Insider Briefing of 9 April 2020

Helping You Thrive in the World's ONLY Vital, Scarce and Recession-Proof Market

America’s water industry needs to get to work again. And our water is tainted with coronavirus, that’s urgent work! Where’s the funding? Investor Water™. In this briefing, CEO Eckelberry tells you all about it. Exciting!

Transcript from recording:

Introduction

Riggs Eckelberry:

Hello everyone. This is Riggs Eckelberry and we are once again in our Thursday briefing and it is the 9th of April. We have a series of audio briefings in between the big first [of the month] Thursday briefing that we do and despite the fact that it's an audio briefing, I am going to play a clip. If you are not on video that's fine. If you are not watching the web version, that's fine. You will be able to hear the speaking and then it will also be shown on the replay that you will get right after the next morning. You can actually watch it, but it is kind of cool. What we have though is we have these video briefings that are full webinars on the first Thursday of every month and it is getting pretty cool and exciting.

Insider Briefings

And we are going to have that as I was saying, I believe it is May 2nd. In the interim, we have these weekly Thursday briefings which are more intimate. They are more relaxed and also give you dynamic, real time updates of what is going on. The purpose, really, of these briefings is to give you an update on what's happening and to share some of the latest. So, without further ado, I am going to run this in a clip and then I will make some comments about it.

The Slowness Problem

For years now we have been trying to break what I call the slowness problem with water. In other words, water equipment deals just take a long time to tee up and to get done. They are very stable but it's not like we are saving all the water problems in the world, right? Only a small percentage of the problems are being dealt with. If we really want to take care of sanitation and good health through good water, properly recycle the water, all those important things then we have got to think of faster ways to expand these projects.

Investor Water

I am working to create a new concept. It is called Investor Water™. Investor Water is like Zillow for water. It's a way to connect investors with water projects so that the people who need the water projects done don't have to come up with a bunch of capital, don't want to have to make multi-year commitments, don't have to pass lots of credit checks. They need the equipment, they get the equipment. And that I believe is a breakthrough because when you think of every single major disruptive thing that has been done in the last 10, 15 years, it's been about the app, right? Zillow, Airbnb, Uber. It's about the app and that is where we are going with that.

Tagline & Slogan

Okay, so the video has ended on a screen that says this, "Investor Water™," and the tagline is: “Investor-Funded Water Systems,” which I will talk more about. The slogan is: “Water Needs Cleaning, America Needs Work, We Connect The Two.” All right, so we are going to explore that a little bit and then we are going to also be talking about the fabulous, amazing Regulation A Offering that is just beating all records. People love it. And I'll explain to you why. But let's first cover this Investor Water concept.

Stable Business

What we have realized is that on the one hand we have these very stable water projects, and, in this economy, which basically the entire economy came to a crashing halt. Restarting it is going to be interesting and a challenge. In this environment though the government is giving a huge amount of money to the big corporations, to the government, the municipalities, the cities, the water districts. So we are seeing these projects cook along just fine. I've got all my guys in Texas working from home, getting all these deals and they are happy to get a lot of action there. They are hearing from large deals that are saying, “This is happening,” and so forth. So that is a stable business and it is going to continue. We are very happy with it.

President & Chief Operating Officer

Recently I promoted, with the approval of the board, we promoted Tom Marchesello to President and Chief Operating Officer of the company. I plan to have Tom on one of these shows soon because he is amazing. He's very real. I'm idealistic and about the future and he is really about, let's get it done, guys. So, he is a great counterpoint to me. He was in the Space Command of the US Air Force in the military, retired as a captain, just an amazing guy.

So he is President and COO of the company specifically with the purpose of running what we've got. And it is these big long water equipment projects. Occasionally you get a $1 to $2 million hit like, whoa! But, it's like kill me, kill me, kill me, kill me, big win, kill me, kill me, kill me, big win. And that is the nature of the water industry. It is what it is. It is high ticket.

OriginClear manufactures industrial grade reverse osmosis systems for government facilities

So that side of the business is really being managed by Tom. I am overlooking it, but he is really the guy in charge of it because I want to focus on this other stuff. So, just to finish on the main OriginClear side, he is running it for productivity but also integrating all the parts of the organization. Finance, let's say that somebody starts a project way over here in an initial proposal, and then it rolls all the way through approval, then automatic invoicing, and interfaces with QuickBooks and automatically goes to the auditors.

Systems incorporate advanced components such as PLC (Programmable Logic Controllers) and are computer monitored and operated

Many, many things that today are done with great amount of work and expense and delay will be fully integrated in a customer relationship management or CRM system called Zoho.

Implementing Zoho

Zoho is very powerful. We are very happy with it. We have implemented it for this initial Regulation A Offering and we see this as continuing to broaden, and that is Tom's main platform, to get the whole company operating very smoothly and ultimately profitably.

Now in addition, he has got to do acquisitions and that is not a bad thing. It is actually a lot of fun doing acquisitions, especially if you have got the money. That has been our problem for years now, where to get the capital? We have solved that we think, so let me continue about that. So, he will have this job of doing human resources and information technology and the CRM, customer relationship management, and getting all of the activities going and interlocked and everything just clicking over beautifully and integrated.

Accelerated By Pandemic

But here is the reality. Water industry projects are so slow that the companies don't grow that fast. To have a company grow by 25% in a year in the water industry is huge. Now, they are very stable. They are very solid money, et cetera, but there is a problem with fast growth. If you want fast growth, there is an issue, and we identified that. The funny thing about this whole pandemic is, aside from the human costs, which is tragic in many ways, especially my friends in New York, is that you have got an acceleration of whatever was going to happen. We were already planning to get into some of these new ideas, but the pandemic forced us because it was a big reset and a lot of things that were going to happen anyway, like big chain department stores closing and all that stuff, well it has just gotten accelerated by this.

In a way it is a big reset button on the economy. And what is going to emerge is going to be on the one hand, heavily, well-funded, big business and government things because the government is going to make sure that is continued; Boeing is being bailed out. At the same time, there is going to be the emergence of online digital marketing.

Water Systems For Every Day Users

And in the middle when you are talking about physical product like water systems, well how do you move into the digital world? Because we have got the government stuff and so forth, but as I said already, that is not in a big growth pattern. It is a good business and we will buy more companies that do that and that would be nice because that is how water companies grow. They grow by acquisition, not by internal, organic growth. So, we come back to the issue of how do we make water systems outside of that protected zone work for the everyday user?

Capital Drying Up

For example, we have a prospective customer, they are actually great friends of ours on a personal basis. My wife and I are good friends with that couple, and they have an investment in a trailer park in Troy, Alabama, which has a water problem. They can't sell that mobile home park until they solve the water problem. We have solved the problem, we've got an elegant solution, but now, where is the money? Okay, so now that problem is there and is going to get worse. We see a lot of capital, ordinary capital, not government giveaways, but ordinary capital, is drying up and it is going to happen.

All You Have To Do, Is Sign!

We are not seeing that problem, and I will explain why in a bit, but I have seen that broadly across the economy. So we came up with this bright idea. What if my friends who have this mobile home park, if they could just go (it was actually in a conference call with them talking), what if you could just go, “Here, here is the water system, just sign for it and go.” So, I told my friend, Steve, I said, "Here, just sign for it and go." He goes, "Wait, what about all the costs of the permitting and the this and the that?" “We got it, we got it all. All you got to do is sign, and you got your machine.”

Factory prefab Modular Water Systems™ - trucked in and dropped in place

All right. Now to make that work, several things had to fall in place. Number one, we had to have a technology solution, right? We had to know how to deliver a solution to a problem that was roughly in the 75 to $125,000 range, and that was the brilliance of Dan Early, who is the guru of modular, prefabricated, role in place water systems. So, that was key and that is a big, big piece of the solution.

Finding Financing

Secondly, if you are going to find finance for it, then how are you going to do it? Years ago, I was trying to do projects in the film industry, like everybody in LA, I spent a year in the film industry. Well, sure enough, I was at an Italian restaurant on La Brea meeting with a film person, and I said, "How do I get in?" This and that. She goes, "Oh, it's impossible, it is so hard. You'll never get in." And I said, "Well, what if I bring the money?" And she said, "Oh, you’ve got the money." She changed completely. I was like, "Wow." All of a sudden, you got the money, you are a celebrity in Hollywood, right? It is true just about everywhere.

Tom Marchesello knows this because he used to work on the buy side in major investment funds for years. So, he was doling out the money, and everybody was like, "Please, can I have the money!" It's a totally different thing.

It’s Funded – Just Sign Here

So, what we are moving toward here is a way to not have to sell a project, but go and be the white knight. “Here, here is your solution, and by the way, it's funded, just sign here.” Imagine what that would do to speed up water solutions all over America and the world. That is where we come to Investor-Funded Water Systems, this new business unit at OriginClear called Investor Water. If you go to InvestorWater.com, you will get a coming soon thing with a nice picture of a Norwegian Fjord. Believe me, we have exciting things happening in the background on that real soon now.

So, what is the funding method? How do we do it? Well, the next piece of the puzzle is that we created a short-term leasing model, much like when somebody who doesn't have a lot of money in a poor part of town and they rent a TV. They rent that TV for way too much money, right? Maybe it's 12, $15 a week, or whatever it is, but they could buy it.. Pretty soon they will have paid for the whole TV and again and again and again and again. But guess what? They don't have the $400 for that TV, and their credit went bad or whatever happened, and so there they are, and so they rent the TV.

It's Month To Month

So that is the concept here is to have short-term leasing of these units. And we tell my friend Steve and his beautiful wife, "Okay, we are going to go ahead and let you have this. It is going to be monthly payments. We are just going to make sure that you haven't convicted a fraud or whatever. But nope, we don't care about your credit score too much and you don't have to mortgage things. Just sign this rental agreement. The machine remains our property. You are going to pay first, last, and security." And it will show up and it'll start doing its job. “It's month to month. Anytime you want to cancel, just tell us. We will take it away. Any time you stop paying, we have the right to come on your property and take it because it's our property.”

Rental Equipment

All right, so that simplifies everything because right now in this economy, let me tell you that, if you are trying to collect on a debt that is secured by property or whatever, oh my God, right now real estate investors are in a world of hurt. So you don't want to have a mortgage on the guy's property because you will be last in line. This is not the place to be. Instead, what you want to do is you own the equipment and basically people pay to use it. And if they can't pay, they don't use it, and if they are done with it, they stop using it. So that is very simple. And of course, we offer them, to be fair, because the rental fee is quite high, we offer them a buyout where they get to, any time, just go ahead, either lease it or buy it and it is all yours.

So, we give them a fair option, and in the meantime, they have their solution. My friend Steve and his beautiful wife get to sell their mobile home park, and the next guy will inherit that deal and can either choose to continue with it or return the equipment. It is up to him or her. So that is that model. It's a very robust financing model.

Keep The Title

Places like Rent-A-Center do not get in trouble with their equipment. They rent it out and it is insured against theft or loss, but in terms of the actual title to it, they keep title, it is theirs.

All right. Now let's see the second big part. The first part was product, making elegant relatively inexpensive products that are portable, modular, prefab, truck on site. The central piece was how, this whole short-term leasing concept. And then the right-hand piece is where does the money come from? And it comes from three places.

Investor Owned

The first is our own investor base. We have an amazingly loyal investor base that has stuck with us through thick and thin. We do our best for them. We have only been able to really help the accredited investor to date, but now we got the unaccredited investor with a great deal, so now we are helping everybody. And we have a lot of people that say, "Riggs, keep going, what you are doing is vital, et cetera." So those investors are interested in becoming investors in these Investor Water equipment deals.

Bonus ROI

Not only that, if you are one of our accredited investors or an investor of any kind above a certain amount, we will give you a credit against your participation in this thing. So, let's say for example, it is a $75,000 system. Well, to keep it simple, let's say it is $100,000 system. Right away, we will give you, if you invest a certain amount or have invested a certain amount in the company, we will give you 15%. It goes all the way down to 10 [%] depending on what level [is or was invested]. Now that machine is $85,000, not $100,000. So that is good for you because, guess what, that 15% difference goes right into your return on investment and it sweetens it beautifully.

18%-20% Every Year

The second thing is, that the monthly rental number is rich enough that it can get you a good return. We estimate 18% to 20% return on your investment every year, and you do nothing for that, zero, and you continue to have a uniform commercial code, UCC-1 form on that machine. That machine is one that we hold, we never give it up to the renter, and you have, as an investor, the right to seize it. So, everybody is happy now. You are making really good money and we get a percentage on everything.

We have a management fee that we take just like anybody, but we don't just manage this machine. We find the projects, we get the permitting done, we do all the technical stuff, all the sausage making that you have to do. Then, when the guy returns the machine, we get it refurbished, put it back in service, we take care of all of it. We get what we think is a modest management fee. The reason I am not giving the number is because it's not finalized, but it is a number that is very fair and that allows the investor, as I said, to have the 18% to 20%. So that is the first part of where the money comes from.

“Arm’s Length” Company Participation

The second part is OriginClear itself. I will tell a quick story in a bit about a particular deal that we are rolling out where it is all about OriginClear having a machine, having invested in a machine, and now being able to supply it. In addition, our big Regulation A offering will provide us capital to do that kind of thing, so OriginClear might be the investor in these deals in an “arm's length” relationship with Investor Water. So, Investor Water is just treating OriginClear, its parent, as, “Oh, you are an investor and we are going to take a management fee from you too.” So, it is all very fair to Investor Water.

The third major way is the government, and this is why we have this three-parts slogan. “Water Needs Cleaning, America Needs Work, We Connect The Two.” First of all, water needs cleaning. There is a lot of work needed in America for cleaning water.

New research examines wastewater to detect community spread of Covid-19

(April 7, 2020. STATREPORTS)

Coronavirus In The Sewage Water?

Here's the problem. The coronavirus is in the sewage water. I have got an article which talks about how, “We can detect the coronavirus by seeing where it goes by looking in the sewage.” I go, "Yeah, it also says that the sewage has got the coronavirus." And so, it is going to be part of the purification efforts. Yes, people have problems with Roundup and with this, that, and the other thing, but this is an active pandemic.

So, there is a problem with water and we need to get a lot of systems out there so that a trailer park doesn't have a manure lagoon, a poop pit, you might call it, for their sanitation. Right? That is 19th century. We just don't want to have it anymore. For the health of America, we have got to have it. So, “Water Needs Cleaning,” for sure, “America Needs Work.”

America’s Historic Unemployment Cliff: 10 Facts You Should Know (April 6, 2020. Foundation for Economic Education)

The Unemployment Cliff

It has been estimated by the Federal Reserve of St. Louis that we are going to 30 plus percent, 32% unemployment and the Great Depression never got beyond 24½ % . In the Great Depression, they went nuts to try and get people work. They ended up working on this Civilian Conservation Corps, the CCC, building dams and whatever. They had the WPA, the Works Project Administration, which allowed big murals to be made and art and this and all kinds of interesting things. They found work.

Phase 4 Coronavirus Infrastructure Spending To Start At $2 Trillion

(March 31, 2020. Forbes)

Lots Of Money

So, in a similar way, if we can get a lot of water companies working on these projects, then the government is going to love this. Currently, the SBA, the Small Business Administration, as well as treasury are looking desperately for places to put money that is going to be productive and get people back to wor. Donald Trump recently announced that the two trillion-dollar infrastructure program that he has proposed will be what he calls phase four of the COVID-19. So, there is going to be lots of money for this and we are providing a channel to get it done fast. So, that is the third big way. And we have a full-time, very qualified Finance Project Manager on the job to work on this right now, so that is really, really important.

Proof Of Concept

Now, moving away from this, you see where this is going is that we are doing these proof of concept projects and I'm not going to have much time to talk about it now because I want to cover the Regulation A offering. We have these projects that are basically proof of concept for us. They are in three specialized areas. One of them is that trailer park. Another one is these manure ponds in actual animal farms, which is a very similar application and the third has to do with flushing out pools, renewing pool water, which is an important business and we have a very elegant solution. Okay, so those are the three areas, but we don't want to do them forever.

Airbnb started by renting out two apartments in downtown San Francisco that these guys owned, the two founders. They were doing it themselves. They proved the model. Okay, this is how it works, this and that. When they got the model, then they took it down the road to Palo Alto and got their millions of dollars.

Connecting Investors & Water Projects

What we are doing here is a very similar thing. We are proving out the model ourselves. As soon as possible, we want to pull away, zoom out and kind of in the same way as Zillow does, connect people. Oh, you are such and such company in Atlanta, Georgia and you have got a multi-home development project that can't connect to sewage and you want to have a black water treatment, and black water means poop, poop water treatment system and go ahead and list it and then investors can browse all these things. Oh, I like that. Click. Indication of interest and pretty soon they are happening and we have connected the two. That is where we are going. It's an app.

That is my vision and it is not mine alone. Some fabulous people have worked with me on this, especially the amazing, brilliant Ken Berenger who is our VP of business development and we get in these…crazy high-speed brainstorming, because two months ago we realized this is where things were going. We went, oh my gosh, the economy is going to hit the wall. We already knew it when we saw China shutdown.

Scaling Up Water Systems

I think it was around my birthday, February 8th. It started really early. We were like, okay, we have got a problem. Ever since then we have been working, working, working on this. Ken, I don't even know who owned what idea, and then Michael Mann, who is commercializing Investor Water. He had some ideas and we've all, Tom Marchesello, and these came together to be this amazing application that we think is going to be world class to scale up water systems without the number one barrier, which is money. They are scalable because of our technology. We are the ones who put in place these rental programs, so that works great, and then the money is there. I am beyond excited about it. Stay tuned for more about Investor Water.

We are live in the market in Phoenix with a pool flushing application. As you know, pool owners, they have to do something every X-amount of months depending how much usage the pool gets because people pee in pools and so you get a rising mineral level. It is kind of like, it turns kind of salty over time and once in a while, you just can't keep shocking the pool, you are going to have to flush it out. Well, there is a 15,000-20,000 gallon pool and when you’re talking Vegas hotels, you are talking a million gallons. But these pools then have to be dumped out.

“Swimming Pool Dialysis”

Well, instead what you can do is you can run them through, much like these kidney machines that run through and clean out your kidney (It is called dialysis and it works like a kidney) It cleans; if your kidney is not working well, very similar.

It runs the water from the pool through this machine and treats it like salt water. So, it is this reverse osmosis, it’s called, and it desalinates it essentially and puts it back in the pool. It can be done in four or five, six, seven hours depending on how much water there is and so forth.

Regional Markets

We are in this market in Phoenix and if you are interested in knowing more about it, just send an email to Michael@originclear.com. He will hook you up. We are looking for people who are pool tradespeople in Phoenix, but also in other metros, who are interested in one of these financed, short-term commitment, don't worry about your FICO score, pool flushing systems. All right. It is exciting. It is literally, we have a demo machine. We were about to go shoot in Phoenix. Sales are happening, et cetera. That is happening. As I told you about the trailer park thing, we are still working out that deal. Then, we have a partner in Wisconsin who is working on a dairy farm startup of this inexpensive initial solution. The 100,000, 50,000, 100,000, whatever it is, dollar solution for these dairy farms to keep them from smelling up the world and so forth.

Regulation A Offering

All right. I kept it quick. It has been very, very high level. There's much more to talk about. In the last few minutes of this conversation, I would like to cover the Regulation A offering. Okay. I am going to turn off the share here and I'm going to go look at FundAmerica right here. I am looking at $47,000 has been subscribed since Monday and it is not even a full week yet. I am blown away. I'm completely blown away.

This Doesn’t Happen!

It does not happen with regulation A offerings. Why? Regulation A was created in 2013 by the Obama administration working with the Republicans. Remember back when Democrats and Republicans used to do stuff together? Seems like last century, doesn't it? Well, they created something called The Jobs Act. One of the ideas was we are going to let investors who are not accredited, means that they don't make $200,000 a year or they don't have $1 million net worth excluding their primary home. We're going to let these people invest as little as $500 and they can't invest more than 10% of their annual income. So, If you are making $60,000 a year, you cannot invest more than $6,000. It is done on the honor system. You just tell us and it's fine, but it is either 10% of your annual income or 10% of your net worth because maybe you are retired and you don't make that much annual income, but you have net worth. If your net worth is $100,000 for example, excluding your home, then you can invest $10,000 very simple.

Now, almost everybody in America can invest. The reason we say America is not because we technically can't market outside of America, but because it is very regulatory challenge to comply with all of the laws in all the countries. Eventually, we'd like to get there. The other issue is, is that we are paying dividends and paying dividends every month across international boundaries is expensive.

We may be able to solve it so, if you are concerned as a foreign investor, do you have a way? First of all, you can wait, but even better if you are an investor who is not in the United States, you can invest in a regular offering through what is called regulation S, S as in Sam, which is exempt from registration requirements. You can do that and you can email invest@originclear.com and we will help you there. If you are not in the US, we can still help you.

But how amazing is it that an offering that has got a $500 minimum would raise $47,000 in four days? It is beyond cool. What is exciting about this is that we have indicated we are going to raise close to $20 million with this and given this kind of momentum, and we haven't even started marketing it. This has just been through the buzz that we created with my updates and so forth. This is going so well.

Contact Us

Now, why do people like it so much? Ken wants me to tell you to call him because he will happily walk you through it. (323) 939-6645 extension 201. (323) 939-6645 extension 201, and Devin is at 116.

Why This Is So Great

Coming back to why it is so great. Very simple. 10% earnings in a 0% world with the government giving away trillions. Where is the treasury bond at? You can buy treasuries for half a percent. Whoop, whoop. Certificates of deposit at the best number you can get is 1.9%. Well, that's great. I mean, banks are supposed to be perfect and wonderful except they also get in trouble. It doesn't even reflect the fact that there is still risk and you are only making less than inflation because here is the other big problem. Inflation is taking off big time.

Inflation Taking Off

Look at the prices of things online in Amazon. China fell apart and now it is coming back. Now, they are not able to do everything and during the Wuhan stoppage, people went elsewhere. My brother Nicholas, he was buying stuff for a Swedish project, and guess what? He couldn't buy in China anymore. He bought in Europe and that was triple the price. The cost of things has dramatically risen. China's supply chain is still kind of messed up.

Shortages Raise Prices

Farms are being plowed under right now. Why? Nobody to pick the crops. In Europe right now, they are flying people in from Bulgaria, because in the UK all the crop pickers have walked off. So, they have managed to convince a bunch of Bulgarian brave people to be flown into the UK, $600 per airfare, fly them in to pick the freaking crops or else they will rot.

We are going to have shortages of fruit, there will be food, but it will just be getting expensive. So we are going to have inflation. Also, at the same time, if you are trying to put your money somewhere, I mean - I'm sorry, the stock market is a little bit crazy. I don't know about putting money in a stock market. It is like it could go up, it could go down, it could go sideways. That is not great. And I say that as a CEO of a company that is a public company, so I am acknowledging that these are pretty wacky times for a publicly traded stock, but we are not asking you to do that right now.

Inflation & Yield

The second big thing is that there is inflation. So, number one is no yield, number two, inflation. So, you are actually going to make negative money if you just park it somewhere. Make 10%. Now, this is a corporate bond. It means that, this is a company that has been in business for 13 years. I can't tell you how much I've been through. Thick or thin, the team has been amazing. We have been through fire and back, and here we are with a company that I'm very proud of, the team that is beyond special. We have accomplished so much.

Company Strength

If you go to originclearoffering.com, you will see a description of this offering that, never mind the description of the offering, the description of the company. Watch a video of my brother drinking the oil production water in Kern County. Literally it came out of a well, run through our machine, and boom, he is drinking it. And look at the one where the Spanish head of our partners there in Spain, who does the animal farms, where he is saying that it's a home run with our technology.

So this is a very strong page that describes all these things. I was like, "Oh, we have done that much? Wow." Because as a CEO, I am always thinking about what we are not doing well. Truth is, we could do better. We need to do all kinds of things better. But, we have done a great job. With our accredited investors we have paid 27 months, nine quarters, of dividends, reliably, on time. So, we are a stable company. We are responsible, and we make sure that we do what we say. It comes from me, and I have to qualify by saying, subject to the Safe Harbor Statement, that this is a plan, et cetera. But, it is the fact that we have been very predictable in our operations.

Get Paid To Wait

Okay. So, that means you are making 10% on a company obligation. That is a company that is not, in my opinion, going to go out of business. That is about 10 times more than you get from anywhere else and you will get it paid every month in your bank account, through electronic deposit. Now, you are getting paid to wait. Well what are you waiting for? That is the second part. So, 10% in a 0% economy, and now the second part is you get paid to wait. Because this investment, you can convert it to free trading stock any time, at a discount to market of 20%. So, let's say you go along for a year, we cannot give you the money back for a year. We have to pay you that 10%.

We could repay it, but let's say you end up at a year, you still have it. You say, "You know what? OriginClear is doing its job. This Investor Water thing took off. Looks like they might be the next thing since sliced bread. I think I'll go ahead and convert to stock." You put in your conversion notice, and we believe that we can deliver the shares in your Schwab or whatever account, that day or the next day. That's how fast we are working on getting it. We have three days, right? So worst case within three days. What we do is we compute the closing price of the stock of our common stock, OCLN, for the last five trading days. We average it, so let's say it's 10 cents, it was averaged at 10 cents. And then we go, "Okay, you can have it at 8 cents." Because we apply that 20% discount and you can immediately trade that stock.

Ride With Us

Now most of you guys and gals won't just immediately trade the stock. You will do that when you feel it is going to run, because you don't want to just bail. Fine, make your 20% on top of the 10%. Guess what? You made 30%. that's a great return for a year. That is an amazing return, and it is pretty reliable, right? You basically benefited from a piece of machinery. It wasn't really even about the technical benefits of the stock. You get given the stock at the price at the time later, so you are protected, relatively speaking, from ups and downs in the market. Okay, great. The reason why you would convert, in my opinion, is because you believe this company is going somewhere and you would want to ride with it.

I was overjoyed when Zoom had a big problem with security and the stock crashed, because guess what? A couple days ago I bought the stock. And I am very happy because they came back. Why? Because Zoom is a good stock. And zoom is doing amazing things, it is becoming the brand, the all-time online brand. Everybody is doing Zoom all over the freaking world, especially America.

So, if and when OCLN gets to that point, you go, "Okay, you know what? Boom, I'm in." Get my 20% discount, which means it takes care of whatever your transactional fees are, et cetera. Okay. And you are on for the ride. Until then, earn 10%. How cool is that? So, it is a wonderful dual instrument, and that is why we love it so much. I think that's why we raised $47,000 in increments starting at $500, in less than one week, in four days.

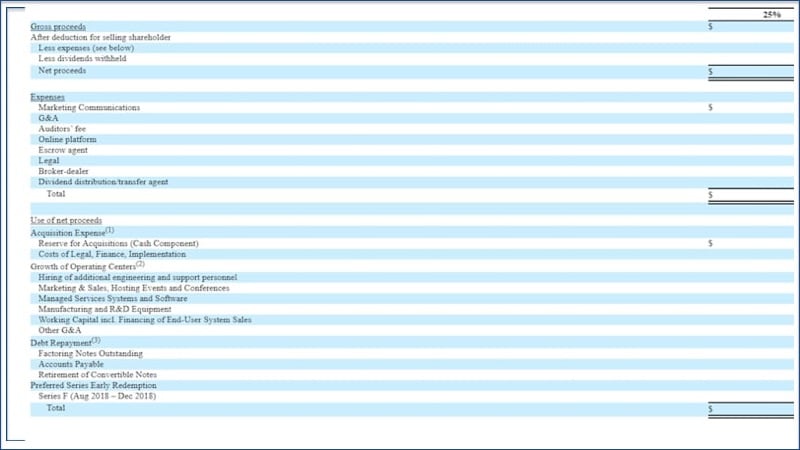

Use of Proceeds are fully disclosed on EDGAR.com

Use of Proceeds are fully disclosed on EDGAR.com

Use Of Proceeds

So, with that, I'm going to thank you. We believe we are going to raise close to a million dollars in this offering. It is going to be used to retire our debt, to make acquisitions, to market things like Investor Water, to provide funding for these important water projects, these mini water projects. All these things are going to be accomplished. We certainly plan it, because it is disclosed in the “use of proceeds."

If you go to the Edgar site, E-D-G-A-R, Edgar, type Edgar OriginClear, enter, on Google, you will get our page. And you will see what is called the offering circular, right in there. We give what we are going to spend it on, and it's all these wonderful things.

In my view, we will end up with a very clean company, no debt, lots of great projects, lots of growth, ultimately - profitability. And then my hope, my personal hope and desire is that in 2021, we will finally ring the bell on the NASDAQ and I have told a couple of very important people that I want them there on that second-floor podium, ringing the bell with me and it will be quite the moment.

Join Us

I hope you join us too in spirit, if not personally. Do join us. You can go to the OriginClear website, the big red banner, invest now. Click that. Go to OriginClear offering.com. Join us in this, because I believe it is going to be world-changing because we will dramatically accelerate water cleaning, and help put America back to work. And while we are at it, get some of that coronavirus out of the water.

Thank you very much for joining me today. It has been a great experience talking to you. I get more excited each time. Let's have a great end of week. Enjoy Easter Passover, and stay safe, stay healthy because we want you around to help go to the next step. Thank you so much, all.

Register for next week’s Insider Briefing: HERE

SAFE HARBOR STATEMENT

Matters discussed in this message contain statements that look forward. When used in this message, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such statements that look forward. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the statements that look forward contained herein, and while expected, there is no guarantee that we will attain the aforementioned anticipated developmental milestones. These statements that look forward are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include, but are not limited to, risks and uncertainties associated with: the impact of economic, competitive and other factors affecting the Company and its operations, markets, product, and distributor performance, the impact on the national and local economies resulting from terrorist actions, and U.S. actions subsequently; and other factors detailed in reports filed by the Company, except as may be required by applicable law.

Regulation A Disclaimer

An offering statement regarding this offering has been filed with the SEC. The SEC has qualified that offering statement, which only means that the company may make sales of the securities described by the offering statement. It does not mean that the SEC has approved, passed upon the merits or passed upon the accuracy or completeness of the information in the offering statement. Please read the offering circular here: Get Offering Circular

Ten percent per year refers to the dividend rate payable on the preferred stock and is subject to the terms, conditions, and risks of the offering. The term of the offering, including with respect to dividend payments, are described in the Company’s Offering Circular, which provides further information about the offering, including the risk factors associated with the offering, such as, but not limited to the Company’s ability to pay the stated dividend in the future.

%20250px.png?width=250&height=53&name=OriginClear%20Logo%202019%20(RGB)%20250px.png)