown away with when I'm talking much deeper stuff than we talk about on the briefing? And they're like, God, if you guys were private, they could throw tons of money at you, right? And we weren't going to bring OriginClear private, it didn't make sense, right? But making this its own entity as a private company, where we can do these VC type of raises, but putting our people first. Putting making them the Ashton Kutcher's, making them the Peter Thiel's.

Riggs: And if anybody does not know what Ken is talking about, you've got to be in this briefing where he shows you the spreadsheets of how Ashton Kutcher made way too much money. Peter Thiel made way too much money.

Ken: Don't give it away. Don't don't read the last page just a little. Yeah, look, it's a very look, it really true. What it truly is is that the compelling story that repeats itself repeatedly that. The the transformational wealth building that's happened in the last 20 years among the Elon Musk. Elon Musk became a billionaire with what, PayPal. Right. So did Peter Thiel. Right? Paypal. Right?

So what they were was early investors, right? Transformational, life altering wealth happened in the past two, two or three decades. Not like the robber baron eras, but they happened by people positioning themselves in the very first venture capital rounds of something that truly became a game changer to, truly transformation. And we're really following that. We're following those, that pattern almost, almost perfectly. And I'm really excited about it.

Freewheeling Discussion

Riggs: And with that, I want to welcome Andrea to the call. He was we know he's in LA because he got stuck in traffic. So therefore.

Andrea: Yes, That's true.

Riggs: He said traffic — LA, yeah, right away. You know something?

Andrea: Right, exactly right. I see. I see that. You know, I see that you know that.

Riggs: Oh, Lord. So yeah. No, we've had a wonderful day to day. And you arrived while I was showing off the 8-K and so forth. But you know, there's something really interesting I want to explore. I'm going to go back and share screen because we're talking about the bigger picture here.

A Commodity that Produces Dividends

And there was a very interesting research piece by GoldMoney.com, which talks about how Russia and China and other economies are tying their currencies to commodities and production instead of collapsing financial assets. Now, of course, this newsletter says, "Well, that means you got to go with gold."

Ken: Buy gold. Right.

Riggs: Fine. Which over time is tied to commodity and energy prices. I would say that's a very indirect relationship because gold, you know, I've got gold in my safe, but it's not earning interest. It's just sitting there now. It's better than cash. I'm glad I have it. But if you really want to look at what is becoming, the new new thing is commodities and production. Commodities and production, by which I mean, it's a commodity like water and it produces means it produces income.

And as I said the other day when I was interviewed by Business Insider, I said, listen, everything's going to go to a basket of commodities, income earning commodities, and savvy investors are going to own those. And of course, I said next time we talk, I'm going to tell you about how water is so hot because it's just starting, whereas it's not priced out of sight. But we're watching all this happen.

End of the Dollar Era

And first of all, here's one thing I've started to believe. It is not the end of the world. What's going on, all this noise, I'm, like, finally I went, "You know what?"

Ken: It wasn't the last three times either, right? Yeah, it wasn't the last three times either.

Riggs: Oh, Lord. Right. So it's like it's going to be fine. You're going to have to scramble to make sure that your wealth is protected and your income is protected. But, you know, as it says in this paragraph, it's the end of the 51 years of the dollar regime. But that does not mean that you can't invest dollars in something that has permanence, such as a commodity. And that's where I really think this is a vital program.

And why our new tagline, which is 'A Springboard for Water Innovation,' that is what we are. So not only are we innovating Water on Demand, but we are developing these other things. Now, you said fintech and we don't normally think of water as a fintech. Water is a bunch of purification systems.

Ken: Did I give something away?

Riggs: No, not at all. Because? Because here's the fact. Water is the building of systems, just like Airbnb involves physical locations. Right? But the value of Airbnb is not the physical locations. Those belong to individuals. It is the actual magnet and the sort of marketplace that Airbnb has created. Now, what I'm saying is a fintech does not try to get involved with the sausage making underneath it.

Ken: Right,

Riggs: Right,

Ken: Right.

Unbundling Water Funding

Riggs: That's the key. So we have we have unbundled the funding of water treatment from the execution of water treatment. We know that we can raise money much faster than we can build anything. You know, the poor guys over it, over at McKinney, Texas and New Castle, Virginia, are, you know, running like crazy to try and deliver $12 million worth of sales. Well, now, what if we gave them $100 million? Forget about it. So we'd have to sit there and build. It would take a couple of decades.

So we've made this this conscious decision and people in the company are going, "We're going to build this, right?" No, no, no, we're not going to build it. "Yeah but what about the money in it?" Well, excuse me. We start building, then we violate this rule that I learned in the dotcom, which is never compete with your natural partners.

We're going to give these projects to the water companies. You know, a project in Atlanta gets the water company in Atlanta and also. We're democratizing the investment. Instead of all the money coming from municipal bonds negotiated by Goldman Sachs. No, regular investors get to put it their investment in. So we're creating all this disconnection from ordinary mechanisms. And we've talked a lot about crypto, but truthfully, we don't need crypto to make this happen. There's a crypto potential for sure. But this thing all by itself, I mean Stripe is where $125 Billion even without crypto.

Ken: 152.

Riggs: 152

Ken: 152. because, because that was like 125 was like yesterday. You got to keep up! To kind of add to, but come at it from a different angle with what you said. Airbnb is $100 Billion valuation. They don't own anything, but they do handle the... Basically it's the velocity of money, right? Every piece they could potentially officiate or handle ,every rental property transaction globally. They could do that.

Like I could buy a place in Montana, never look, never see it and rent it to Andrea and have never met him. And that, so the potentiality of it is so massive. That's why it's 100 billion. Can you imagine the valuation of Airbnb if they owned the real estate? Well, that's Water on Demand.

Riggs: Importantly, though we don't operate the real estate. It's whatever you...

WOD is Smarter

Andrea: Yeah. In fact, I think that is smarter. Water on Demand is smarter because it's not like We Work. You know, the company, We Work, that had all the buildings and so on and so forth. We are free from the risk.

Ken: Oh, absolutely.

Andrea: Is wonderful. Is way better.

Ken: Absolutely. We own the building, but we don't but we don't manage the building. Really in a sense, like Airbnb know they have to handle that stuff. I simply meant from a market size. It's phenomenal. And you're right, it is smarter and you do, look you're violating the natural tendency to want to have it all. Having it all slows you down tremendously. I mean, in this case, it would be catastrophically great.

We can have exponential growth by simply not trying to have it all. Also, by doing this what you just said, Riggs never compete with your natural partners. We are now offering the $1,000,000,000,000 industry something. It's an offer they can't refuse. It's the ability to finance all of their stuck projects and give them and be able to kind of give them almost a global footprint, which is something they wouldn't be able to do thinking, very parochially, which is how the water business has existed for the past 100 years. Am I right?

Leverage Factor

Riggs: Well, exactly. And I also want to talk even more about a FinTech aspect that we've been exploring recently, which is the leverage factor. Right. And so we come to this this you know, let's say that we have, this shows how we have $1,000,000 investment in water systems, generates 10% net profits. It's just off the bat, you know, it could be 15% whatever. And the net profit then is this much. And therefore we pay out of that $100,000, we pay $25,000. Right. But what about if we leverage that money? And that's where the royalty paid on the actual investment rises. That becomes something very interesting, right? So literally a 4 to 1 ratio of leverage multiplies the investors. He still gets 25% of 400,000.

Ken: Four times as much, right.

Riggs: A four times as much as he was going to get.

Riggs: Because you leverage the purchasing power.

Riggs: As we leverage now, this is the benefit of keeping the machines in house. Right. That that these machines now are the security for the leverage which directly benefits the investor. Now we're only doing 4 to 1 as opposed to some banks to 26 to 1, because we actually would not like to have the thing fall apart. We're trying to do it very conservatively. And also, we're not too big to fail, so therefore we have to kind of do it the old fashioned way.

Ken: The mortgage business just made these derivative things and the government bailed them out. We probably don't want to go there, right?

Finance Network

Riggs: Yes, exactly. So this is something that that we'll be further quantifying, but it's something that's come out of our discussions recently. And I wanted to mention that. So and one final thing that that in terms of leverage, we talked about focusing on finance, delegating the building of the machines and their maintenance. But now what about if we build a financial network and we start having financing hubs in Dubai, in London, in Singapore, in Tokyo? These are financing hubs for Water on Demand for their regions.

Ken: Right. So financial, nervous centers, New York, Dallas, Atlanta, Miami. Then you get into Tokyo, London. These are, these are financial epicenters, right. Where there's a concentration of wealth that don't have access to these types of opportunities. These could interconnect these things. We could essentially be that latticework that runs over the top of it, which is I mean, just it's breathtaking in its potential scope.

Riggs: So what we're doing is we're exporting a working model. What we're doing right now is doing it in the US with just one air in Clearwater, Florida, doing the financing. It's all good. We're not going ahead and getting ahead of ourselves, but by building the secret sauce and getting it all working and doing it. Doing it right, it works. All right.

Call Ken

Well, it's getting on 10 to 9. And I wanted to say that we will be discussing further next week about the business model, talking about there's some hybrid models out there that are not pure pay per gallon, which we'll get into. And so we'll talk about those types of things. Meanwhile, you can talk to Ken. You know, we're going to give you an opportunity to really hear some of the inside scoop, because Ken actually knows more than what we discussed here. Just saying, I'm just, you know, lifting lifting the.

Ken: The thing the veil.

Riggs: The hem just a little bit.

Ken: Just just just a little ankle.

Riggs: A little ankle. Good. Well, anyway, so that's that's it for tonight. It's, we're so excited because Ken is like Ken's been trying to not talk about this special carve out for two weeks now.

Ken: And when you and I discussed how it actually affects the investors, it was like, I just said, you know, just. You want, I mean, you really want to communicate that really, really bad. Right. So to be able, the ability now to discuss this more openly. And I can also look, I'm literally one on one with you in the development of this rollout, spinoff, VC thing. So I will be able to kind of give you some very, very well thought through potential plans that we hope to, and what those implications could be. And it's really, really exciting stuff. So. oc.gold/Ken.

Riggs: Just like that. And next week, as I was saying, we will get into the business model versions, which we're starting to get very sophisticated. Also, we're going to have more news about that. The one hotel launch that's occurring and what part we have in it, it's been pushed back to June by the hotel chain. And Ken Bogart says "Congrats on the spinoff." Thank you very much, sir. I'm super happy that you guys are here to be on. Really? This is the red letter. The 13th of April was the red letter day for us. Thank you all for being on board, Andrea. I'm glad you're back in America, even though it's LA.

Ken: Is LA still America?

Riggs: Yes. La is still America.

Ken: Technically.

Andrea: 'merica, 'merica,

Ken: Merica. Right.

Riggs: All right, everyone, listen, thank you very, very much. I appreciate you being on board. And do do do show up next week. Believe me, we have news every single week and.

Ken: We just scratched the surface today. Which is which is hot. Yeah.

Riggs: Definitely. Thank you, everyone. Andrea, you have a good weekend.

Andrea: Thank you, guys.

Riggs: Smoggy L.A. and you Ken in Pittsburgh and everyone who's tuned in. You guys are the best. See you next week, Ciao.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)