Insider Briefing of 3 September 2020

Helping you thrive in the world’s ONLY vital, scarce and recession-proof market

Half a million people already viewed our pool recycling video, what is the result? Meanwhile, find out how our Sales are doing so far this year! And… why you want to be paid to wait.

COVERED IN THIS BRIEFING — QUICK LINKS

- Phones in trees? The ferocious competition for work in the COVID economy.

- "It's the money, stupid!" Why water treatment equipment-backed investments can demonstrate repression-proof performance.

- Could OriginClear's Water As A Career™ model be the "GMAC of water?"

- Why OriginClear is looking like The Next Generation Water Company

- How 80,000 entrepreneurs put out of work by the COVID-19 debacle have a new chance.

- And now our lab-test pilot explodes into a runaway, highly-demanded overnight success.

- Why Pool Preserver program will only get better!

- The globally embracive OriginClear Wave business model and its implications.

- OriginClear's vision of a marketplace that enables independence and clean water for all people.

- How our core business division and products are in greater demand than ever before.

- Are Modular Water Systems™ becoming the new industry standard?

- The new water equipment financing model.

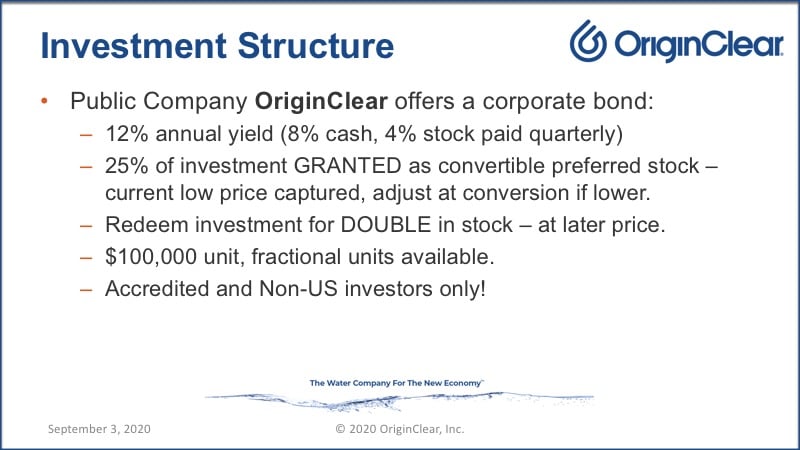

- How our generous offering for accredited investors combines the stable benefits of a bond with the upside potential of a stock.

- What about the Regulation A offering?

Transcript from recording

Introduction

Riggs Eckelberry:

And good evening everyone. It is the first briefing of September, and it actually happens to be our 77th briefing, but without further ado, I'm going to get started. Ken Berenger will be joining me for the discussion of our business model, which is amazing. But in fact, I have some cool stuff for you, that I'm going to start right away.

Again. "Water Is The New Gold." There's no question that water does not crash. We had a big stock pullback, stock market pullback today. You really want to be in a yield product. There's no question. Do not be in a pure equity product, be in a yield product, Ken and I will be discussing that further. Forward looking statements. Again, we are not prophets. We try our very best to predict the future and to tell you exactly how it is, and this briefing is where you will find out how it is. So here we go.

Putting Smartphones in Trees

By the way, those Amazon drivers, huh? Putting smartphones in trees to get more work. And this is the ferocious competition for work. This is what we've been saying all along, which is that the economy is in a terrible place and I'll be getting into details about why we're doing so well as a result.

Podcast Appearance

So earlier this week I was on something called the Growth Podcast, which is a very cool podcast. Aaron Civitarese is actually in Rome and I was being interviewed online. Let's have some highlights from that interview. Here we go.

Podcast Highlights

Aaron Civitarese: All right, this is the Growth Podcast. My name is Aaron Activities and I'm here today with my guest Riggs Eckelberry.

Riggs: The pleasure is mine.

Shaken Out of a Trance

Aaron: I feel like COVID shook people out of a trance.

Riggs: For us here at OriginClear, on the 29th of January. I remember that day. My key thinker in the company, Ken Berenger, who's our VP of business development, and I got together and went, "Oh my gosh, everything is changing." My CEO briefing that week was, "There is an epidemic in Wuhan and it will change everything." And it did, right? So at that point, we went into a race to deal with the chronic problem we have in the water industry, which is complacency and lack of change. Water is screwed up in the world. There's about 2.6 billion people who don't have access to clean water. Yet the water industry it like, "It's cool, dude. Everything's fine."

Somebody wake up. We knew that we had to pull an Uber or an Airbnb on it, meaning that this is a legacy industry, we got to do something completely new. It took us... Well, it took us until recently to fully build the model.

Company Mission

Aaron: Let's talk a little bit about your company and your mission.

Riggs: This year we got to the core of it, which is at the end of the day, "It's the money, stupid." Funding water projects is the longest piece of the sales cycle of a water project. We realized something very interesting, water has gone from being highly centralized, to very dispersed, very decentralized. Doing your own water treatment means that now water systems are small enough that people can invest in them. We realized, "Hey, wait a minute. It's just like oil and gas investors can passively invest in a water equipment project."

80,000 Entrepreneurs Shut Down

We realized we had to find a space that really, really, really needed money, that couldn't otherwise get it. That collided with the fact that 80,000 entrepreneurs have been shut down this year in the US alone, due to COVID. Of those businesses, 60,000 are small businesses. These people are looking, they're great entrepreneurs, but they can't operate a restaurant, or a beauty salon, or whatever. So they need a new career.

Water As A Career

Now the final piece of it was, Water As A Career™. Then we realized the final piece of it is, wait a minute. Why are we asking other people to invest in water equipment? Why don't we just pull a GMAC and do it ourselves? And now you've got this cool GM financial, Water As A Career, biz-op thing, and then you start replicating it. Vertical, vertical, vertical, vertical, vertical, vertical.

Now we have people out there with little mini water companies prosecuting the water attack, and I believe very strongly in decentralizing your teams. We've seen that with Amway, and all those guys, right? Where you turn everybody into a mini store and off they go, right? That I believe is the way forward. I mean, if you go to a GM dealership, they're not going to let you have Joe Dude lend you the money for that, they'll have GM financial lend it. It's an in-house, company store thing. Well, so we now have the company store and I think that's the complete package.

What a Business Model!

Aaron: Wow. What a business model. Holy man. That's impressive. Congratulations.

Riggs: It took us months. It was not day one. Believe me.

Aaron: No, absolutely. There's so much structure and layers involved and it's self serving, right? It's its own ecosystem and it all helps the next step. The entrepreneur can come in and seamless and you're giving them everything they need, including funding and stuff like this. There's so many entrepreneurs now. Just like you say, "They're smart, good, honest people who want to have an honest business. And since COVID, a lot of people have lost that.

Why is the US at 1%

Riggs: In the developed world. You have really good players like Israel. Israel recycles 90% of its water, close to 90%. What's the second in the world? Spain at 20%. Where's the US? 1%. Now, why is that so? Why is the US at 1%? It's because in the postwar era, we went for these big central processing systems where 85% of the water treated is these like five hyper mega water districts in America. You have a commercial and population growth that outstrips the central facilities.

You can no longer build a giant facility because you now urbanized the landscape. So there's no more room. What are you going to do? Put a water treatment plant in Fort Lauderdale? Not going to happen.

Going Granular

Now in the developing world, they never even got to it. India. Oh my God. It's just horrendous. There's people dying, people clean out the sewers by hand, who die from the sewer gases constantly. Well, the solution is very simple. Everything is going to be granular, right?

The Next Generation of Water Companies

Aaron: Doing it yourself. Get your own solar panels, your own water treatment, your own everything, right? And OriginClear is bringing the power to the people to now not only have clean and clear water to drink, but actually to create their own entrepreneurial business in the meantime. You're doing both sides of the coin, right?

You're helping people build a business, self-sufficient business owners, correctly, with the whole structure in place, and the product is something of extreme value. Arguably the most important thing in the world. It's so big. I can't even open my arms big enough to say how big it is, what you're doing. It's absolutely amazing. Wow.

Riggs: I believe that we represent the next generation in water companies.

Aaron: Cool, man. All right. Well, you enjoy the rest of your day there in Florida. A pleasure having you on.

Riggs: Aaron, thank you for the very fulfilling interview. Take care.

Aaron: Ciao

End of Podcast highlights

Riggs: So that was a very cool interview with Aaron. As you can tell, he really, really got it. I now am going to actually go to the next video.

Water As A Career Series Video Presentation

Transcript from recording:

Ryan Koistra: I've always been an entrepreneur by spirit. After over two decades in the corporate world, I wanted to do something else, but during the COVID shutdowns, it was not an ideal time to try and make a switch.

Very Little Experience

So I have very little experience with pools other than swimming in them. So the thought of shifting careers during this time, during this point in my life, after 20 years in the corporate world was very scary. But the folks at OriginClear made it very simple to walk right into an opportunity that allows me to make money right away and be profitable within the first month.

No Risk of Cracking

Typical drain. But they're going to drain your pool and it's going to potentially risk cracking so that crack can lead to thousands, if not tens of thousands of dollars in fees. Potentially I've heard anywhere from six to $20,000 for maintenance and repair of structural type cracks. The advantages of this process are there's zero risk because all the water stays in the pool and it just flows right through the trailer and it goes right back in not affecting the water level. So I don't ever risk any kind of structural issues to the pool whatsoever.

Perfectly Balanced

Saving and recycling all that water, it's a huge impact for the environment, especially here in the desert, where there's always a constant drought. And then also the results are actually better than doing a drain and fill because our process removes the chlorine. They come in with a bunch of other things. This takes all of that out of there, and you have a perfectly balanced body of water.

Honestly, it sells itself. As of right now, I have a rolling billboard behind me here with the trailer, the phone number, the website.

Word of Mouth

A lot of pool professionals, whether it's the weekly pool maintenance guys or the pool stores around the Valley, when folks go in and they need to change their water in the past required to drain their pool. So this is starting to become more and more talked about with pool professionals and they'll offer this out to their customers. And I get a lot of calls that way.

It was the cheapest, easiest, most streamlined business I've ever started with the least amount of overhead and the maximum amount of profits, honestly.

End of video presentation.

Riggs: And Ken you are with us.

Ken: Yes.

Riggs: Essentially what we had was first of all this podcast, which I think does a great job of discussing our business model, right. You and I will be talking about that further, but I promised a couple updates, so I'm going to continue. Our videographer, the amazing Steven Eckelberry. Yes, we practice nepotism because that way I get things cheaper. Steven Eckelberry delivered an excellent video, which you got a little piece of there. And I think Ryan Koistra is an example of a great customer who actually wants to get another unit and so forth. So I'm going to give you the full story on what's going on by sharing right now. And first of all, I got a couple of chats here.

All right. Okay. Brent, wants to know about his Regulation A investment and your regulation A investment, Brent is well and good. We're not going to be getting into the Regulation A offering tonight, only for lack of time. But next week I promise a full update on where that's going. It's very, very exciting.

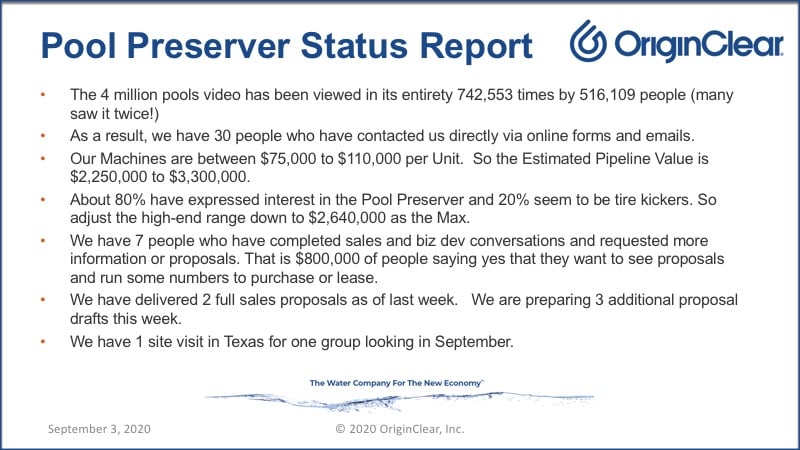

Pool Preserver Status Report

So I'm going to jump right back into the presentation and get past the videos and share it again. Here we go. All right. So, Pool Preserver's status report. We were wondering where all the leads were coming from. In fact, what we learned was that our marketing campaigns have been seen tremendously. There's a video called 4 millionpools. Actually it's 2 millionpools, but we call it Pool Preserver now, that's the name of it today, but it's been viewed almost three quarters of a million times by half a million people, which is part of why we get all this business.

The Results

30 people have contacted us. Now, our machines, depending on what you purchase, run in the hundred thousand dollar range, which puts us in that $3 million range for sales. Out of those, we think the real people are around two and a half million dollars. We have seven people who have completed these conversations with us. And so $800,000 in people who have reached. We delivered two full sales proposals, three more coming, one site visit in Texas.

Financing if Not Qualified

And then we have three equipment lease financing groups. Because our strategy is to have the financing groups for the people who can qualify, but they have to have a two year history. Guess what? This is weird. This is typical of any recession, which is, the government floods money to the banks and then the banks shut the tap. They hold onto the money. They get all freaked out. The money is plentiful, but very hard.

And sure enough, you have to have an excellent credit history for your business to get the funding. So this is a problem for people trying to lease, which is why most buyers are interested in the business opportunity and the package. And as capital becomes available, we want to provide funding. And this is through the bond offering that you and I will be discussing, Ken, further.

Free Equipment Contest!

And here's what's cool. This is a flash... You're hearing it for the first time. We're developing a contest where a winner would get free equipment rental, et cetera, and that is going to be a big, fun contest to get people going. Turnkey marketing program with business and technical elements, a full business-in-a-box. I also heard on Monday from Marc Stevens at Progressive Water Treatment, that the Generation 2 pilot is being built there right now.

And we're also getting ready to take the Pond Monster, the Pondster™ as our next business-in-a-box venture. Remember the Pondster is for ponds, it's for manure ponds, it's for the ponds... Let's say you got a condo and it's got a pond. They usually end up being green. Well, we have the equipment to handle it very efficiently for these people.

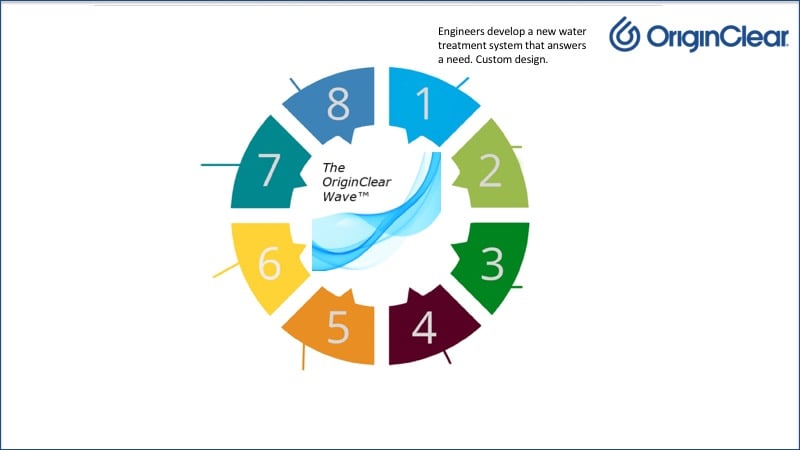

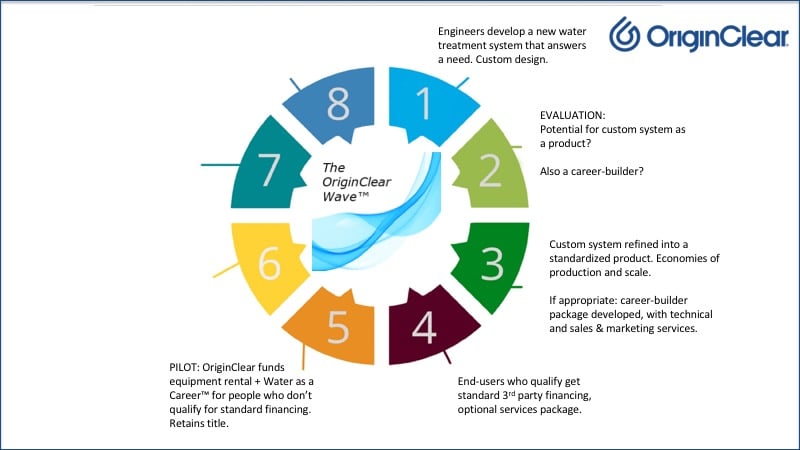

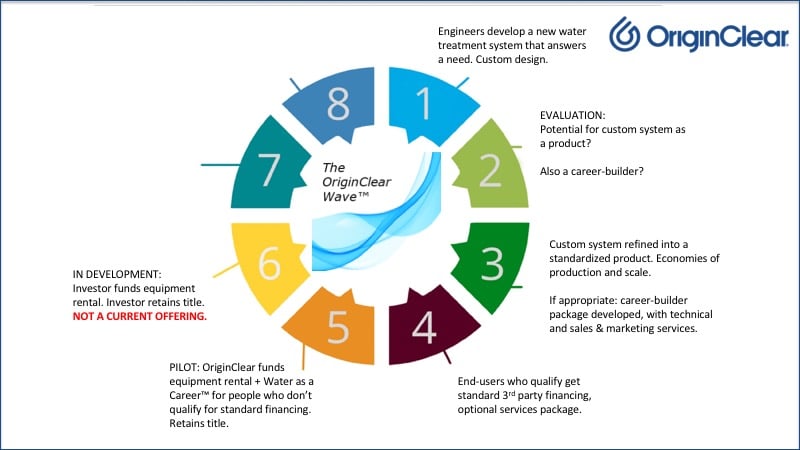

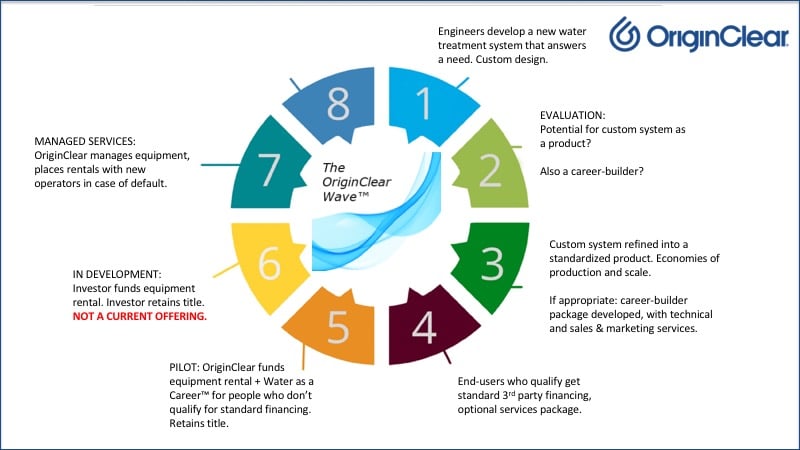

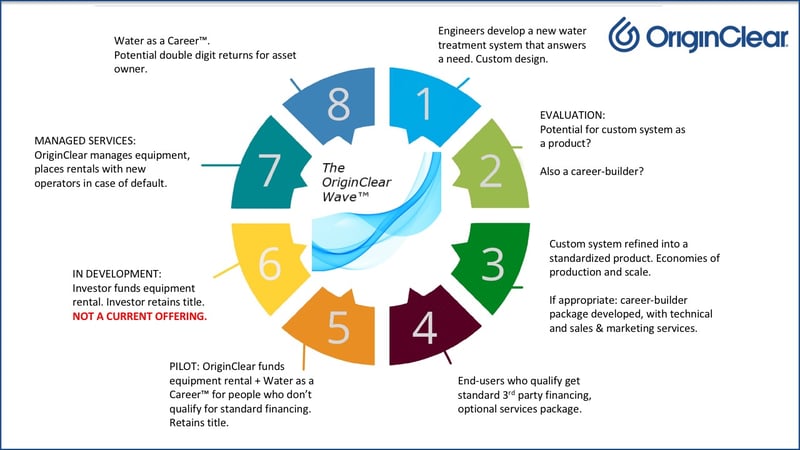

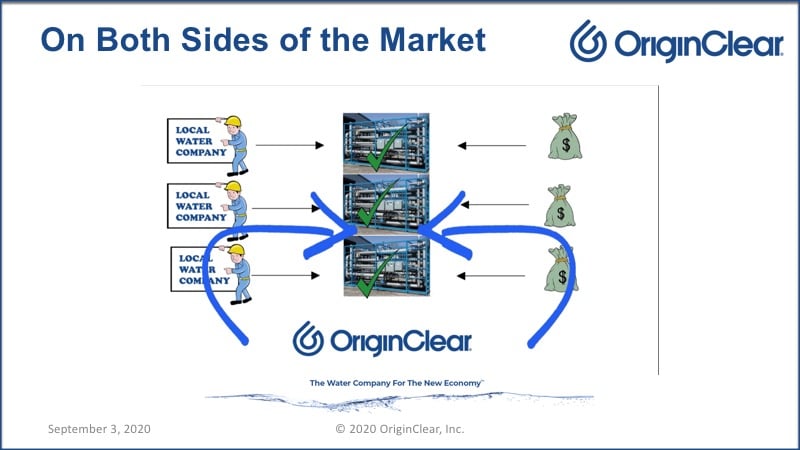

The OriginClear Wave

So to review how this all works, for those of you who have not been in our briefings, let's take a look at what we call the OriginClear Wave. And how does that work? Well, here's a nice little diagram, courtesy of our friends over at PhilanthroInvestors® who are helping us with our international network. First of all, of course, we have a wonderful Texas team that develops custom solutions for these water treatment systems.

Custom Solutions

So a customer wants a particular product, but a one-off, a custom design. We develop it. We're very good at that. That's why we do about a million dollars a quarter in business. And you've noticed that Pool Preserver's already generating about that in solid forecast, so that's really a good sign. But nonetheless, we do about a million dollars a quarter in this custom business.

Becoming Products and Building Careers

Then could it be a product? And that's where Pool Preserver became a product. Now Pondster is becoming a product, more to come. Could it be a career builder? That's always a possibility. Sometimes it's not. For example, pump stations go into the ground and they're very hard for somebody like us to rent out to somebody as a business because then the things end up in the ground, the guy fails and we can't get the equipment back. So it's basically got to be a mobile system. So not all products become career builders.

Standardized

Standardized product, economies of production. The Gen-2 thing with Pool Preserver as an example where we certainly feel we can double production. So maybe people can do two pools a day, perhaps. We don't know about the money savings yet, but we can at least do a lot more in terms of production. A career builder package is developed, what we call biz op, with technical, et cetera.

Qualified

From there people who qualify get those leases, but again they have to have two years of business. So that's kind of a problem these days.

People Who Don't Qualify

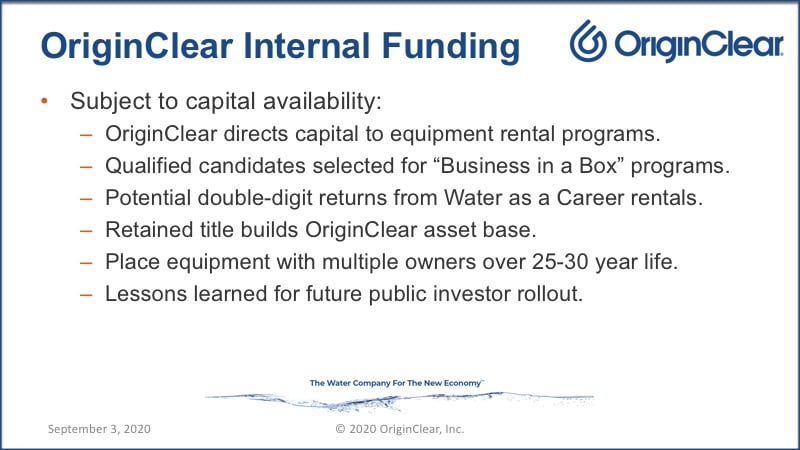

We are funding these equipment rentals. We did that for Ryan Koistra, worked very well, and he's extremely happy. So, we're doing extremely well raising capital currently. And when you invest in OriginClear, you'll get your double-digit yield, and we'll be able to put that money to work and retain the title so we have an asset. We're building an asset, and that has implications for going on to a national exchange. To be on the NASDAQ or the New York Stock Exchange you have to have assets.

External Investor Funding

Okay. We're also in development on doing investors funding equipment. Now we don't want to do that too soon, and I'll explain why in a second.

Regardless of who's funding it, OriginClear manages the equipment, places rentals with the new operators in case of default.

And finally double-digit returns for the asset owner

Building An Asset Base

So obviously it's very good for OriginClear to do the internal funding. Why? Because we can direct the capital. We get to reap double-digit returns. We build an asset base 25 to 30 year life. Gives us, we think 300% return on investment over the life of the investment. And here's what's important. We want to learn on our dime how many people fail, how many defaults, how many people abandoned, equipment maintenance costs. All these things currently are theoretical in this kind of a rental model where things get banged up a lot when they get recycled and so forth. How much refurbishing do you have to do?

We want to learn it ourselves, not with some extremely concerned financier like, "What's going on? Why isn't my machine working?" And so forth. We want to do it with our asset and our revenue stream. So that's why we're doing it in house.

The Water Marketplace

What does that look like? Again, you've seen this picture of the vision for a water marketplace, what we call the Airbnb for water. But we're the only water company, and we're the only financier aside from the leasing companies. In the middle we're putting together these water systems. So that is the workable model in our opinion. That's going extremely well. And at the same time we have our regular business, right? This is all Pool Preserver. It's new business. It's on top. It's the cream on top of the pie or the cake. Well, what is the cake? Okay. That's important to know.

What is the Cake?

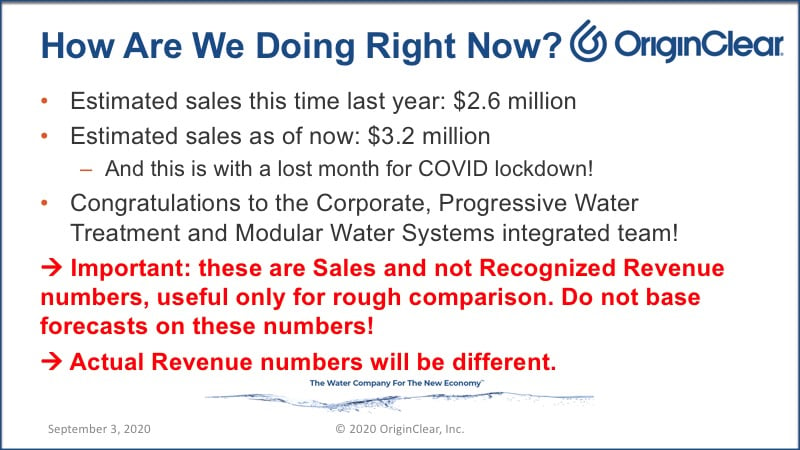

Well, I promised you that I would tell you how things are going right now. As you'd know, we had a 22% increase for the first half of the year, against the year before. Well, now we're going into Q4. How are we looking? Ta-da, here we go. Last year, this time we are a $2.6 million. Which meant that we were actually running shy of that million dollar run rate. And now we're well ahead 3.2 million in sales. Now this includes the fact that Texas had to lock down for a month and there was nothing that went on, like most of us.

It really was a breakthrough for corporate with Tom Marchesello, bringing in business and also driving the show. Progressive Water Treatment with Marc Stevens, running the show there. Mike Jenkins, the amazing head of sales there. The whole team. And then Modular Water Systems™ with Dan Early. Integrated, important to know these are not what we call revenue. Public companies use what's called recognized revenue, which is complicated.

Which is why we can never tell right away ... It's very hard to tell people after the end of a quarter just how well we've done, because it takes a while to work it out. But I've given you a snapshot of sales. Do not base your forecast on these numbers. The actual revenue numbers will be different, but it's very, very good news.

All right, now, Dan Early gave us a report. And again, he's our Chief Engineer and he's been running around doing webinars and so forth. Literally packed audiences for these Zoom webinars that he's been doing.

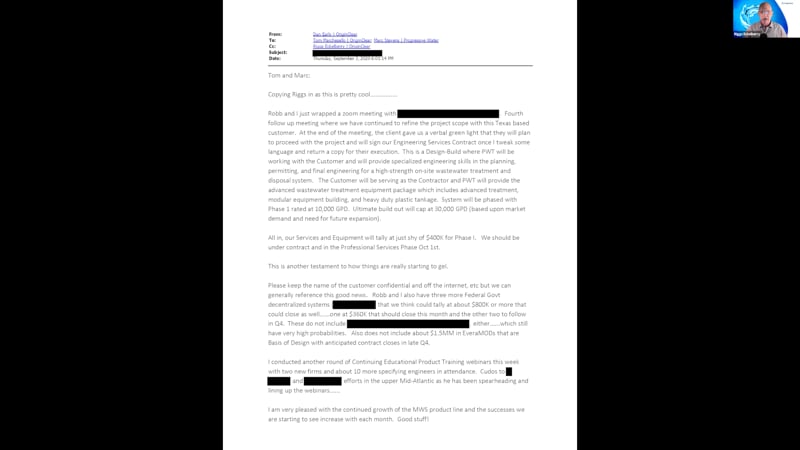

1M Dollar System

And I'm going to go ahead and cut over to a email he sent us. And there it is. And this email I've had to cut out the actual name of the project of course. But, "Robb and I just wrapped up a Zoom meeting with [so-and-so] and this is a ultimately 30,000 gallon per day system. The one right now, 10,000 gallons per day is $400,000. And so we expect to have that run on October 1st. Well, it's a multiple of that. I don't know exactly what the ultimate build-out will be at 30,000, but call it a million just to be safe."

But that's wonderful because this is the Modular Water Systems™ product line that we have been building all this time. It's actually working. So you can see how these things go down. "Now we are the design builders. We provide the specialized engineering skills, and final engineering for a high strength onsite wastewater treatment and disposal system."

Of course the names are confidential. "We have three more federal government systems being done." Again could be $800, 000. Remember, this is all speculative, but this is an email that literally came across my desk two hours ago...and then another one at $360, 000, et cetera.

We're Basis of Design

And then EveraMOD™. These are the pump stations. And that's 1.5 million where we are basis of design. What does basis of design mean? It means that we are the designers and it's very hard for somebody to rip off the contract because they don't have the design. So if we are the basis of design, then the customer has accepted us as the architect. And this is Dan Early's specialty. So you can see if you can just kind of look through the numbers there. He's got a couple million dollars worth of stuff going on in real time. Which is wonderful to hear about what's happening.

Continuing Education Webinars

He's doing his continuing webinars to more firms. And this is a sales rep organization that has been spearheading these. I think he's up to 200 or 300 engineers to date. So extremely good news and kudos to my man.

The GMAC of Water

So with that, I'm going to return to Ken here. And we're going to talk a little bit about how people can participate in this. So we've been telling you about how we want to be the GMAC. That was the old word for what's now called GM financial. It was called GM Acceptance Corporation. That was the old name for it. It was always super profitable. Even in the pandemic year, GM sales have gone to zero basically. Whereas the financial group, it's bumping along 10% plus. So it's a very, very strong piece of the business.

Our Corporate Bond

When you invest in our corporate bond, you see a 12% annual yield. You see an immediate, additional 25% cherry on top, granted to you as stock that can be converted to common stock. And then that investment you made, let's say you invested $100,000, and by the way that can be broken up. But let's say a $100,000. You get $25,000 in stock right off the bat and then you get 12% along the way.

Redeemable at 200%

And the day when you think, "Ooh, the stock is going up." Great. You can redeem your $100,000 for $200,000 in stock at that later price, right? So, you know what, if the stock starts running, you don't want to wait. Like the people who didn't pick up on Zoom early on, they're still scrambling around and playing around with Zoom, kind of being crazy right now. So you definitely want to be an owner early on these things, and that's your opportunity today. But this is only for accredited and non US investors. Remember for unaccredited investors that is being rolled out right now. You'll hear more about that next week. So why is that? Perhaps Ken you'd like to talk about this slide here.

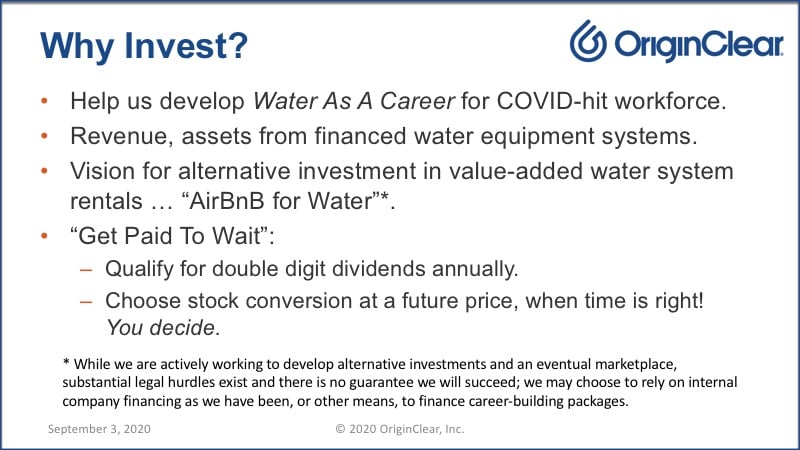

Why Invest?

Ken: You were on a roll. I didn't want to get in the way! So, the ultimate goal here. And I tell prospective investors this. Yes, we want to be an Airbnb of water someday, but we're in a very unique time. You can launch something in the next several months, have an eCommerce marketplace, which is always a force multiplier for evaluation. That's hot. If that force multiplier actually has the potential to put thousands or tens of thousands of entrepreneurs back to work, that's a second really attractive feature. The Airbnb for water is the eCommerce solution to drop-and-go systems.

Being an Angel, Without the Nail-biting

The getting paid to wait allows folks to, essentially, be angels, but not have the nail-biting scenario. So you and I talked about this, Riggs. The early Tesla investors, you had bond investors, you had stock investors. Now, in the very early days, I promise you the stock investors wish they were bond investors because he was getting shorted. He was getting killed. Everyone thought he was crazy. And I can also promise you with the same degree of certainty, much more certainty, as the guy who didn't buy it at 400 because it was a car company. And the, bond holders today wish they were the stockholders.

Riggs: So for people who are not finance people, what's the difference between a bond holder and a stockholder in terms of their expectations. And what does it look like?

Ken: So bonds are going to have a virtually certain or reasonably certain return of principal and a very steady rate of return. It's already monetized. You already know what you're going to make on it. Now stock, you have the unlimited potential. You have the dream. You also have the ups and downs with the market. The market dropped 700 points today. Someone bought at the high today, they think that they're having a bad day.

Steady Earnings Plus an Upside

What we wanted to do was provide both. We wanted to start out our angels, that allowed this thing to happen, as a nice, steady income-bearing instrument with the option to literally convert it to a 200% premium into our common stock the minute that the appreciation in our stock actually outpaces the dividend. So the pay to wait, I wanted to kind of paint a bigger picture on that. You're literally collecting 12% until one day you wake up and go, "Well, 12% is costing me money. Stock has moved X over a period of time. I'm actually better served now enjoying the upside," but you didn't sit there waiting for something to happen. You didn't leave the porch light on. You were earning money the entire time. So what we've tried to do here, and you and I spent a couple of nights on this.

Riggs: More than that.

Ken: And that's when you were in California and I was on East coast, so I was up late. But what we wanted to do was to develop a way to provide unlimited potential, always with the understanding that it can go the other way, but until it doesn't, you will just earn a rate of return. You'll have a nice, solid corporate bond. We paid 33 months of dividends consistently since we started this concept. And I'm really proud of that. And PWT [Progressive Water Treatment] and that solid revenue base allows us to continue to do that indefinitely.

Don't Quit Before the Big Move

So if you ask the early Tesla stockholders how they're feeling right now, most of them will say miserable because they got out because they made a little bit of money and they were gone. If you're making 12% to wait, maybe you'll hang in there a little longer. You won't quit before the big move. And that was my mentality.

Lender Mentality and a Self-Serving Motive

Riggs: Well, I think that's a very good introduction to the concept. And so we have this idea of a get paid to wait, as you were saying. Water As A Career gets these mini water companies going and then, of course, we get revenue and assets from stuff we finance ourselves in the future and Airbnb for water. And, again, we want to disclaim that it's not happening in the short term. Why? Well, because, again, we want to work out the bugs ourselves internally and not out there in the marketplace with the quote, unquote lender mentality beating us up, we'll be the lender and we'll beat ourselves up. That's what we'll do anyway.

Ken: There's also a self-serving motive there too. These units being rented out to an end user generate two to three times the type of revenue that we would generate as a water company selling them. So being able to put a couple of dozen of these out, we've shown models on the Investor Water™. The ultimate goal was to have these things owned by investors. You'll see a hundred-thousand-dollar piece of equipment generating what, $240,000 in rents over a five-year period, instead of just making a 20% margin on the sale of the product, we can capture most, if not all of that, as we figure out what parts need to be revised.

Riggs: Unquestionably.

Ken: That is huge.

Something You CAN Invest In

Riggs: Not only that, there's a wonderful company called Cambrian Innovation, which has done a great job of building and financing and doing Water as a Service, but they're private. So unless you, one of the venture capitalists investing in that, you have to go with something you can invest in like, "Surprise, surprise. OriginClear." So this is your opportunity to get a market product.

So all the good reasons why people should invest in a bond, which is we've done 33 months, I think, of dividend payments on time, of course. We've been in business for 13 years. We've got all these technologies and abilities and so forth. So we've built a real performance capability and a heck of a team. So that's where the bond side works. And then the stock conversion. Stock's been stable, but who knows where it goes, but if and when it takes off, as we perform and get our fundamentals rolling, then you have the option, at your discretion, to convert.

Contact Us

I'm not going to take up too much for their time because these cool videos took up much of our evening, but I think they were worth it. To talk to the amazing Ken Berenger here, you can dial the number (877) 440-4603, extension 201, but even better, just go to oc.gold/ken, schedule a call. I think you'll find it to be amazing.

So thank you very much, everyone. We've been really privileged to have you on board. We think that September is going to be amazing. I want to wish everyone an amazing Labor Day weekend. Relax and hopefully you'll get out from whatever COVID situation you're stuck in. Some places are better than others, but here's the good news. We know that the economy for us is rolling, that there are orders being made, that we are ahead of plan, that there seems to be a COVID catchup going on, which we're grateful for. Made in USA seems to work. Tom was telling us about that last week.And we are doing very well with Pool Preserver as it rolls out.

Regulation A Next Week

So next week you'll hear more about the regulation A offering. And I think it's going to be very exciting. So do join us.

Disclaimers

And the usual address is, I'm going to give that because I need to give you a little disclaimer after all that discussion of the offering, which is that security is the regulation D which is this offering has not been approved by the Securities Exchange Commission and you can lose your investment, of course.

Thank You!

Thank you. Be sure to join us next week. Just go to oc.gold/ceo. I look forward to seeing you. Thank you, everyone. Happy Labor Day and thank you, Ken, for joining us.

Register for next week’s Insider Briefing: HERE

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)