We saw Ken's presentation to the Prestel & Partner Family Office Forum in London which was great, But what was really enlightening was his live report in the briefing. Ultra High Net Worth Individuals are taking greater risks and seeking philanthropic investments… So, how did they respond to Water on Demand's unique societal benefit and yield generating structure? Find out here in the replay video!

Transcript from recording

Introduction

Show Host: OriginClear is a company that focuses on wastewater treatment.

Riggs: And hello, everyone. Welcome to the Water is the New Gold CEO briefing. Our mission is to transform the water industry.

Dan Early: Decentralization offers us this opportunity.

Financier: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you are giving us investors.

Riggs: The decentralization of water treatment means that we no longer need to establish giant water treatment plants, but.

Ken: Let them fight over the 20%. Let's work with the 80% that's untreated

Fund Manager: Over 21,000 unique alternative investments.

Riggs: 3 million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: Lucrative and fulfilling.

Dan Early: The vision I've got is to standardize these products design, build, own and operate.

Riggs: We have 65 people in the room.

Manuel Suarez: We got an important message to the world.

Company CEO : We can put a guy on the moon but our water is horrible.

Entrepreneur: Recycling all that water, it's a huge impact for the environment.

Tom M: Bringing new infrastructure in, drive growth in COOAmerica.

Riggs: That's a critical part of the picture.

Engineer: It's a twin 125 gallon per minute RO system.

Riggs: I don't think we're talking about a $10 Million fund. We're talking about a series of $10 million funds.

Show Guest: The opportunity itself is very big.

Investor: To live, Yes, take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Riggs: And welcome everyone to the CEO briefing. This is a very special one since we have footage coming in from London where we made our very first institutional appearance. And you'll get to see some of the excerpted footage, and I'm going to go ahead and start this. But just want to make it clear that we were this is not where we're pitching you, right? This is one of those things where you kind of lay it out in a very friendly peer environment. But I have to say, after this event, there was a tremendous amount of interest. Anyway, so let's get going here and get this party started.

Well, this is the last June event and will soon be in July. Oh, no, we have one more. The 30th. Thursday is the 30th, so we will see you then. And it is briefing number 166. So Ken will join us. He's having a little trouble with his Internet because, well, I don't know, he went to the U.K. and it doesn't work now. But, you know, let's let's blame the English. Why not? Robert Baxter says, "Hi, Riggs and Ken, go Yankees." Right on. Right on. All right.

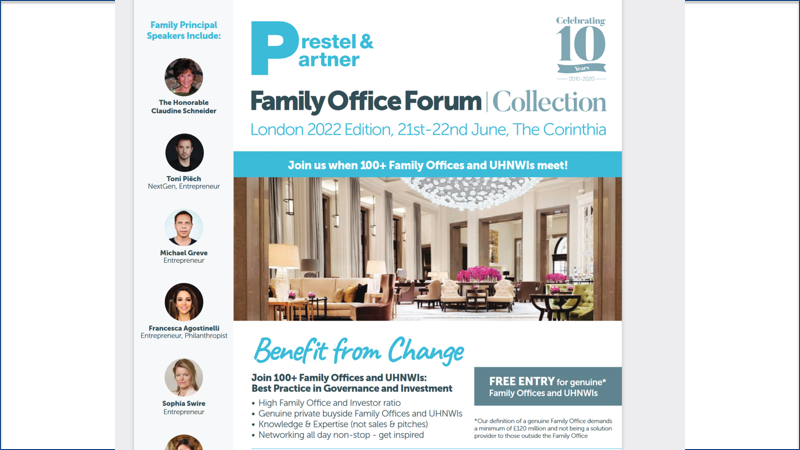

So, sure enough, Ken spoke at the Family Office Forum. This is a group called Press Talent Partners, was held at the posh Corinthia Hotel.

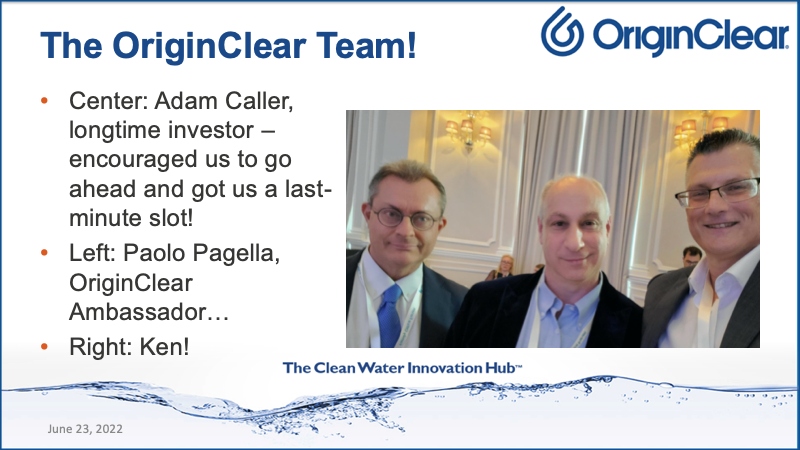

In the middle, we have Adam Caller, who is a longtime friend and investor, and he called us up. What was it like, Wednesday or something like that. Thursday, it was like really late in the game and said, hey. And so we moved quickly to show up and make it happen. Paolo Pagella is an ambassador of ours who also showed up. And in fact, he took the video that you'll see. And of course, on the right hand side, we got Ken. So there they are, the Three Musketeers.

Definition

Just give you a sense of what this is about is what it looks like. It's family offices. Definition of a genuine family office demands a minimum of £120 million and not being a solution provider to those outside the family office. So they're really managing themselves. No sales and pitches, knowledge and expertise.

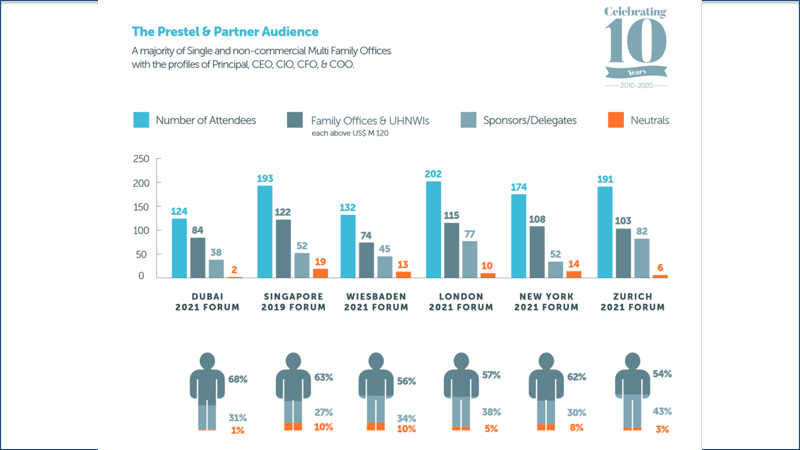

And here's what the audience looks like depending on where it was. But as you see, never more than roughly 200 attendees and the family offices were numbered, about 100, 120, something like that. And that gives you a sense of what this was.

Middle Ground

All right. Upcoming editions, what we're not going to do the Weisbaden one because we're not genuine German speaking, but we do think we're going to do the New York One. I was unable to make it this time to London, but I darn well plan to be in New York so we can look forward to that. And then we'll see where those others of these go. This is not the only family office show conference, but I think that would be very, very good for us as we step into this space, because the truth is that we want to raise a lot of capital to make Water on Demand, water as a service work well for us.

And really this is going to be a very powerful way to go. It doesn't get as complicated as talking to venture capitalists and PE funds. And, you know, it's sort of the middle ground, which is, I think where we will fit. Of course, we want to remember that our roots remain the good old single accredited investor, and that's who we favor most of all.

So here he is about to present and. He's coming up on stage, getting ready to go. So why don't we go ahead and play the short video?

Start of presentation

Ken: Well, thank you very much. My name is Ken Berenger. I'm executive vice president of a company called OriginClear. COVID has driven a lot of folks out of major cities into what they call secondary cities and even rural areas. So there's a perfect storm happening in the United States, and I don't know how much to the extent Europe. But there's basically decades of infrastructure neglect. It's combined with people moving into underserved areas. Now, due to these kind of twin trends here happening, infrastructure neglect and population migration, I think it's going to be with us for a long time.

So the same forces that were bringing about kind of globalization of commerce are also bringing about more decentralized water systems from the creation of clean water processing to effluent water to recycling of the subsequently treated water. The United States is very bad at this, by the way, the United States recycles about 1% of its water. I know it's awful, especially when you compare it to Israel, which is 90%.

Now, Israel's tiny size makes it providing infrastructure to a very small geographic area more practical. So it's the larger the area, the more difficult and burdensome centralized infrastructure becomes and the more the need for globalized, decentralized water treatment, which is what we do. An additional factor which is emerging in the industry is the concept of something called design, build, own and operate. And this is where a water company actually finances a water system and charges the business or the community a utility.

Don't worry, here's your million dollar system. We'll provide you your very specific needs. You pay on the meter, we'll maintain it. We'll run it like any piece of ground industrial equipment. And the response has been, sure, great. Where do I sign? It's been it's been very, very popular. And we're basically almost acting like a mini, mini municipality. So companies are already doing this, not just us.

We personally been creating and selling these things for over a decade to the mid-sized local business and mid-sized, smaller 100 home housing communities, luxury homes right now. But hotels, big picture, anything that's going to be producing a lot of water. OriginClear, with something I've co-created with my with my CEO. It's a Water on Demand program and what is a little different here is that it's enabling investors to receive long term residual income like an oil well.

Those of you who are familiar with MLPs, they have shielded and protected more income and more general wealth in the last 40 years than very few other instruments. The problem is they are dirty, right? So certain investment groups simply won't participate in. This has the benefit of being water and making it better, right? So you're basically making money while doing good. In short, I'm the co creator of something that I came here feeling was very special and unique because it solves real serious problems, but it aligns all sides of the equation where all parties benefit because generally not without exemptions.

But there are generally there are two crowds out there, those who deploy capital to make money. And that's number one, number two and number three priority. That's fine. And then there's those that deploy capital to do good. And that's a, you know, so if you can actually create something that does both and where those interests don't run at odds with each other, then thankfully they're starting to get there, I think, in my view, and I think that's what we do. So this is having a really good, virtuous, do good type motivation is great if it happens to be very, very capital friendly, well that's even better. Doing well by doing good.

Many of you will do this because it's the right thing to do. There's a reward that's not tied to money. And it's to save the lives of children, which, who's going to argue with that? Some of the statistics he came out with on child trafficking and basically slave labor were absolutely heartbreaking. So if you could solve a different problem that had a almost equally devastating an impact on children, but also do well financially by doing good, I think that you can unlock a lot more capital.

There's those who are, you know, they just want to make money. That's cool. I'm fine with that. And then those who will do it virtuously. But if you can if you can do that, you can unlock the capital that would only do it because they're making money. And I think if you could harmonize doing well with doing good in the same effort, the same instrument, I think I believe that's what Water on Demand is.

So I saw also a major deficiency in how governments were handling our most precious asset in the world, which is water. So he came up with that statistic. Here's another infuriating statistic. And that's why what he said struck me. More than 80% of sewage is discharged into water supplies around the world. Sewage gets no treatment whatsoever. This contributes in, at least in part, to the fact that as we're having this conversation today in this lovely hotel, 6000 children are going to die today from water borne illnesses.

If you can crack this code, once again, affluent people of conscience will be the ones that can power this initial solution to this. So if we do this, the environmental and humanitarian benefits of fixing this problem are incalculable. But outside of this room, many in the world are only going to invest in what makes them money. That's okay. I keep saying that I am a capitalist, all right?

But if you can bring them Series A founder's round position with a planned public offering, combine it with the only income bearing, inflation friendly asset class that hasn't even begun to run and accelerate it through fintech. The bulk of the world that does not invest virtuously will do well by doing good, even if that wasn't their motivation in the first place.

So founders round, future offering, inflation friendly income, new asset class water, and there's a planned blockchain and cryptocurrency application that Riggs and I created that will be developed parallel and added later. So with money, as per a number of times today, money not being so easy anymore. I believe we will have a lot of appeal to diverse audiences in both the virtuous and the purely capital focused areas.

So with that, I'm very proud to announce the launch at this Prestel & Partner Family Office Forum, our $300 million Water on Demand capital offering that will be featured on Manhattan Street Capital's website, one of the premier crowdfunding sites in the world. And it has variable terms. It's kind of unique and I won't get too much into the details here. We don't want to pitch you on it. I want to inform and then we can we can speak one on one, but it's got a couple of different variable terms. So it's designed to appeal to really everyone, the ordinary accredited investor, the high net worth individual and even family offices. What I find most exciting about this is it is the world's first income bearing asset in clean water delivered as a service. So with that, I'm going to give you a little glimpse at the screen at the website that we launched. My co-creator, my co conspirator, Riggs Eckelberry, my CEO speaks on it quickly. So Alan, if you wouldn't mind.

Start of video

Riggs: Hi, I'm Riggs Eckelberry, co founder, chairman, CEO of OriginClear. The government needs to continue to provide a lot of abundant clean water, but what happens to it after it's used when it's dirty? Do you know that 80% of all sewage is never treated, it's just dumped? That leads to water scarcity, but it also leads to a lot of disease and pollution and the ocean turning into something horrible. The same time, the cities and counties are not getting the funding they need to really treat the water and so they can't keep up.

The solution is let the people who use the water clean the water. Water on Demand is a way for regular investors to invest in water systems that are built at the local business, industrial, agricultural level, not the big central systems, but rather this new breed of private water treatment. Let's say you're a brewery. And you're you're making lots more beer and therefore you make lots more left over water. Where does it go?

Well, the cities are saying that's too much. We can't take it at the brewery. They're not in the business of water treatment. This is brand new. And so they need a solution. Also, they're not experts. You're going to ask them to hire a water expert. That doesn't work either, right? What we have is a solution which is Water on Demand, which means I need water treatment, boom, you get it? No need for capital, no need for maintenance. Just sign on the dotted line. Machine shows up on your site and it's maintained and it treats the water.

We have opened up investment in these water systems to the general investing public. We're charging these people on the meter just the same way they're used to with the city, right? But it's not the city doing it anymore. It's the business. Business loves it. Why? Because if they treat the water themselves, guess what? They can reuse it, they can recycle, they can get more water for their money. And now we take care of a lot of the scarcity problems. So this is a solution that solves so many problems in the water industry.

In today's economic climate, you want to get away from just holding on to dollars or even holding on to gold because gold doesn't earn money, right? Water on Demand is investment in actual capital assets that earn income. But think about it. If you can get a tangible asset and make royalty money from your tangible asset, then it's the best of all worlds. Lots of assets out there. A lot of people know they need to invest in assets, so therefore assets are skyrocketing in value. Crude oil, precious metals, commodities of all kinds, lumber, you name it.

Water has only begun. It's the beginning of the run for water. Water on Demand is the first program to enable investors like you and me to get into an asset. I believe it's a once in a generation opportunity to make real change with our health, water, and also to take advantage of the development of an asset that will throw off revenue and, I believe, increase in value tremendously.

The first thing you can do is to sign up to hear my weekly briefing. It's every Thursday night, 5 p.m. Pacific, 8 p.m. eastern. Just put oc.gold/ceo in your browser register for the briefing. If you can't make it to actually watch it, you'll get the replays automatically. But week by week you will hear about this amazing program being developed in real time and you will be in on something exciting whether you invest or not. You will be in on this heartbeat of an activity that I think is just phenomenal. Obviously, I love it. I'm one of the people who helped develop it and we have a lot of work ahead of us. We want you to join us because it needs to become and I believe it will become a movement. Stay tuned and I look forward to hearing more from you.

End of video

Ken: So you're investing in Water Like an Oil Well™. What we're doing is we're duplicating what was so successful with the MLP model in inflation. Look, energy is a it's a it's a worldwide currency in its own right. So can water be. Water is not, is completely immune however to global events. A war in Ukraine doesn't affect your local water rates. So it has the steadiness that we want when we're earning income off something. So it's inflation countering, it means that water inflates at four times the rate of inflation.

We can argue that the core inflation numbers they give are nonsense, they are. But if you're inflating at four times the speed, you're providing a real value to the end user while staying your royalties that you're paying, that metered billing that they're paying, that's coming to us as investors. It stays way ahead of inflation. So generational wealth. Water is the new gold.

Water right now is $1,000,000,000,000 a year industry supplying treatment to only 20% of the planet. You can do the math of what the total accessible market is. Total addressable market. Obviously we can just get the TOM, not the TAM. It's a multitrillion dollar market. People who are doers, people who are innovators, people who are investors and entrepreneurs. We're here to solve problems.

So this is federal spending is obviously collapsing. These are just some stats. In the United States, we are now down to a tiny fraction of what it was just in the 1980s. And we're talking about 55 billion gallons, $55 billion per year we're falling behind. That's not, so the $55 billion devoted to water in the recent Biden bill literally covers one year. It's a massive problem that can't be solved one cup at a time.

So it's getting worse by orders of magnitude. As you can see right here at 2025 where it's $75 billion a year. So you're talking about a vibrant, amazing market that can be addressed by creating an asset and then accelerating it by fintech. The burden is falling on cities. 80% of agriculture and industry are responsible for 80% of the water usage. You treat it there. It gets better everywhere and not by a little, by a lot.

So I mentioned that Water on Demand is a it's an actual instrument. We have a planned initial public offering in about two years. So if you're not an angel, I hear about, if you don't want to get phone calls at 6:00 in the morning on Sunday begging for more money, don't be an angel. If you don't want that, don't be an angel investor. The incubation part has already been done by a public company. They funded it. The first few million are in very, very effective in raising capital through a series A-plus. And with individual, kind of a bench of individual accredited investors that are supporting this endeavor.

So what we're now going to be doing is set a $300 Million raise. The first 20 million will be a series a round, as you can see, granted preferred stock, it's 10% water on demand, non dilute, dilution protection. So no matter how large this offering gets, the first 20 million will own 10% of this company's float. When it does eventually go public, you're going to be 25% of the net profits of those water royalties, and that's for life.

These systems are designed to last for 100 years. So if we talk a quarter century, it's certainly realistic. And then you're going to because it was incubated by a parent company, the parent company will have a tremendous benefit when this thing goes live and is, of course, a valuable public property. We hope that stock will do very, very well. You're going to get a grant of one and a half times your investment in the underlying company. So that's just a little bit on the on the on the structure.

So what we're going to be doing is we are going to this is the the website that basically takes it's going to be taking kind of crowdfunding investors in through the portal. Here is some of the pro forma performance of the of the fund. Water is an extremely profitable asset. Every dollar of water every dollar of equipment that is created, what we can do is we can create about $5 worth of actual assets. So it's a it's a very powerful model.

Here's another statistic. $100,000 in this type of fund set up this way, will probably treat about 27 million gallons of water. Okay. That's the definition of impact investing. And obviously for the long term, it looks great. You know what? I know I'm out of time, so I'm going to thank you for your time and your your generous attention. And I'm available to we can meet privately, I can give you my card and you can set up a one on one meeting. Thank you so much.

End of presentation

Riggs: There we go. That was a short look. It was about a 30 minute presentation, which we cut down for the purpose of brevity. But, you know, we're starting to really make a lot of sense to strategic investors because people are looking for those income bearing assets.

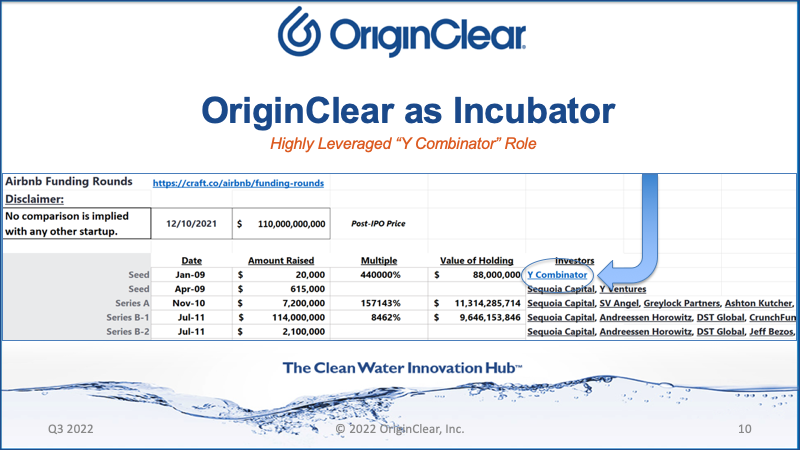

And with that in mind, I wanted to talk a little bit about how, we've been talking about how, this is in our strategic presentation, that we are leveraged like Y Combinator. Which is Y Combinator showed up in so many of these huge IPOs, and it's not bad to make 140,000% of your money. Now, to be clear. We don't plan to just concede. We want to take it all the way through the first few series. But this gives an idea of where we start.

How is Y Combinator doing?

Well, so let's ask a question. How is Y Combinator doing? Well, here's what's going on. And that is that Y Combinator has this nontraditional approach to venture funding where it's basically an accelerator, and now it's going to by 2025 backing 1400 companies a year. So, that's pretty astonishing.

And I've been pointed out to, there we go. Thank you very much, Manuel, for pointing out that my microphone was still pointed at the speaker, so hopefully that's better. There we go. Good. All right. So with that, I'm going to continue. So hopefully, Manuel, you'll let me know that it is cured, ASAP. Moving on here. More from the same newsletter, CB Insights an outstanding newsletter, by the way.

Real Estate

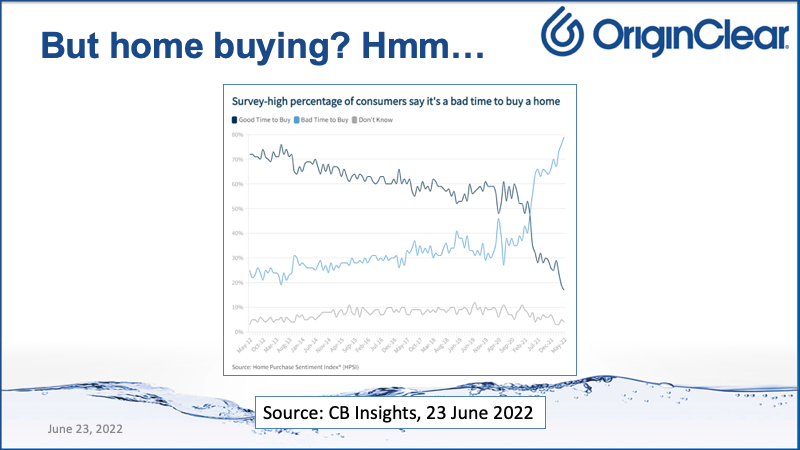

Home buying. This is not a great graph. A good time to buy was all the way back in 2012 coming out of the last recession, and it's been dwindling ever since. It really took a dive, though, in early 21 because the housing prices went up. But now it's continuing to go down because now interest rates are high. So it's kind of a double whammy. So, again, real estate, not in great situation. This is why water can and should be an alternative. All right.

Crashing Market Caps

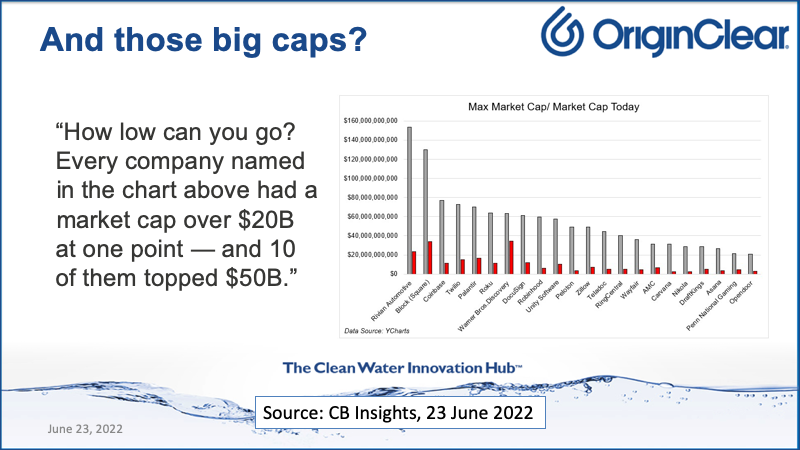

This is a terrible graph. These are the companies that had a market cap over $20 Billion at one point. In the grey. That was their previous market cap. And in the red is their current market cap. Lord. Take a look. Well, Rivian Automotive is still at about 22 billion, Square, which was at about 145 billion, is now around 38 billion and onward.

So this is a pretty scary situation here for people who went in at very high rates. I believe that this is a time to be starting one of these things so that two years from now we're looking at an IPO for Water on Demand that can be robust coming out of what appears to be a recession situation.

Water on Demand

All right. Alternative? Well, of course, the alternative is and Katherine Austin Fitts, who's an amazing thinker, former assistant secretary of housing and. She states, this is a world where people are trying to get into real assets that can generate a yield. So that's the key. Look for assets that can generate a yield. The article here is it's not a turndown. It's a takedown. She believes that this is not an economic turndown. It's actually done on purpose for reasons she states. This article is also on ZeroHedge. So what is this real asset that can generate a yield? Water On Demand.

With that, I'm going to bring in Ken, who is still alive and well. I'm going to turn on his video so that he's allowed to be part of the team.

Ken: And I'm not so sure I want my video on after the week I had. But okay. Pardon the, I'm struggling on my main computer through internet issues.

Riggs: You look good actually.

Doing Good with Investments

Ken: For a guy who hasn't slept in four days. I look marvelous, right? Yeah. So I. I go away for three days, and nothing works when I come home. I don't get it. I'll fix it later anyway. So what I got was, it was a lot of people there talking about. So the common themes and I have, I brought home a copy of the program but they were investing into major disruptions was one topic of discussion. The other one was doing, how to do good with your investments. We've been talking about doing well by doing good for what, three years?

So kind of the quasi institutional money, you know, people I would call of true affluence are really starting to have these conversations. And whereas we always associated family offices as being kind of like institutions like, hey, send me an 800 page due diligence package and we'll get back to you in ten months.

Riggs: Right.

Taking on More Risk

But in my discussions with Toby, right, Toby Prestel, he says, no. He goes, you're he goes, these guys will take down 1 to $10 million and it'll take about eight, ten weeks. Right. So they've shifted. They're taking on more risk because they have to. Because the stuff that was safe. Right. Not so much right now.

Ken: And it was kind of a real sea change. It really opened my eyes and I heard the same kind of concepts over and over and over again that, you know, you're going to put money out there, you're going to take risks to some extent. Why not do it in something that will have a measurable, definable good in the world? And most of these guys were pitching maybe pitching isn't the word we're they ask was donating money. Donating money to causes to prevent human slavery. To donate money to schools that did turn around on troubled youth.

Really, really good. I mean, very noble stuff. Very powerful videos and stuff like that. But the ask was really a donation. So there's an expectation that these folks will deploy capital with getting nothing back in the capital realm but feeling good about it, having an impact. And we came into this thing very, very last second. We hadn't really formulated how we wanted to do it, and I think it resonated extraordinarily well. I had numerous family offices come up to me, probably four or five conversations immediately following, and they said, Look, I love what you're doing. We did something similar. A Singaporean couple, my dad just did something with energy. Then he bundled up all the power purchase agreements and sold them, you know.

Generational Wealth

So it was like, boom, right? So they totally got like nothing had to be really explained. So I think there's going to be a very, very powerful surge this year of your family office generally. I mean, we talked there were some folks on stage. We're talking thousand year old money. They're the descendants of Dukes in Luxembourg, in Germany and stuff like that. So these guys, these guys have figured out how to protect that wealth for a millennia. So, you know, it's you know, there's new money and then there's them, right? It's very, very different. And they have turned very they've turned very philanthropic.

This is, I think this is going to, I think our message will resonate even better in the New York show. And it's a 45 minute flight, so I'm really happy about that. Yeah. So, you know, it was look, it was a great experience. I learned more watching than I did speaking. Right. I picked up a lot. You know what? You and I have talked about this. There's those who listen to listen to rebut and those who listen to reply and those who listen to learn. So I got there. I was so tired. I just wanted to sit and listen. And I heard what we I heard things that we've been talking about for years being repeated, almost similar, like similar phrase. So this is when you think you have a new idea. Talk to somebody.

Similar Mindset

And there are no original, brilliant ideas. People have thought about it. Coming from a different place. But the fact that it's on the minds of some of the most successful, most affluent people in the world. And they're thinking on the same train of thought as we were without having had discussions with us. I was super excited that we're on the right path. This is what the world's wealthiest people are thinking about. They're thinking, and no one, no one, no one came out and said of it. They kept talking about it. It was kind of a holy shit moment.

Like these guys are talking about, what are you going to do? And I've heard and heard people say, look, you're going to have to take some risks. This is uncharted waters right now. You have to take some risk. Do it, do it in something that will make a difference. Right. And I was able to kind of frame it in a way. Yeah, look, yeah, we're early, but here's how, Here's how we're trying to kind of de-risk, de-leverage, you know, risk manage you. And here's the serious, serious societal benefit. And I thought it resonated well.

Manhattan Street Capital Launch

Riggs: Well, my friend, you were highly adaptive, and I think you did the right move by making it a very relaxed show. And now we officially, Robert Baxter says, "Fly private." That's a very good idea, actually. The launch of the Manhattan Street Capital Portal, which is now up and running, and we announced it there. There'll be a press release early next week about that and then we'll start feeding people into that. And that's going to be very interesting. And then, of course, doing the deals on the side with these sophisticated investors. So, my friend, you do look wasted.

Right Time for Family Offices

Ken: I mean, look, you know, it's been a rough couple of days, but I'll tell you what it was. It was a tremendous experience, learned a ton about the new world we're heading into. Just by sitting there and observing. And the need for what we're doing has never been, I mean, it's never been more like, you know, bonfire obvious. It's a bonfire right now. So it's. It's. I mean, New York's going to be a lot of fun.

First of all, I do believe that several of these players that I spoke with, I believe we'll get some investments out of just, you know, just this first. And you don't usually get investments in your first show. You get interest. You get conversations. Right. And those conversations go on for several months. They show up to the second show. You're there again and there you go.

But I think it exceedingly likely that a couple of the attendees that I spoke with there was so there was such significant interest that we will we'll see some I think we'll see some family office players and I think the Manhattan Street Capital Portal being up also advertising to that. I think we can speak to those guys about that as well.

We said at first when we launched Manhattan Capital. Yeah, we'll get to the family office guys after we do X. No, I think no, I think we, I think we talk to them now. I think where we are right now in the way this is being framed and the way that institutional presentation is set up, I think those conversations can happen now, believe me when I tell you, they need it. There's a lot of smoke on the horizon in where they have their assets right now.

Riggs: No, they need to, this is essentially going to dollar cost average there total portfolio debt way down because water as an asset is starting so low. And even though some reason the stock took off last few days, still it is a bargain. And so...

Ken: But their entry level into the private placement is, it's completely separate from the stock. Right. And that is insanely low.

Riggs: Right.

Coming in as a Founder

Ken: You know, because you're coming in as a founder, for goodness sake. So not only is it an asset as a dollar cost average, kind of lowering your overall exposure in assets, getting one of the bottom. But our yields are far more favorable because those assets don't index against inflation very well right now. You know, it's very hard. You know what these commercial real estate, commercial properties did they all locked in seven year. They all locked in seven year leases.

Riggs: Sure.

Ken: Oh, my God. You know what? You know, what's that lease going to look like and how bad? How bad, how badly upside down are these mortgage holders going to be?

Riggs: Yeah. Well, my friend. Thank you very much. It was you. You charged into the valley of death.

Ken: I dove into the breach.

Riggs: Did indeed. So well done. I'm going to let you go. I want to thank you for doing this. And I think it was really, really interesting. So, everyone, have a wonderful weekend. I'll be seeing you on the 30th. And we'll be following up on a lot of this. So stay tuned. Do show up and thank you again for your strong support. Keep joining us. Good night, Ken. Good night, everyone.

Ken: Good night.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)