Tony Bradshaw delivered a fabulous interview on The Millionaire Choice... Want to know the major shift Water on Demand is bringing to water? And how investors can track the # of gallons clean water they personally made possible? Hint - The answer has to do with a unique new innovation of industrialized Modular Water Systems! See it here in the replay.

Transcript from recording

Opening

News Show Host: OriginClear is a company that focuses on wastewater treatment.

CEO OriginClear — Riggs: And hello everyone. Welcome to the Water is the New Gold CEO briefing.

Riggs: Our mission is to transform the water industry.

OriginClear Chief Engineer: Decentralization offers us this opportunity.

CEO Manhattan Street Capital: The plan that you've built here is super impressive.

Investor: The world is experiencing a crisis in regards to water. It's a great opportunity that you're giving us investors.

Riggs: Decentralization of water treatment means that we no longer need to establish giant water treatment plants.

OriginClear VP Development: Let them fight over the 20%. Let's work with the 80% that's untreated.

Investment Advisor: Over 21 thousand unique alternative investments.

Riggs: Three million jobs in the US alone.

Investor: Making it easy for the regular investor.

Riggs: All the old trends just accelerated.

Investor: It's lucrative and fulfilling.

OriginClear Chief Engineer: The vision I've got is to standardize these products. Design, Build, Own and Operate.

Riggs: We have 65 people in the room.

CEO AGM Agency: We've got an important message to give to the world.

CEO PhilanthroInvestors: We can put a guy on the moon but our water is horrible.

Pool Cleaning Technician: Recycling all that water, it's a huge impact for the environment.

COO OriginClear: Bringing new infrastructure in drives the growth in America.

Riggs: That's a critical part of the picture.

Progressive Water Engineer: It's a twin 125 gallon per minute RO (reverse osmosis) system.

Riggs: I don't think we're talking about a 10 Million dollar fund, we're talking about a series of 10 million dollar funds.

Overseas Partner: The opportunity itself is very big.

International Investor: You want to live? Take care of the water.

Investor: Not too many CEOs do a weekly briefing and are willing to talk to individual investors.

Introduction

Riggs Eckelberry:

Riggs: And welcome everyone. We are live in the CEO briefing, and Ken, have you been able to let in Andrea?

Ken: Here he is.

Andrea: So, how comes that I don't have the button to make anybody else co-host, right?

Riggs: You've got to earn the button, you're still in consideration. It's going to be about three years before you end up being...

Andrea: That's when you get the button.

Riggs: Then you retire.

Andrea: Then you're good to go. I love it.

Ken: It's the orientation period.

Riggs: Anyway, it was really fantastic. It's a pleasure having Andrea in town because we actually met face to face, which was amazing. It's like, wow.

Andrea: Yeah, it was great.

Riggs: It's kind of cool. So it's something to be said for physical meetings. We've got so much done. It was ridiculous.

Ken: They used to do that.

Riggs: Yeah, I hear.

Ken: It was a thing.

Andrea: And next, in two weeks, the whole team will get together. All the Execs will get together. And it's going to be a very, very dense few days because things are moving,

Riggs: But it's not going to be an eighties type meeting. Because the eighties was a different kind of meeting, Ken has a clue what I'm talking about.

Ken: You actually don't have much memory of the 80s, so you're probably right.

Riggs: JRW says, "Greetings. Andrea is here, so it will not take three years, Lol." Baby. I like that. From your lips to God's ears. JRW. Thank you very much. Well, let's jump into it. We've got a nice crowd tonight.

And really, our vital mission is to help the world invest in water. And that is increasingly what the world needs because there is this, you know, essentially business users are being left to their own devices for capital. And this is creating an opportunity for investors to invest in water, as we say, "Like an Oil Well™, stable and inflation friendly. And you know, you'll see what I'd say. There's a podcast I'm going to play in a little bit and I make an analogy you're going to like very much, but I will put you on the edge of your seat for that one.

Of course, this is the safe harbor statement that says that while we try very best to say it correctly, but it's not a done deal until it happens, we do correct ourselves if we screw up. We try and tell it like it is,

Current Capital Status

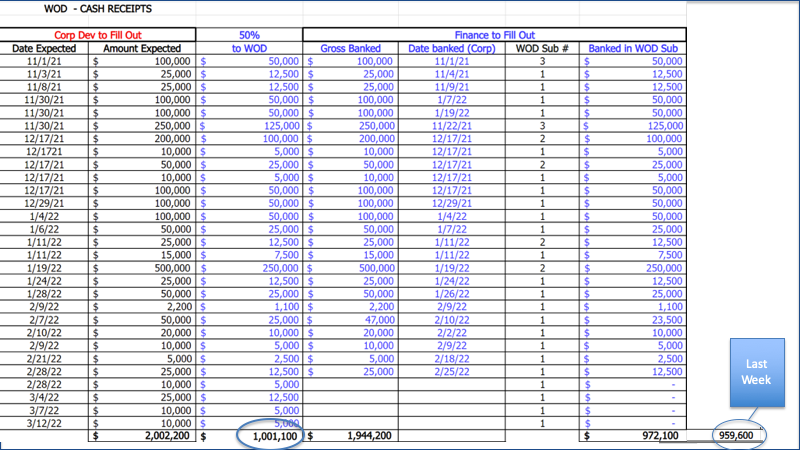

OK? What is the current capital status? Well, I'll be. I'm happy to tell you that on paper, at least, we are at a million dollars. We are still waiting for a few one, two, three, four more investments to be banked. So we jumped from nine hundred fifty nine thousand six hundred to nine, seventy-two, one hundred. But that magic 100 million, magic 100 million, yeah.

Ken: Your mouth to God's ears.

Riggs: Right, exactly. Million is a magical mark that we do plan to announce to the world because it means something. It means that in just a few months in, you know, five months, less than five months, we've managed to raise that kind of money and we have big plans to raise much, much more. So that's good news and thank you, Ken, for staying on top of it. In fact, the whole corporate development team, you know, Devin and Larry, you guys are working hard. Prasad — CFO, Eric Sandler — Controller, John Peraza, the director of Admin. Everyone's important in this game.

The Millionaire Choice

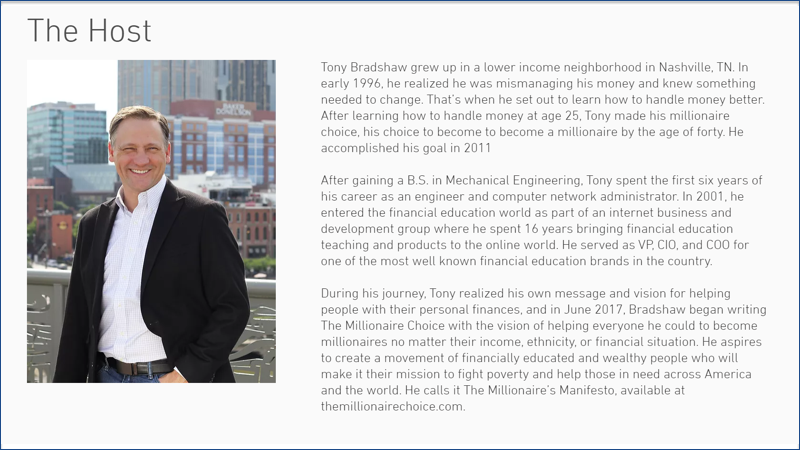

Ok, I have an interview here with Tony Bradshaw, and he's an interesting guy podcast called The Millionaire Choice.

Here he is, and he basically grew up in a lower income neighborhood and basically decided he was going to become a millionaire. Did it, and very quickly then moved on from being a millionaire by the age of 40 to teaching people. And just to give you an idea the kind of stuff that he covers here.

Episode seventy six, forty thousand dollars in 40 days Zach Boothe. So the real question is why did he get interested in a water story, right? And so this is where it becomes relevant to what he was interested in. Here we go.

Start of video presentation

Tony B: Welcome back to The Millionaire Choice Show. Man, we're going have some fun on the show today because I'm going to learn something today from Riggs Eckelberry. He's the chairman, CEO and Co-Founder of OriginClear water and before we get going hear Riggs' story, I really want you guys to listen because he's doing something very unique and interesting in the water space, and I'm not going to give all that away because I'm going to be learning on this call as well. And man, welcome to the show Riggs. I'm really excited to hear what you've got to say. It's always fun to learn about, not just new investments but new things that people are doing to make the world a better place.

Riggs: I really appreciate the opportunity. Let's have some fun.

Tony B: Jump in man. Let's educate some people on, you know, this whole concept, especially your business and how it works

Riggs: Something like 78% of all water use is by agriculture and industrial. So that's most of the water use. What's happening, unfortunately, is that the America's central water infrastructure is falling apart. It's not funded. That's why Flint became a problem. That's why South Bend, Indiana, Compton, California where the water started running brown and then when they asked, "So what's up with that?" The city said, "Yeah, well, we've been asking for money for 10 years, but you never gave it to us. Now the water is brown." That kind of stuff has been going on. So, we tend to take water for granted until it's broken.

But businesses have had this shock, this water shock for some time. There's cases, for example, look at Russian River Brewery in Sonoma county, northern California. They're a case study by a very good company that is in our space called Cambrian Innovation, great company. And what they found was that they were expanding their water treatment, I'm sorry, their brewery. They were expanding the brewery production. They were being very successful and the Sonoma County water rates were just sky high and they realized they had to treat their own water in order to survive.

The problem with that, and this is happening across America in the world, is you then get into a real problem with how do you finance something like that? Russian River Brewery is not interested in water treatment systems. They're interested in brewing systems. They want to make beer! And so you say, "Well, you're gonna have to spend a million dollars on your own water treatment." Well, OK, I'll get to that. What we do, we shortcut the whole issue by saying, "Don't worry about paying upfront. We'll be your private utility and you just pay on the meter." And they go, "OK, that's a no brainer. Where do I sign?" Because, now it's just in their operating budget. It's just like your water bill at home, right? Nothing to it. People don't mind paying on the monthly because it's gradual pain as opposed to sudden pain.

So that's what we do. It's a program we call Water on Demand. Now, here's what we learned. There's a huge success story in the oil industry called Master Limited Partnerships, and in 1981 Apache Corporation invented these clustered oil or energy projects. Oil production, gas production and pipelines, and they package them up. And they created these partnerships and then you would have a royalty, it's a generational royalty and it just goes on forever, right? That that oil does not stop producing. That pipeline does not stop running.

We went, wait a minute. We can offer the same thing, but for water. You can invest in a basket of water projects, which we call Water on Demand. We create subsidiaries and we put capital in there and you're going to get 25% of the net profits from that, from your investments, for the life of the project, which can be 25 years or more. And you get a bunch of stock and everybody's happy, but you're getting water like an oil well.

But instead of it being fossil fuels, which we know the problems with that, I mean, right now I challenge anybody to drive very far without fossil fuel. Even the people driving electric cars, they're charging from a fossil source. So it's still very much embedded in our society, but we'd like to move away from it.

But we don't want to move away from water, we like that and want to do more water treatment. 6000 kids a day in the world die from bad water and it's something that we need to fix, right? So there's unlimited potential for water investment. What we did, we went, "Wait a minute. Why are we just waiting for the government to pay for the water systems, why don't we bring in ordinary investors and connect them up with water projects, like these oil limited partnerships?" And now you've got a new way for people to invest. Now, here's what we want to do. You've noticed, maybe that the elites are cornering the market on a bunch of stuff, right? Bill Gates just became the number one owner of real estate in America, for example, right?

Tony B: Yeah, farmland, farmland real estate.

Riggs: Farmland, exactly. But guess what? Water, this new water, like an oil well, is a way to democratize it that we don't, it does not have to be elite. out company will welcome investors in these systems. And now, instead of having one Jeff Bezos, you have Jeff Bezos divided by 10000, which is still a lot of money. And now we've democratized water investment. We've made it something for everybody and it's beneficial. And that's what excites us so much about it and why people are, you know, we're doing extremely well with this. We're accumulating capital so that, you know, out of every dollar we raise, 50 cents goes into this capital fund. We're now past a million dollars and it's rolling and we're putting money into these water systems and people are going to get their royalties. And that is a new day for water and we are so excited about doing that.

Tony B: Well, I love the idea of innovation that you're bringing into that play. It's very interesting. Like you talked about the elites, you know, they look at the world as their planet. They look at us as more like occupants that are kind of in the way and that they own everything, right? So when you look at Bezos buying up land, you know, Bezos is probably over three hundred fifty thousand acres. He's one of the top 30 landowners in the country. Private landowners and Gates is on the farmland list at about 200 and I think last I saw 250,260.

Water systems right now are a centralized system, so if you want to get water for Nashville, you go to the public utility for Nashville. That's where you go for the water. What you're talking, decentralizing that water treatment, decentralizing, putting the power really back into the individual's hands or in, you said 70 percent of all water usage is agricultural or industrial and they kind of become their own utility again, because now it's affordable to be your own utility. Is that generally the concept?

Riggs: Well, when I was living Los Angeles, you know, we'd flush the toilet and it would go all the way down to the ocean and they would treat the water, they weren't, they were dumping it treated. But they were dumping it. It was not coming back to Beverly Hills to be reused. And this is why we have very, very bad recycling rates. You know, Israel recycles almost 90 percent of their water. We recycle 1% and the reason is we have this big old centralized system that's out of date.

The central water system in this country, the 150,000 water systems in this country are not really going to be updated. What we're going to do is we're now building this ring of treatment systems around it that are private, that then do recycle, do get multiple turns on the water, treat it to better quality and then give it to the cities treated. I think we're going to see a lot of upheaval in water systems and some places are going to do okay and some places won't.

Tony B: Like water is the next gold. But you mentioned every day 6000 kids die from bad water. Well, I'm a numbers guy. So I translated that while we're talking. And that means that roughly about 2.2 million kids per year die just from bad water supply. That's about two hundred and fifty per hour, which this show is about an hour long, so that means somewhere in the world, 250 children died, during this show while we're doing this recording from bad water. That's mind boggling like it really kind of wakes you up.

Riggs: I just saw an article today that the real heroes of illness eradication in the early 20th century were not the doctors, although they played their part. It was the sanitation engineers who cleaned up the water, right?

Tony B: Oh, that's good.

Riggs: Here's the good news. Remember how when we went to wire up Africa for phones, we didn't build land lines, right? We just went to cell towers. There's no landlines in Africa, but they have phone service. So when you don't have infrastructure you can go straight to the new thing. We're not going to build big central plants to treat water in places like India, Bangladesh and Africa.

It's going to be a lot of small stuff. So the modular, small, self-treatment system that we're pioneering here today. We have great technology in house, that is these prefab systems called Modular Water Systems™, that is our brand. Well, we're doing it in America with these do-it-yourself businesses, but in the future it's going to be the entirety of the water system in a place like Republic of Central Africa or Gabon or Chad, right? That's going to be the entirety of it. They're not going to have a big central system and that I think is very exciting because we're going to make some big difference in those horrendous death tolls.

Tony B: Yeah. I love what you said there because I think people that don't understand systems or business, you get what's called a legacy system which is what the US has. It's a legacy system. It's old, it's outdated. It, you know, you want to put something new in, you want to improve it. It's ust so cost prohibitive just because vou've got to pull the old out, put the new in. Whereas in a place like you mentioned Africa, there's nothing there to replace. So it's you cut your cost like in half because you don't have to do away with the old you don't have to rip out the old. You just put the new in and everything's better.

That's an interesting concept. I'm going to be really fun following you guys over the next couple of years, and seeing how everything develops and goes. Let's talk for a minute before we wrap up because we're talking about all the dirty water and all this kind of stuff. What have you found like, you know, for us. I know when I went through the water process and what was in my house, you know, a lot of times people just drinking tap water thinking it's clean. But that couldn't be further from the truth.

There are so many things when I go to to clean my filter out, you know, you have to supposed to clean it out like once every 90 days. These household filters, 6 months in some cases. It's an, it's nasty, like the stuff that comes out of the water and I've got two stages. You said a .02 I think I've got a 10 micron and a point, something like a point o five. So I catch it in two stages and it's turned, the water turns brown and it's things floating in it. And I'm like, if I didn't have this filter on like that would be in me, it's bad. So what are you finding in water quality that needs to be cleaned up out there?

Riggs: Well. By the way, there's a very good website called EWG.org, Environmental Working Group, EWG.org/tapwater. And you can look up the water quality in your zip code EWG, just google EWG/tapwater and it'll come right up. And you'll be fascinated by what's there now. What they do is they,

Tony B: Fascinated or disgusted?

Riggs: Well, fascinated because the municipality you're looking at will probably be compliant with the law, but then they'll show OK, point something microns of arsenic let's say, right? And that's compliant. Then They say the actual level that science has determined is safe is much lower. So they have. the law is permitting much, much higher levels than are healthy.

Now these things are nasty in the water, glyphosate, which is roundup, is a terrible thing and we invested in a showerhead that is known to reduce the roundup you get into your body because it's absorbed through the skin and it leads to brain cancers. Farmers in the Midwest have these brain cancers that come out of being exposed to extra high levels of roundup. So, all these things are just not great. We need to do something about it. But, the problem is how? It's always been how?

But look at what happened in Flint. They had their big problem and we're still hearing about years later! Why? Because it's a municipality and there's all these, too many cooks in the kitchen and got into this, got into that. Meanwhile, we polluted, even the water heaters got led in them. Everything's got led in it. It just got messed up and so our solution is: Don't try to fix City Hall, fix your own point of use. That's the philosophy of Water on Demand.

As I said, we're currently operating in the industrial, agricultural, commercial space. Housing developments are about as small as we get but that's where most of the usage is, and we believe we're engineering the water revolution. What's even more of a revolution is we found a whole group of investors who are delighted to invest in water systems. Water rates inflate at three times the rate of inflation so that's definitely good because you're an inflation friendly investment.

And you're a founder so you get a ton of stock. So people are delighted to get involved with this because it's the first new asset investment that's come along since bitcoin really you know there hasn't been anything new, and this is brand new. And I would say it's much safer than bitcoin. We saw the Canadian government confiscate wallet addresses of these protesters. I don't think crypto is quite as safe as you think,

Tony B: Oh, it's absolutely not. That's a conversation for another day. I keep telling people, everybody, all the crypto guys, which I'm a crypto guy. I invest in cryptocurrency too but everybody tells you it's decentralized, get away from centralized, the central banks. But I'm gonna tell you it's the highest form of centralization there is because all the money in the world is going to be a one or a zero. And when every form of money is a digital piece of money and it's the one or zero and it's fully trackable, fully monitorable.

And this is the thing, you know, you guys listen, you can make money in crypto. I got a friend that made a million bucks lat year in crypto. First time, first year in crypto. He latched on to some people and just did what they told him to do, and he ran with it. Disclaimer I have not made a million dollars in crypto yet. I'm still working on it. I should have kept everything I bought back in the day. I'll be like three million right now.

Riggs: Don't...preaching to the choir.

Tony B: But I'm IKEA and I'll figure it out. But but the deal is, you know, if cryptocurrency had been i place bak to Adam and Eve you would have a financial record history transaction that was viewable to anybody all the way back to Adam and Eve. Every transaction, the Louisiana purchase, I mean, everything, everything, everybody would be able to see it and that, in my opinion, is not a very good thing if it's in the wrong hands.

As far as your stuff goes. Let's let's get the people over to your site and learn a little bit more, because I think this is really important stuff. You know, like I said, the elite are trying to buy up resources. They see the planet as their oyster, they own it. And we're just, you know, probably like ants eating off the fruit and they see that resource as a way to make money and control. And they are they have a plan for that. They're looking at that kind of stuff, right? Just be aware of it. It's not anything to be afraid of, but just be aware of it. Do the best you can do. And I love your strategies, Riggs. So how are the people going to find out about you? Follow up and look at your investment opportunities?

Riggs: Well, if they go to originclear.com, one word OriginClear right away, they will see a piece that Newsmax Morning Show did on us, which tell us about this story. And on top right, you'll see invest now. You know it's accredited investors. We don't currently have an offering for unaccredited investors, so best thing that unaccredited investors could do is simply invest in the stock itself on the open market. But for accredited investors, we offer this income flow, just like an oil well, and that is super exciting. Simply go to invest now and you'll see it explained in great detail and you'll get a chance to talk to my main man, Ken Berenger, who is one of the creators of Water on Demand and he will talk to you. We love this mission. We're making a change finally in water and we couldn't be happier to be finally be doing this. It's been a long time coming but like I say, when you apprentice at something you eventually get what you need.

Tony B: I love it, Riggs, you got a lot of wisdom there. Appreciate you being on the show today and sharing that. Let me remind you guys, that's originclear.com. Go check out what Riggs has got. OCLN is the ticker symbol, is that right Riggs? And if you want to look at if you look at buying it on the open market, is that is that DOW? Is that S&P? What is that?

Riggs: It's the OTC. So it's over the counter, basically, any one of your brokers, Ameritrade, whatever, you can buy it from and it's a penny stock and which means that, you know, sometimes it's better to buy something in pennies than in thousands of dollars a share, right?

Tony B: I'm a big believer man. You know, buying something on the ground floor and getting into it. And you know, I think my new investment strategy personally is like, find where you can stick a thousand ten thousand bucks to different places and just stick it everywhere you can for these opportunities. One of them's going to pay off and the sky's the limit. My wife, told me to buy Apple stock at $3 a share in... I tell her it was 2003. She told me she told me back in 1998. I don't know. But anyway, I missed it because, you know, $3000 was like, I don't know, two, three million bucks right now. And yeah, and I didn't listen to her. I didn't. She never made an investment in her life. She told me to buy Apple stock and I passed on it, I thought they were dead and gone.

Riggs: You listen to your wife. I've learned that lesson like how many times.

Tony B: Man, I'm telling you, I've got, I need to do a book on like picking stocks and letting her because she doesn't know anything about it. And I went through a process with her to see how she would do, and she liked nailed like eight out of 10 she picked and would have made money on the last ten years. Like a lot of money. Beat the S&P index.

I think everybody should pay attention to their health because there's so many chemicals and things in the water, in the food today. And when you look back just from a health perspective, these are things I've been learning over the last three, four or five years. But when you look at cancers, cancers were like one in one hundred or something like that. One in sixty you know 60 years ago. Now. it's like one in four. And you go, why is there a cancer epidemic? It wasn't like that 50 or 60 years ago. The only thing you can really point to is, you know, the v word.

Riggs: The environment.

Tony B: The environment, the food, the water. Diabetes, same thing and high fructose corn sirup. Man it's in there somewhere doing something bad to us. But anyway, Riggs, I appreciate it. Thank you,

Riggs: Tony. It's been such a pleasure and I hope we talk again in about six months and I'll give you update.

Tony B: Sure thing.

End of presentation

Open Discussion

Apprenticeship

Riggs: There we are. That was a really interesting interview, as you saw. And really a great interviewer he made. He briefly made. This is a small excerpt from an hour long podcast, but he made a brief reference to, We were talking about apprenticeship. He said to me, What's the secret to success? And I said apprentice, learn the trade, right, on the line, and I violated that so many times, it's scary. So I know by having violated that rule, try and apprentice. So, you know, saying so.

Huge Breakthrough

Keith Roeten says, "If MLP's are a proven system, that should be an easy sell to most people who are familiar with business."

What's your comment about that, Ken?

Ken: Yeah, so when I when I speak with prospects, look, this is like an MLP for water and they go, Oh, OK. Yes. You know, and then and then they go. So how does that, you know, of course, then it's well, how does that work? And I go, Well, picture you owned a private utility. It was a piece of equipment that drew if it drew oil out of the Earth, you'd get the royalty.

And if it's your water or actually recreated clean water from dirty, that is a billable commodity. All right. And and then it just, you know, it clicks. So then when I try to do, I mean, it's literally a 30-second explanation. And then it's just kind of going into the actual mechanics of the offering, which takes a little bit more care in time to, you know, to kind of lay out. But I think the concept is interesting.

Riggs: That was a huge breakthrough you know, comparing it to MLPs and you and I kind of just went, Whoa, this is like perfect. Now, as you say, the devil's in the details. It's far from the end of it, but it does a huge jump because before that, we'd have to explain. Now listen. Not all water is being treated da da da da. It was a long...

Not Everyone is in the Know

Ken: Right, exactly. Not everybody has the money to buy these systems, you know? And people don't realize that they go, Well, you know, I flush the toilet. It works. It's fine, you know, because people that are disconnected, people that are disconnected from agriculture in it. And you talk to anybody who's ever run anything in the agricultural or manufacturing line, they go, Oh yeah, water is, you know, water is a huge problem.

But folks that, you know, may be in, you know, in business or the corporate world, they don't really have as much of a in some cases, some are brilliant and they get it. And not people that aren't that don't get it. It's not that they may not be brilliant people, but they're not exposed to that. You know, only by, you know, you talk about apprenticeship when I went to join this company three and a half years ago, I had a vague idea that the water is bad. But you know, it's like, you know, it's like. Once you're in the water business, you'll never drink tap water again. You know, I think once you know, once you work in a slaughterhouse, you'll never eat a hamburger again. You know, that sort of thing, right? So, yeah, that's kind of what I experienced.

Riggs: Right, and you know, the truth is that we like to say that a button is not a hot button for people. If you have to explain it right, right, it's got to be like, boom.

Ken: And explain the punchline. The joke was not funny.

Riggs: That's right.

Ken: That's right.

Riggs: That's what happens with dad jokes, right? I get I get hit on all the time. So, Andrea, you're being remarkably quiet. You're just listening to us carry on and on, right?

Never a Better Time

Andrea: Well, it was a beautiful like it was a beautiful narrative that Ken was going through and I was a little captured. I was like, OK, that's really interesting. I actually like, You need to know guys that I think there is never been a better time to connect with the OriginClear because it's to use an analogy that the gentleman was using. If you're not in the market, you have no clue how much demand there is for what we are doing and how much our technology is really unique.

We were talking with Riggs today and we're going over really the technology that we have and what we are able to do with it. It's mind blowing. So it's really the right moment to jump on board of Apple, right? Like the water space, but like it's like an Apple in comparison. And yeah, I'm very excited. I'm a very conservative person when it comes to announcement and to be excited, especially in business. But I can tell you that these game you're playing and I got to say the freedom that Riggs keeps us in coming up with ideas and solutions and the approach we are going to make a dent in in the United States, that's for sure. We're going to it's going to be a major corporation in the United States, that's for sure.

Riggs: We're going to be an 11 30.

Ken: Oh, I'm sorry. What did you say, Riggs?

Riggs: No, never mind bad joke.

Ken: Ok? Many, many call at 11 30. Hey, got a minute?

Riggs: Ok, here we go. Oh my god, yes. Oh yeah,

Doing Well by Doing Good

Ken: Yeah. You know, I wanted to comment on something that Andrea said. Usually there's it's a binary choice when you're investing in a ground floor opportunity, it's either you're doing it entirely. In other words, you can make a lot of money or you can do a lot of good. It can make a lot of money if you do a lot of good, right? And if you do a lot of good, you can't make a lot of money, right? It was like a joke my friend often told me about, you know, with my wife, you can. You can be right or you can be married. Which one would you like, right? So I'm still married. So it's worked out fine.

Riggs: You learn humility.

Ken: What we learned is that too often it really is a it's a binary choice. You have to either chase this massive, accessible market with unlimited upside, and it's probably doing some, you know, not good things, whether it's to the environment or whatever. Or you can be kind of a philanthropist. What we've managed to do is combine doing well by doing good, right?

Think about every dollar that goes into Water on Demand, right? So every $100000 invested in Water on Demand creates seventeen point five million gallons of clean water. You want to talk about the, that's the definition of impact investing, isn't it, being actually able to calculate the impact you have a lot of impact investing is guesswork. Well, we think it's going to do this. We think it's going to do that.

This is direct. I mean, it's how we build for goodness sake. Right. So we can tell you to the drop. And I when I when I talk to folks that really. That, yeah, they want to make money, you know? Of course, they want to make money. That's why they're they're not just giving it away to charities. But, you know, when you see their eyes light up and you can say, look, you can personally track the number, the number of gallons that you personally will be responsible for reclaiming and Riggs huge booms, right?

I mean, and you can tell there's certain people that that is the heart of why they're what they really wanted to do. You know, we all want to rule the world. We all want to make a lot of money. But if you can do a heck of a lot of good, literally without any consequence to being part of this, you know, there's no downside to it. It's part of the process. I think it's a win win, and I think that's probably one of the more exciting elements.

The Importance of Modular Water Systems

Riggs: I wanted to circle back to the technology story that Andrea brought up. And in fact, this was the meeting I had this morning with Dan Early in. He was in Alabama. And what was really, really interesting and this is going to be next week. I'm teasing the next week thing. It's going to be a fascinating. We shot it in high res on both sides, so it's actually not a Zoom call. It's got good quality.

Industrialized Water Systems

And you know, he's really, what is coming out here is that Water on Demand is super important. But we also realized, Oh my gosh, we have got to standardize all the systems that go out there. Otherwise we will never be able to scale, right? So it is about Modular Water Systems has developed. They have industrialized water treatment systems in a way that is unique. And this, you know, literally this product line that is all very, very standardized is essential.

It's got to be part of the story with with Water on Demand, you can't have Water on Demand without solving the technology problem and you. And of course, this all started Ken, as you remember, because the technology was great, but it wasn't getting sold because of the capital. So, they kind of work together, right? They work hand in hand, solve capital and solve technology, but standardize and that's, we're going to cover that in detail next week.

Andrea: That's the key word. Interesting.

Ken: Yeah. And it's like. Go ahead. Go ahead, Andrea.

Demand and Adoption

Andrea: We are really like the more we go. So here's how it goes. Like when you enter into the market, you need to understand the perception of the market and then make it so cool that it becomes a no brainer, right? So in our particular case, we have we have this company, which is a technology company, and then we built the financial infrastructure around it so we can license the technology and do things with the technology basically handling whatever barrier is there for the adoption of such technology in the market. And I can tell you that, yeah, I cannot tell you yet, but I will tell you soon

Ken: You tell me offline, Okay, now you've got me,

Andrea: I can call you later. All right. Cool, please. But we have a really a technology that bring some serious innovation into the market for the way we can embrace larger projects, as well as more projects and keep using the same technology, same standard technology. Our business model that we are building is very solid and the demand for it guys, the quantity of demand is really surprising. Sometimes Riggs shows us how things are going on that on that end. It's a challenge to satisfy the demand, which is great. A great position to be in.

Ken: Pleasant problem.

Riggs: 100% right.

The Key to Scalability

Ken: Standardization is the key to scalability. I wanted to circle back as long as we keep using that term. I wanted to circle back to yes. Now don't say it. Don't say it. You say, name Jen. Yes. All right. The term industrialized water treatment. Explain the context under which Dan said it because some people may not understand that in the context that it's been used in this, you know, they think industrial, right?

Riggs: Ok, industrial. Fast forward to. I don't know five hundred or a thousand installations, right? If they are not identical in terms of the specs and the parts and the interchangeability and so forth. Forget it. It's over. Don't even try. Right? And this is where it's going. We're, Andrea and I really, today, we spent a lot of time looking at how this scales out big time and what are the, you know, what do we do first and second and third and above all, what came out of bubbled out of it was the vital ness of this industrialization really means standardization, right?

Ken: Model T.

Riggs: It means that model bump, bump, bump, bump, bump. And this is how the, for example, the Chinese have done so well is they just ramped it up, right? Well, we got to learn something from that.

Ken: And that's really what, the first assembly line car it was, you know, 10000 identical vehicles. You know, the Henry Ford Model T, right? I mean, that was really, that's what created the assembly line car.

Audience Participation

Riggs: I wanted to quickly cover, there's been some great comments in chat here. And "Hello," from Robert Baxter, who "had a great meeting with Ken," apparently.

Ken: Well, every meeting with me is a great meeting.

Riggs: Oh my God. Ok. And by the way, Ken is very modest. I just wanted to say that Daryl Polston says, "Standardization and modularity is important. I am in the beginning of an ideal for a digester with RNG compression to capture the methane while reducing the solid waste for safe reuse." Well, thank you for that, Darryl.

That is off topic for us because we've learned like we're water, all water all the time, but I wish you the best of luck. Kris Parks says, "I have so many shares of this stock because who doesn't want clean water? That's a buy and hold stock." We are not worthy. We are not worthy. This is beautiful.

And then our good friend, Rick Garcia, Ricardo Fabiano Garcia says, "That's very true. Having standardization will greatly simplify the logistics for parts and support." And Ricardo should know because he's a senior program manager at a major tech company in Boston. Fortunately, he doesn't have to live in Boston. Good for him, but he is, He's also one of our very, very close people, and he's involved with our crypto effort, which, by the way, we have not reported on a long time. Why? Because we got things bubbling here. We got things bubbling and we want to do it right.

Crypto Security

By the way, crypto just took off again. Why? Because of the stupid insanity that's going on where people are realizing that their Google Pay. A could be turned off, right, right? Apple Pay can be turned off, and so that's oops. So that's an oops moment for all of us. And and I think that we're going to see a lot of that and this is a big reason why we were planning to package the dividends in a crypto secure way that reflects the actual asset. The difference between the crypto vision that we have and and most others is that it every single gallon of water represented by that coin has money behind it. So is an actual income bearing asset. And that, I think, makes it really interesting.

We'll go. Bill Lucas Manzano, "Is the crypto on the ERC 20 format." Well, yes. Let's put it this way most everything is on, is on the Ethereum platform, but I don't want to drill down. But just think about what crypto standards are being used to package assets these days. Hmm. That's all I got to say. And we won't go any further on that. It is a different ERC altogether.

But it is correct that it is on the Ethereum platform, which is smart contracts, right? And so then you can you can say, Oh, if this happens, then pay this much to so and so. It's very, it's got all the if/then boolean stuff down, which my son learned by playing Minecraft, and he became very good at that stuff. He literally goes, Dad, what's this? Oh, that's an if not statement in Minecraft. How cool is that anyway?

I'm going to start wrapping it up. It's been an excellent call. Everybody stuck around. It's been so interesting. And you know, the podcast, The Millionaire Choice podcast, which is not video. He sent me the video just for fun, but it's going to be a radio podcast. It'll be out in a two or three weeks and it's a full hour and it goes into these things in a greater detail. Very, very good podcast with a lot of fun. Ken says, "Best wishes from El Salvador!" So, thank you, Ken.

Ken: Hello, Dr. Ken.

Riggs: Baddah boom. And Tom says, Tom, Liakos, "Thank you." Well, thank you, everyone. It's been really, really good.

Andrea: Thank you so much, guys.

Call Ken

Riggs: Next week we're going to have some really good, really, really, really interesting interview with Dan Early. You're going to want to be there. So just remember that if you want to talk to Ken, oc.gold/Ken and or email invest@originclear.com. But the best thing is just oc.gold/ken right in your browser, schedule a call, and I'll make sure that he has time for you. Just, you know.

Ken: And I'll try not to be boring.

Riggs: Yeah, because the rest of us are.

Andrea: Ha ha.

Ken: I never said that.

Riggs: All right, guys. Thank you.

Andrea: Thank you very much, guys,

Ken: Thanks for coming in.

Riggs: Blue Gold Baby. Ricardas says, "Blue Gold Baby." Right on baby. Thank you. Awesome sauce. Stay cool, guys.

Register for the next Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)